Global Limestone Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (High Calcium, Magnesian), End-use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Limestone Market Size

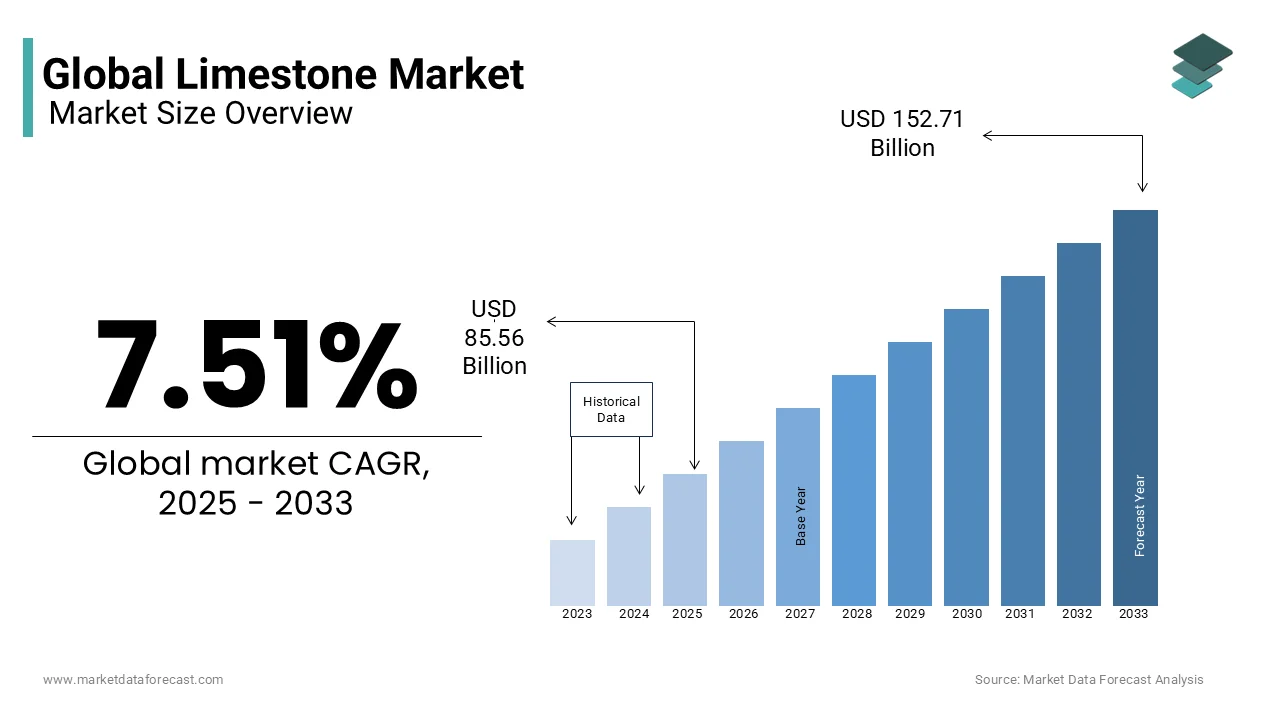

The global limestone market size was valued at USD 79.58 billion in 2024 and is expected to reach USD 152.71 billion by 2033 from USD 85.56 billion in 2025. The market is projected to grow at a CAGR of 7.51%.

Limestone is a sedimentary rock primarily composed of calcium carbonate (CaCO₃) and is an essential raw material extensively used across various industries, including construction, steel manufacturing, agriculture, environmental applications, and chemical processing. Limestone plays a critical role in industrial and environmental applications. According to the U.S. Geological Survey (USGS), more than 90% of the lime derived from limestone is used for chemical and industrial purposes, compared to its dominant use in construction in the early 20th century. This shift highlights limestone’s increasing importance in metallurgy, water purification, and pollution control. One of its key applications is in flue gas desulfurization, where limestone-based solutions help reduce sulfur dioxide (SO₂) emissions from power plants and industrial processes.

In the steel industry, limestone serves as a flux to eliminate impurities during iron refining. The World Steel Association reports that global crude steel production reached approximately 1.888 billion metric tons in 2023, reinforcing the demand for limestone in steel manufacturing. Its role in agriculture is equally significant, as it neutralizes acidic soils, improving crop yields. The Food and Agriculture Organization (FAO) has documented that lime-based soil treatments enhance agricultural productivity, especially in regions with acidic soil conditions.

