Global LiDAR Market Size, Share, Trends, & Growth Forecast Report - Segmented By Type (Mechanical LiDAR and Solid-State LiDAR), Installation (Airborne and Ground-Based), Application (Corridor Mapping, ADAS & Driverless Car, and Engineering), Range, Component, Service & Region - Industry Forecast From 2024 to 2032

Global LiDAR Market Size (2024 to 2032)

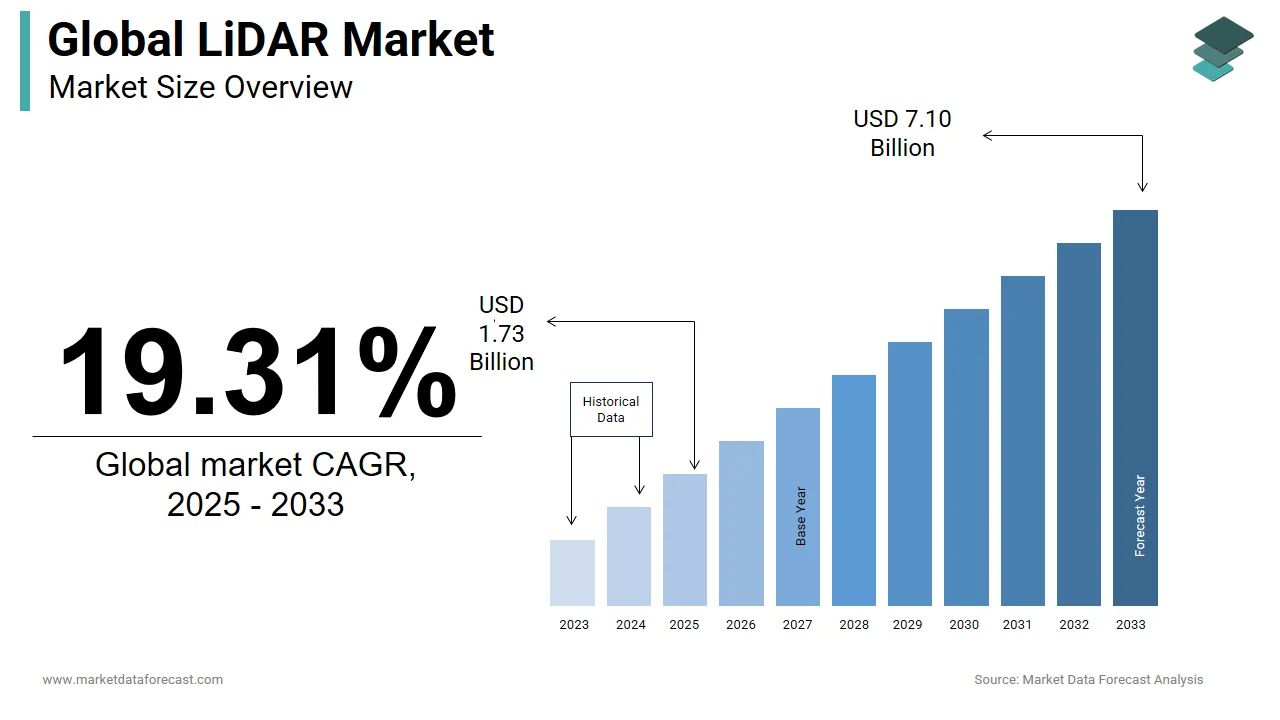

The global LiDAR market size was worth USD 1.2 billion in 2023. The global market is expected to grow at a CAGR of 19.31% from 2024 to 2029 and be worth USD 1.45 billion in 2024 and USD 5.95 billion by 2032. The growth of the global LiDAR market is primarily driven by the rising need for surveying both on-ground and in the air.

LiDAR is a remote sensing technology that uses laser beams to measure distances and create 3D maps. It emits laser pulses, measuring the time taken for light to return, enabling precise distance calculations. It is essential in geographic mapping, autonomous vehicles, forestry, and environmental monitoring, LiDAR also provides high-resolution spatial information. Its applications range across industries and research fields, offering a powerful tool for accurately mapping and understanding the intricacies of the physical world.

MARKET DRIVERS

Smart Cities and Infrastructure Development play a pivotal role in the growth of the LiDAR market. It enables the creation of highly detailed 3D maps, providing urban planners and policymakers with crucial insights for efficient city management.

