Latin America Thrombectomy Devices Market Size, Share, Trends & Growth Forecast Report By Type, Application, End User & Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America) - Industry Analysis (2024 to 2032)

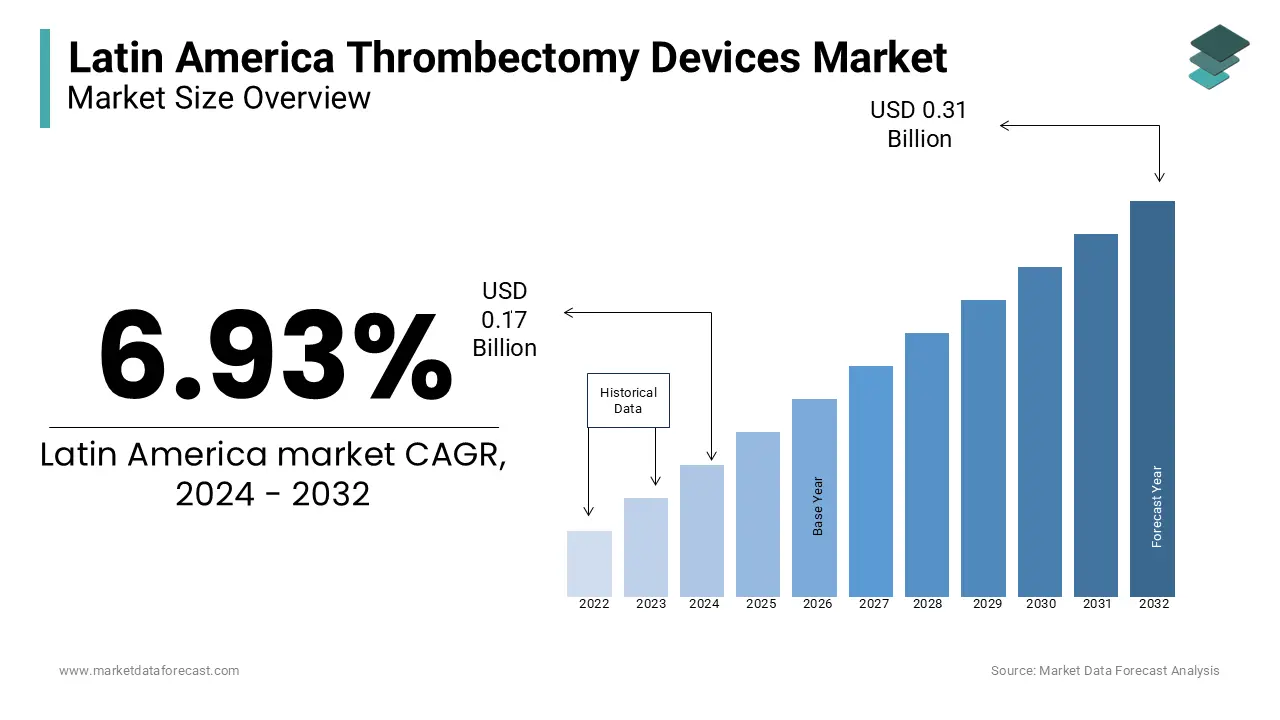

Latin America Thrombectomy Devices Market Size (2024 to 2032)

The size of the Latin America thrombectomy devices market is expected to be worth USD 0.17 billion in 2024 and USD 0.31 billion by 2032, growing at a CAGR of 6.93% from 2024 to 2032.

The Latin American thrombectomy devices market is growing steadily, and the growth of the regional market is primarily driven by an increasing need for advanced cardiovascular interventions across the region. Latin America faces a high prevalence of cardiovascular conditions, with ischemic stroke being one of the leading causes of mortality. For instance, stroke mortality rates in countries like Brazil and Argentina are significantly higher than the global average, underscoring the critical need for effective thrombectomy solutions. The market growth in Latin America is concentrated in countries with more advanced healthcare infrastructures, such as Brazil, Mexico, and Argentina, where hospitals are increasingly equipped to perform complex vascular procedures. Multinational companies like Medtronic, Stryker, and Boston Scientific have a strong presence in the region, often collaborating with local distributors to ensure accessibility and compliance with regional regulations. Some domestic players are emerging, focusing on cost-effective devices that address local healthcare budget constraints. Despite the progress, challenges remain due to limited access to specialized facilities in rural areas. For instance, approximately 30% of the population of Latin America lives outside of major cities, which is creating disparities in access to advanced medical treatments.