Beyond these industrial uses, limestone is also a key ingredient in paper production, pharmaceuticals, and sustainable construction materials. With a growing emphasis on eco-friendly and low-carbon building materials, limestone-based products, including lime mortar and limestone aggregates, are increasingly favored in green construction projects.

MARKET DRIVERS

Rising Demand for Limestone in the Construction Industry

The construction industry is a major driver of the limestone market, with limestone being a key raw material for cement production. According to the U.S. Geological Survey (USGS), global limestone production exceeded 4.5 billion metric tons in 2021, with approximately 65% utilized in cement manufacturing . The International Energy Agency (IEA) highlights that cement production accounts for approximately 7-8% of global CO₂ emissions, underscoring limestone's critical role in construction. Rapid urbanization in Asia-Pacific, particularly in China and India, has fueled demand, with China producing over 2.2 billion metric tons of cement in 2021, as reported by the IEA. Government infrastructure projects, such as India’s National Infrastructure Pipeline worth $1.4 trillion, further boost limestone consumption. As global population growth drives housing and infrastructure needs, limestone remains indispensable for meeting construction demands sustainably.

Increasing Use of Limestone in Environmental Applications

Limestone plays a vital role in environmental applications, particularly in flue gas desulfurization (FGD) systems and water treatment. The U.S. Environmental Protection Agency (EPA) reports that FGD systems, which rely heavily on limestone, have reduced sulfur dioxide emissions from coal-fired power plants by over 90% since their widespread adoption in the 1990s . In 2022, the European Environment Agency (EEA) noted that limestone-based technologies are integral to achieving the EU Green Deal’s air quality targets. Additionally, the United Nations World Water Development Report 2023 highlights that limestone is widely used in wastewater treatment to neutralize acidity and remove impurities. With stricter environmental regulations globally, such as the Paris Agreement’s emission reduction goals, the demand for limestone in pollution control and water purification is expected to grow significantly, ensuring its importance in sustainable industrial practices.

MARKET RESTRAINTS

Environmental Concerns and Regulatory Restrictions

Environmental concerns and regulatory restrictions pose significant challenges to the limestone market. The extraction of limestone through quarrying often leads to habitat destruction, dust pollution, and water resource depletion. According to the European Environment Agency (EEA), mining activities, including limestone quarrying, contribute significantly to land degradation, with mining affecting over 15% of Europe’s land area . In the United States, the Environmental Protection Agency (EPA) enforces strict regulations under the Clean Air Act and Clean Water Act, which increase operational costs for producers. Additionally, the International Union for Conservation of Nature (IUCN) highlights that quarrying disrupts biodiversity, leading to stricter permitting processes. These regulatory pressures, combined with opposition from local communities, limit access to high-quality limestone reserves. As governments prioritize environmental sustainability, compliance costs are expected to rise, constraining market growth.

High Energy Consumption and Carbon Emissions

The limestone market faces significant restraints due to its high energy consumption and carbon emissions. The U.S. Geological Survey (USGS) reports that limestone processing is energy-intensive, consuming approximately 3.0 million British thermal units (Btu) per ton of material. This reliance on fossil fuels contributes to greenhouse gas emissions, with the cement industry alone accounting for 7-8% of global CO₂ emissions, as noted by the International Energy Agency (IEA). In 2022, the European Commission introduced the Carbon Border Adjustment Mechanism (CBAM), imposing additional costs on carbon-intensive industries, including limestone. Similarly, India’s Ministry of Environment, Forest and Climate Change mandates energy audits for limestone producers, increasing operational expenses. These factors, coupled with global decarbonization goals under the Paris Agreement, create financial and operational challenges for the limestone market.

MARKET OPPORTUNITIES

Growing Demand for Limestone in Sustainable Construction

The increasing focus on sustainable construction presents a significant opportunity for the limestone market. The U.S. Green Building Council (USGBC) highlights that green building projects are expected to grow by 12% annually through 2025, driven by the demand for eco-friendly materials like limestone. Limestone is widely used in producing low-carbon cement and as a substitute for traditional aggregates in concrete, reducing the carbon footprint of construction activities. According to the International Energy Agency (IEA), using limestone-based alternatives can cut CO₂ emissions from cement production by up to 15-20% . Additionally, government initiatives like the European Union’s Circular Economy Action Plan promote the use of sustainable materials, boosting limestone adoption. With global urbanization projected to add 2.5 billion people to urban areas by 2050, as reported by the United Nations Department of Economic and Social Affairs (UN DESA), the demand for limestone in sustainable infrastructure will rise significantly, creating lucrative growth opportunities.

