Global Legionella Testing Market Size, Share, Trends & Growth Forecast Report By Test Type, Application, End-Users and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Legionella Testing Market Size

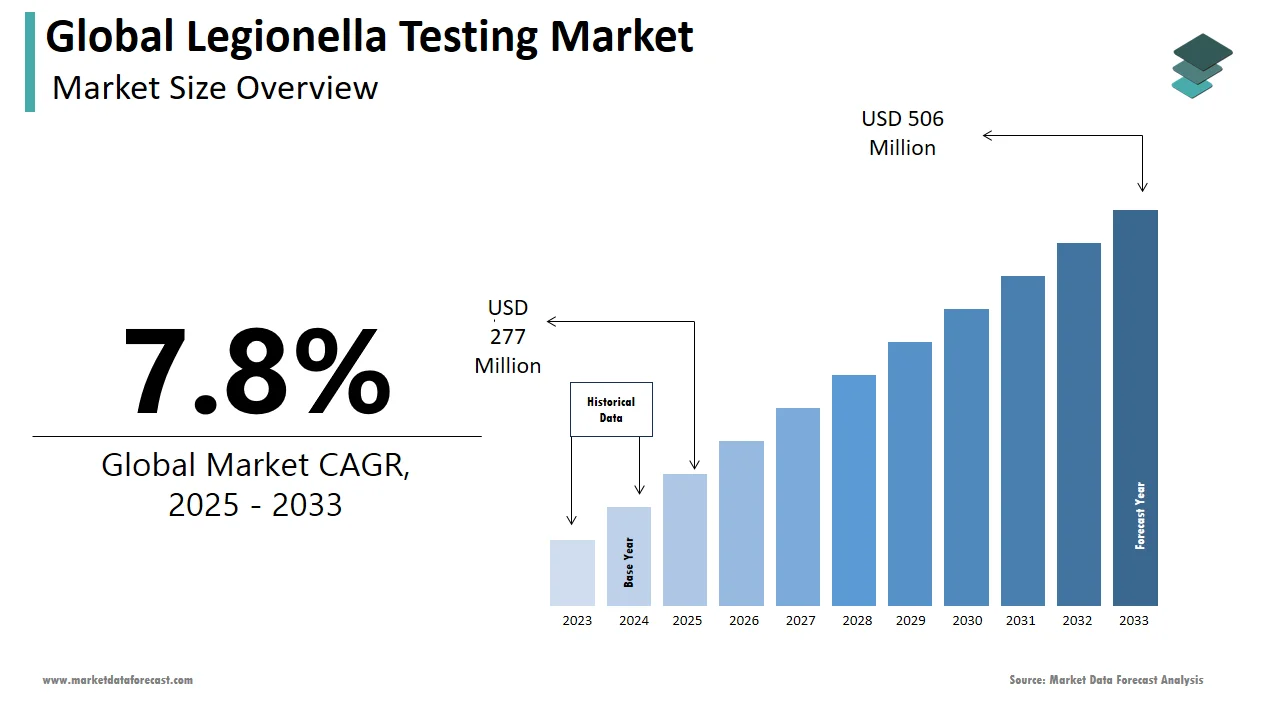

The size of the global legionella testing market was worth USD 257 million in 2024. The global market is anticipated to grow at a CAGR of 7.8% from 2025 to 2033 and be worth USD 506 million by 2033 from USD 277 million in 2025.

MARKET DRIVERS

Increasing spending on R&D, rising awareness around legionella, technological advancements, and untapped potential in emerging markets are a few factors driving the legionella testing market.

Legionella infection is caused by inhaling airborne water droplets contaminated with legionella bacteria. This has led to rising awareness regarding bacteria and its adverse effects on people's health. Since outbreaks of Legionnaires' disease can sometimes be fatal, regular Legionella testing is preferred. Owing to the increased adoption of these testing devices, the market participants and manufacturers are investing continuously to improve further these testing devices, which is anticipated to boost market growth during the forecast period. Increasing initiatives by various governments and market participants to develop technological advancements for effective legionella testing is another factor promoting the market growth. Sometimes, these testing devices must be carried to places such as publicly accessible buildings, health care centers, fountains, cooling towers, and hospitals for testing purposes. In addition, YOY growth in aging people is expected to favor the legionella testing market. This is because people over 50 are much more likely to get infected with legionella.

