Latin America Whey Protein Market Size, Share, Trends & Growth Forecast Report By Type (Isolates, Concentrates and Hydrolysate), Application (Nutritional, Personal Care, Feed and Food), And Country (Brazil, Mexico, Argentina, Chile And Rest Of Latin America), Industry Analysis (2025 To 2033)

Latin America Whey Protein Market Size

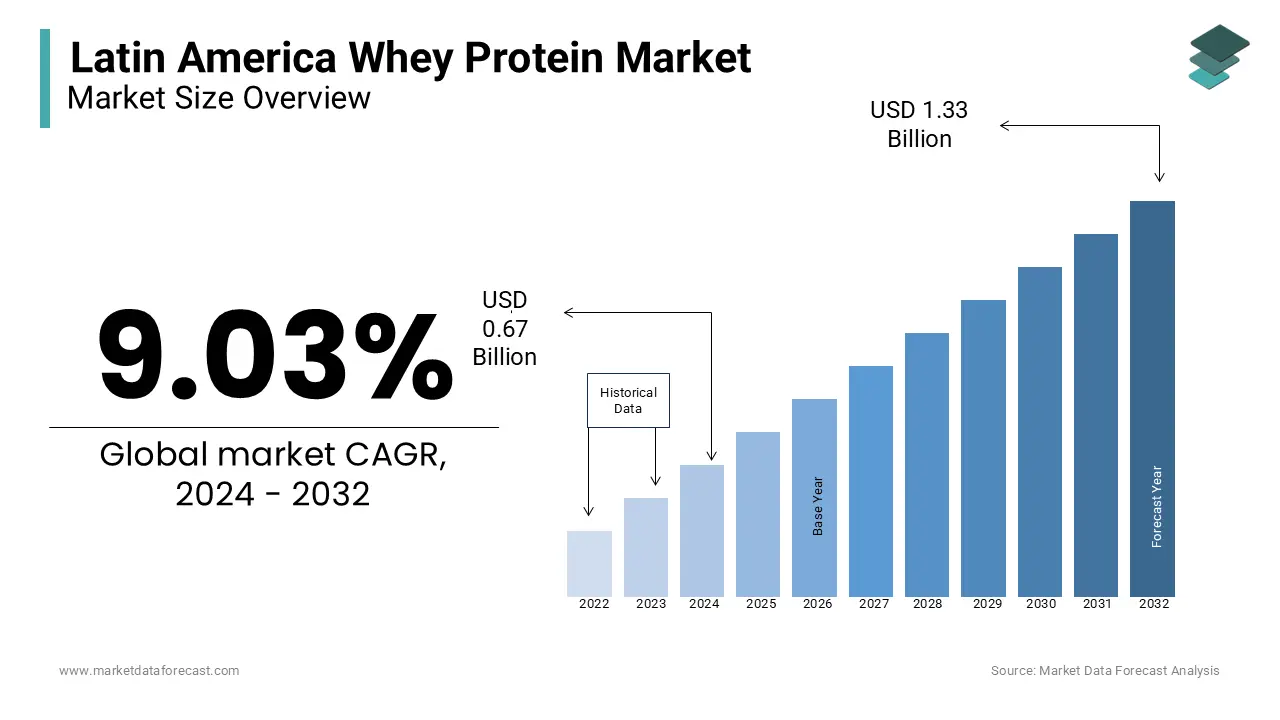

The whey protein market in Latin America was valued at USD 0.67 billion in 2024. The Latin American market is expected to grow at a CAGR of 9.03% from 2025 to 2033 and be worth USD 1.46 billion by 2033 from USD 0.73 billion in 2025.

Whey protein is a by-product of cheese production and is renowned for its high-quality amino acid profile, digestibility and versatility, which makes it a popular choice among athletes, fitness enthusiasts, and health-conscious consumers. Brazil, Mexico, and Argentina are key contributors to the regional market expansion due to the growing middle-class population and changing dietary preferences. According to the Brazilian Institute of Geography and Statistics, the fitness industry in Brazil has grown at a rate of 8% annually and is supporting increased demand for sports nutrition products, including whey protein. Similarly, as per the reports of the Mexican Health Ministry, a surge in demand for functional foods and supplements is seen in Mexico owing to the shift of the population toward healthier lifestyles.

