Latin America Sports Medicine Market Size, Share, Trends & Growth Forecast Report By Product, Application and Country (Mexico, Brazil, Argentina, Chile and Rest of Latin America), Industry Analysis From 2025 to 2033

Latin America Sports Medicine Market Size

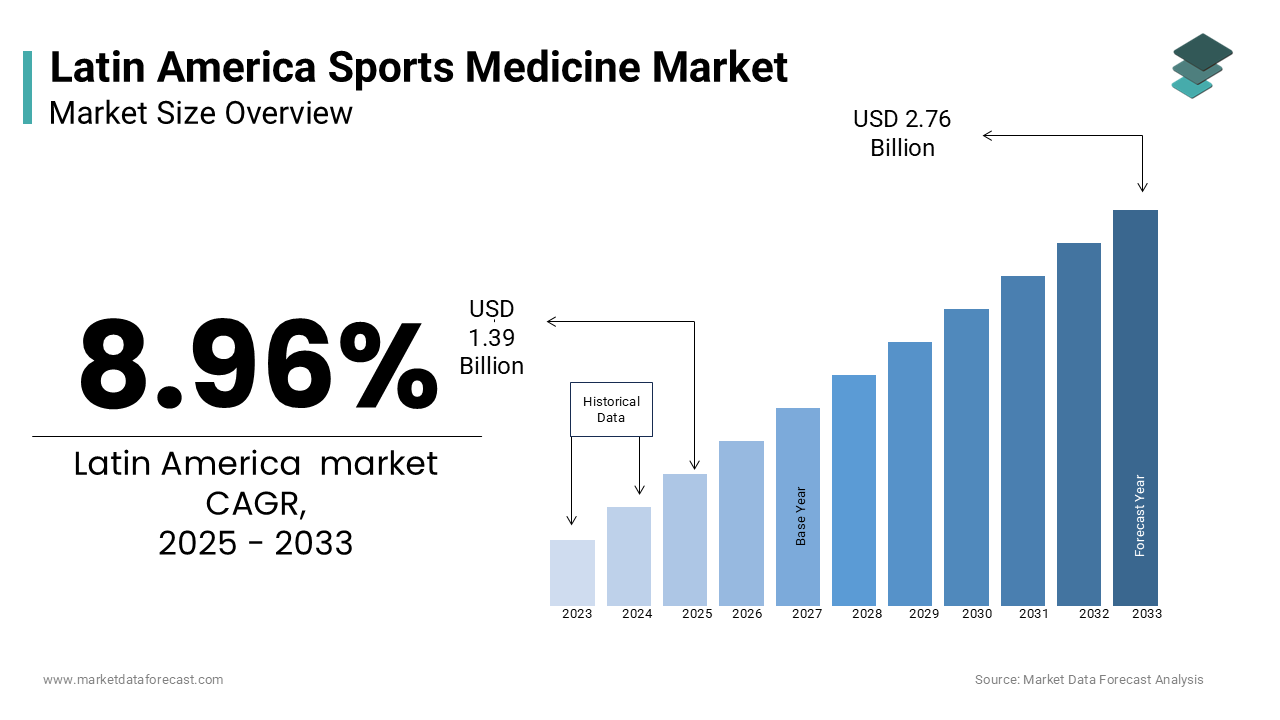

The sports medicine market size in Latin America was valued at USD 1.28 billion in 2024. The global market is estimated to grow at a CAGR of 8.96% from 2025 to 2033 and be valued at USD 2.76 billion by 2033 from USD 1.39 billion in 2025.

MARKET DRIVERS

Increasing Incidence of Sports Injuries

The growing participation in sports and physical activities across Latin America has led to a notable rise in sports-related injuries and driving the demand for sports medicine in Latin America. According to the World Health Organization, musculoskeletal injuries account for a significant proportion of injuries sustained during physical activities in the region. In countries such as Brazil and Mexico, where football and other high-intensity sports dominate, ligament tears and fractures are particularly prevalent. This rising injury rate necessitates advanced orthopedic products and rehabilitation solutions, fostering the expansion of the sports medicine sector. Additionally, as awareness regarding the importance of timely and specialized care increases, healthcare providers are investing in cutting-edge sports medicine technologies to address the growing needs of active populations.