MARKET DRIVERS

The high prevalence of cardiovascular diseases in Latin America is one of the major factors propelling the Latin American thrombectomy devices market growth. Latin America has a high burden of cardiovascular diseases, including ischemic stroke, deep vein thrombosis, and peripheral artery disease, which require prompt and effective interventions. According to the World Health Organization (WHO), cardiovascular diseases account for nearly 20% of deaths in the region, with ischemic stroke being a leading cause. Brazil and Argentina, in particular, face higher-than-average stroke mortality rates, creating a strong demand for effective treatment options like thrombectomy devices. This high prevalence of disease supports the adoption of thrombectomy procedures as a frontline treatment, especially in urban areas where healthcare facilities are better equipped.

Growing awareness and adoption of minimally invasive procedures promotes regional market growth. There is a rising demand for minimally invasive procedures, including mechanical thrombectomy, across Latin America. These procedures offer several benefits over traditional surgical methods, including shorter recovery times, reduced risk of complications, and lower overall costs. With awareness campaigns led by healthcare providers and organizations, patients are becoming more informed about minimally invasive treatment options. The adoption of these procedures is notable in larger cities with advanced medical centers, and they are becoming increasingly preferred by healthcare professionals for treating complex cardiovascular conditions efficiently.

The rapidly expanding healthcare infrastructure in urban areas in the Latin American region boosts the regional market expansion. Latin American countries are making significant investments in healthcare infrastructure, particularly in Brazil, Mexico, and Argentina, which are home to some of the region's largest healthcare markets. Governments are focusing on building and upgrading hospitals, expanding access to advanced medical technologies, and improving stroke care systems. According to the World Bank, healthcare spending as a percentage of GDP is increasing across several Latin American nations, allowing for better access to technologies like thrombectomy devices. This improvement in infrastructure facilitates the adoption of advanced cardiovascular treatments, driving market growth.

MARKET RESTRAINTS

One of the primary barriers to market growth is the high cost of thrombectomy devices and associated procedures. Thrombectomy devices, which include aspiration and stent retriever devices, can be expensive, with individual procedures costing thousands of dollars. In a region where healthcare budgets are often limited and out-of-pocket expenditure is common, affordability is a significant concern. This limits access to thrombectomy procedures, especially among low-income patients and in public healthcare facilities, which rely on government funding.

Limited access in rural and remote areas is another major restraint to the growth of the Latin American market. While urban areas have made strides in adopting advanced medical technologies, access to specialized cardiovascular care remains limited in rural and remote areas. Approximately 30% of Latin America’s population lives outside major urban centers, often far from facilities that offer thrombectomy procedures. The disparity in access to care affects rural populations disproportionately, leading to delays in treatment and worse outcomes for cardiovascular patients. Transporting patients from rural areas to urban hospitals with specialized facilities is challenging and often not feasible for timely intervention, which can restrict market growth.

Strict regulatory and approval processes are hindering the regional market growth. Regulatory bodies in Latin American countries require medical devices, including thrombectomy devices, to undergo rigorous testing and approval processes before they can be introduced to the market. This often includes lengthy registration, compliance checks, and certification, which can delay market entry for newer, potentially more effective devices. Although these regulations are essential for ensuring patient safety, they can hinder the quick adoption of advanced technology. For multinational companies, this means additional costs and time, which can slow down the pace of innovation in the region.