MARKET DRIVERS

Increasing Focus on Fitness and Sports Nutrition

The growing emphasis on fitness and sports nutrition is a significant driver of the Latin American whey protein market. With rising awareness of the benefits of active lifestyles, more consumers are seeking high-protein supplements to support muscle growth and recovery. According to the Brazilian Institute of Geography and Statistics, Brazil’s fitness industry has been expanding at an annual rate of 8%, making it one of the largest fitness markets globally. Additionally, according to the National Health and Nutrition Survey of Mexico, more than 20% of urban adults engage in regular fitness activities, which boosts the demand for whey protein as a convenient and effective nutritional supplement for athletes and fitness enthusiasts across the region.

Rising Demand for Functional Foods and Beverages

The increasing popularity of functional foods and beverages is driving the adoption of whey protein in Latin America. Whey protein’s versatility and nutritional benefits make it a preferred ingredient in products like protein bars, meal replacements, and fortified drinks. According to Argentina’s Ministry of Agriculture, the functional food segment has grown by 10% annually, reflecting consumers’ shift toward health-focused diets. Similarly, Brazil’s Food Industry Association reports an increase in the incorporation of whey protein in ready-to-drink beverages and bakery products. This trend aligns with changing consumer preferences for convenient and nutrient-rich options, further bolstering the whey protein market in the region.

MARKET RESTRAINTS

High Production and Import Costs

The Latin American whey protein market faces significant challenges due to high production and import costs. Whey protein production relies heavily on advanced technologies and equipment, which are not widely available in the region, leading to dependence on imports. According to the Brazilian Agricultural Research Corporation, over 60% of whey protein used in Brazil is imported, making it vulnerable to international price fluctuations and currency exchange rates. Additionally, tariffs and logistical challenges further increase costs for manufacturers and consumers. These high costs limit accessibility, particularly for price-sensitive markets, constraining the broader adoption of whey protein products across the region.

Lack of Consumer Awareness in Rural Areas

Limited consumer awareness about whey protein and its benefits in rural areas is another major restraint on market growth. While urban centers like São Paulo and Mexico City drive demand, rural regions often lack exposure to health supplements and functional foods. The Food and Agriculture Organization reports that approximately 20% of Latin America’s population resides in rural areas with lower access to educational resources and nutritional products. This disparity creates a significant gap in market penetration, restricting the growth potential of whey protein products. Efforts to expand awareness and distribution networks are essential to overcoming this challenge and reaching underserved demographics.

MARKET OPPORTUNITIES

Growing Demand for Infant Nutrition Products

The increasing demand for infant nutrition products presents a significant opportunity for the Latin American whey protein market. Whey protein is a critical ingredient in infant formulas due to its high digestibility and nutritional profile, closely resembling breast milk. According to the United Nations Children’s Fund (UNICEF), Latin America has seen a steady rise in infant formula consumption, with sales growing by 6% annually between 2020 and 2022. Brazil and Mexico are key markets, driven by increasing urbanization and higher disposable incomes among young parents. This growth allows manufacturers to tap into the expanding infant nutrition segment, developing specialized whey protein-based products tailored to regional needs.

Expansion of Plant-Based and Blended Protein Products

The rising popularity of plant-based diets creates an opportunity for whey protein manufacturers to innovate with blended protein products that combine dairy and plant proteins. Consumers seeking sustainable and balanced nutrition are driving this trend, particularly in urban areas. According to the Food and Agriculture Organization, plant-based food consumption in Latin America grew by 10% annually between 2019 and 2022. This shift allows whey protein producers to cater to a broader audience by offering hybrid products that align with environmental and dietary preferences. Incorporating local ingredients such as quinoa and amaranth into blends can further enhance market appeal and differentiation.

MARKET CHALLENGES

Regulatory Barriers and Compliance Issues

The Latin American whey protein market faces challenges from complex regulatory environments that vary across countries. Compliance with food safety standards, labeling requirements, and import/export regulations often creates hurdles for manufacturers and distributors. According to the World Trade Organization, Latin American nations such as Brazil and Argentina have stringent import tariffs and regulatory processes that can delay market entry. Additionally, the need to meet country-specific nutritional labeling standards increases operational costs. These regulatory barriers can hinder the timely introduction of new whey protein products, limiting market growth and deterring smaller manufacturers from expanding within the region.

