Latin America Media Streaming Market Size, Share, Trends, & Growth Forecast Report – Segmented By Type of Service (Audio Streaming, Video Streaming, and Others (Live Captions, Tapes, And Real-Time Text)), Application (Real-Time Entertainment, Web Browsing & Advertising, Gaming, Social Media, and Online/Distance Learning), End-users (Personal/Household Users, Educational Institutions, and Professional Organizations) and Country (Brazil, Argentina, Chile, and Rest of Latin America) Industry Analysis From 2024 to 2033

Latin America Media Streaming Market Size

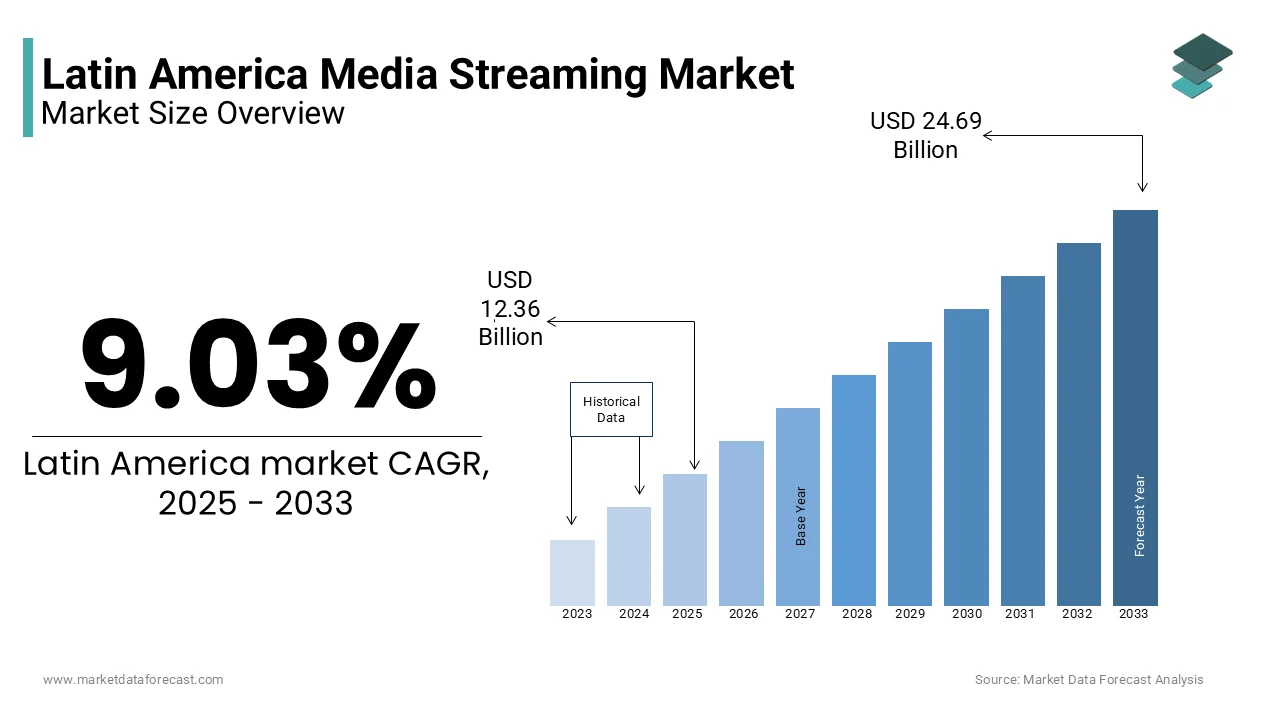

The size of the Latin American media streaming market was worth USD 11.34 billion in 2024. The Latin America market is estimated to be worth USD 24.69 billion by 2033 from USD 12.36 billion in 2025, growing at a CAGR of 9.03% from 2025 to 2033.

OTT services are said to lead growth in Latin America. Many video producers and content owners are expanding into the region in search of a high-potential and growing market. Brazil and Mexico are number 4 and number 5 on the world list. Of this total, the top five countries (Argentina, Brazil, Colombia, Mexico and Puerto Rico) will represent 83% of the regional total.