Expansion of Limestone Applications in Agriculture

The agricultural sector offers a promising opportunity for the limestone market due to its role in soil treatment and pH correction. The Food and Agriculture Organization (FAO) estimates that approximately 30% of the world’s arable land suffers from soil acidity, driving demand for agricultural lime. In India, the Indian Institute of Soil Science (IISS), under the Ministry of Agriculture, reports that over 49% of cultivated land in India requires lime application to improve soil fertility and crop yields. Limestone also aids in water retention and nutrient availability, making it essential for sustainable farming practices. As global food demand rises, with the FAO projecting a 50% increase by 2050, the need for high-quality agricultural inputs like limestone will surge. Governments worldwide are promoting soil health initiatives, such as the U.S. Department of Agriculture’s Conservation Stewardship Program, further expanding limestone’s role in modern agriculture.

MARKET CHALLENGES

Depletion of High-Quality Limestone Reserves

The depletion of high-quality limestone reserves poses a significant challenge to the limestone market. According to the U.S. Geological Survey (USGS), over-extraction has led to a decline in easily accessible, high-purity limestone deposits, particularly in regions like Europe and North America. In 2022, the USGS reported that global limestone production reached approximately 4.3 billion metric tons, with many quarries facing resource exhaustion. The European Lime Association (EuLA) highlights that quarrying operations are increasingly constrained by land-use conflicts and environmental restrictions, limiting access to new reserves. Additionally, the Indian Bureau of Mines notes that limestone extraction costs have risen by 8-12% annually due to deeper mining requirements and stricter environmental regulations. As demand for limestone grows, securing sustainable supplies will become more challenging, impacting industries reliant on this critical raw material.

Rising Transportation and Logistics Costs

Transportation and logistics challenges significantly impact the limestone market due to its bulk nature and weight-to-value ratio. The U.S. Department of Energy (DOE) reports that freight costs for bulk materials like limestone can account for up to 25-30% of the total product price, making long-distance transportation economically unviable. In 2022, the International Transport Forum (ITF) noted a 20-25% increase in freight rates due to supply chain disruptions, rising fuel prices, and geopolitical tensions. Additionally, limestone’s susceptibility to moisture and degradation during transit requires specialized handling, further increasing operational costs. Smaller producers, particularly in regions like Latin America and Africa, face disproportionate challenges in competing globally. These logistical barriers hinder market expansion and limit access to cost-effective limestone supplies for end-users.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.51% |

|

Segments Covered |

By Product, End-use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Limestoneers Profiled |

CARMEUSE, CEMEX S.A.B. de C.V, GCCP Resources Limited, Imerys, Holcim Group, Lhoist, Mineral Technologies Inc., Mississippi Lime Company, National Lime & Stone Company, and others |

SEGMENTAL ANALYSIS

By Product Insights

The high calcium limestone segment dominated the market by holding 65.2% of the global market share in 2024. The widespread use of high calcium limestone in cement production, construction, and flue gas desulfurization primarily contributes to the domination of the high calcium segment in the global market. The International Energy Agency (IEA) highlights that cement production, which relies heavily on high calcium limestone, reached 4.1 billion metric tons globally in 2021. Additionally, its role in neutralizing acidic soils in agriculture further solidifies its importance. High calcium limestone’s cost-effectiveness and versatility make it indispensable across industries, ensuring its dominance in the market.

The magnesian limestone segment is anticipated to progress at a CAGR of 5.2% over the forecast period owing to the increasing demand in specialized applications such as refractories, glass manufacturing, and soil stabilization. The European Lime Association (EuLA) notes that magnesian limestone’s unique properties, including its magnesium content, make it ideal for improving crop yields in magnesium-deficient soils. In the construction sector, its use in producing high-strength concrete is gaining traction. As governments promote sustainable agricultural practices and advanced construction materials, magnesian limestone’s adoption will surge, making it a key driver of future market expansion.