MARKET OPPORTUNITIES

Rising Investments from multinational and domestic players is an opportunity in Latin America. Several global medical device manufacturers, including Medtronic, Stryker, and Boston Scientific, are increasing their presence in Latin America. Through collaborations with local distributors and healthcare providers, these companies are making thrombectomy devices more accessible across the region. Domestic players are also emerging, aiming to provide cost-effective solutions tailored to the region’s needs. These investments are helping to bridge gaps in accessibility and affordability, making thrombectomy devices more widely available to healthcare providers and patients.

Emerging Markets and Untapped Potential in Secondary Cities could be an opportunity. While the market is concentrated in major urban areas, secondary cities in Latin America are beginning to expand their healthcare services. Cities in countries like Chile, Peru, and Colombia are investing in new healthcare facilities, allowing for broader adoption of thrombectomy procedures. With urbanization trends and increasing healthcare spending in secondary cities, there is potential for market growth beyond the primary metropolitan areas. These markets present opportunities for device manufacturers to expand their footprint and reach underserved populations who previously lacked access to advanced cardiovascular care.

Technological advancements in thrombectomy devices are considered viable opportunities in the Latin American market. Innovations in thrombectomy devices, such as dual-function aspiration and stent retriever systems, are improving procedure success rates and reducing treatment time. These advancements appeal to healthcare providers focused on efficient, effective treatments. As Latin American healthcare providers seek to adopt new technologies that improve patient outcomes, thrombectomy device manufacturers have the opportunity to introduce innovative products that address local clinical needs. Enhanced devices that are user-friendly and adaptable to different clinical settings could gain traction, especially as facilities seek to improve their cardiovascular care capabilities.

MARKET CHALLENGES

Economic Constraints and Funding Limitations is a big challenge to the Latin American market. Economic challenges, including budget restrictions in public healthcare systems, pose a significant challenge to the growth of the thrombectomy devices market in Latin America. Government funding for healthcare is often limited, especially for costly cardiovascular treatments that require advanced technology. During economic downturns, healthcare budgets are often constrained, which affects the purchasing of specialized devices like thrombectomy equipment. This financial limitation restricts adoption rates in public hospitals and among lower-income populations, which form a considerable portion of the patient base.

Training and Skill Gaps among Healthcare Professionals is another notable challenge. Performing thrombectomy procedures requires specialized skills and training, which are often limited in Latin America. Hospitals that acquire thrombectomy devices must also invest in staff training to ensure effective use. However, shortages in skilled personnel, combined with limited training programs, create challenges for healthcare providers aiming to offer thrombectomy services. Some hospitals in Latin America rely on international training programs or visiting specialists, which can be costly and logistically complex, impacting the widespread adoption of these procedures.

Competition with Other Treatment Options is also a significant challenge to the growth of the Latin American market. Although thrombectomy devices are effective, other treatment options, such as thrombolytic drugs, are more affordable and accessible in Latin America. For hospitals and clinics facing budget constraints, drug-based treatments can be a preferable alternative despite having limitations, particularly in complex cases. This competition limits the use of thrombectomy devices, as they are often reserved for cases where other treatments fail or are contraindicated. Market players must demonstrate the efficacy and long-term cost-effectiveness of thrombectomy devices to position them as a preferred option.

This research report on the Latin America Thrombectomy Devices Market has been segmented and sub-segmented into the following categories.

By Type

- Mechanical Thrombectomy Devices

- Stent Retrievers

- Basket/Brush Retrievers

- Coil Retrievers

- Ultrasonic Thrombectomy Devices

- Aspiration Thrombectomy Devices

- Hydrodynamic Thrombectomy Devices

The mechanical thrombectomy devices segment led the market and occupied 40.4% of the regional market share in 2023. This segment's dominance is attributed to its efficacy in quickly removing clots in critical blood vessels, significantly improving outcomes for patients with ischemic stroke and other vascular conditions. Mechanical thrombectomy devices, such as stent retrievers, have proven highly effective, with studies showing up to a 90% revascularization rate, which is critical in reducing stroke-related disability and mortality. Hospitals in Latin America increasingly rely on these devices as they offer reliable, minimally invasive clot removal options and are often favored in urban areas with advanced healthcare facilities.

