Global Laminating Adhesives Market Size, Share, Trends & Growth Forecast Report By Technology (Solvent-Based, Solvent Less and Water-Based), End-Use (Packaging, Industrial, Automotive & Transportation), Resin (Polyurethane and Acrylic) and Region (North America, Latin America, Europe, Asia Pacific, Middle East & Africa), Industry Analysis (2024 to 2032)

Global Laminating Adhesives Market Size

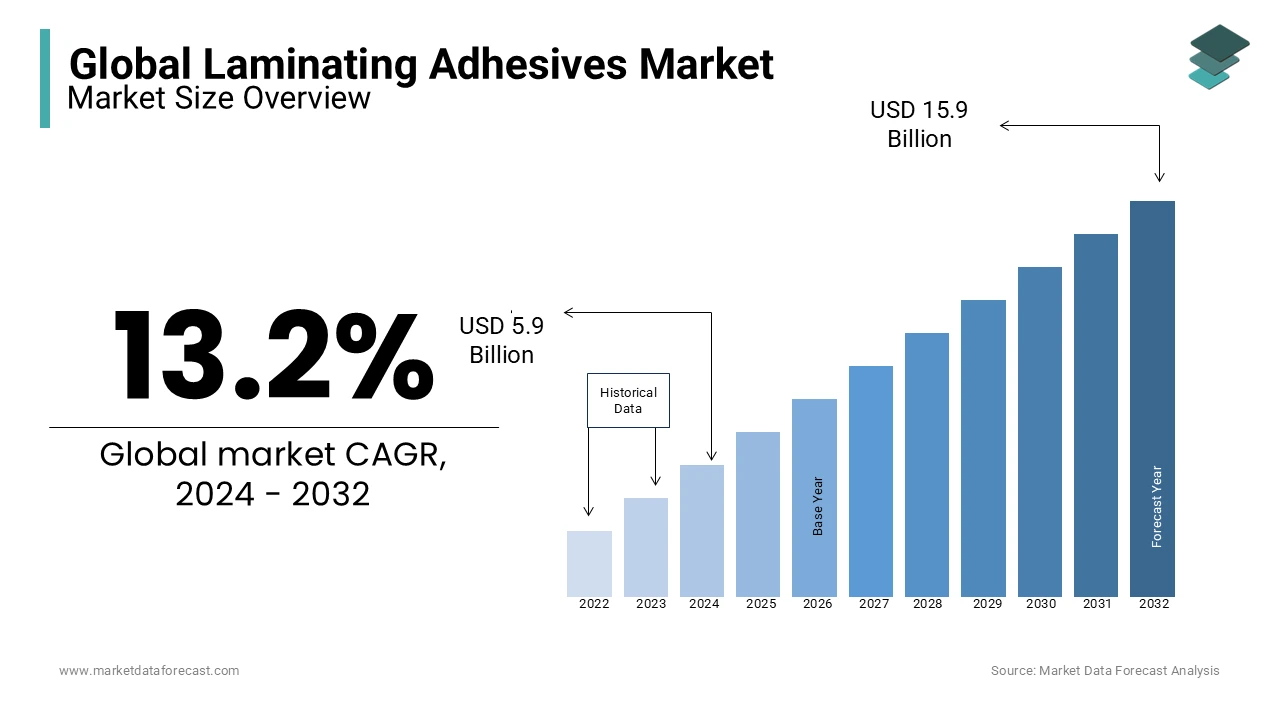

The global laminating adhesives market size was valued at USD 5.21 billion in 2023. The global market is estimated to grow from USD 5.9 billion in 2024 to USD 15.9 billion by 2032, exhibiting a CAGR of 13.2% from 2024 to 2032.

