Global Lime Market Size, Share, Trends, & Growth Forecast Report Segmented By Type (Quick Lime and Hydrated Lime), Application (Agriculture, Building Material, Mining & Metallurgy, Water Treatment, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Lime Market Size

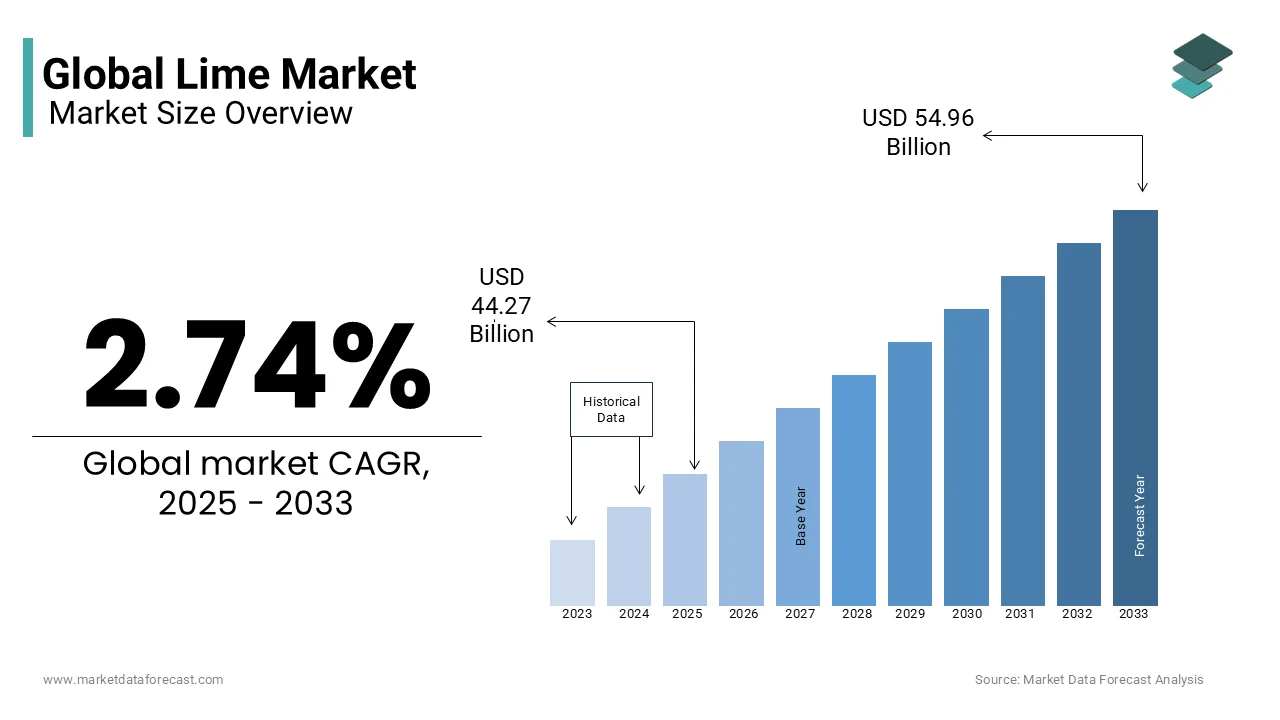

The global lime market was worth USD 43.09 billion in 2024. The global market is projected to reach USD 54.96 billion by 2033 from USD 44.27 billion in 2025, growing at a CAGR of 2.74% from 2025 to 2033.

Lime is primarily composed of calcium oxide (quicklime) and calcium hydroxide (hydrated lime) and is a fundamental material utilized across various industries, including construction, metallurgy, environmental management, and agriculture. In 2023, global lime production was estimated at approximately 430 million metric tons. This substantial output underscores the material’s critical role in supporting industrial activities worldwide. The steel industry remains one of the largest consumers of lime, using it as a flux to remove impurities during steel production. Additionally, in environmental applications, lime is widely employed in wastewater treatment and flue gas desulfurization, helping industries comply with stricter emission control regulations. In agriculture, lime plays a crucial role in soil management, where it is used to regulate pH levels, improve soil fertility, and enhance crop yields.