By End-use Insights

The building and construction segment led the limestone market by accounting for 35.6% of the global market share in 2024. Limestone is a critical raw material in cement production, with global cement output reaching 4.1 billion metric tons in 2021, according to the International Energy Agency (IEA). Its use in concrete, mortar, and road construction further solidifies its dominance. Rapid urbanization, particularly in Asia-Pacific, and infrastructure investments like the U.S. $1.2 trillion Infrastructure Investment and Jobs Act drive demand. The segment's versatility and cost-effectiveness make it indispensable for meeting global housing and infrastructure needs, ensuring its continued leadership in the limestone market.

The agriculture segment is anticipated to showcase the highest CAGR of 5.2% over the forecast period owing to the increasing demand for limestone in soil treatment to neutralize acidity and improve fertility. The Food and Agriculture Organization (FAO) estimates that 30% of the world’s arable land suffers from soil acidity, boosting limestone usage. In India, the Indian Institute of Soil Science (IISS), under the Ministry of Agriculture, highlights that over 49% of cultivated land requires lime application to enhance crop yields. As governments promote sustainable farming practices to meet rising food demand, projected to grow by 50% by 2050 (FAO), limestone’s role in agriculture will expand significantly, making it a key driver of future market growth.

REGIONAL ANALYSIS

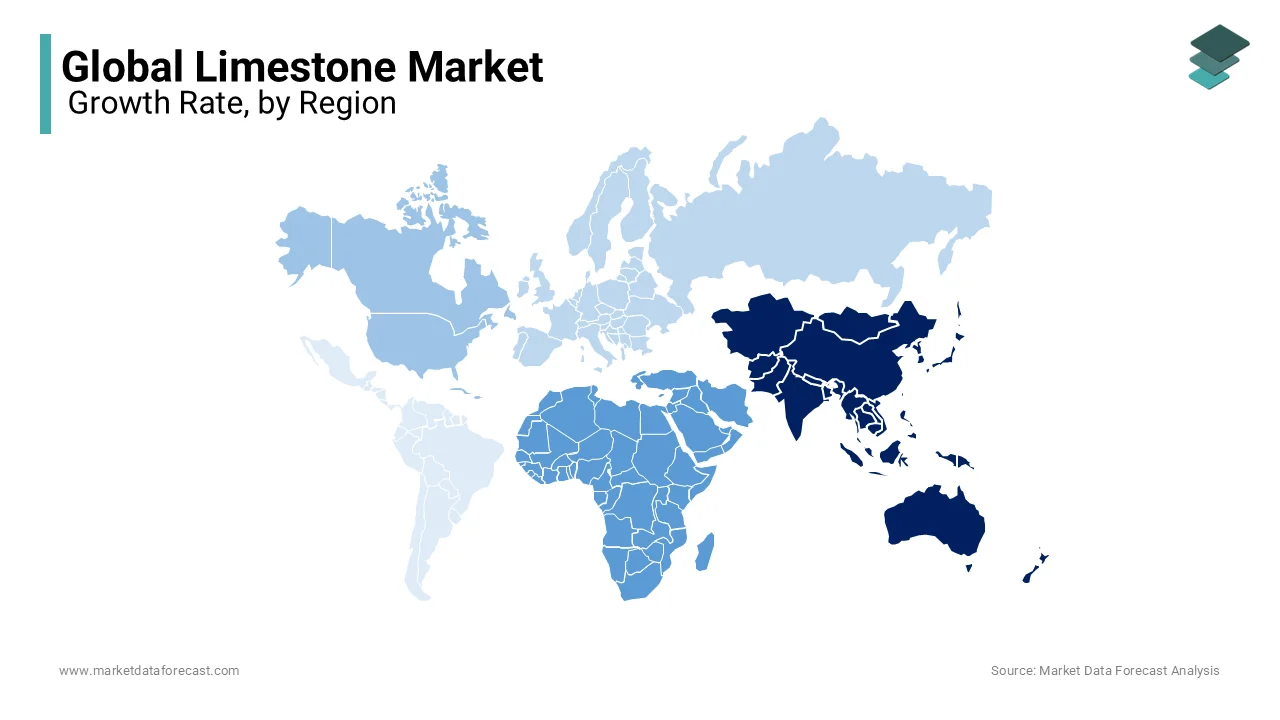

Asia-Pacific commanded the limestone market by accounting for 40.2% of the global market share in 2024. The domination of Asia-Pacific in the global market is majorly driven from rapid industrialization, urbanization, and infrastructure development, particularly in China and India. China alone produced over 2.1 billion metric tons of limestone in 2021, primarily for cement and steel production, according to the International Energy Agency (IEA). Government investments in mega-infrastructure projects, such as India’s $1.4 trillion National Infrastructure Pipeline, further boost demand. With increasing applications in construction and environmental sectors, Asia-Pacific remains pivotal to the global limestone market.

The limestone market in Middle East and Africa is estimated to grow at a notable CAGR during the forecast period due to the rising investments in infrastructure, mining, and water treatment projects. For instance, Saudi Arabia’s Vision 2030 initiative aims to invest $1 trillion in infrastructure, boosting limestone demand. Additionally, South Africa’s Department of Water and Sanitation highlights that limestone-based solutions are widely used in water purification systems. The region's focus on addressing water scarcity and improving agricultural productivity accelerates adoption, making it a critical driver of future market expansion.

North America holds a significant share of the limestone market. The regional development is propelled by its mature industrial and environmental sectors. According to the U.S. Geological Survey (USGS), the United States produced approximately 1.05 billion metric tons of limestone in 2022, with key applications in construction, steelmaking, and flue gas desulfurization (FGD). The U.S. Environmental Protection Agency (EPA) highlights that over 25% of limestone demand stems from environmental applications, including wastewater treatment and air pollution control. Canada also contributes significantly, particularly in mining and agriculture. North America’s focus on sustainability and regulatory compliance ensures its continued importance in the global limestone market.

