Europe Li-Fi (Light Fidelity) Market Size, Share, Trends & Growth Forecast Report By End-User Industry (Industrial, Healthcare, Retail, Corporate Buildings, Education, Residential, Aerospace and Defense, Automotive and Transportation, and Other End-User Industries (Hospitality, Disaster Management, and Others)), and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe), Industry Analysis From 2025 to 2033

Europe Li-Fi (Light Fidelity) Market Size

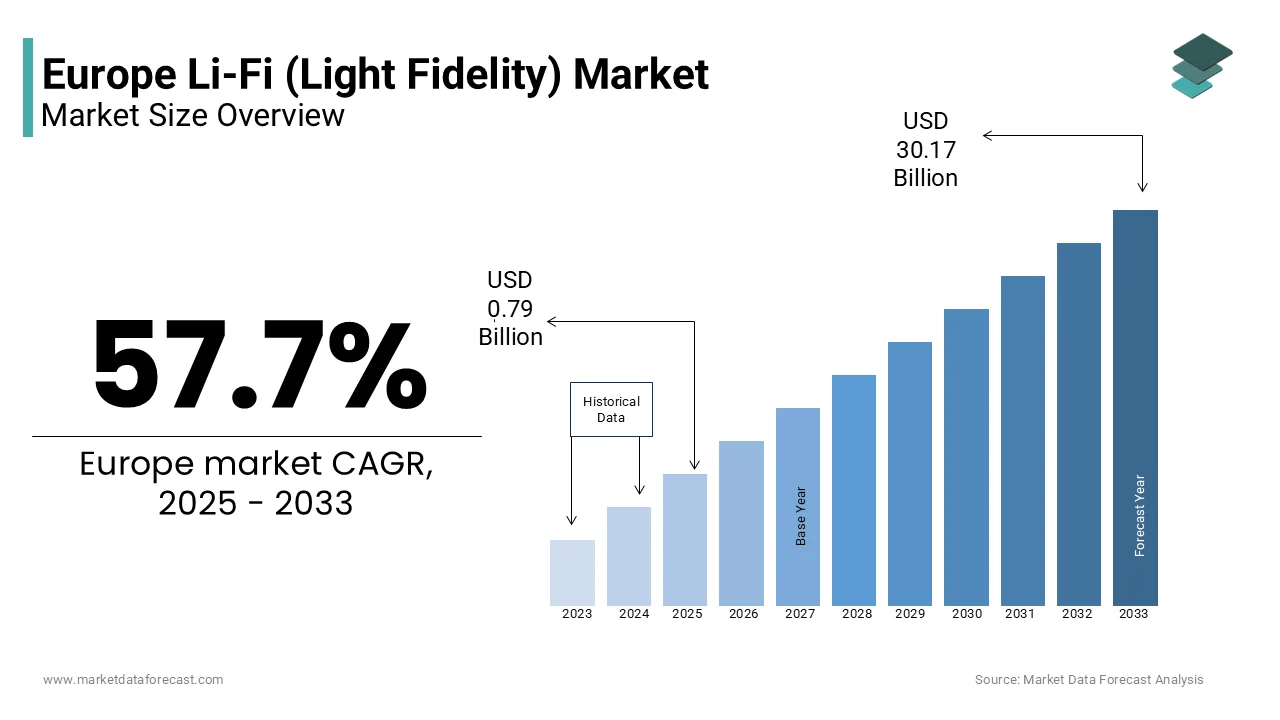

The Europe Li-Fi (Light Fidelity) market size was valued at USD 0.50 billion in 2024. The European market size is estimated to be worth USD 30.17 billion by 2033 from USD 0.79 billion in 2025, growing at a CAGR of 57.7% from 2025 to 2033.

The Europe Li-Fi (Light Fidelity) market is witnessing rapid adoption, driven by the need for secure, high-speed data transmission in environments where traditional Wi-Fi faces limitations. The demand for Li-Fi is further fueled by its application in sensitive sectors like healthcare and defense, where electromagnetic interference must be minimized. As per Eurostat, over 30% of European enterprises have expressed interest in adopting Li-Fi solutions by 2025, with its growing relevance. Additionally, government investments in smart city projects and IoT integration are propelling the market forward.

MARKET DRIVERS

Increasing Demand for Secure Communication Solutions

The rising need for secure communication channels is a key driver of the Europe Li-Fi market. According to the European Cybersecurity Organization, cyberattacks targeting sensitive industries like healthcare and defense increased by 40% in 2023 with vulnerabilities in traditional wireless networks. Li-Fi offers a secure alternative, as it uses light waves that cannot penetrate walls, significantly reducing the risk of unauthorized access. This feature makes it ideal for hospitals, where patient data confidentiality is paramount, and defense facilities requiring classified communication.