The demand for laminating adhesives is growing significantly owing to the increasing need for high-performance bonding materials across industries such as packaging, automotive, and electronics. In particular, laminating adhesives are crucial in the food packaging industry, where they are used to enhance barrier properties, preserve freshness, and extend shelf life. For instance, flexible packaging has grown in popularity due to its convenience, with laminating adhesives playing a central role in maintaining product quality. Approximately 70% of flexible packaging materials rely on these adhesives to ensure effective sealing and protection. In the automotive sector, laminating adhesives are increasingly used for lightweight composite materials and enhancing vehicle interiors. Automotive applications benefit from the adhesives' ability to bond dissimilar materials like metals, plastics, and composites, contributing to lighter, more fuel-efficient vehicles. Additionally, adhesive formulations have evolved to offer better heat resistance, with newer products capable of withstanding temperatures as high as 200°C. There is also an increasing emphasis on sustainable and eco-friendly adhesives. Water-based adhesives are preferred due to their lower volatile organic compound (VOC) emissions. The adoption of bio-based adhesives is expected to rise, driven by both consumer demand for sustainable products and regulatory pressures on VOC levels. Europe has already set targets to reduce VOC emissions, prompting companies to invest in greener adhesive technologies.

MARKET DRIVERS

Growing Demand for Sustainable Packaging Solutions:

The demand for sustainable and eco-friendly products is a major driver of the laminating adhesives market. With increasing concerns about plastic waste and environmental impact, manufacturers are turning to water-based and bio-based adhesives. These adhesives offer a lower volatile organic compound (VOC) emissions profile, which aligns with consumer preferences and government regulations. Water-based adhesives account for over 60% of the market due to their environmentally friendly properties. The packaging sector, particularly in food and beverage, is a key adopter, as these adhesives help improve the recyclability and sustainability of packaging materials.

Technological Advancements in Adhesive Performance

Continuous innovations in adhesive technologies are driving the laminating adhesives market. The development of adhesives with improved heat resistance, higher bonding strength, and enhanced barrier properties has expanded the applications of laminating adhesives across various industries, including automotive and electronics. For instance, modern formulations can withstand temperatures up to 200°C, making them ideal for automotive components that require high-performance bonding. These advancements enable laminating adhesives to meet the increasing demands of complex, high-performance applications, ensuring their widespread adoption in diverse sectors.

MARKET RESTRAINTS

High Cost of Raw Materials

One of the key restraints in the laminating adhesives market is the rising cost of raw materials, particularly in bio-based adhesives and specialty polymers. As the demand for sustainable and eco-friendly adhesives increases, manufacturers face challenges in sourcing high-quality, renewable materials at competitive prices. Bio-based adhesives, while environmentally beneficial, are often more expensive than their traditional counterparts. This price disparity can limit adoption, especially in price-sensitive sectors like packaging, where cost efficiency is crucial. For example, the cost of bio-based materials can be up to 30% higher compared to petroleum-based alternatives.

Strict Regulatory Standards

The growing number of environmental regulations around volatile organic compounds (VOCs) and solvent-based adhesives is another significant restraint. While the shift toward water-based and bio-based adhesives is beneficial for sustainability, the stringent regulations around VOC emissions in regions like Europe and North America can pose challenges for manufacturers. Compliance with these regulations requires investments in new technology and reformulation of existing adhesives, which increases operational costs. For example, Europe’s REACH regulations mandate strict limits on VOC emissions, pushing companies to adapt their production processes, which can delay product launches and increase overall production costs.

MARKET OPPORTUNITIES

Expansion of Eco-friendly Adhesive Solutions

The growing consumer and regulatory demand for sustainable products presents a major opportunity in the laminating adhesives market. Manufacturers can capitalize on the shift toward bio-based and water-based adhesives, which are increasingly favored due to their reduced environmental impact. The rising trend of eco-conscious packaging is fueling this growth, especially in sectors like food and beverage packaging. Water-based adhesives, for example, now make up more than 60% of the market, driven by their ability to meet stringent environmental regulations. Companies that focus on creating greener alternatives are well-positioned to tap into this demand, especially as consumers prioritize sustainability.

Adoption of Laminating Adhesives in Electronics and Automotive Applications

Expanding laminating adhesives into the electronics and automotive industries presents significant growth potential. In the automotive sector, adhesives are used to bond lightweight materials, reduce vehicle weight, and improve fuel efficiency. Similarly, in electronics, laminating adhesives offer solutions for bonding delicate components while maintaining heat resistance and electrical insulation. The automotive industry is projected to grow at a compound annual growth rate (CAGR) of 7.5%, with adhesives becoming critical in next-generation manufacturing. As both industries seek lightweight, high-performance materials, laminating adhesives are increasingly being integrated into innovative product designs.

