Latin America Fast Food Market Research Report Segmented By Type, Distribution Platform and Country (Brazil, Mexico, Argentina, Chile and Rest Of Latin America), Analysis on Market Size, Share, Trends, and Growth Forecast (2024 to 2032)

Latin America Fast Food Market Size (2024 to 2032)

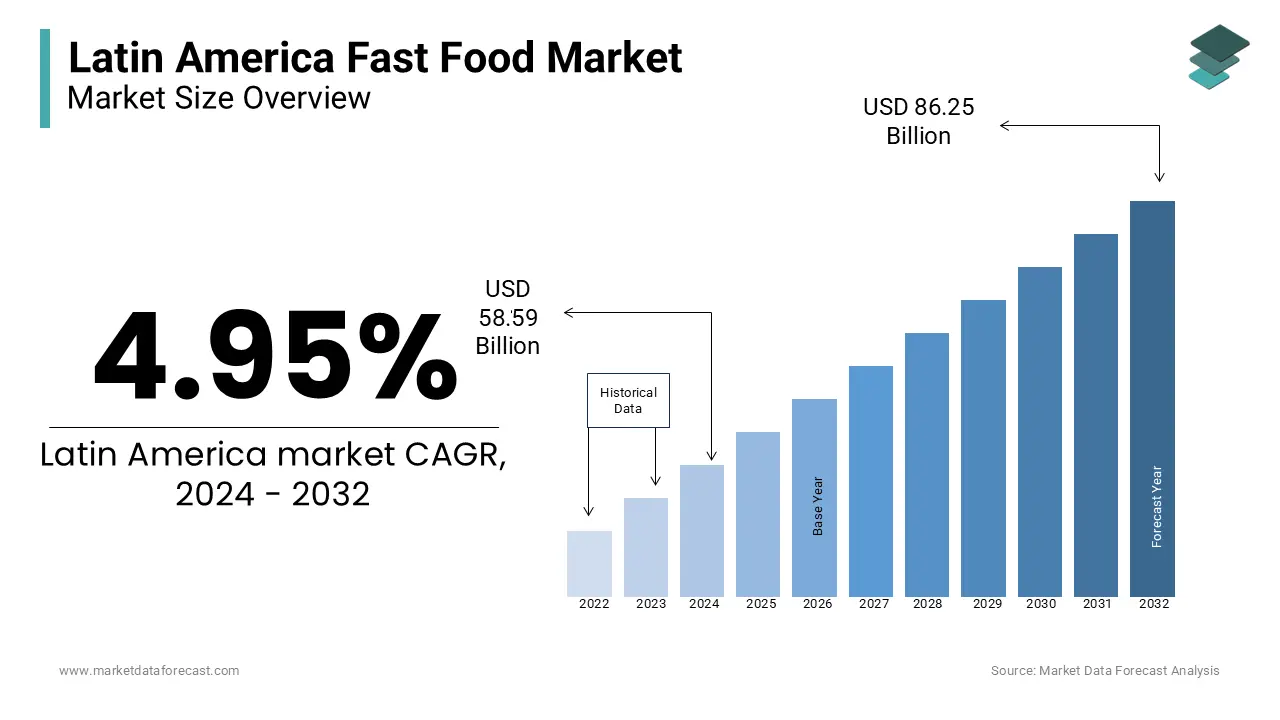

The fast food market size in Latin America is estimated to be worth USD 86.25 billion by 2032 from USD 58.59 billion in 2024, growing at a CAGR of 4.95% from 2024 to 2032.

Current Scenario of the Latin America Fast food Market

The Latin America fast food market is in a transformational phase, where chain operators and brands reformulating their strategies to strengthen their position. Moreover, the region’s cooking is marked by a range of flavours, colours, and textures but also its separate identity. Today, chefs across the continent are emphasising the preparation of authentic dishes to reclaim their cultural and culinary heritage, utilising native ingredients, traditional cooking methods and marketing an inclusive and diverse cuisine, which is reshaping the regional dynamics. Besides this, professional cooks play a major part in food activism. Besides these, restaurants are evolving into community hubs and movements, as seen with Mater in Peru, initiated by the stakeholders of Central Restaurant. Presently, they are heading movements that encourage a sustainable food system, by engaging with local makers and farmers, thus saving the natural heritage.

Brazil is experiencing a key change, with market players openly searching for strategic prospects for their operations. This is because, after the disruption associated with the pandemic, brands and chain operators strived to make cost structure more efficient and speed up growth, either finding mergers and acquisitions or starting new stores. This trend in the market is justified by the current state of the fast-food category in the nation, which has a small penetration in contrast to other markets and is divided between regional players.