On the other hand, the aspiration thrombectomy devices segment is projected to grow at the fastest CAGR of 9.12% over the forecast period. This rapid growth is driven by the appeal of these devices’ simpler, less-invasive approach compared to mechanical options. Aspiration devices use suction to remove clots, making them cost-effective and easier to operate, which is particularly beneficial in Latin American healthcare systems where resource availability may be limited. Recent clinical studies show promising results for aspiration devices in stroke care, especially in small or moderate-sized clots, which has led to a surge in their popularity among healthcare providers seeking accessible and efficient thrombectomy solutions.

By Application

- Peripheral Vascular Application

- Neurovascular Application

- Cardiovascular Application

The neurovascular application segment captured 45.1% of the regional market share and emerged as the most dominating segment in the regional market in 2023. This dominance is due to the high prevalence of ischemic strokes in Latin America, where stroke remains a leading cause of death and long-term disability. Neurovascular thrombectomy procedures, primarily focused on acute ischemic stroke, are increasingly performed in urban hospitals equipped with advanced stroke care facilities. Studies show that mechanical thrombectomy can significantly improve functional outcomes in stroke patients, with up to 90% success in restoring blood flow. The growing focus on improving stroke care outcomes, combined with rising stroke awareness, underscores the importance of neurovascular applications in this market.

The peripheral vascular segment is expected to be the fastest-growing segment in the Latin America thrombectomy devices market during the forecast period. This growth is driven by the increasing prevalence of peripheral artery disease (PAD) in Latin America, largely linked to rising rates of diabetes, hypertension, and aging populations. PAD affects over 12% of adults over the age of 60 in the region, and thrombectomy procedures are increasingly utilized to treat blockages and restore blood flow in peripheral arteries. The demand for minimally invasive procedures, particularly for treating lower-limb vascular obstructions, is on the rise as they offer shorter recovery times and are less invasive than surgical alternatives, making this application critical in addressing PAD-related complications.

By End Users

- Research Laboratories & Academic Institutes

- Ambulatory Surgical Centres

- Hospital Surgical Centres

- Others

By Disease

- Coronary Diseases

- Neural Diseases

- Peripheral Diseases

By Country

- Mexico

- Brazil

- Argentina

- Chile

- The rest of Latin America

Brazil holds the largest share in the Latin America thrombectomy devices market and had 40.7% of the regional market share in 2023. This leadership is driven by Brazil's advanced healthcare infrastructure, extensive hospital networks, and high prevalence of cardiovascular and neurovascular diseases. Brazil faces a high incidence of ischemic stroke, one of the leading causes of death in the country, with nearly 100,000 stroke-related deaths reported annually. Recognizing the need for advanced stroke care, Brazil has invested in developing specialized stroke centers, particularly in urban areas like São Paulo and Rio de Janeiro. These facilities are equipped to handle thrombectomy procedures, especially for neurovascular and cardiovascular applications, making Brazil a central market for thrombectomy devices in Latin America.

Mexico is the fastest-growing country in the Latin America thrombectomy devices market. This rapid growth is fueled by rising healthcare investments, particularly in expanding stroke and cardiovascular care facilities. Cardiovascular diseases are the leading cause of death in Mexico, and the demand for minimally invasive thrombectomy procedures is rising to address stroke and peripheral artery disease effectively. Mexico’s government has also prioritized improving access to advanced healthcare technologies, making it easier for hospitals to acquire thrombectomy devices. Additionally, increased awareness of minimally invasive stroke interventions among healthcare providers and patients is contributing to the accelerated adoption of thrombectomy devices in Mexico.

KEY MARKET PARTICIPANTS

Companies playing a dominating role in the Latin American thrombectomy devices market profiled in the report include Stryker Corporation (U.S.), Medtronic Plc (U.S.), Boston Scientific Corporation (U.S.), Penumbra, Inc. (U.S.) Johnson & Johnson (U.S.), Terumo Corporation (Japan), Spectranetics Corporation (U.S.), Edwards Lifesciences Corporation (U.S.), Argon Medical Devices, Inc. (U.S.), and Teleflex Incorporated (U.S.).

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]