Fluctuating Dairy Supply and Raw Material Costs

The dependence on dairy as a primary raw material for whey protein production poses a significant challenge, particularly with fluctuating milk supply and prices. The Food and Agriculture Organization reports that adverse climate conditions and shifting agricultural priorities have led to inconsistent milk production in countries like Argentina and Uruguay, major dairy producers in the region. Such volatility affects the availability and cost of whey, impacting profit margins for manufacturers. In addition, competition from other dairy-based industries exacerbates supply constraints, making it difficult for whey protein producers to maintain stable production levels and pricing, especially in price-sensitive markets.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.03% |

|

Segments Covered |

By Type, Application, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Brazil, Mexico, Argentina, Chile, and Rest Of Latin America |

|

Market Leaders Profiled |

Hilmar Cheese Company, Maple Island Inc., Glanbia, Saputo Inc., Davisco Foods International Inc., Alpavit, Fonterra Cooperative Group Ltd, Milk Speciality Globals, Wheyco Gmbh, Milkaut SA. |

SEGMENTAL ANALYSIS

By Type Insights

In 2023, the concentrates segment led the Latin American whey protein market due to its features like a low degree of fat, cholesterol, and lactose-free. Also, they contain vital segments that are wealthy in proteins and beneficial properties, with high utilization in processed foods.

By Application Insights

The food business ruled the market with a notable income in 2018. This part has been rising due to the increasing attention paid to dietary advantages among the masses. Interest in substantial food items is becoming inferable from extending the well-being consciousness of purchasers, for example, grown-ups and seniors, newborn children and babies, and middle-class wellness devotees. For instance, Boomers Nutrition produces protein vitality for 40+ individuals. Similarly, Carbery developed peptide-specific pre-processed proteins for neonatal children. Organizations like Optimum Nutrition, an auxiliary of Glanbia, are among the most prominent players in the business.

REGIONAL ANALYSIS

Brazil captured the major share of the whey protein market in Latin America in 2023. The whey protein market growth in Brazil is majorly driven by its robust fitness industry and rising consumer health awareness. According to the Brazilian Institute of Geography and Statistics, Brazil’s fitness market grows at an 8% annual rate, which is potentially driving demand for sports nutrition products, including whey protein. Brazil also boasts a strong dairy sector and produce more than 34 billion liters of milk annually, as reported by the Brazilian Agricultural Research Corporation, which supports local whey protein production. With a large urban population increasingly adopting high-protein diets, Brazil remains a critical player in expanding the regional whey protein market.

Mexico is a key contributor to the Latin America whey protein market. The whey protein market growth in Mexico is primarily driven by its growing food and beverage industry and increasing demand for functional foods. According to the reports of the Mexican Ministry of Health, the dietary supplement sector is growing at a 12% annual growth with whey protein being a significant segment. The proximity of Mexico to the U.S. further facilitates the import of high-quality whey protein products. Additionally, rising disposable incomes and greater awareness of nutrition drive the adoption of protein-enriched foods, positioning Mexico as a prominent market for whey protein consumption and innovation.

Argentina also plays a significant role in the Latin America whey protein market. According to Argentina’s Ministry of Agriculture, the country produces over 10 billion liters of milk annually and supports the manufacturing of whey protein. Argentina is also a key exporter of dairy-based products, catering to international markets with high-quality whey protein. Domestically, rising interest in fitness and health-conscious diets has increased the demand for whey protein supplements. With its well-established dairy infrastructure and growing consumer market, Argentina is a vital contributor to the regional whey protein market.

KEY MARKET PLAYERS

Major Key Players in the Latin America whey protein market are Hilmar Cheese Company, Maple Island Inc., Glanbia, Saputo Inc., Davisco Foods International Inc., Alpavit, Fonterra Cooperative Group Ltd, Milk Speciality Globals, Wheyco Gmbh, Milkaut SA.

RECENT HAPPENINGS IN THE MARKET

- DSM gives animal feed as an imaginative and economic arrangement. The items offered by the organization are carotenoids, milk probiotics, nutrients like UFO, ROVIMIX remains and natural green grass whey powder.

- Ora Organic offers an assortment of whey protein moves in powder structure. This veggie-lover protein powder arrives in a variety of flavors, for example, chocolate, vanilla, and vanilla chai.

- Isopure zero discharges starch powder that comprises protein and low calories, which is advantageous for the keto diet.

MARKET SEGMENTATION

This research report on the Latin America whey protein market is segmented and sub-segmented into the following categories.

By Type

- Isolates

- Concentrates

- Hydrolysate

By Application

- Nutritional

- Personal Care

- Feed

- Food

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest Of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]