Global Laptop Market Size, Share, Trends & Growth Forecast Report By Type (Traditional Laptop and 2-in-1 Laptop), Screen Size, Enterprise Price, End-use and Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Laptop Market Size

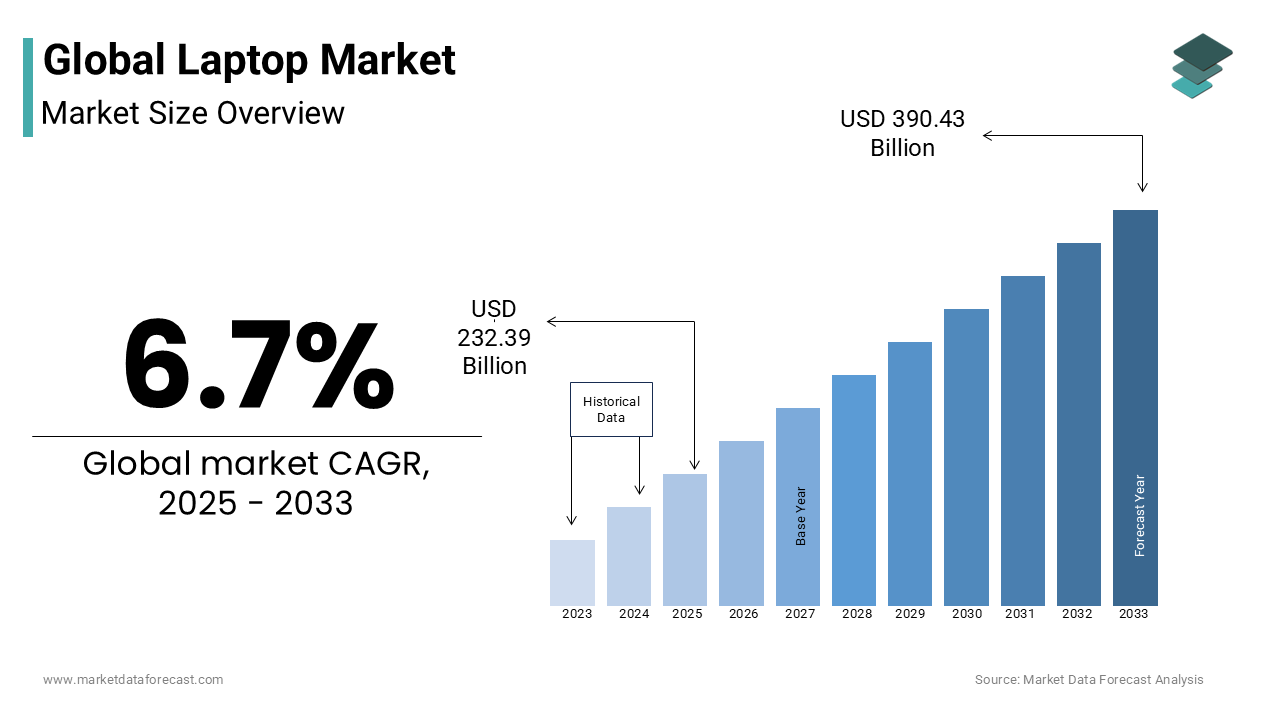

The global laptop market size was valued at USD 217.8 billion in 2024. The global laptop market size is expected to have 6.7% CAGR from 2025 to 2033 and be worth USD 390.43 billion by 2033 from USD 232.39 billion in 2025.

Laptops offer portable computing solutions for consumers, professionals, students, and businesses. Laptops integrate essential components such as a display, keyboard, processor, memory, and battery into a compact, mobile form factor, making them indispensable for work, education, gaming, and entertainment. Over the years, technological advancements have led to the development of lighter, faster, and more efficient devices catering to diverse user needs.

The growing preference for lightweight and high-performance laptops is consistently boosting the demand for laptops worldwide. Modern ultrabooks, for instance, weigh as little as 1 kg (2.2 lbs) while offering high-speed processing capabilities, with many models featuring Intel Core i7 and AMD Ryzen 7 processors. Battery life has also significantly improved, with premium models now offering up to 20 hours of usage on a single charge which is a considerable increase from the 4-6 hours commonly found a decade ago.