The European Lime Association has outlined a roadmap aiming for negative CO₂ emissions by 2050, demonstrating the industry's commitment to sustainability. These efforts include modernizing production plants, optimizing fuel sources, and investing in carbon capture technologies, aligning with global environmental goals.

MARKET DRIVERS

Growing Demand for Lime in the Construction Industry

The construction industry is a key driver of lime demand, with applications spanning soil stabilization, mortar, and plaster. According to the U.S. Geological Survey (USGS), lime production in the United States totaled approximately 16 million metric tons in 2021, with about 45% allocated to construction-related uses. Globally, infrastructure development remains a major growth catalyst, particularly in emerging economies like India and China. The Indian Brand Equity Foundation (IBEF), under India's Ministry of Commerce, reported that India’s infrastructure sector attracted $37 billion in investments during FY 2021-22, reflecting steady growth. Lime plays a vital role in enhancing the durability and workability of construction materials. With global urbanization trends and increased government spending on sustainable infrastructure projects, such as green buildings and road networks, the demand for lime is expected to grow consistently over the next decade.

Environmental Regulations Promoting Lime Usage in Flue Gas Desulfurization

Environmental regulations targeting sulfur dioxide (SO₂) emissions have significantly increased lime consumption in flue gas desulfurization (FGD) systems. The U.S. Environmental Protection Agency (EPA) reports that FGD systems installed in coal-fired power plants have reduced SO₂ emissions by over 90% since their widespread adoption in the 1990s. These systems rely heavily on lime and limestone for scrubbing pollutants from exhaust gases. In Europe, the Industrial Emissions Directive (IED) enforces strict emission limits, encouraging industries to adopt lime-based technologies. According to the European Lime Association (EuLA), lime accounts for approximately 25% of total industrial lime usage in environmental applications, including FGD. As countries align with international climate agreements like the Paris Accord, the demand for lime in pollution control technologies is projected to remain robust, ensuring its critical role in mitigating industrial emissions.

MARKET RESTRAINTS

High Energy Costs in Lime Production

The production of lime is highly energy-intensive, primarily due to the calcination process, which requires temperatures exceeding 900°C. According to the U.S. Geological Survey (USGS), producing one ton of lime consumes approximately 3.14 million British thermal units (Btu) of energy, making it one of the most energy-demanding industrial processes. The U.S. Energy Information Administration (EIA) reported that industrial energy consumption accounted for about one-third of total U.S. energy use in 2022, with rising natural gas prices significantly impacting energy-intensive industries. In Europe, the International Energy Agency (IEA) noted a 50% increase in natural gas prices during 2022, further straining lime producers. These high energy costs reduce profit margins and hinder market expansion. Additionally, regulatory scrutiny over fossil fuel usage has pushed producers to explore alternative energy sources, though these often come with higher upfront costs.

Stringent Environmental Regulations on Carbon Emissions

Stringent environmental regulations targeting carbon emissions pose a major challenge to the lime market. The calcination process emits approximately 785 kg of CO₂ per ton of lime produced, contributing significantly to global industrial emissions, as highlighted by the European Lime Association (EuLA). In the European Union, the Emissions Trading System (ETS) imposes a carbon pricing mechanism, with carbon prices averaging €88 per ton in 2022, according to the European Commission. Similarly, the U.S. Environmental Protection Agency (EPA) enforces strict emission limits under the Clean Air Act, requiring lime producers to adopt costly mitigation technologies like carbon capture and storage (CCS). These compliance costs disproportionately affect smaller producers, reducing their competitiveness. As global efforts to combat climate change intensify, regulatory pressures are expected to escalate, further constraining the growth of the lime market.

MARKET OPPORTUNITIES

Expansion of Lime Applications in Wastewater Treatment

The growing emphasis on water quality and sanitation has created significant opportunities for lime in wastewater treatment. According to the United Nations World Water Development Report 2022, approximately 80% of global wastewater is discharged untreated, driving demand for effective treatment solutions. Lime is widely used in wastewater treatment plants to adjust pH levels, remove impurities, and stabilize sludge. The U.S. Environmental Protection Agency (EPA) highlights that lime-based treatments are cost-effective and environmentally sustainable, making them a preferred choice for municipalities and industries. In the United States, the EPA estimates that $271 billion will be required over the next two decades to upgrade aging wastewater infrastructure, creating a substantial market for lime. With urbanization and stricter water quality regulations, particularly in developing regions like Asia-Pacific, the demand for lime in wastewater treatment is projected to grow significantly by 2030.