Market Drivers

The increasing prominence of quick and tasty eating habits among people due to busy lifestyles is a major factor in the growth of the Latin American market.

Recently, women have also been participating in the workplace, where their time to cook food at home is less. Therefore, many people are habituated to eating food in hotels or restaurants.

- According to the International Labour Organization, 48% of women in Latin America participated in the workplace in 2023.

Increasing disposable income and the rising popularity of the fast food centers that are easily available in the streets and more convenient even for the middle-class economy people are sole to promote the growth rate of the market in Latin America. Fast food does not cost much and is more convenient to cook in less time. College students, working-class people, and others generally prefer fast food as a time-saving factor. They usually prefer tasty and healthy food that can be prepared in less time without much effort in cooking.

Though the number of people eating fast food is growing, the rising awareness of the negative effects as they are less in nutrient value results in type 2 diabetes and various diseases. This negative effect of eating fast food regularly is impeding the growth rate of the Latin American fast food market.

- In 2022, according to survey reports, approximately 14.1 million adults suffered from diabetes only in Mexico. These statistics show that nearly 17% of the population in Mexico is suffering from diabetes.

These statistics show that the awareness to eat a healthy diet rather than fast food is subsequently to limit the growth rate of the Latin American fast food market.

The penetration of e-commerce platforms in delivering food products to the doorstep is greatly influencing the growth rate of the Latin American fast food market.

In urban cities, online food delivery is becoming more popular these days, which is raising the demand for food supply. The rising number of smartphone users is also one of the common factors for the growing demand for the use of online food delivery applications. Smartphone users can easily install the food application and order their food products according to their interests.

- According to the statistics, Rappi was Mexico's most popular food delivery app. Roughly 6.3 million people downloaded the Rappi app on their mobile phones, which showed drastic demand for fast food in 2023.

Market Restraints

Stringent rules and regulations by the government to approve ready-to-eat food products that are made with ingredients that are quite harmful are acting as a barrier for key players in the Latin American fast food market.

The world is worst affected by the emergence of COVID-19, where supply chain disruptions erupted at huge levels that constantly varied the cost of the final products. The low-economy countries suffered from the crisis due to these tough times that proportionally degraded the growth rate of the fast-food market in Latin America. The lack of skilled workers in hotels and restaurants due to the economic crisis also causes a slow decline in the market's growth rate.

Market Challenges

High operational costs is one of the major challenges faced by the Latin America fast food market.

Like in Brazil, operational productivity and maintaining quality is relatively tough which needs constant investment. Moreover, fast food restaurant’s exorbitant cost of operations is because of labour and real estate expenses. Salaries or wages on average in Central American nations are higher. Panama, Costa Rica, and Puerto Rico are regarded as having higher salaries. Wages in South America differ considerably across various nations, job roles, and industries, which is a key hindrance in operating these outlets or stores in this region. In addition, the region’s market growth is further affected by social security contributions. The expenses of employment encompass not only wages but also social security payments. For instance, in Colombia, the total contributions made by employers to employee social security are considerable and consist of various elements designed to ensure extensive community benefits.

- According to a study, Colombia records the maximum average rate of contribution at 29 per cent towards social security. In contrast, employers in Central America have the lowest social security contributions, roughly 10 per cent.

Market Opportunities

In general, franchising in Central and South America in the last few years displays a yearly growth rate of 6 to 10 per cent, and there remains a significant potential for growth across all franchising avenues. One of the reasons behind this progress is the influx of Arab funds into this market, which is shaping the entire landscape in South America. Moreover, regional preferences are another factor presenting potential opportunities for market growth. The adaptation of local preferences is an important strategy for brands and chain operators in this market looking to succeed in diversified Latin America. These market players must acknowledge and respect local traditions, dietary restrictions, and cultural practices, For instance, mainly in catholic countries such as Brazil, specific periods such as Lent witness a surge in demand for fish dishes. Interestingly, in Northeastern Brazil and Mexico, white individuals are known for their love of spicy foods. However, in the older regions of Southern South America, mayonnaise is generally seen as the spiciest item on the menu.

Additionally, leveraging the region's biodiversity is expected to benefit the market. As per the United Nations Environment Program, around 60 per cent of the world’s rivers and various marine species and terrestrial life can be located in Latin America and the Caribbean. This range of diversity is well understood by chefs and restaurants that seek to experiment with exciting flavour combinations, and at the same time, discover the health benefits provided by several ingredients, like plants or insects. Therefore, capitalising on this factor can further accelerate the region’s market growth rate.

Apart from these, chefs are turning back to native ingredients and ancestral recipes, motivated by the flavours and health advantages, and a way to reconnect with their cultural roots.