The shift towards remote work and digital learning has led to a surge in laptop demand. According to a 2023 report by IDC, over 70% of professionals globally use laptops as their primary work device, reflecting the growing reliance on portable computing solutions. In the education sector, UNESCO reported that over 1.5 billion students worldwide engaged in remote learning during the COVID-19 pandemic and is further accelerating laptop adoption. Security and connectivity advancements have also played a crucial role in the industry’s evolution. Many modern laptops now feature biometric authentication, including fingerprint sensors and facial recognition, enhancing device security. Additionally, the rise of Wi-Fi 6 and 5G connectivity has improved internet speeds, enabling seamless remote collaboration and cloud computing.

MARKET DRIVERS

Technological Advancements in Connectivity

The proliferation of high-speed internet and the rollout of 5G networks have significantly bolstered laptop usage. According to the Global System for Mobile Communications Association (GSMA), by 2025, 5G networks are expected to cover one-third of the world's population, enhancing online experiences and driving demand for portable devices like laptops. The U.S. Federal Communications Commission (FCC) reports that as of 2023, 93% of Americans have access to high-speed internet and is facilitating remote work and learning. These advancements in connectivity make laptops essential tools for seamless communication and productivity.

Government Initiatives Promoting Digitalization

Various governments are implementing policies to promote digital literacy and access, thereby increasing laptop adoption. For instance, India's Production-Linked Incentive (PLI) scheme has attracted over $17 billion in investments across 14 sectors, including electronics, aiming to boost domestic manufacturing and reduce reliance on imports, as reported by Reuters. Similarly, the European Union's Digital Education Action Plan emphasizes the importance of digital devices in education, encouraging member states to integrate laptops into their educational frameworks. These initiatives underscore the role of laptops in achieving broader digitalization goals.

MARKET RESTRAINTS

Supply Chain Disruptions

The laptop market faces significant challenges due to global supply chain disruptions. The U.S. General Services Administration (GSA) highlights that such disruptions have led to increased lead times and costs for critical components like semiconductors. These shortages have resulted in production delays and higher prices for consumers. The GSA's report emphasizes the need for diversified supply chains to mitigate these risks. In 2021, lead times for some enterprise mobile PC models extended to as long as 120 days, as reported by Gartner.

Regulatory Barriers

Stringent import regulations in key markets pose challenges for laptop manufacturers. For instance, India has announced that starting January 1, 2025, companies will need to seek new approvals for importing laptops and tablets. This move aims to boost local manufacturing but could disrupt supply chains for major global brands. Reuters reports that India's laptop and personal computer imports between April and July stood at $1.7 billion indicating the potential impact of such regulatory changes.

MARKET OPPORTUNITIES

Rising Demand for Gaming Laptops

The increasing popularity of gaming has created a significant opportunity in the laptop market. Modern gaming laptops are equipped with advanced graphics cards, high-refresh-rate displays, and efficient cooling systems to meet the demands of contemporary games. The Entertainment Software Association reports that 65% of American adults play video games, indicating a substantial market for gaming hardware. This trend is not limited to the United States; globally, the gaming industry is experiencing rapid growth and further driving the demand for high-performance gaming laptops.

Expansion in Emerging Markets

Emerging economies present a substantial growth opportunity for the laptop market. As countries like India, Brazil, and Indonesia experience economic development, there is a rising middle class with increased purchasing power. The World Bank notes that in 2022, India's GDP grew by 8.7%, reflecting significant economic progress. This economic growth leads to higher demand for consumer electronics, including laptops, for both personal and professional use. Additionally, government initiatives in these countries to promote digital literacy and education further bolster laptop adoption, creating a favorable market environment.

MARKET CHALLENGES

Environmental Concerns

The environmental impact of laptop production and disposal presents a significant challenge. The European Commission's Joint Research Centre highlights that personal computers, including laptops, contribute to electronic waste and resource depletion. A life cycle assessment of a typical laptop reveals that approximately 85% of its greenhouse gas emissions occur during manufacturing and shipping, with the remaining 15% arising from electricity consumption during use. The extraction of raw materials and energy consumption during manufacturing exacerbate environmental degradation. Additionally, the disposal of electronic devices leads to e-waste accumulation, posing environmental and health risks. These concerns necessitate the development of sustainable practices within the laptop industry.