Rising Adoption of Lime in Soil Stabilization for Sustainable Agriculture

The increasing focus on sustainable agriculture presents a major opportunity for lime usage in soil stabilization and pH correction. The Food and Agriculture Organization (FAO) reports that soil degradation affects 33% of the world’s arable land, necessitating interventions to improve soil health. Agricultural lime is essential for neutralizing acidic soils, enhancing nutrient availability, and boosting crop yields. In India, the Indian Institute of Soil Science (IISS), under the Ministry of Agriculture, estimates that approximately 49% of cultivated land suffers from soil acidity, driving demand for agricultural lime. The U.S. Department of Agriculture (USDA) also emphasizes the role of lime in improving soil fertility and reducing fertilizer dependency. As global food demand rises, with the FAO projecting a 50% increase by 2050, the adoption of lime in sustainable farming practices is set to expand, offering lucrative growth prospects for the lime market.

MARKET CHALLENGES

Limited Availability of High-Quality Limestone Reserves

The availability of high-quality limestone, the primary raw material for lime production, is a growing challenge for the lime market. According to the U.S. Geological Survey (USGS), while global limestone reserves are abundant, only a fraction meets the purity requirements for industrial lime production. In 2022, the USGS reported that the United States produced approximately 16 million metric tons of lime, with key production concentrated in states like Texas, Alabama, and Pennsylvania. Over-extraction has depleted some high-quality deposits, while environmental regulations have restricted access to new sites. The European Lime Association (EuLA) notes that quarrying operations face increasing opposition due to land-use conflicts, noise pollution, and dust emissions. For instance, stricter permitting processes under the EU’s Environmental Impact Assessment Directive have delayed new projects. As demand for lime rises, particularly in construction and industrial applications, securing sustainable limestone supplies will remain a critical hurdle for market growth.

Transportation and Logistics Constraints

Transportation and logistics pose significant challenges to the lime market due to its bulk nature and weight-to-value ratio. The U.S. Department of Energy (DOE) highlights that transporting materials like lime over long distances is energy-intensive, with freight costs often exceeding 25% of the total product price. In 2022, global supply chain disruptions caused by geopolitical tensions, such as the Russia-Ukraine conflict, and lingering effects of the COVID-19 pandemic exacerbated these challenges. The International Transport Forum (ITF) reported that global freight rates surged by 20-30% between 2021 and 2022, straining producers. Additionally, lime’s susceptibility to moisture and degradation during transit requires specialized handling and storage, further increasing operational costs. These logistical barriers disproportionately affect small-scale producers, limiting their ability to compete effectively in regional and international markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.74% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Carmeuse (Belgium), Lhoist Group (Belgium), Graymont Limited (Canada), Mississippi Lime Company (U.S.), United States Lime & Minerals Inc. (U.S.), Afrimat (South Africa), Linwood Mining & Minerals Corporation (U.S.), Minerals Technologies, Inc. (U.S.), Cheney Lime & Cement Company (U.S.), and Pete Lien & Sons, Inc. (U.S.). |

SEGMENTAL ANALYSIS

By Type Insights

The quick lime segment ruled the market by occupying 60.8% of the global market share in 2024. The widespread use of quick lime in steel manufacturing, construction, and chemical industries is majorly driving the domination of the quick lime segment in the global market. Quick lime is a critical raw material in the production of cement and lime-based mortars, with global cement production reaching 4.1 billion metric tons in 2021, according to the International Energy Agency (IEA). Additionally, its role in flue gas desulfurization systems for reducing sulfur dioxide emissions further solidifies its importance. The segment's cost-effectiveness and versatility make it indispensable, ensuring its dominance in industrial applications.

The hydrated lime segment is estimated to witness a CAGR of 5.2% over the forecast period due to the increasing demand in environmental applications such as wastewater treatment and air pollution control. The U.S. Environmental Protection Agency (EPA) highlights that hydrated lime is widely used in advanced water purification systems, with over 25% of U.S. wastewater treatment plants adopting lime-based solutions. In Europe, the European Lime Association (EuLA) notes its rising adoption in soil stabilization and pH correction for agriculture. As governments worldwide prioritize sustainability and stricter emission regulations, hydrated lime’s role in green technologies will continue to expand, making it a key driver of future market growth.