MARKET CHALLENGES

Fluctuations in Raw Material Prices

One of the significant challenges faced by the laminating adhesives market is the volatility in raw material costs, particularly for petrochemical-based components. The cost of key materials like resins, solvents, and specialty polymers can fluctuate due to global supply chain disruptions, geopolitical tensions, and changes in crude oil prices. For instance, the price of ethylene, a crucial raw material for many adhesives, can rise by 10-15% in response to oil price hikes. These fluctuations lead to unpredictable production costs, which affect profit margins and force companies to adjust their pricing strategies or absorb additional costs.

Complexity in Meeting Stringent Regulatory Standards

The evolving and complex regulatory landscape surrounding VOC emissions, sustainability, and product safety presents a considerable challenge for laminating adhesives manufacturers. Regulations such as the EU REACH and California’s Proposition 65 impose strict limits on the chemicals used in adhesives, which forces companies to invest heavily in research and development to ensure compliance. This can slow down innovation cycles, increase R&D costs, and delay product launches. Moreover, meeting these standards requires significant investment in new manufacturing processes and equipment, adding to the financial burden of manufacturers.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

13.2% |

|

Segments Covered |

By Technology, Resin, End-use and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

|

Market Leaders Profiled |

Toyo-Morton Ltd, Dow Chemical Company, 3M Company, COIM Group, Ashland, Inc., Bostik, H.B Fuller, Comens New Materials, Henkel, Vimasco Corporation, Flint Group, Coim and L.D. Davis |

SEGMENTAL ANALYSIS

By Technology Insights

The water-based adhesives segment held 60.4% of the global market share in 2023 due to their eco-friendly nature and compliance with increasingly stringent environmental regulations. Their popularity is driven by growing consumer demand for sustainable solutions and the need to reduce volatile organic compound (VOC) emissions, which has made them particularly favorable in regions like Europe and North America. The rise in eco-conscious consumer behavior, along with regulatory pressures, makes water-based adhesives essential in industries such as food packaging, where sustainability and recyclability are critical. These adhesives provide a balance of strong bonding, durability, and environmental safety, positioning them as the preferred choice across multiple sectors.

The solventless technology segment is predicted to witness the highest CAGR of 8.84% over the forecast period in the laminating adhesives market. Increasing demand for high-performance and low-emission adhesives is propelling the expansion of the solventless technology segment in the global market. Solventless adhesives, which do not contain solvents and thus emit little to no VOCs, are gaining traction in industries that prioritize environmental sustainability. Particularly in automotive and electronics applications, where durability and heat resistance are critical, solventless adhesives offer superior performance. Their adoption is accelerating as companies seek to reduce environmental impact while maintaining high adhesive strength, making them key for manufacturers transitioning to greener solutions.

By End-User Insights

The packaging segment dominated the laminating adhesives market in 2023 due to the significant use of adhesives in flexible and rigid packaging solutions. This segment accounts for over 50% of the global market share. The key drivers of this dominance are the increasing demand for durable, cost-effective, and sustainable packaging solutions, particularly in the food and beverage industry. Laminating adhesives in packaging are essential for creating protective layers that improve moisture, oxygen, and light barrier properties, thus extending the shelf life of products. Additionally, the rise in eco-friendly packaging is propelling growth, as water-based adhesives, which are commonly used in packaging, align with the trend toward sustainability. The global focus on reducing plastic waste and increasing recyclability is further fueling the demand for laminating adhesives in packaging applications.

The automotive and transportation segment is the fastest-growing in the global laminating adhesives market and is projected to witness a CAGR of 9.4% over the forecast period. This growth is driven by the increasing use of laminating adhesives in lightweight composite materials and vehicle interiors, where they replace traditional mechanical fasteners. Adhesives in automotive applications are vital for bonding components such as panels, trims, and seats, offering weight reduction and improving fuel efficiency. As electric vehicles (EVs) gain market share, the demand for lightweight, high-performance adhesives is accelerating. Additionally, the trend toward sustainability in the automotive industry, including the reduction of carbon emissions, is pushing manufacturers to adopt adhesives that provide strong bonding with lower environmental impact, further driving the demand for laminating adhesives in this sector.