MARKET RESTRAINTS

Accuracy issues and high costs associated with legionella testing are majorly hampering the market growth. In addition, legionella testing takes a considerable amount of time to announce testing results. So, there is a need to develop quick devices to give results. Due to the low purchasing power of underdeveloped and developing countries, the market is not seeing much encouragement from such regions, which is hampering the overall growth rate of the legionella testing market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.8% |

|

Segments Covered |

By Test Type, Application, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Becton Dickinson and Co., bioMerieux SA, Bio Rad Laboratories Inc., Eiken Chemical Co. Ltd., Element Materials Technology Group Ltd., EMSL Analytical Inc., Eurofins Scientific SE, IDEXX Laboratories Inc., Intertek Group Plc, Pace Analytical Services LLC, PDC Laboratories LLC, Pro Lab Diagnostics Inc., and Quidel Corp., and Others. |

SEGMENTAL ANALYSIS

By Test Type Insights

Based on test type, the urinary antigen testing segment led the market in 2024. During the forecast period, the UAN test type is anticipated to showcase healthy CAGR owing to the advantages associated with UAN testing, such as rapid tests, ease of handling, higher sensitivity, and reasonable specificity. In addition, it is used as a diagnostic tool that provides same-day results without requiring respiratory fluid samples, further reducing sensitivity issues. Also, being a cost-effective test, it is preferred by underdeveloped or developing regions.On the other hand, the chest X-ray segment is also anticipated to hold a substantial share of the global legionella testing market over the forecast period.

By Application Insights

Based on application, the water testing segment is widely adopted. It is anticipated to dominate the market during the forecast period owing to strict government laws, increasing incidence of legionella testing, and increasing adoption and usage of water testing methods.However, the antibody-based in vitro diagnostics (IVD) segment is expected to showcase a healthy CAGR during the forecast period. IVD testing is a powerful and popular tool for diagnosing infectious diseases, including Legionella, with high accuracy, due to which many laboratory specialists adopt it.

By End-User Insights

Based on the end-user, the diagnostic laboratories segment is anticipated to hold the largest share of the legionella testing market during the forecast period. Growing adoption of diagnostic laboratories for legionella testing, awareness, and penetration of advanced tests for diagnosing Legionella infection are favoring the segment’s growth. In addition, the lab professionals determine the health of a water system, most of them complying with companies to get more subtle indicators for better testing.The hospital and clinics segment is anticipated to register a healthy CAGR during the forecast period owing to much better shift supervisors through applying strict regulations with environmental controls and managing a suitable treatment plan for legionella testing and treating its infection.