By Application Insights

The building material segment led the lime market by accounting for 30.7% of the global market share in 2024. Lime is extensively used in cement production, soil stabilization, and masonry applications. Global cement production reached 4.1 billion metric tons in 2021 , according to the International Energy Agency (IEA), underscoring its critical role in construction. Additionally, lime’s use in flue gas desulfurization systems boosts demand in industrial construction. The segment's dominance is driven by rapid urbanization, particularly in Asia-Pacific, and infrastructure investments like the U.S. $1.2 trillion Infrastructure Investment and Jobs Act. Its versatility and cost-effectiveness ensure its continued leadership in the lime market.

The water treatment segment is anticipated to the fastest CAGR of 5.8% over the forecast period due to the increasing global water scarcity and stricter environmental regulations. The U.S. Environmental Protection Agency (EPA) highlights that lime-based solutions are widely used in advanced water purification systems, with over 20% of U.S. wastewater treatment plants adopting lime technologies. In Europe, the European Environment Agency (EEA) emphasizes lime’s role in achieving EU Green Deal targets for clean water. As governments invest in sustainable water management, particularly in developing regions like Africa and Asia, the demand for lime in water treatment will surge, making it a critical driver of future market expansion.

REGIONAL ANALYSIS

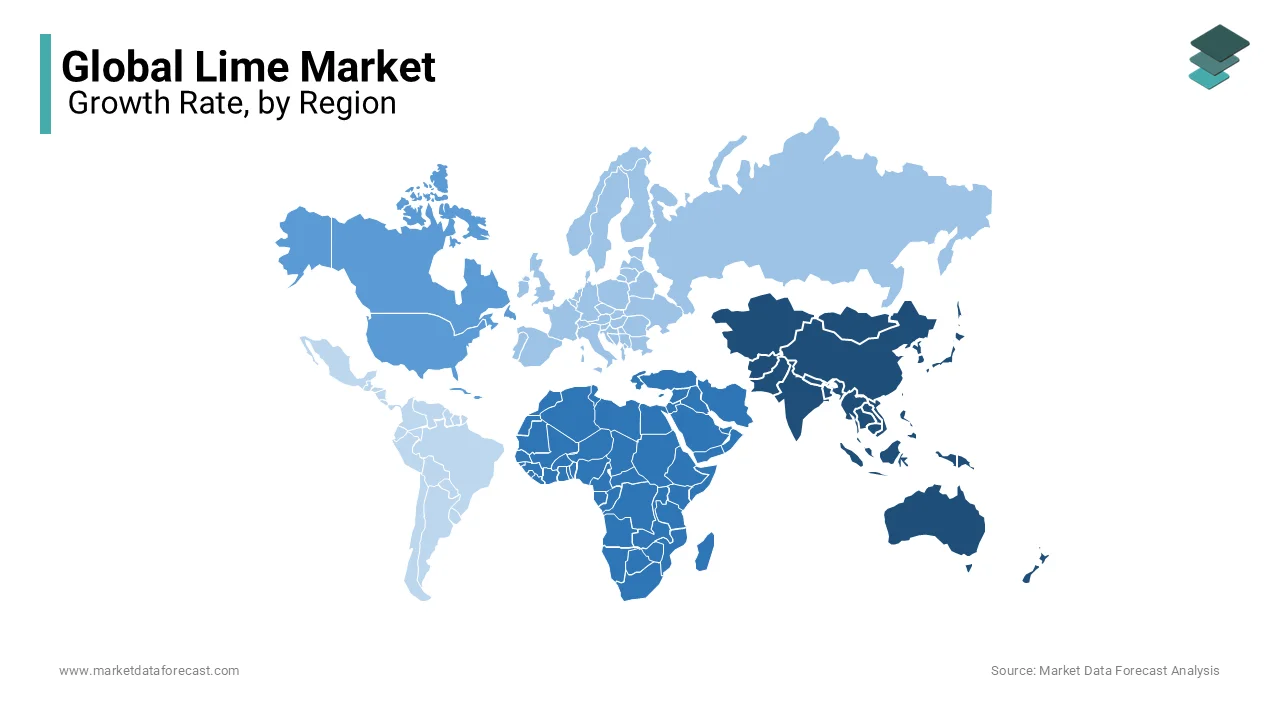

Asia-Pacific led the lime market by holding 40.6% of the global market share in 2024. The rapid industrialization, urbanization, and infrastructure development, particularly in China and India are propelling the lime market growth in the Asia-Pacific region. China remains the largest producer, with the US Geological Survey (USGS) reporting that the country accounted for over 50% of global lime production in 2021, driven by its construction and steel industries. Government initiatives, such as India’s National Infrastructure Pipeline, which aims to invest $1.4 trillion by 2025, further boost demand. With increasing applications in flue gas desulfurization and wastewater treatment, Asia-Pacific continues to play a pivotal role in shaping the global lime market.

The Middle East and Africa lime market is anticipated to grow at a CAGR of 5.9% over the forecast period. The growth of the regional market is fueled by rising investments in infrastructure, mining, and water treatment projects. For instance, Saudi Arabia’s Vision 2030 initiative plans to invest $1 trillion in infrastructure, boosting lime demand. Additionally, South Africa’s Department of Water and Sanitation emphasizes that lime-based solutions are widely used in water purification systems across the region. Efforts to combat water scarcity and improve agricultural productivity further accelerate lime adoption, making the region a critical driver of global lime market expansion.

