Global Lead-Acid Battery Scrap Market Size, Share, Trends, & Growth Forecast Report – Segmented By Battery (Flooded and Sealed), Source (Motor Vehicles, UPS, Telecom Stations, Electric Power, Watercraft, Aircraft, Military, Oil & Gas, Stand-Alone Systems and Others), & Region - Industry Forecast From 2024 to 2032

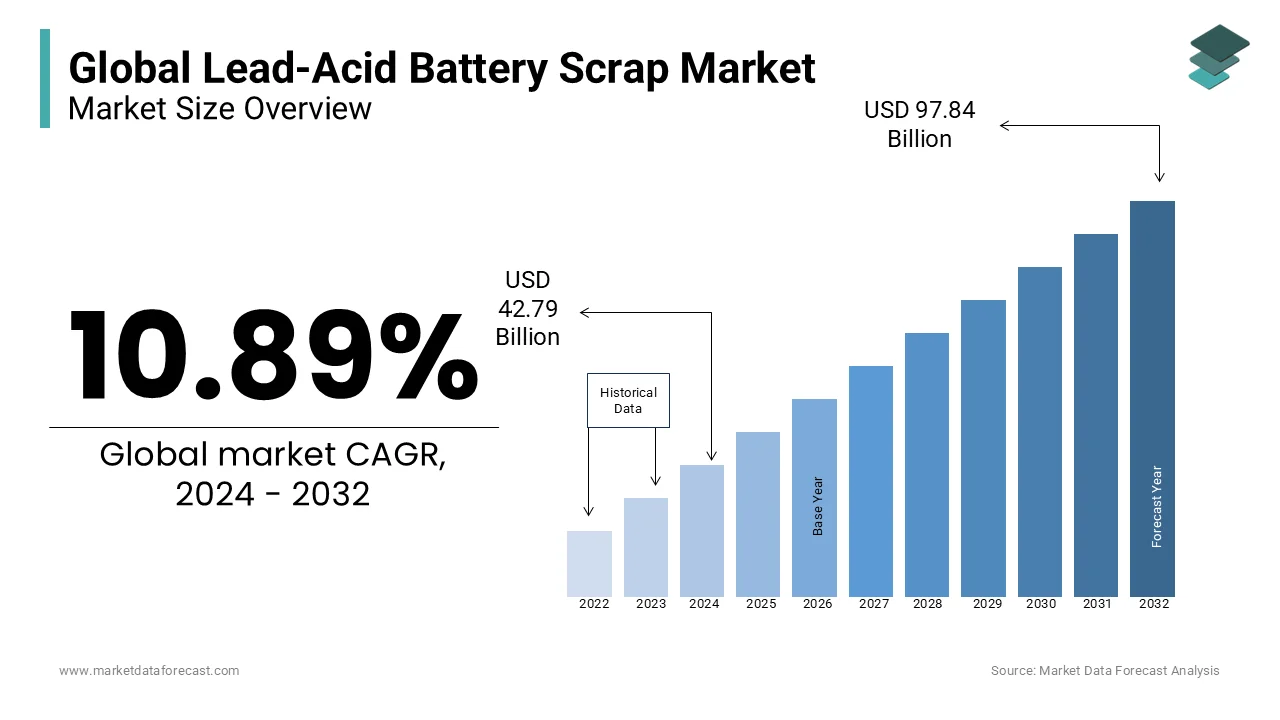

Global Lead-Acid Battery Scrap Market Size (2024 to 2032):

The Global Lead-Acid Battery Market was valued at USD 38.59 billion in 2023 and is estimated to reach a valuation of USD 97.84 billion by 2032 from US$ 42.79 billion in 2024, with a CAGR of 10.89% over the foreseen period 2024 - 2032.