Surge in Physical Fitness Trends

The emphasis on fitness and physical well-being has surged in Latin America, and an increasing number of individuals are engaging in exercise routines to combat lifestyle diseases. The Pan American Health Organization reports that non-communicable diseases such as obesity and diabetes affect over 60% of adults in the region. Considering the trend, governments and private organizations have introduced several fitness initiatives. This cultural shift has expanded the market for preventive care solutions like braces, compression garments, and fitness monitoring devices. Moreover, the adoption of rehabilitation therapies post-injury or surgery has seen significant growth, underscoring the critical role of sports medicine in supporting healthier lifestyles.

Technological Advancements in Sports Medicine

The adoption of innovative technologies in sports medicine is transforming the way injuries are diagnosed and treated in Latin America. According to the International Society of Arthroscopy, Knee Surgery, and Orthopedic Sports Medicine, the introduction of minimally invasive procedures such as arthroscopy and 3D-printed orthopedic implants has significantly improved patient outcomes. Wearable devices equipped with sensors to monitor movement and detect potential injury risks are also gaining traction. These advancements have attracted investments from healthcare providers and technology firms, contributing to the development of a more efficient and accessible sports medicine infrastructure across the region.

MARKET RESTRAINTS

Limited Access to Advanced Healthcare Facilities

In several Latin American regions, particularly rural and underserved areas, access to advanced healthcare facilities remains limited. This disparity hampers the timely diagnosis and treatment of sports-related injuries, thereby restraining the growth of the sports medicine market. For instance, the World Bank reports that in 2020, the number of physicians per 1,000 people was 2.1 in Brazil and 2.4 in Mexico, compared to higher ratios in developed countries. This shortage of medical professionals and facilities equipped to handle specialized sports injuries limits market expansion.

High Cost of Sports Medicine Products and Services

The elevated cost associated with sports medicine products and services poses a significant barrier to market growth in Latin America. Many athletes and sports enthusiasts may find it challenging to afford advanced treatment options, leading to a reliance on traditional remedies or foregoing treatment altogether. According to the Pan American Health Organization, out-of-pocket health expenditure in Latin America accounted for over 30% of total health expenditure in 2019, indicating a substantial financial burden on individuals. This economic constraint restricts the adoption of specialized sports medicine solutions.

MARKET OPPORTUNITIES

Expansion of Sports Infrastructure in Emerging Economies

The development of sports facilities in Latin American countries like Brazil and Mexico is creating significant demand for sports medicine products and services. Government initiatives to promote physical activity and sports participation are further driving this growth. For instance, the Brazilian government's investment in sports infrastructure has led to an increase in the number of athletes and sports-related activities, thereby boosting the need for sports medicine solutions. This expansion presents a lucrative opportunity for companies specializing in sports injury prevention and rehabilitation.

Rising Incidence of Sports Injuries Among Youth

The increasing participation of young individuals in sports has led to a higher incidence of sports-related injuries in Latin America. According to the National Institute of Health, a study on Brazilian volleyball players reported an incidence of seven injuries per 1,000 hours of competition and two injuries per 1,000 hours of training. This trend underscores the growing need for effective sports medicine interventions tailored to the youth demographic, offering a substantial market opportunity for providers of injury prevention and treatment solutions.

MARKET CHALLENGES

Limited Availability of Specialized Sports Medicine Professionals

The shortage of healthcare professionals trained in sports medicine in Latin America poses a significant challenge to the market. This scarcity can lead to delayed or inadequate treatment of sports-related injuries, affecting athletes' recovery and performance. For instance, the World Health Organization reports that the density of physicians per 1,000 population in Latin America is below the global average, indicating a gap in specialized medical services. This deficiency hampers the growth of the sports medicine market, as the effective delivery of specialized care is crucial for market expansion.

