Latin America Agricultural Biologicals Market Size, Share, Trends & Growth Forecast Report By Type, Application, Sources, Mode Of Application and Country (Brazil, Chile, Argentina, Mexico, and Colombia and others), Industry Analysis From 2025 to 2033

Latin American Agricultural Biologicals Market Size

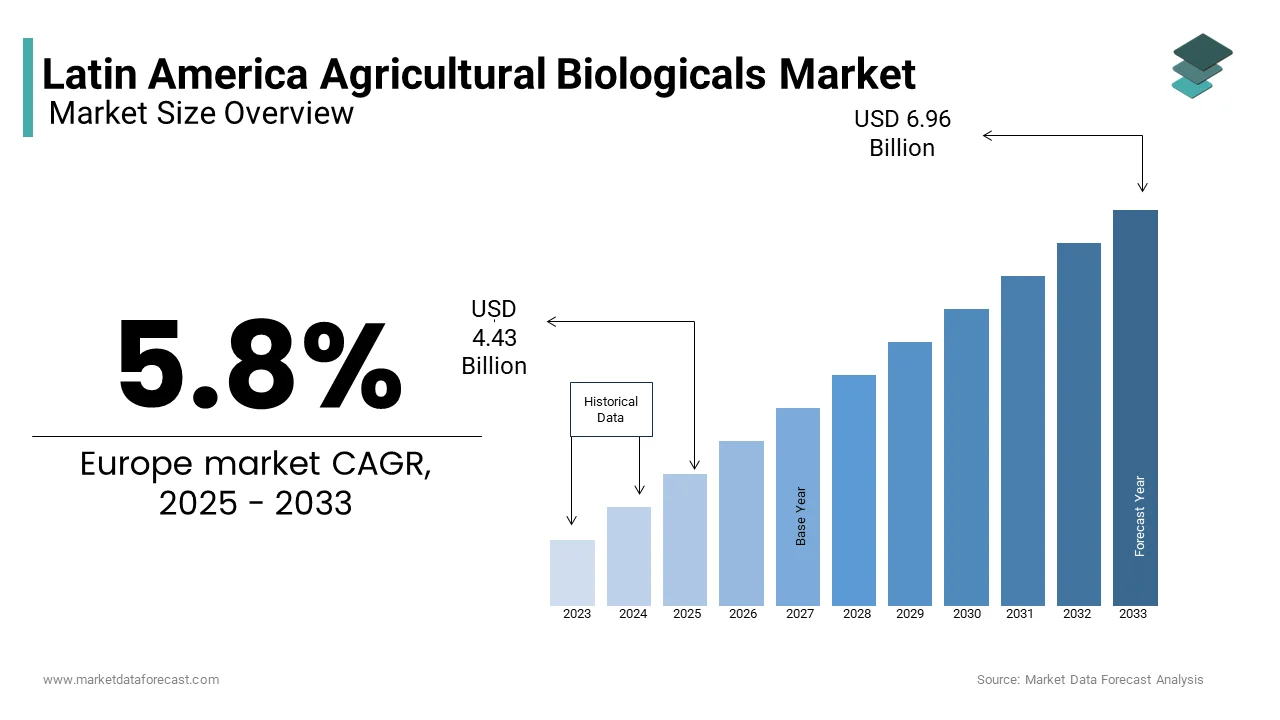

The Latin American agricultural biologicals market was valued at USD 4.19 billion in 2024, and it is anticipated to reach USD 4.43 billion in 2025 from USD 6.96 billion by 2033, growing at a CAGR of 5.8% during the forecast period from 2025 to 2033.

With the world increasingly embracing sustainable agriculture, the Latin American biopesticide market is witnessing exponential growth. Moreover, the region is perfect for becoming the hub for innovation in biopesticides. It is extremely well-positioned to command the charge for the latest biopesticides. The area has an affluent biodiversity that offers a gold mine of potential bioactive elements. As a matter of fact, a recent report shows the overall valuation of the crop protection industry in Brazil surged by over 70 percent during the last two years. This can primarily be credited to price increases, particularly of non-selective herbicides. The study also discovered that soybeans are the biggest crop in the nation, holding about 52 percent of the agricultural area in 2023. Apart from this, agriculture in South America plays an important part in rural development, food security, and the economy of the region. While pest control has conventionally depended on chemicals, there is rising acceptance of sustainable agricultural practices. Hence, in the last few years, there has been an increasing focus on sustainable cultivation techniques involving biological controls to reduce ecological effects, preserve natural resources, and maintain lasting agricultural efficiency. Furthermore, various Latin American nations are progressively active in the manufacturing of biological control agents and biofertilizers. Some, like Colombia, Brazil, and Argentina, are encouraging biological inputs with incentive schemes and packages and revisions to their regulations.