Cybersecurity Threats

The increasing prevalence of cyber threats poses a significant challenge to the laptop market. The UK's Cyber Security Breaches Survey 2024 indicates that half of businesses (50%) and around a third of charities (32%) reported experiencing cyber security breaches or attacks in the past year. This high incidence of cyber threats underscores the need for robust security measures in laptop devices to protect sensitive information and maintain user trust.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Screen Size,Enterprise Price,End-use and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis; DROC, PESTLE Analysis, Porter's Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell, HP Development Company, L.P., Huawei Technologies Co., Ltd., LG, Lenovo, Micro-Star International Co., Ltd. (MSI) and Microsoft Corporation |

SEGMENT ANALYSIS

By Type Insights

The traditional laptops segment accounted for 65.6% of the global market share in 2024 due to their powerful hardware configurations, which make them suitable for demanding tasks such as gaming, video editing, and software development. For instance, traditional laptops often feature high-performance processors like Intel Core i7 or AMD Ryzen 7, and dedicated graphics cards, providing the necessary computing power for resource-intensive applications. Their widespread adoption across various sectors, including education, business, and personal use, underscores their importance in meeting diverse computing needs.

The 2-in-1 laptop segment is predicted to witness a CAGR of 12.3% over the forecast period due to the increasing demand from consumers for versatile and portable computing solutions. This growth is fueled by the increasing need for devices that combine the functionality of a laptop with the convenience of a tablet, catering to professionals and students who require flexibility for both work and leisure activities. The rise of remote work and digital learning environments has further accelerated the adoption of 2-in-1 laptops, highlighting their importance in the evolving computing landscape. According to the U.S. Bureau of Labor Statistics, the COVID-19 pandemic led to a substantial increase in remote work, with the percentage of workers primarily working from home rising from 6.5% in 2019 to a higher percentage during the pandemic.

By Screen Size Insights

The 15.0" to 16.9" screen size segment was the major segment and captured 38.3% of the global market share in 2024. The dominance of the segment is attributed to the balance these laptops offer between display size and portability, making them ideal for both professional and personal use. In the first half of 2023, global laptop sales reached USD 127.6 billion, with 114.8 million units shipped, as per the Cool Gadgets. They provide ample screen space for multitasking and enhanced viewing experiences, which appeal to a broad range of consumers, including professionals, students, and gamers. Their versatility and widespread adoption underscore their leading position in the market.

The 11" to 12.9" laptop segment is anticipated to showcase rapid growth over the forecast period by witnessing a CAGR of 8.4% owing to the increasing demand for ultra-portable devices that do not compromise on performance. As remote work and digital learning become more prevalent, consumers seek lightweight laptops that offer convenience during travel without sacrificing functionality. Manufacturers are responding by developing compact laptops with enhanced capabilities, such as high-resolution displays and efficient processors, to meet the needs of this growing consumer base. For instance, in June 2022, Apple announced the launch of 12-inch laptops, which will be available by the end of 2023.

By Enterprise Price Insights

The USD 501 to USD 1000 price bracket is the dominant segment in the global laptop market and is holding for 35.8% of the market share. This segment's prominence is due to its appeal to a broad consumer base, including students, professionals, and small businesses, offering a balance between affordability and performance. Laptops in this range typically provide adequate processing power, storage, and build quality, meeting the needs of most users without the premium cost. For instance, the Microsoft Surface Laptop 7 is available in configurations priced under $1,000, offering a balance of performance and portability suitable for both students and professionals. The availability of diverse models from various manufacturers in this segment further enhances its market share.