Economic Disparities Limiting Access to Sports Medicine

Economic inequalities across Latin American countries restrict access to sports medicine services and products. High out-of-pocket healthcare expenditures can deter individuals from seeking necessary treatment for sports injuries. According to the Pan American Health Organization, out-of-pocket health expenditure in Latin America accounted for over 30% of total health expenditure in 2019, indicating a substantial financial burden on individuals. This economic barrier limits the adoption of sports medicine solutions, thereby challenging market growth.

SEGMENTAL ANALYSIS

By Product Insights

The reconstruction and repair segment accounted for the major share of the Latin American market in 2023 due to the increasing prevalence of sports-related injuries necessitating surgical interventions. The Pan American Health Organization reports that sports injuries are a significant public health concern in the region, contributing to the demand for advanced surgical procedures. The rising adoption of minimally invasive techniques further underscores the importance of this segment in enhancing patient outcomes and reducing recovery times.

By Application Insights

The knee injuries segment captured the largest share of the Latin American sports medicine market in 2023. The high incidence of knee-related injuries among athletes and physically active individuals drives the demand for specialized treatments. According to the Pan American Health Organization, musculoskeletal injuries, including those affecting the knee, are prevalent in the region, necessitating advanced medical interventions. The complexity and frequency of knee injuries underscore the importance of this segment, as effective treatment is crucial for restoring mobility and ensuring athletes' return to optimal performance levels.

REGIONAL ANALYSIS

Brazil is currently leading the sports medicine market in Latin America. The sports medicine market in Brazil is primarily driven by substantial investments in healthcare infrastructure and a growing emphasis on sports activities. The Pan American Health Organization reports that Brazil's per capita health expenditure is approximately US$900, reflecting its commitment to healthcare development. This financial dedication facilitates the adoption of advanced sports medicine technologies and services. Additionally, Brazil's active participation in international sporting events has heightened the focus on athlete health and injury prevention, further propelling market growth. With continuous investments and a robust sports culture, Brazil is poised to maintain its leading position in the sports medicine market.

Mexico is experiencing the fastest growth in the sports medicine market within the region. The Pan American Health Organization indicates that Mexico's per capita health expenditure is around US$530, demonstrating a commitment to enhancing healthcare services. This investment, coupled with increasing public interest in sports and physical fitness, drives the demand for sports medicine products and services. Government initiatives promoting physical activity and the development of sports infrastructure further contribute to market expansion. As these trends continue, Mexico is expected to experience significant growth in the sports medicine sector, potentially narrowing the gap with current market leaders.

KEY MARKET PLAYERS

A few of the noteworthy companies operating in the Latin American Sports Medicine Market profiled in this report are Smith & Nephew PLC., Arthrex, Inc., Össur hf, Stryker Corporation, Conmed Corporation, Zimmer Biomet Holdings, Inc., Breg, Inc., Mueller Sports Medicine, Inc., Tornier, Inc., Skins International Trading AG, Wright Medical Technology, Inc., DePuy Mitek, Inc., 3M Company Ace Brand, OttoBock Healthcare GmbH and DJO Global, Inc.

MARKET SEGMENTATION

This research report on the Latin American sports medicine market has been segmented and sub-segmented into the following categories.

By Product:

- Reconstruction and Repair

- Implants

- Prosthetics

- Arthroscopy Devices

- Fracture and Ligament Repair Products

- Orthobiologics

- Support and Recovery

- Braces and Support

- Thermal Therapy Products

- Topical Pain Relief Products

- Compression Clothing

- Monitoring Devices

- Other Body Support and Recovery Products

- Accessories

By Application:

- Head Injuries

- Shoulder Injuries

- Elbow and Wrist Injuries

- Back and Spine Injuries

- Hip and Groin Injuries

- Knee Injuries

- Foot and Ankle Injuries

By Country:

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]