However, its application extends to monitoring changes in the urban landscape and the development of sustainable infrastructure. As cities strive for enhanced connectivity, resource optimization, and environmental sustainability, LiDAR's capacity to deliver accurate spatial data. As a result, the LiDAR market experiences heightened demand as smart city projects increase, emphasizing the significance of technology in shaping the future of urban living through innovative, technology-driven solutions for intelligent infrastructure development and management.

The LiDAR Market is also experiencing another notable surge driven by the rising industrial realms, emerging as a catalyst for innovation in robotics, manufacturing, and warehouse automation. Its application offers real-time spatial data that enhances automation processes to high levels of efficiency. In robotics, LiDAR eventually facilitates precise navigation and obstacle avoidance. However, warehouse automation also benefits from LiDAR's capacity to optimize inventory management and streamline logistics through accurate spatial awareness. As industries increasingly prioritize automation for productivity gains, the LiDAR market experiences a surge in demand, becoming an integral component in the industrial landscape, driving advancements that redefine the possibilities of automated processes in manufacturing and logistics.

The LiDAR market stands at the forefront of telecommunications evolution, offering significant growth opportunities through its pivotal role in planning and optimizing 5G infrastructure. LiDAR's precision in mapping and assessing urban landscapes proves instrumental in the efficient deployment of network equipment for advanced telecommunications networks. However, this technology facilitates the strategic placement of antennas and ensures optimal coverage, addressing the unique challenges of urban environments. Moreover, the relationship between LiDAR and 5G infrastructure positions the market as a key player in shaping the future of telecommunications, offering solutions that enable seamless connectivity and contribute to the realization of the 5G revolution.

MARKET RESTRAINTS

The rising LiDAR market encounters a significant restraint in the form of cost and affordability.

The expense associated with receiving and implementing LiDAR technology serves as a substantial barrier, particularly for smaller businesses and applications struggling with budget constraints. As industries seek to tackle the transformative potential of LiDAR for applications like autonomous vehicles, precision agriculture, and industrial automation, the financial burden still remains a main consideration. However, the market's challenge lies in addressing these cost barriers, whether through technological innovations that drive down manufacturing costs, strategic partnerships, or the development of more cost-effective LiDAR solutions.

The market growth faces a critical challenge as the environmental impact. As the demand for LiDAR technology rises across various industries, there is also a need to adopt sustainable practices in manufacturing and disposal. Also, the extraction and processing of materials for LiDAR systems and electronic waste concerns underscore the imperative for environmentally conscious strategies. Industry stakeholders must prioritize the development of eco-friendly manufacturing processes, recyclable materials, and responsible disposal methods.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

19.31% |

|

Segments Covered |

By Type, Installation, Application, Service, Component, Geography and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Teledyne Technologies Inc. (US), Geodigital (Canada), Optech (Canada), BLOM (Norway), Faro Technologies (US), Leica Geosystems (Switzerland), Michael Baker International (U.S.), Topcon Positioning Systems, Inc. (U.S.), Trimble (US), Hexagon AB (Sweden), Beike Tianhui Technology Co., Ltd. (China), Quantum Spatial (US), YellowScan (France), Velodyne LiDAR (US), Merrick & Co. (US), Reigl Laser Measurement Systems (Austria), Beijing Surestar Technology (China), Geokno (India), and Sick AG (Germany) and Others. |

SEGMENTAL ANALYSIS

Global LiDAR Market Analysis By Type

The solid-state segment is anticipated to be the fastest growing segment in the global LiDAR market during the forecast period, owing to its increasing application in the automotive and robotics industries.

Global LiDAR Market Analysis By Installation

The ground-based segment is expected to lead the market in the forecast period mainly due to its use in SUVs and ATVs. Tripods help them map uneven terrain.

Global LiDAR Market Analysis By Application

The ADAS and Driverless car segment is anticipated to have the highest CAGR in the forecast period due to the advancements made by significant companies like Honda, BMW, and AUDI.

The corridor mapping segment is estimated to account for a substantial share of the global market during the forecast period. Corridor Mapping stands out as a widely adopted application. It also involves the use of LiDAR for surveying and mapping linear features like roads, railways, pipelines, and power lines. The dominance of Corridor Mapping is attributed to its critical role in infrastructure development, urban planning, and transportation projects. LiDAR's ability to provide detailed and accurate 3D mapping of linear structures enhances efficiency in design, construction, and maintenance.

Global LiDAR Market Analysis By Service

The ground-based surveying segment is expected to be the fastest-growing due to the increase in the use of LiDAR technology in SUVs and ATVs for surveillance purposes, especially in defense applications.