The USD 1001 to USD 1500 segment is projected to expand at a CAGR of 7.1% over the forecast period. This rapid expansion is driven by increasing demand for high-performance laptops among professionals in fields such as graphic design, video editing, and software development, as well as gaming enthusiasts seeking enhanced specifications. Laptops in this price range often feature advanced components like high-resolution displays, powerful processors, and dedicated graphics cards, catering to users requiring superior performance. The willingness of consumers to invest in premium devices for enhanced productivity and entertainment contributes to the rapid growth of this segment. For instance, the Dell XPS 15, priced within this range, is favored by professionals for its Intel Core i7 processor, NVIDIA GeForce GTX 1650 Ti graphics card, and 15.6-inch 4K UHD+ display, making it suitable for resource-intensive tasks.

By End-use Insights

The business segment led the laptop market by accounting for 43.9% of the global market share in 2024 owing to the essential role of laptops play in corporate environments, facilitating tasks such as presentations, coding, graphic design, and document editing. As of 2024, 82% of Fortune 500 companies offer flexible work environments, necessitating reliable and secure laptops for tasks such as presentations, coding, graphic design, and document editing. The demand for robust, reliable, and secure laptops in both large and small enterprises underscores the segment's prominence. Features like enhanced connectivity options and durable designs are particularly valued in business settings, contributing to the sustained demand in this segment.

The gaming segment is witnessing the rapid growth in the laptop market and is expected to witness a CAGR of 7.8% through the forecast period due to the increasing popularity of gaming among millennials and professional gamers. As of 2024, the global gaming community comprises approximately 3.32 billion gamers, reflecting a significant rise in gaming engagement. The rising interest in augmented reality (AR) and virtual reality (VR) technologies further propels this growth, as gaming laptops are often equipped with advanced processors and high-end graphics cards to support immersive gaming experiences. Major manufacturers are responding to this trend by introducing innovative gaming laptops with enhanced performance capabilities, catering to the evolving preferences of the gaming community.