Integration with Smart City Initiatives

Smart city development across Europe is accelerating the adoption of Li-Fi technology. According to the European Smart Cities Observatory, over 100 cities in Europe are implementing smart infrastructure projects, including intelligent lighting and connected public spaces. Li-Fi-enabled LED systems not only provide energy-efficient illumination but also facilitate high-speed internet connectivity, creating dual-purpose infrastructure. For instance, Barcelona’s smart streetlights equipped with Li-Fi technology have demonstrated a 30% reduction in energy consumption while enhancing connectivity for IoT devices. The investments in smart cities are expected to provide a fertile ground for Li-Fi deployment.

MARKET RESTRAINTS

High Initial Deployment Costs

The high cost of Li-Fi system installation poses a significant barrier to widespread adoption. Setting up a Li-Fi network requires specialized hardware, including photodetectors and modulators, which can increase initial expenses by 50% compared to traditional Wi-Fi setups. This financial burden is particularly challenging for SMEs, which account for over 90% of European businesses. As per the European Federation of Small Businesses, less than 15% of SMEs have the resources to invest in advanced technologies like Li-Fi that is limiting its market penetration. While larger enterprises can absorb these costs, smaller organizations often delay adoption is hindering overall market growth.

Limited Awareness and Technical Expertise

A lack of awareness and technical expertise among end-users and installers is another restraint affecting the Europe Li-Fi market. According to the European Technology Training Institute, over 60% of IT professionals are unfamiliar with Li-Fi technology and its applications. This knowledge gap creates hesitation among potential adopters in industries like retail and education, where decision-makers prioritize proven solutions. Additionally, as per the European Skills Gap Report, there is a shortage of skilled technicians capable of deploying and maintaining Li-Fi systems, further slowing adoption rates. Bridging this gap requires extensive training programs and awareness campaigns, which remain underdeveloped in many regions.

MARKET OPPORTUNITIES

Expansion into Untapped Sectors

Emerging sectors such as disaster management and hospitality present untapped opportunities for the Europe Li-Fi market. According to the European Disaster Management Agency, Li-Fi can play a critical role in emergency response scenarios by providing secure and reliable communication in areas with damaged traditional networks. For instance, Li-Fi-enabled drones were successfully deployed during flood relief operations in Italy in 2023 that is demonstrating its potential. Similarly, the hospitality sector is exploring Li-Fi for guest rooms and conference halls by offering seamless connectivity without compromising privacy. As per the European Hotel and Restaurant Association, over 50% of luxury hotels are considering Li-Fi installations by 2026 with its growth potential in niche markets.

Collaboration with IoT Ecosystems

The integration of Li-Fi with IoT ecosystems offers significant growth opportunities. According to the European IoT Alliance, the number of connected devices in Europe is expected to reach 5 billion by 2028 by creating a massive demand for high-speed, low-latency communication solutions. Li-Fi’s ability to support dense device networks makes it ideal for IoT applications in industrial automation, smart homes, and transportation. For example, German automotive manufacturers are leveraging Li-Fi to enable real-time vehicle-to-infrastructure communication, reducing traffic congestion and improving safety. As per the European Industrial IoT Consortium, Li-Fi adoption in IoT applications is projected to grow by 80% annually, positioning it as a cornerstone of future connectivity.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

57.7% |

|

Segments Covered |

By End-User Industry, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, Rest of Europe |

|

Market Leaders Profiled |

Panasonic Holdings Corporation, Signify N.V., Renesas Electronics Corporation, Wipro Lighting, pureLiFi Limited, Oledcomm, VLNComm, Velmenni, LiFiComm Tech, and others. |

SEGMENT ANALYSIS

By End-User Industry Insights

The industrial sector was the largest segment with 25.4% of the Europe Li-Fi market share in 2024 with the need for secure, high-speed data transmission in factory environments, where electromagnetic interference from Wi-Fi can disrupt operations. According to Eurostat, over 40% of European manufacturing facilities are integrating Li-Fi into their Industry 4.0 initiatives by enabling real-time monitoring and predictive maintenance. The technology’s compatibility with IoT devices further enhances operational efficiency with its position as the leading segment.

The healthcare segment is projected to grow at a CAGR of 70.3% in the next coming years driven by the need for secure communication in sensitive environments. According to the European Health Technology Institute, Li-Fi’s ability to prevent electromagnetic interference ensures uninterrupted operation of medical devices, making it indispensable in hospitals. Its application in telemedicine and remote diagnostics is further fueling adoption, with over 60% of European healthcare providers planning to integrate Li-Fi by 2027.

REGIONAL ANALYSIS

Germany led the Europe Li-Fi market with 28.5% of share in 2024 with the robust investments in smart factories and IoT ecosystems, where over 50% of industrial facilities have adopted Li-Fi technology. According to Eurostat, Germany’s focus on Industry 4.0 initiatives has created a fertile ground for Li-Fi adoption in manufacturing and logistics sectors.