The major drivers of the Latin American streaming media market are the hike in the adoption of video and audio streaming services across the area. The rising penetration of high-speed Internet and the popularity of online shows create promising opportunities for the media streaming market to expand during the forecast period, along with the untapped areas in Latin America and increased user awareness. The convenience of watching video content, the surge in mobile subscriptions and adoption of connected mobile devices, and the augmenting need for original content and live streaming are also driving the expansion of the LATAM video streaming market.

However, transmission interruptions, hacking, and reduced bandwidth are some of the major limitations to the Latin American media streaming market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

9.03% |

|

Segments Covered |

By Service Type, Application, End-Users, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Countries Covered |

Brazil, Argentina, Mexico, and Rest of Latin America |

|

Market Leaders Profiled |

Amazon Prime Video, Blim, Claro Video, Crackle, HBO, Movistar Play and Netflix |

SEGMENTAL ANALYSIS

By Service Type Insights

Of these, the video streaming sub-segment is likely to record substantial growth due to the rising fame of on-demand entertainment services like movies, shows, videos and live games, on televisions and other portable device platforms.

By Application Insights

Of these, the real-time entertainment segment dominated the market. However, other application segments such as online learning and web advertising are also emerging as potential revenue streams due to their growing popularity among educational institutions and businesses. With the reduction in costs and the addition of additional innovative features, e-learning software is going beyond universities to include general business education.

By End-Users Insights

The adoption of video streaming services among home users is driven by the wide availability of high-speed Internet access and the growing popularity of online TV shows. Businesses and educational institutions are also witnessing rapid adoption of media streaming services during the forecast period.

REGIONAL ANALYSIS

After Asia and Western Europe, the geography that attracts much of the OTT traction is Latin America. Despite limited broadband penetration and high levels of piracy, Latin America has great potential to become an OTT-dominated region over the next 5 years, given changing consumer habits. Brazil, Mexico, Argentina, Colombia and Chile are the main LATAM countries that lead the growth of OTT in the region. Venezuela has been a very slow growth opportunity to take advantage of OTT adoption. According to an analysis by Citibanamex, a third (30%) of Mexican households are expected to pay for OTT services by 2025. According to a recent study, revenue from subscription VOD services in Venezuela was recorded at $0.02 million in 2011 (when Netflix was launched), which is expected to increase to $47.28 million in 202. Colombia, on the other hand, appears to be the fourth potential market for OTT video in Latin America, with 5.4% of the estimated 4.5 million OTT video-on-demand subscribers in Latin America. Around 88% of the Colombian population watches online videos regularly, but they rely on UGC sites like YouTube and Vimeo. OTT adoption in the country accounts for 26% of adoption, which is certainly expected to increase, given the increasing availability of infrastructure.

KEY MARKET PLAYERS

Amazon Prime Video, Blim, Claro Video, Crackle, HBO, Movistar Play and Netflix are the leading players in the Latin American media streaming market.

MARKET SEGMENTATION

This research report on the Latin American media streaming market has been segmented and sub-segmented based on type of service, applications, end users, and regions.

By Service Type

- Audio Streaming

- Video Streaming

- Others (Live Captions, Tapes, And Real-Time Text)

By Application

- Real-Time Entertainment

- Web Browsing & Advertising

- Gaming

- Social Media

- Online/Distance Learning

By End-Users

- Personal/Household Users

- Educational Institutions

- Professional Organizations

By Country

- Mexico

- Brazil

- Argentina

- Chile

- Rest of Latin America

Frequently Asked Questions

What are the primary factors driving the growth of the media streaming market in Latin America?

Key factors include increasing internet penetration, the rising popularity of smart devices, a growing middle class with higher disposable income, and a shift in consumer preference from traditional TV to on-demand content.

What are the main challenges faced by streaming platforms in Latin America?

Challenges include internet connectivity issues in rural areas, high competition among platforms, content localization, and piracy.

How are streaming platforms addressing the issue of content localization in Latin America?

Streaming platforms are investing in local content production, offering subtitles and dubbing in Spanish and Portuguese, and partnering with regional content creators to make their offerings more appealing to local audiences.

How are regulatory policies affecting the media streaming market in Latin America?

Regulatory policies vary by country, with some governments implementing measures to support local content production and others imposing taxes on digital services. These policies can impact the operational strategies and pricing models of streaming platforms.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]