Europe is a mature market for limestone which is characterized by stringent environmental regulations and advanced industrial applications. The European Lime Association (EuLA) reports that the region accounts for approximately 18% of the global limestone market, with major producers like Germany, France, and the UK leading the way. In 2022, the European Environment Agency (EEA) noted that limestone-based technologies are integral to achieving carbon neutrality goals under the EU Green Deal. The region’s emphasis on water treatment, soil stabilization, and emission control systems drives consistent demand.

Latin America represents a growing segment in the limestone market. This progress is fueled by expanding agriculture and mining industries. Brazil’s Ministry of Agriculture estimates that limestone usage for soil treatment will grow by 3-4% annually through 2030, as acidic soils cover nearly 65% of arable land in the region. Mexico and Argentina also contribute significantly, with limestone used extensively in construction and water treatment. According to the Inter-American Development Bank (IDB), infrastructure investments in the region are expected to increase by 3.5% annually, further boosting limestone demand. While the region currently holds a smaller share of the global market, its focus on agricultural productivity and urbanization positions it as a promising growth area in the coming years.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

CARMEUSE, CEMEX S.A.B. de C.V, GCCP Resources Limited, Imerys, Holcim Group, Lhoist, Mineral Technologies Inc., Mississippi Lime Company, National Lime & Stone Company are playing dominating role in the global limestone market

The global limestone market is highly competitive, driven by factors such as increasing demand from the construction, steel, agriculture, and environmental sectors. Competition in the market is shaped by key players, including Carmeuse, Lhoist Group, Vulcan Materials Company, and CEMEX, who dominate the market through large-scale production, technological advancements, and extensive supply chains. These companies compete on the basis of product quality, geographic presence, cost efficiency, and sustainability initiatives.

One of the primary competitive strategies in the market is mergers and acquisitions, as seen with Ambuja Cements' acquisition of Sanghi Industries, strengthening its limestone reserves. Additionally, companies engage in geographic expansion to access new markets, with firms like Stonex India extending their reach to North America, the Middle East, and Southeast Asia. Product diversification is also a key strategy, with companies offering limestone in various forms, including aggregates, quicklime, and hydrated lime, catering to multiple industries.

Furthermore, sustainability has become a major competitive factor, with leading companies adopting eco-friendly mining techniques and carbon reduction initiatives. Overall, the limestone market is characterized by intense rivalry, with companies focusing on innovation, operational efficiency, and strategic partnerships to maintain a strong position in this essential materials market.