SEGMENTAL ANALYSIS

This research report on the Latin American fast food market has been segmented and sub-segmented based on the following categories.

Latin America Fast Food Market By Type

- Burgers & Sandwiches

- Pizzas & Pasta

- Asian/Latin American Food

- Chicken/Seafood

The burgers & sandwiches segment is likely to hold the largest share of the market, whereas the pizzas & pasta segment is likely to grow at a faster rate during the forecast period. Burgers and sandwiches are becoming a staple food in Latin America, and many people are commonly opting for these foods in their regular diet options. Pizzas and pasta are also gaining popularity, with many top companies launching innovative flavours to attract consumers.

The launch of innovative pizzas in Argentina, which is its own recipe, is expected to gear up the new opportunities for pizza & pasta in Latin America.

Latin America Fast Food Market Analysis By Distribution Platform

- Quick Service Restaurant (QSR)

- Street Vendors

- Food Delivery Services

- Online Food Delivery

The quick-service restaurant segment is gaining huge traction in the growth rate of the Latin American fast food market. Street vendors segment is likely to hit the highest CAGR by the end of 2029. Recently, online food delivery applications have gained huge popularity as many people rely on online applications to order their preferred food. The launch of many McDonald's restaurants in Mexico and Argentina has substantially elevated the market's growth rate. MC Donald offers various offers to online customers that statistically surge the growth rate of the online food delivery segment during the forecast period.

COUNTRY-LEVEL ANALYSIS

Top key companies are focusing on launching innovative food options that deliver healthy products using prominent raw materials. Launching innovative fast-food options based on consumer preference and healthy ingredients is anticipated to showcase huge opportunities for the growth rate of the Latin American fast-food market.

Mexico has been led with the dominant share of the market for the past few years and is likely to gain a huge growth rate in the coming years as well. Growing per capita income and rising expenditure on innovative fast food products that are newly launched among people in Mexico substantially show the huge growth rate of the Latin American fast food market. Mexican cuisine is becoming popular worldwide these days. The launch of these recipes, especially by companies like McDonald's and others, is certainly meant to leverage the market's growth rate. MC Donald's recent launch is Crocs Happy Meal, which is affordable for common people and will enhance the growth rate of fast food.

The fast food market in Argentina is likely to have a steady pace throughout the forecast period. An increasing number of top companies and rising people's interest in ready food products due to lack of time to cook are anticipated to promote the market's growth rate. The demand for the value combo meals is most popular in Latin America, which drives the growth rate of the fast food market.

Brazil's fast food market is dynamic and demanding. It is expected to experience notable changes and growth during the forecast period. In a contested and fragmented industry, big fast-food brands and chains are over again exploring merger and acquisition opportunities in the country, signalling a fresh wave of industry consolidation.

- Like, in September 2024, Zamp (ZAMP3) signed an agreement to manage Subway restaurants all over the nation. This acquisition signifies a major growth for the company backed by Mubadala, already well-known for operating Popeyes and Burger King in Brazil.

Also, the advancement arrived at a time when Subway lately faced challenges in the Brazilian market. The interest Of Zamp in Subway goes in line with its overall strategy to establish itself as a powerhouse in the country’s competitive fast-food landscape. Previously it also purchased the operations of Starbucks and is anticipated to add fresh brands, as per industry experts. In addition, Domino’s biggest shareholder in the nation, Vinci, has also set his eyes on this segment of the market once again. Moreover, the owner of Abraccio and Outback, Bloomin Brands has also formally declared that it is examining the substitutes in Brazil, involving disinvestment. Hence, it can be said that companies in Brazil are undergoing consolidation, which ultimately is expected to drive the market forward.

LIST OF KEY PLAYERS IN THE LATIN AMERICA FAST FOOD MARKET

Companies playing a major role in the Latin American fast food market include Domino's Pizza, Burger King, KFC, Subway, Dunkin' Donuts, McDonald's, Hardee's, Pizza Hut, Firehouse Subs and Auntie Anne's.

RECENT HAPPENINGS IN THE MARKET

- In March 2024, MC Donald and Formula One partnered together in Latin America. The iconic leader in fast food brands in Latin America, MC Donalds, is likely to deliver their fast food products in collaboration with Formula One from here on. This company is committed to delivering high-quality products for the fan base of Formula One from here on across the Latin American region.

- In August 2018, McDonald's introduced its new application for the advancements and made individuals utilize the application. It is parting with McDonald's gold cards as a piece of the battle.

- In August 2018, CNBC confirmed that Subway has the most areas around the globe, around 43000 out of 2017.

- In August 2018, Burger King began selling many soft drinks that are making acceptable benefits from the beginning of the day.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]