MARKET DRIVERS

The growth of the Latin American agricultural biologicals market is driven by the increasing regulatory changes and formulation of public policies. These are increasingly designed to improve the application of substitutes for agrochemicals (fertilizers and pesticides). Regulation is a propellent of the progress of biologicals in South America. Legislation opposing the utilization of artificial pesticides and leftover levels in food has surged the application of biologicals by the farmers of this region. Another major market accelerator is the favorable legal framework for biologicals in several South American economies. Hence, the last two decades have been identified by a dynamic competitive scenario or environment, with foreign organizations quickly entering this regional market. The takeover of local biological market players and the financial support of new startups and ventures have further molded the industry positively.

During the past few years, the majority of farmers have preferred to use chemicals and inorganic fertilizers to improve the nutrients in the soil and thereby resulting in the weakening of soil health. This led to the slow migration of farmers towards agricultural biological products. These products are eco-friendly and boost soil fertility, which enhances crop productivity. Moreover, consumers' shift towards organic food products is fueling the growth of the market. Increasing demand for organic products, improving yield and productivity, growing population, rapid growth in the use of these products in seed treatment, increasing spending in R&D efforts, support from the government, and increasing health consciousness are the drivers propelling the growth of the market.

MARKET RESTRAINTS

Lack of awareness among the farmers and reluctance to change from existing practices of chemical pesticides are the restraints limiting the market. The growers in the region are not very educated and informed about biopesticides, bio-stimulants, bio-fertilizers, and technical understanding of biologicals, including the suitable usage period, target pests, and their mode of action. In addition, it is essential to assist cultivators in understanding how to incorporate these items into existing pest management techniques and customs to maximize their impact. As per the study released in the Oxford Academic, it is projected that there are about 15 million family farms in Latin America (around 400 million hectares under their control), and out of these, 10 million constitute subsistence farms and the rest of the others are medium and large groups with several levels of incorporation with markets.

MARKET OPPORTUNITIES

The potential prospects for the agricultural biologicals market are immense. These can bring significant additions to solve problems resulting from changes in land application, degradation, and deforestation, mitigated by soil restoration erosion management and improved resistance to climate change. Inferior soil quality in Brazil and other barren nations like Mexico and Peru shows positive reactions to biological agents, particularly biostimulants and associated products, for reducing abiotic stress. A rising pattern of government incentives offered to farmers to enhance soil fertility and health will become one of the most essential drives for the future of this market if expanded throughout Latin America.

MARKET CHALLENGES

The expansion of the Latin American agricultural biologicals market is derailed by supply chain issues and the lack of trust in safety. Cultivators are hesitant to adopt biological materials. Moreover, they do not relate safety with biologicals. According to research, even though around 62 percent of the growers are considered knowledgeable about biologicals, just 10 percent recognized awareness of the presence of safer options or substitutes. Further, approximately 60 percent of the participants did not see biologicals as constantly risk-free. Safety aspects barely factored into cultivator’s decision-making when buying agricultural raw materials. Besides this, the supply chain of these products is another challenge impeding the market growth at a time when innovations in this sphere are flourishing. They are also necessitated to make it easier to adapt to current agricultural frameworks. Additionally, among the major issues with biologicals can be the enormous difficulty of the market, with the continuous rollout of new technologies and breakthroughs, leaving farmers disoriented, suspicious, and overwhelmed.

SEGMENTAL ANALYSIS

By Type Insights

The biopesticides segment is the most widely used category of the Latin American agricultural biologicals market. The region offers a perfect center for innovations in biopesticides. Moreover, the natural resources and ecological conditions of this region in general and Brazil specifically create a fertile base for exploration and development. With major collaboration in research, development, and supply chain, nations all over the region can become leaders at the global level in sustainable pest management solutions. Therefore, due to these factors, the segment’s market share is increasing.