TOP 3 PLAYERS IN THE MARKET

Carmeuse

Carmeuse is a Belgian mining company specializing in the production of high-calcium and dolomitic lime, chemical-grade limestone, and crushed limestone aggregate. Founded in 1860, the company has expanded its operations across Europe, North America, Africa, and Asia. Carmeuse's products are integral to various industries, including steel manufacturing, construction, and environmental services, underscoring its substantial contribution to the global limestone market.

Vulcan Materials Company

Headquartered in Birmingham, Alabama, Vulcan Materials Company is the largest producer of construction aggregates in the United States, including crushed stone, sand, and gravel. With over 400 facilities, Vulcan serves markets across 22 U.S. states, as well as in Mexico, Canada, the Bahamas, and the U.S. Virgin Islands. The company's extensive distribution network and significant production capacity make it a major player in the global limestone market.

Lhoist Group

Lhoist Group is a family-owned company specializing in the production of lime, dolime, and minerals. Operating in more than 25 countries with over 100 facilities, Lhoist serves diverse markets, including environmental, agricultural, and industrial sectors. The company's focus on innovation and sustainable practices contributes to its leading position in the global limestone market.

STRATEGIES USED BY THE MARKET PLAYERS

Mergers and Acquisitions (M&A)

Mergers and acquisitions remain a crucial strategy for limestone companies to consolidate their market share, expand production capacities, and strengthen supply chains. By acquiring competitors or smaller firms with significant limestone reserves, companies enhance their resource base and increase operational efficiency. For example, in March 2024, Breedon Group acquired U.S.-based BMC Enterprises for £238.1 million, marking a significant expansion into the North American market. Similarly, Ambuja Cements, under the Adani Group, strengthened its limestone reserves by acquiring Sanghi Industries in 2023, adding over one billion tonnes to its holdings. Ambuja also moved to acquire Orient Cement in 2024, further expanding its limestone resources in Rajasthan. These acquisitions provide companies with increased production capabilities, improved logistical efficiency, and access to new markets, solidifying their leadership positions in the limestone market.

Geographic Expansion

Expanding operations across multiple regions allows limestone companies to diversify revenue streams and reduce dependency on a single market. This strategy is particularly useful in meeting growing demand from industries such as construction, agriculture, and steel manufacturing. Companies like Carmeuse, a Belgian limestone producer, have expanded their operations into North America, Europe, Africa, and Asia, ensuring a strong global presence. Likewise, Stonex India, originally an Indian firm, extended its market reach to the USA, Canada, UAE, Singapore, and Australia, tapping into new customer bases. Geographic expansion enables companies to take advantage of regional industrial growth, favorable mining regulations, and logistical efficiency, ensuring long-term sustainability and competitive market positioning.

Product Diversification

Limestone producers increasingly focus on diversifying their product offerings to cater to multiple industries and reduce reliance on a single revenue stream. This strategy helps companies remain resilient amid fluctuating demand in specific sectors. Lhoist Group, for instance, produces a variety of products including lime, dolime, and minerals, serving industries such as steel production, agriculture, and chemical processing. Similarly, CEMEX, a major cement manufacturer, integrates limestone into its cement, ready-mix concrete, and infrastructure solutions, ensuring a steady demand for its raw materials. By offering specialized limestone products for construction, environmental applications, and industrial use, companies maximize their profitability and reach a broader customer base.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, Oriole Resources, an exploration company, announced the renewal of its 85%-owned Wapouzé limestone property license in northern Cameroon. This renewal allows the company to continue its exploration and development activities in the region.

MARKET SEGMENTATION

This research report on the global limestone market has been segmented and sub-segmented based on product, end-use, and region.

By Product

- High Calcium

- Magnesian

By End-use

- Building & Construction

- Iron & Steel

- Agriculture

- Chemical

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the limestone market?

The market is expected to grow from USD 85.56 billion in 2025 to USD 152.71 billion by 2033, at a CAGR of 7.51% during the forecast period.

2. How is sustainable construction driving demand for limestone?

The increasing focus on sustainable construction is boosting demand for limestone-based materials, such as low-carbon cement and limestone aggregates, which help reduce the carbon footprint of construction projects.

3. Which region dominated the global limestone market in 2024?

Asia-Pacific led the global limestone market in 2024, accounting for 40.2% of the total market share.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com