MARKET SCENARIO

Lead-acid batteries are employed or spent batteries that are directly drained, recycled, or disposed of after use. More than 95% of waste lead-acid batteries are recyclable, and They can be reemployed in the production of new lead-acid batteries. The considerable increase in the number of vehicles is likely to generate larger amounts of waste lead-acid batteries in the future. It is punishable to ship lead-acid batteries to overseas destinations for recycling due to their dangerous nature. Collection centres normally receive employed batteries from consumers and transport them to authorized recycling centres for further processing. Lead-acid batteries are being employed more and more in the automotive sector. Since almost three-quarters of lead-acid batteries are made of metal, and metal is easy to recycle, this translates to a hefty price per tonne volume. Therefore, the lucrative recycling business helps scrap lead-acid battery dealers further expand their business reach due to 100 percent lead-acid battery recycling rates. The rails must be free of non-metallic materials such as plastic or rubber. The tracks consist of starter, lighting, and ignition batteries and a large list of other batteries, including automotive and marine types. The rains must be free of any liquid. Cases must be made of plastic or rubber and must be complete, including stoppers.

MARKET TRENDS

Rising environmental concerns are the main drivers of this market expansion. However, factors such as the lack of skilled labour in waste collection are holding back the growth of the market. The waste lead-acid battery market is supposed to grow steadily due to its high recyclable value and versatile applications in sectors such as the automotive, electrical power industry, and telecommunications sectors. Whether the lead-acid batteries have been fully or partially depleted, the battery paste is reemployed to make new batteries, and the metal components are sent to melt and flow to make products employed in various industries, creating new opportunities for them.

MARKET DRIVERS

Due to many factors, such as its versatile application, expansion in electric vehicle (EV) adoption, and high recycling value, the call is escalating in the telecommunications and automotive industries.

Rising environmental concerns are the main factor driving market expansion. One of the fastest-growing drivers in the global lead acid battery market is developing in the transportation industry. As technology has evolved, the application of energy storage has evolved. Therefore, escalating call for passenger cars, call for utility vehicles, and call for motorcycles leads to a higher call for these batteries as profit margins improve. It also paves the way for the expansion of the worldwide lead-acid pulp scrap market. Advances in minerals and metallurgy have emerged as an independent engine of call in the world market. In recent times, several recovery channels for lead-acid battery waste have appeared. Furthermore, car batteries can also be disposed of in lead-acid battery waste. The immediate availability of waste lead-acid batteries and the ability of scientists to recycle them has fueled the market expansion. The energy sector's growing focus on e-waste recycling has played a vital role in the expansion of the market. The total value of this market is predicted to increase in the coming years.

MARKET RESTRAINTS

Strict lead emissions rules and regulations aimed at regulating the release of lead and tailings can hamper the expansion of the global lead-acid battery market.

Factors such as a lack of skilled labour in the waste collection are hampering the expansion of the market. The high risk of health problems and the strict environmental regulations for effective treatment during the separation of waste lead-acid batteries are negatively affecting the expansion of the market.

MARKET OPPORTUNITIES

Waste lead-acid batteries play an important role in the electric power industry, creating opportunities for stakeholders in cities and rural areas of developing economies.

MARKET CHALLENGES

The switch to lithium-ion batteries is likely to pose a serious threat to the market for lead-acid batteries.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.89% |

|

Segments Covered |

By Battery, Source, and Region. |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

EnviroServe, Madenat Al Nokhba Recycling Services LLC, Bee'ah Sharjah Environment Company LLC, Systems Sunlight S.A., Exide Industries Ltd., ECOBAT Technologies Ltd, Engitec Technologies SpA, Duracell Inc., Amidt Group, Aqua Metals Inc., Gravita India Ltd., Johnson Controls International PLC, and Others. |

SEGMENTAL ANALYSIS

Global Lead-Acid Battery Scrap Market Analysis By Battery

Sealed lead-acid batteries, including AGM (absorbent glass mat) and gel batteries, are more expensive than flooded lead-acid batteries. Therefore, players in the lead acid battery disposal landscape are trying to match the call for both types of batteries by also providing high load resistance in AGM batteries and high-temperature resistance in gel batteries.

Global Lead-Acid Battery Scrap Market Analysis By Source

The automotive sector accounts for more than half of the lead-acid battery scrap market share, with stakeholders aiming to maximize its commercial potential in various regions where the automotive business is currently flourishing. Due to the expansion in the adoption of electric vehicles (EVs), automakers are highly demanding recycled lead-acid batteries to make EVs.