Global LiDAR Market Analysis By Component

The laser scanners segment held the major share of the worldwide market in 2023 and is projected to have the fastest growth rate in the proposed forecast period.

REGIONAL ANALYSIS

North America is the most dominant region in the LiDAR market, driven by a robust demand for LiDAR technology in applications such as autonomous vehicles, smart cities, and infrastructure development. Strong technological advancements, significant investments in research and development, and a well-established automotive sector contribute to the dominance of LiDAR technology in North America.

Europe is a second significant player in the LiDAR market, with widespread adoption across industries like forestry, agriculture, and environmental monitoring. Stringent environmental regulations, emphasis on sustainable practices, and advancements in precision agriculture contribute to the growing utilization of LiDAR technology in Europe.

The Asia-Pacific region is also experiencing a growing influence in the LiDAR market, fuelled by increasing applications in industries like mining, urban planning, and agriculture. Rapid urbanization, infrastructure development, and a surge in demand for autonomous technologies contribute to the expanding footprint of LiDAR in the Asia-Pacific region.

Latin America is an emerging market for LiDAR, with applications primarily in agriculture, forestry, and environmental monitoring. Increasing awareness of LiDAR technology benefits and growing investments in agriculture and environmental preservation contribute to its gradual adoption in Latin America.

The Middle East and Africa are in the early stages of LiDAR adoption, primarily driven by applications in topographic mapping, infrastructure planning, and mining. Infrastructure development projects, natural resource exploration, and a focus on enhancing surveying capabilities contribute to the nascent adoption of LiDAR in the Middle East and Africa.

KEY MARKET PLAYERS IN THE GLOBAL LiDAR MARKET

Teledyne Technologies Inc. (US), Geodigital (Canada), Optech (Canada), BLOM (Norway), Faro Technologies (US), Leica Geosystems (Switzerland), Michael Baker International (U.S.), Topcon Positioning Systems, Inc. (U.S.), Trimble (US), Hexagon AB (Sweden), Beike Tianhui Technology Co., Ltd. (China), Quantum Spatial (US), YellowScan (France), Velodyne LiDAR (US), Merrick & Co. (US), Reigl Laser Measurement Systems (Austria), Beijing Surestar Technology (China), Geokno (India), and Sick AG (Germany) are playing a leading role in the global LiDAR market.

RECENT HAPPENINGS IN THE GLOBAL LiDAR MARKET

- In 2023, Innoviz Technologies focused on developing high-performance, solid-state LiDAR sensors for autonomous vehicles. The company made strides in reducing the size and cost of its LiDAR sensors while maintaining or improving their performance.

- In 2023, Luminar Technologies concentrated on improving the performance and capabilities of its LiDAR sensors, with a particular emphasis on long-range perception. The company aimed to reduce the cost of its LiDAR sensors through technological advancements and increased production scale.

DETAILED SEGMENTATION OF THE GLOBAL LiDAR MARKET INCLUDED IN THIS REPORT

This research report on the global LiDAR market has been segmented and sub-segmented based on type, installation, application, service, component, geography, and region.

By Type

- Mechanical

- Solid-state

By Installation

- Airborne

- Ground-Based

By Application

-

Corridor Mapping

- ADAS & Driverless Car

- Engineering

By Service

-

Aerial Surveying

- GIS Services

- Ground-Based Surveying

- Asset Management

- Others

By Component

-

Navigation

- Laser Scanners

- Positioning Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the key applications of LiDAR technology in the global automotive sector?

In the automotive sector, LiDAR technology plays a crucial role in advanced driver assistance systems (ADAS), autonomous vehicles, and vehicle-to-everything (V2X) communication. LiDAR sensors provide high-resolution 3D mapping and object detection capabilities, enhancing vehicle safety and enabling autonomous navigation.

What role does LiDAR technology play in the development of smart cities globally?

In the context of smart cities, LiDAR technology supports urban planning and development by enabling accurate mapping of urban infrastructure, traffic management, pollution monitoring, and enhancing public safety through real-time data analytics.

How does LiDAR technology contribute to precision agriculture on a global scale?

In precision agriculture, LiDAR technology helps optimize crop management practices by providing detailed terrain elevation data, monitoring crop health, and facilitating precise application of fertilizers and pesticides. This improves agricultural productivity while minimizing environmental impact.

What advancements are anticipated in the global LiDAR market in the near future?

The global LiDAR market is expected to witness advancements in sensor miniaturization, cost reduction, and improved data processing algorithms, leading to enhanced performance, increased adoption across industries, and the emergence of new applications such as indoor mapping and infrastructure inspection.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]