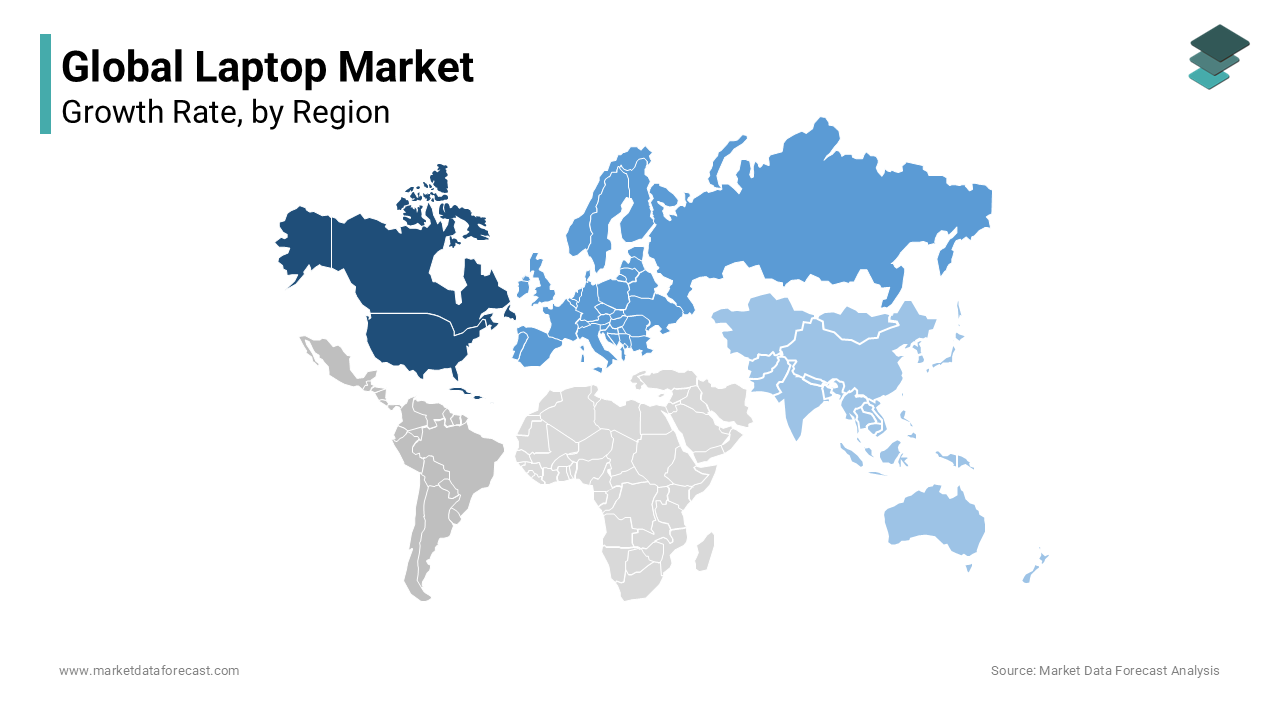

REGIONAL ANALYSIS

North America accounted for 37.4% of the global market share in 2024 and outranked other regions. This dominance is attributed to the region's high average income, enabling consumers to invest in premium technology for both personal and business use. In 2023, the real median household income in the United States was $80,610, reflecting a 4.0% increase from the previous year, as per the US Census. Additionally, North American consumers and businesses are typically early adopters of new technologies, fueling demand for the latest laptop innovations, such as advanced processing power and features. The strong presence of major technology companies and a robust infrastructure further bolster the market's leading position in this region.

The Asia-Pacific region is likely to register the fastest growth in the global laptop market and showcase a CAGR of 5.6% during the forecast period. This rapid expansion is driven by several factors including increasing urbanization, a burgeoning middle class and a growing tech-savvy youth population in countries like China, India, and Japan. Government initiatives promoting digitalization and education such as India's "Digital India" program and is further stimulate laptop adoption. Currently, 54% of the global urban population, more than 2.2 billion people, reside in Asia. By 2050, this number is expected to grow by an additional 1.2 billion, reflecting a 50% increase. The rising demand for affordable laptops coexists with an increasing interest in premium devices and thereby reflecting diverse consumer segments within the region.

European market is growing at a steady rate. This growth is supported by government initiatives to enhance digital education and the increasing demand for ultra-thin, lightweight laptops with modern designs. For instance, the European Union's e-Schools project has provided thousands of students and teachers with access to laptops and tablets, promoting digital learning.

The Latin American laptop market has faced challenges in recent years. In 2023, the market value decreased by 6.7% and is marking the third consecutive year of decline, as reported by IndexBox. This downturn is attributed to economic instability and high inflation rates, which have constrained consumer spending on electronics. However, the region's growing digitalization efforts and increasing internet penetration present opportunities for recovery. As economies stabilize and initiatives to enhance digital infrastructure progress, the demand for laptops is expected to rebound, particularly in sectors like education and remote work.

The Middle East and Africa laptop market is poised for steady expansion during the forecast period. This growth is driven by increasing digital adoption, government initiatives promoting technology use, and a youthful population embracing digital tools. Countries like the United Arab Emirates are anticipated to register the highest growth rates during this period. The expanding e-learning sector and the rise of remote working trends further contribute to the increasing demand for laptops in the region.

Top 3 Players in the market

Lenovo

Lenovo has maintained its position as the leading personal computer vendor globally since 2013. In 2023, the company held a market share of 25.5%, with unit shipments totaling approximately 62.5 million. Lenovo's success is attributed to its extensive product lineup, including the renowned ThinkPad series, which has been a staple in the business world for decades. The company's global manufacturing footprint and consistent innovation have solidified its leadership in the market.

HP Inc.

HP Inc. secured the second-largest share of the global personal computer market in 2023, accounting for 21.6% with around 53.03 million units shipped. The company's diverse portfolio caters to various consumer segments, from everyday users to professionals seeking high-performance devices. HP's commitment to quality and innovation has reinforced its strong market presence.

Dell Technologies

Dell Technologies held the third position in the global personal computer market in 2023, with a market share of 15.0%. The company's product range includes the Inspiron, Latitude, and XPS series, known for their performance and reliability. Dell's focus on customer-centric solutions and direct sales model has contributed to its significant market share.

Top strategies used by the key market participants

Lenovo

Lenovo emphasizes vertical integration in its manufacturing processes, allowing for greater control over production and supply chain management. This approach enables Lenovo to respond swiftly to market demands and maintain cost efficiency. The company operates manufacturing facilities in multiple countries, including China, Japan, and the United States, ensuring a robust global presence. Additionally, Lenovo's commitment to innovation is evident in its extensive research centers across the globe, fostering the development of cutting-edge technologies.