REGIONAL ANALYSIS

APAC is predicted to dominate the market with a CAGR of 4.6% during the foreseen period. Due to the increase in the application rate in the automotive, oil and gas, manufacturing, and healthcare industries. In addition, the expansion of the construction industry in emerging countries, especially China, India, Japan, South Korea, Malaysia, Indonesia, and Vietnam, is predicted to push the use of Solid Acid Batteries. Europe is predicted to post a second market expansion due to the escalating number of offshore and onshore renewable energy installations in Germany, Italy, Sweden, and the UK. Also, population expansion and escalated disposable income in the region are predicted to drive calls for passenger cars, which in turn will contribute to the expansion of the industry. The Asia Pacific region will see lucrative expansion during the foreseen period due to rising environmental concerns and the implementation of strict environmental policies regarding battery recycling is having a positive impact on the lead-acid battery scrap market in the area. China is one of the leading countries in the Asia-Pacific lead-acid battery scrap market. The market is predicted to experience the highest expansion in the Asia Pacific region, followed by Europe and North America. The escalating adoption of electric vehicles and emerging opportunities in the solar, oil, and gas industries are fueling the call for waste lead-acid batteries.

KEY PLAYERS IN THE GLOBAL LEAD-ACID BATTERY SCRAP MARKET

Companies playing a prominent role in the global lead-acid battery scrap market include EnviroServe, Madenat Al Nokhba Recycling Services LLC, Bee'ah Sharjah Environment Company LLC, Systems Sunlight S.A., Exide Industries Ltd., ECOBAT Technologies Ltd, Engitec Technologies SpA, Duracell Inc., Amidt Group, Aqua Metals Inc., Gravita India Ltd., Johnson Controls International PLC, and Others.

RECENT HAPPENINGS IN THE GLOBAL LEAD-ACID BATTERY SCRAP MARKET

-

Kokam Co., Ltd., a provider of lithium-ion batteries and integrated power solutions, has introduced the latest battery system for uninterruptible power systems. Already present in the UPS battery industry, Kokamboosts its place with the latest developed battery system that utilizes innovative cellular technology to escalate C-rate and energy density.

DETAILED SEGMENTATION OF THE GLOBAL LEAD-ACID BATTERY SCRAP MARKET INCLUDED IN THIS REPORT

This research report on the global lead-acid battery scrap market has been segmented and sub-segmented based on battery, source, and region.

By Battery

- Flooded

- Sealed

By Source

- Motor Vehicles

- UPS

- Telecom Stations

- Electric Power

- Watercraft

- Aircraft

- Military

- Oil & Gas

- Stand-alone Systems

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What factors are driving the growth of the lead-acid battery scrap market?

The growth of the market is primarily driven by the increasing demand for lead-acid batteries in electric vehicles (EVs), renewable energy storage systems, and backup power applications. Additionally, stringent regulations regarding battery recycling and the growing environmental concerns around battery disposal have led to a higher demand for lead recycling and recovery from used batteries.

How are regulations affecting the lead-acid battery scrap market?

Regulations such as the European Union's Directive on Waste Batteries and Accumulators and similar regulations in the U.S. and other countries are fueling the demand for battery recycling. These regulations enforce proper disposal and recycling of batteries, which is pushing companies to recycle lead from used batteries, boosting the scrap market.

What technologies are being used in the lead-acid battery recycling process?

Advanced technologies, such as hydrometallurgical processes and mechanical separation methods, are being used to efficiently extract lead from spent batteries. These methods improve recovery rates, reduce environmental impacts, and enhance the economic feasibility of recycling lead-acid batteries. Newer technologies also focus on reducing emissions and ensuring safer processing conditions.

What is the future outlook for the lead-acid battery scrap market?

The future of the lead-acid battery scrap market looks positive, with continuous growth driven by the rising demand for lead in various industries and the increasing importance of recycling for environmental sustainability. However, long-term shifts towards alternative energy storage solutions like lithium-ion batteries may pose challenges. Nonetheless, the market is expected to maintain strong growth, supported by increasing recycling practices and regulatory frameworks.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]