North America holds a significant share of the lime market. According to the U.S. Geological Survey (USGS), the United States produced approximately 16 million metric tons of lime in 2022, with key applications in construction, steelmaking, and flue gas desulfurization. The U.S. Environmental Protection Agency (EPA) highlights that over 30% of lime demand stems from environmental applications, including wastewater treatment and air pollution control. Canada also contributes significantly, particularly in mining and agriculture. North America’s focus on sustainability and regulatory compliance ensures its continued importance in the global lime market.

Europe is a mature market for lime and is characterized by stringent environmental regulations and advanced industrial applications. The European Lime Association (EuLA) reports that the region accounts for approximately 20% of the global lime market , with major producers like Germany, France, and the UK leading the way. In 2022, the European Environment Agency (EEA) noted that lime-based technologies are integral to achieving carbon neutrality goals under the EU Green Deal. The region’s emphasis on water treatment, soil stabilization, and emission control systems drives consistent demand.

Latin America represents a growing segment in the lime market. This is fueled by expanding agriculture and mining industries. Brazil’s Ministry of Agriculture estimates that lime usage for soil treatment will grow by 4-5% annually through 2030 , as acidic soils cover nearly 70% of arable land in the region. Mexico and Argentina also contribute significantly, with lime used extensively in construction and water treatment. According to the Inter-American Development Bank (IDB), infrastructure investments in the region are expected to increase by 3.8% annually , further boosting lime demand.

KEY MARKET PLAYERS & COMPETITIVE LANDSCAPE

The major players in the global lime market include Carmeuse (Belgium), Lhoist Group (Belgium), Graymont Limited (Canada), Mississippi Lime Company (U.S.), United States Lime & Minerals Inc. (U.S.), Afrimat (South Africa), Linwood Mining & Minerals Corporation (U.S.), Minerals Technologies, Inc. (U.S.), Cheney Lime & Cement Company (U.S.), and Pete Lien & Sons, Inc. (U.S.).

The global lime market is highly competitive, with a mix of multinational corporations, regional manufacturers, and specialized producers vying for market share. Competition is primarily influenced by production capacity, geographic reach, pricing strategies, and the ability to meet the growing demand for high-quality lime products across various industries. Leading players continually invest in infrastructure, mergers, and acquisitions to strengthen their market presence and expand into new regions.

Major companies such as Carmeuse, Lhoist Group, and Graymont Limited dominate the market with extensive production facilities and global distribution networks. These companies have a strong foothold in North America, Europe, and Asia-Pacific, leveraging economies of scale and advanced manufacturing techniques to maintain competitive pricing. Regional players also contribute significantly, serving local markets with customized solutions and lower transportation costs.