By Application Insights

The fruits and vegetables segment gained the maximum share of the Latin American agricultural biologicals market and is expected to attain further growth over the forecast period. The regional market is marked by high acceptance of biologicals, especially biostimulants, achieving 60 percent in fruits and vegetables (F&V) and up to 30 percent in row crops. Row crops, such as cotton, soybean, corn, and sugarcane, are the strongest markets in Argentina and Brazil. On the other hand, the application of biologicals in Peru, Chile, and Mexico mainly involves fruits and vegetable crops. Furthermore, in the F&V farming areas of Mexico and Chile, new legislations are being formulated with proportional needs of data for the approval of biological items, which ultimately surges the sgemental expansion.

By Source Insights

The microbial segment commands this category of the Latin American agricultural biologicals market. This trend is mainly propelled by the rising implementation of microbial-based products like biopesticides and bio-fertilizers. Both are considered for their productivity in improving soil health and encouraging sustainable farming techniques.

By Mode of Application Insights

The seed treatment segment is the most implemented mode in the Latin American agricultural biologicals market. This can be attributed to enhanced protection which gives vital protection against soil-born pests and pathogens throughout the decisive germination phase, enhancing emergence rates and seedling vigor.

REGIONAL ANALYSIS

Brazil is the biggest market in Latin America, with a share of more than 40 percent, followed by Argentina. Bio-pesticides held a major in the Latin American Agricultural Biologicals market. The market in Brazil expands with the enactment of a new pesticide and this regulatory revamp holds substantial implications for the nation’s agrochemical industry and its competitiveness in the world as the country shifts to be among the biggest exporters from being a net importer of agricultural products and livestock. Possibly the most important change brought about by the new regulation is the centralization of the legal procedures within the Ministry of Agriculture, Livestock, and Supply (MAPA). So, this is expected to propel the region’s market share further in the future. In addition, this transition depicts an exit from the previous framework, where responsibilities were segregated among various agencies, generally resulting in delays and irregularities in the registration process. Additionally, Brazil is at the vanguard of this development, with its biopesticide market projected to remain consistent in maintaining a fast rate. According to the Foreign Agricultural Service under the U.S. Department of Agriculture, Brazil is the second-biggest cultivator of biotech crops around the world, with 105 events permitted.

KEY MARKET PLAYERS

Some of the major companies dominating the market, by their products and services, include BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A and Koppert B.V, Sagro.

RECENT MARKET HAPPENINGS

- In December 2023, the legislative chambers in Brazil transformed pesticide regulation and administration with the new law, i.e., law No. 14.785. This will govern the manufacturing, commercialization, and application of pesticides in the country by repealing laws 7,802/89.

- In August 2024, the Inter-American Institute for Cooperation on Agricultural (IICA) and CABI entered into an agreement, i.e., a Memorandum of Understanding (MoU), for a closer partnership on the sustainable development of technology and science via joint projects and ventures in benefitting the Caribbean and Latin America. This MOU will enable both participants to work jointly on international and domestic projects of common interest associated with Integrated Pest Management (IPM), biological control, bioeconomy, and food security and safety. Further, other aspects of the partnership will concentrate on sustainable agricultural production and ecological problems. These comprise the rational application of pesticides, transfer of technology and the implementation of digital measures like those under the PlantwisePlus Digital Toolkit.

MARKET SEGMENTATION

This research report on the biological market of Latin American agriculture is segmented and sub-segmented into the following categories.

By Type

- Biopesticides

- Bioinsecticides

- Bio nematicides

- Bio Herbicides

- Biofertilizers

- Biostimulants

By Application

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

By Source

- Microbial

- Biorationals

- Others

By Mode of Application

- Soil Treatment

- Seed Treatment

- Foliar Spray

By Country

- Brazil

- Chile

- Argentina

- Mexico

- Columbia

- Rest of Latin America

Frequently Asked Questions

What is the current market size of the latin America agricultural biologicals market?

The current market size of the Latin America agricultural biologicals market was valued at USD 4.43 billion in 2025

What segments are added in the latin America agricultural biologicals market?

The segments are type insights, application insights, source insights, mode of application insights, and by region.

Who are the market players that are dominating the latin America agricultural biologicals market?

BASF, Bayer Crop Science, Syngenta, Novozymes A/S, Isagro, Arysta Lifescience Limited, Arysta LifeScience Corporation, Valent BioScience Corporation, Marrone Bio Innovations Inc., Certis U.S.A and Koppert B.V, Sagro. are the market players that are dominating the latin America agricultural biologicals market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]