HP Inc.

HP Inc. focuses on a customer-centric approach, tailoring its products to meet diverse consumer needs. The company offers a wide range of laptops, from budget-friendly models to high-performance devices for professionals and gamers. HP's marketing strategies highlight the unique features and capabilities of its products, effectively reaching various market segments. The company's commitment to quality and innovation has reinforced its strong market presence.

Dell Technologies

Dell Technologies has implemented a significant rebranding strategy to streamline its product lines and enhance brand clarity. At CES 2025, Dell announced the consolidation of its existing brands, such as XPS and Inspiron, into three main product lines: Dell, Dell Pro, and Dell Pro Max, each with sub-tiers of Base, Plus, and Premium. This rebranding aims to simplify the product lineup and align with consumer preferences for clear and straightforward naming conventions.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Companies playing a prominent role in the global laptop market include Acer Inc., Apple Inc., ASUSTeK Computer Inc., Dell, HP Development Company, L.P., Huawei Technologies Co., Ltd., LG, Lenovo, Micro-Star International Co., Ltd. (MSI) and Microsoft Corporation.

The global laptop market is characterized by intense competition among key players striving for market share through innovation, strategic partnerships, and diversification. As of 2023, Lenovo leads the market with a 24.8% share, followed by HP at 21.9%, and Dell at 16.6%.

These companies compete by offering a wide range of products tailored to various consumer needs, from high-performance gaming laptops to ultra-portable models for professionals. Innovation is a critical competitive factor, with firms investing heavily in research and development to introduce features such as enhanced battery life, superior graphics capabilities, and integration of artificial intelligence. For instance, Lenovo plans to expand its global manufacturing footprint and has launched AI-powered PCs, expecting them to constitute up to 80% of shipments by 2027.

The market also sees competition from emerging players and regional brands, particularly in the Asia-Pacific region, where economic growth and increasing digital adoption fuel demand. Companies are also focusing on sustainability, offering eco-friendly products to appeal to environmentally conscious consumers.

Overall, the laptop market's competitive landscape is dynamic, with companies continuously adapting to technological advancements and consumer preferences to maintain and grow their market positions.

RECENT HAPPENINGS IN THE MARKET

- In January 2025, at CES 2025, Lenovo unveiled a laptop featuring a rollable OLED screen, showcasing innovation in display technology.

- In November 2024, Apple launched its latest M4 Mac lineup, including the new entry-level MacBook Pro starting at $1,599, and updated 14-inch and 16-inch MacBook Pros with M4 Pro/Max chips, starting at $1,999 and $2,499 respectively. These devices feature faster processors and increased RAM, with entry models starting at 16GB.

MARKET SEGMENTATION

This research report on the Laptop Market is segmented and sub-segmented into the following categories.

By Type

-

Traditional Laptop

- 2-in-1 Laptop

By Screen Size

- Upto 10.9"

- 11" to 12.9"

- 13" to 14.9"

- 15.0" to 16.9"

- More than 17"

By Enterprise Price

- Up to 500

- USD 501 to USD 1000

- USD 1001 to USD 1500

- USD 1501 to USD 2000

- Above USD 2001

By End-use

- Personal

- Business

- Gaming

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What is the current size of the global laptop market?

As of 2024, the global laptop market was valued at approximately USD 176.5 billion. Projections indicate that by 2025, this figure will rise to USD 186.3 billion, with further growth expected in subsequent years.

What are the future trends in the laptop market?

Future trends include the development of laptops with advanced features like high-refresh-rate displays for gaming, improved battery life, and enhanced connectivity options. There's also a growing focus on sustainability, with manufacturers exploring eco-friendly materials and energy-efficient designs.

Which regions are leading in laptop market growth?

North America is a mature market with high consumer adoption and technological advancements. However, regions like Asia Pacific are experiencing significant growth due to increasing consumer spending on electronics and the rising adoption of laptops for various applications.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]