Spain is projected to grow at a CAGR of 75.1% throughout the forecast period with its aggressive smart city initiatives. According to the Spanish Ministry of Industry, over 30 cities are integrating Li-Fi-enabled LED systems into public infrastructure, such as streetlights and transportation hubs. This push towards sustainable urban development is coupled with government incentives for green technologies, positions Spain as the fastest-growing market for Li-Fi in Europe.

According to the UK Department for Digital, Culture, Media & Sport, UK, France, and Italy are investing heavily in healthcare and transportation sectors that is driving Li-Fi adoption. France’s focus on aerospace applications and Italy’s advancements in disaster management solutions further enhance their contributions to the market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Panasonic Holdings Corporation, Signify N.V., Renesas Electronics Corporation, Wipro Lighting, pureLiFi Limited, Oledcomm, VLNComm, Velmenni, LiFiComm Tech, and Lucibel SA are playing dominating role in the Europe Li-Fi (Light Fidelity) market

The Europe Li-Fi market is highly competitive is characterized by the dominance of established players like pureLiFi, Signify, and Oledcomm, alongside emerging firms focusing on niche segments. Oledcomm’s affordability strategy appeals to budget-conscious clients, particularly SMEs. Regional fragmentation allows smaller innovators to carve out niches, fostering innovation. Pricing wars occasionally arise in cost-sensitive markets like Eastern Europe. Regulatory frameworks further intensify rivalry, as manufacturers must continuously adapt to evolving compliance requirements. Despite challenges, collaboration opportunities exist in integrating green technologies and IoT-driven solutions.

TOP PLAYERS IN THIS MARKET

PureLiFi

pureLiFi dominates the market. The company specializes in secure communication solutions, catering primarily to defense and healthcare sectors. pureLiFi’s cutting-edge innovations, such as its next-generation Li-Fi modules, ensure high-speed data transmission while maintaining unparalleled security, making it a preferred choice for sensitive environments.

Signify (Philips Lighting)

Signify’s Li-Fi-enabled LED systems are widely adopted in European smart cities, including Barcelona and Amsterdam. The company’s strategic partnerships with municipal governments have enabled large-scale deployment of Li-Fi infrastructure is reinforcing its domiannce in the commercial and public sectors.

Oledcomm

Oledcomm’s affordable and scalable solutions appeal to SMEs and emerging markets. Its collaborations with IoT providers have expanded its global footprint is positioning it as a key player in niche industries like retail analytics and smart warehousing.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players employ diverse strategies to maintain competitiveness and drive growth. Product innovation remains central, with pureLiFi launching advanced modules for secure data transmission. Strategic partnerships are another focus, exemplified by Signify’s collaborations with municipal governments for smart city projects. Oledcomm emphasizes affordability , targeting SMEs through cost-effective solutions. Additionally, all three companies prioritize sustainability by aligning with EU regulations and consumer demand for eco-friendly technologies. These multifaceted approaches ensure sustained market presence while addressing evolving customer needs.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, pureLiFi launched its next-generation Li-Fi module in Europe. This initiative aims to enhance data security in sensitive environments in defence and healthcare sectors.

- In May 2024, Signify partnered with Barcelona’s municipal government. This collaboration seeks to integrate Li-Fi into smart streetlights by reducing energy consumption while improving connectivity.

- In July 2024, Oledcomm announced a distribution agreement with TechData in Italy. This move enhances accessibility to affordable Li-Fi solutions for SMEs in underserved regions.

- In September 2024, pureLiFi expanded its Berlin R&D center. This development ensures localized innovation for European clients by accelerating product development and customization.

- In November 2024, Signify initiated a training program for IoT professionals in France. This action addresses the talent gap in Li-Fi deployment by fostering long-term industry growth and expertise.

MARKET SEGMENTATION

This research report on the Europe Li-Fi (Light Fidelity) market is segmented and sub-segmented into the following categories.

By End-User Industry

-

Industrial

-

Healthcare

-

Retail

-

Corporate Buildings

-

Education

-

Residential

-

Aerospace and Defense

-

Automotive and Transportation

-

Other End-user Industries (Hospitality, Disaster Management, and Others)

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

1. What are the key opportunities in the Europe Li-Fi Market?

The Europe Li-Fi market is witnessing strong growth opportunities due to rising demand for high-speed, secure wireless communication in sectors like defense, healthcare, and smart cities, along with increasing investments in next-gen indoor connectivity solutions.

2. What are the major challenges facing the Europe Li-Fi Market?

Key challenges include limited range compared to traditional Wi-Fi, high initial setup costs, lack of standardized infrastructure, and the need for consistent line-of-sight for effective communication.

3. Who are the major players in the Europe Li-Fi Market?

Leading companies include pureLiFi, Signify (formerly Philips Lighting), Oledcomm, VLNComm, and Lucibel, known for their cutting-edge Li-Fi technologies and collaborations with government and enterprise sectors across Europe.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]