By Resin Insights

The polyurethane resin segment led the market by accounting for 40.8% of the global market share in 2023. Polyurethane adhesives are favored for their exceptional bonding strength, flexibility, and durability, making them the preferred choice for applications in the automotive, packaging, and industrial sectors. In the automotive industry, they are widely used for bonding components such as panels and trim, which require high performance in challenging conditions. In packaging, polyurethane-based adhesives are used to create strong, flexible bonds in flexible films and labels, which are critical for ensuring product protection. These adhesives also offer excellent abrasion resistance, making them ideal for applications in demanding environments. As a result, polyurethane resins remain the dominant technology in the laminating adhesives market.

The acrylic resin segment is predicted to exhibit the highest CAGR of 8.22% over the forecast period. The growth is primarily driven by the increasing demand for adhesives with superior UV stability, weather resistance, and high-strength bonding capabilities, especially in automotive and industrial applications. Acrylic-based adhesives are gaining traction in automotive manufacturing, where they are used to bond lightweight components and composite materials, which are critical for improving fuel efficiency and performance. Additionally, their faster curing times and ability to withstand environmental stress make them an attractive option for industries with high productivity requirements. This combination of enhanced performance and faster production cycles contributes to the rapid expansion of acrylic resins in the laminating adhesives market.

REGIONAL INSIGHTS

North America led the market laminating adhesives market globally and occupied a share of 35.6% of the global market in 2023. The region is poised for steady growth, with a projected CAGR of around 5-6% over the next several years. The key drivers for this growth include increasing demand for eco-friendly packaging solutions, particularly in the food and beverage sector, as well as rising adoption of sustainable adhesives in automotive and industrial applications. The United States, as the largest economy in the region, leads this market with its growing focus on lightweight materials in automotive manufacturing and regulatory pressures for low-VOC adhesives. Additionally, Canada’s emphasis on green technologies is supporting growth in the laminating adhesives market.

Europe is another major player in the laminating adhesives market. The growth of the laminating adhesives market in Europe is majorly driven by the strong demand for sustainable and eco-friendly products spurred by stringent regulations such as the EU REACH standards. Countries like Germany, France, and Italy are the leading markets for laminating adhesives, with Germany being a major manufacturing hub for automotive adhesives and packaging solutions. The growth in electric vehicle (EV) production and increased demand for bio-based adhesives are expected to drive market expansion in the region.

The Asia-Pacific region is the fastest-growing in the laminating adhesives market. The region currently holds a considerable share of the global market and this share is expected to increase as industrialization and urbanization continue at a rapid pace. China, India, and Japan are the dominant players in this region. China, as the largest manufacturer of packaging materials and automotive components, is driving significant demand for laminating adhesives. The booming e-commerce sector, growing demand for flexible packaging, and the increasing adoption of sustainable adhesives are fueling this growth.

Latin America is expected to grow at a CAGR of 5.66% over the forecast period owing to the rising demand for packaging solutions in countries like Brazil and Mexico, driven by expanding consumer markets and a growing focus on sustainability in packaging. Although it is a smaller market, the rise in disposable incomes and the demand for eco-friendly packaging and adhesives in industries like food and beverage are creating opportunities for manufacturers to expand in the region.

The Middle East and Africa region holds a smaller share of the global market currently. However, this region is expected to grow at a steady CAGR over the forecast period owing to industrial growth and increased investments in infrastructure projects. The UAE, Saudi Arabia, and South Africa are the leading countries in the MEA market. The demand for automotive adhesives and packaging applications is growing due to expanding manufacturing sectors and a push for sustainable and low-emission adhesives in the region. The growth of e-commerce and rising consumer awareness about environmental sustainability are also expected to contribute to market expansion.

KEY MARKET PLAYERS

Companies playing a noteworthy role in the global laminating adhesives market include Toyo-Morton Ltd., Dow Chemical Company, 3M Company, COIM Group, Ashland, Inc., Bostik, H.B. Fuller, Comens New Materials, Henkel, Vimasco Corporation, Flint Group, Coim, L.D. Davis and Bostik.

MARKET SEGMENTATION

This research report on the global laminating adhesives market is segmented and sub-segmented into technology, resin type, end-user and region.

By Technology

- Solvent-based

- Solventless

- Water-based

- Others

- EB

- UV

- Hot-growth

By End-Use

- Packaging

- Industrial

- Automotive & Transportation

By Resin

- Polyurethane

- Acrylic

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle east and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]