REGIONAL ANALYSIS

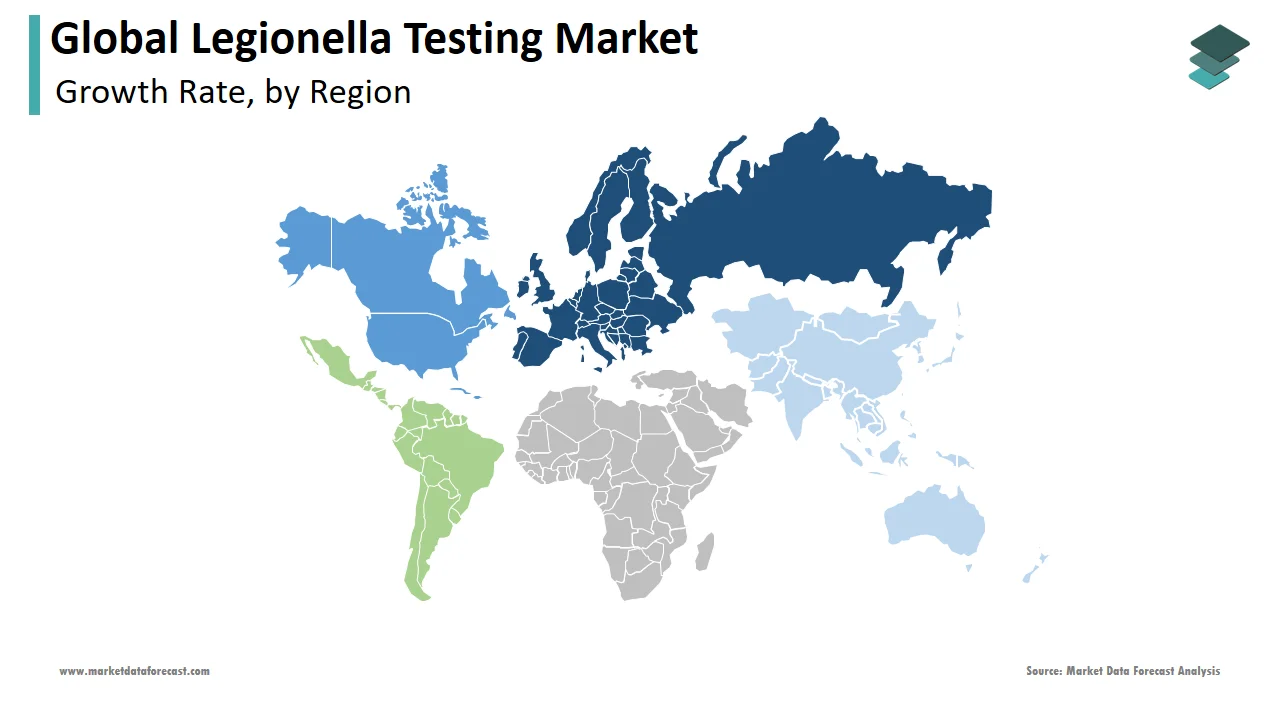

Europe had the largest global legionella testing market share in 2024, closely followed by North America. The legionella testing market in Europe is majorly driven by the growing awareness of Legionnaires' disease, increasing incidence of legionellosis, rising prevalence of waterborne diseases across Europe, and increasing investments from the key market participants on R&D. An estimated 11298 legionellosis cases were identified in Europe in 2021, according to European Centre for Disease Prevention and Control (ECDC).

North America is another promising region for the legionella testing market worldwide and is anticipated to account for a notable share of the global market during the forecast period. The market's growth in this region can be attributed mainly to the vast number of professionals focusing on Legionella risk assessments and related treatments. According to the CDC, 8,000 to 18,000 people are hospitalized with Legionnaires' disease every year in the United States. The increasing number of people affected by legionnaires is boosting the growth of the legionella testing market. Furthermore, the presence of key market players in the region from pharmaceutical and biotechnology industries, implementation of strict water safety regulatory laws by the government along with considering some favorable initiatives for making Legionella screening compulsory by the governments in countries such as Germany and the United Kingdom has further resulted in driving the growth of the market.

The APAC region is anticipated to hold the fastest CAGR in the global market. Growing investments to conduct R&D activities, growing awareness of Legionella screening techniques, increasing government support, increasing geriatric population prone to these infections, and availability of funds are supporting the legionella testing market in the Asia-Pacific region.

KEY MARKET PLAYERS

Companies playing a significant role in the global legionella testing market profiled in this report are Becton Dickinson and Co., bioMerieux SA, Bio Rad Laboratories Inc., Eiken Chemical Co. Ltd., Element Materials Technology Group Ltd., EMSL Analytical Inc., Eurofins Scientific SE, IDEXX Laboratories Inc., Intertek Group Plc, Pace Analytical Services LLC, PDC Laboratories LLC, Pro Lab Diagnostics Inc., and Quidel Corp.

RECENT MARKET DEVELOPMENTS

- In November 2022, the world leader in rapid microbiological testing for water, IDEXX, acquired an innovative Canadian company, Tecta-PDS, to expand its water microbiology testing devices range for laboratory and field testing, providing fast, simple, accurate, and cost-effective water quality testing to protect billions of people every day.

- In August 2022, Water-i.d. invented the ultimate photometer, PrimeLab 2.0, for measuring 18 wavelengths in parallel, helping various end users with sensor configuration and over 140 flexibly selectable parameters for easy management.

MARKET SEGMENTATION

This research report on the global legionella testing market has been segmented and sub-segmented based on test type, application, end-user & region.

By Test Type

- Sputum or Lung Tissue Test

- Urine Antigen Test

- Chest X-ray

- Blood Test

By Application

- Water Testing

- IVD Testing

By End-User

- Diagnostic Laboratories

- Hospital and Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much was the global legionella testing market worth in 2024?

The global legionella testing market size was valued at USD 257 million in 2024.

Which region had the largest legionella testing market share worldwide in 2024?

Europe captured the leading share of the global market in 2024.

Which segment by test type held major legionella testing market share in 2024?

Based on test type, the UAN test segment accounted for the leading share of the global market in 2024.

Which are the companies playing a key role in the legionella testing market?

Becton Dickinson and Co., bioMerieux SA, Bio Rad Laboratories Inc., Eiken Chemical Co. Ltd., Element Materials Technology Group Ltd., EMSL Analytical Inc., Eurofins Scientific SE, IDEXX Laboratories Inc., Intertek Group Plc, Pace Analytical Services LLC, PDC Laboratories LLC, Pro Lab Diagnostics Inc., and Quidel Corp are a few of the notable companies in the legionella testing market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]