Innovation plays a crucial role in competition, with companies focusing on product diversification to meet the needs of industries such as steel manufacturing, chemical processing, water treatment, and agriculture. High-calcium and dolomitic lime variants are developed for specific applications, and advancements in processing technology ensure consistent quality and efficiency. Companies that can offer specialized products with superior performance often gain a competitive edge.

Sustainability has emerged as a key competitive factor, as regulatory pressures and environmental concerns push companies toward greener production methods. Leading lime producers are investing in carbon capture technologies, alternative energy sources, and waste reduction initiatives to align with stricter environmental standards. Firms that proactively implement sustainable practices not only comply with regulations but also appeal to environmentally conscious customers, strengthening their position in the market.

The competitive landscape of the lime market is dynamic, with ongoing consolidation, technological advancements, and shifting market demands shaping the strategies of key players. As industries worldwide continue to prioritize efficiency and sustainability, companies that adapt to these trends will maintain a strong competitive advantage in the evolving lime market.

Top 3 Players in the Market

Carmeuse

Carmeuse is a leading global producer of lime and limestone products, serving various industries such as steel manufacturing, construction, and environmental services. The company operates facilities across Europe, North America, and Africa, providing high-quality lime products that are essential in processes like steel refining, flue gas treatment, and water purification. Carmeuse's extensive distribution network and commitment to sustainable practices have solidified its position as a key contributor to the global lime market.

Lhoist Group

Lhoist is a prominent lime producer with operations spanning more than 25 countries. The company offers a wide range of lime-based products utilized in industries including metallurgy, environmental protection, and chemical manufacturing. Lhoist's focus on innovation and development of customized solutions has enabled it to meet diverse customer needs, thereby strengthening its influence in the global lime market.

Graymont Limited

Graymont is a significant player in the lime market, with operations primarily in North America and the Asia-Pacific region. The company produces high-calcium and dolomitic lime products used in sectors such as construction, agriculture, and water treatment. Graymont's strategic investments in expanding production capacities and enhancing product quality have contributed to its substantial role in the global lime market.

TOP STRTEGIES USED BY THE KEY PARTICIPANTS

Acquisitions and Expansions

Companies like Mississippi Lime Company focus on expanding their production capacities and distribution networks. Operating multiple manufacturing facilities and distribution centers enables them to meet diverse customer demands effectively.

Product Diversification and Innovation

Firms such as Imerys offer a broad range of lime-based products tailored to various industrial applications. This approach allows them to serve multiple sectors, including construction, agriculture, and environmental services, thereby broadening their customer base.

Sustainability Initiatives

Environmental responsibility is a significant focus for major lime producers. Companies like Graymont Limited invest in sustainable practices to minimize their environmental footprint, aligning with regulatory requirements and appealing to environmentally conscious clients.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, SigmaRoc, a Northern European lime and limestone group, completed the acquisition of CRH plc's UK lime operations for €155 million (approximately £133 million). This acquisition included sites in Tunstead and Hindlow, positioning SigmaRoc as a leading producer of lime products in the UK. In a separate transaction, SigmaRoc acquired CRH's European lime operations for $1.1 billion. This strategic move expanded SigmaRoc's footprint in the European lime market, enhancing its production capabilities and market reach.

- In April 2024, the European Commission extended the approval period for the active substance lime sulphur, among others, to allow for the completion of ongoing assessments.

- In September 2024, the Bureau of Indian Standards approved a project to revise the standard "Methods of Tests for Building Limes: Part 4 Determination of Fineness of Hydrated Lime." This revision aims to enhance the accuracy and reliability of lime testing procedures in India.

MARKET SEGMENTATION

This research report on the global lime market is segmented and sub-segmented into the following categories.

By Type

- Quick Lime

- Hydrated Lime

By Application

- Agriculture

- Building Material

- Mining & Metallurgy

- Water Treatment

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the lime market?

Rising demand for citrus-based flavors, increasing use in health-conscious diets, and industrial applications in construction and chemicals are key growth drivers.

Which industries use limes the most?

The food and beverage industry, pharmaceuticals, cosmetics, and chemical processing sectors are major consumers of limes.

Are organic limes gaining popularity?

Yes, demand for organic limes is increasing due to consumer preference for chemical-free and environmentally sustainable products.

How is technology improving lime production?

Advancements in irrigation systems, precision farming, and genetic research are helping improve lime yields and quality.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]