Global Ladder Market Size, Share, Trends, & Growth Forecast Report Segmented By Type of Material (Aluminum, Steel, Wood, Fibreglass, and Other material Types), Application, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Ladder Market Size

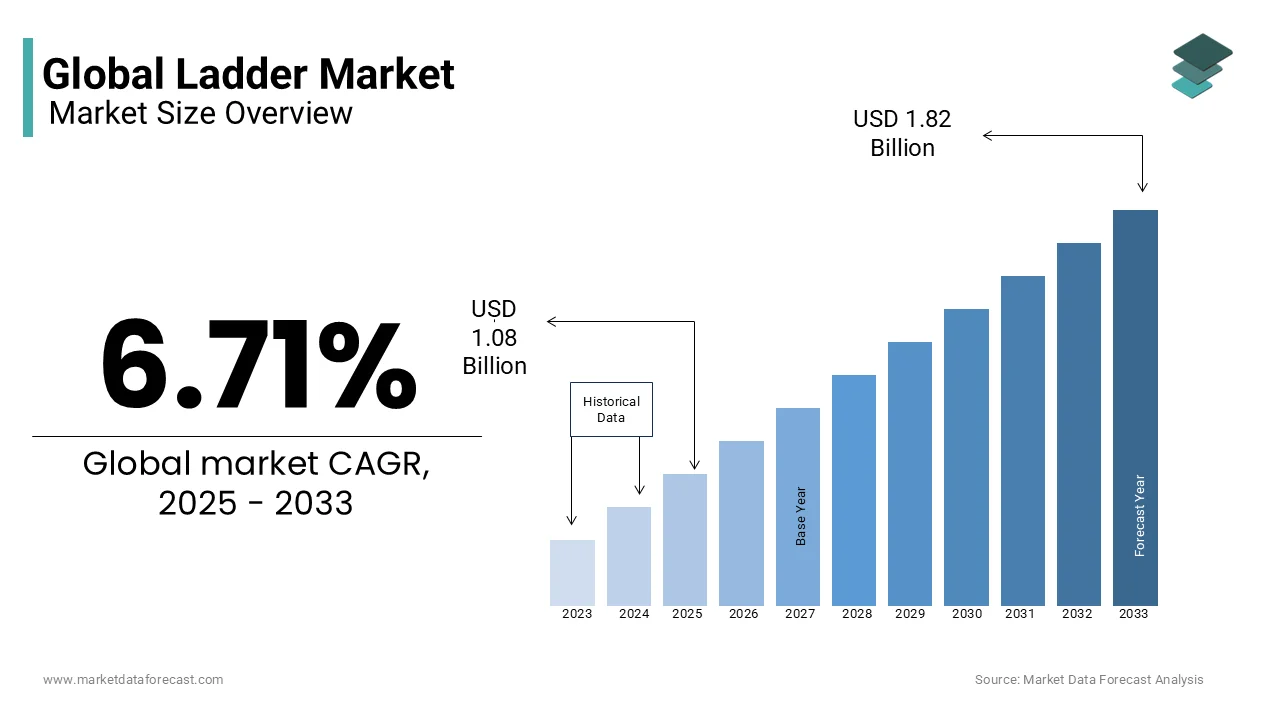

The global ladder market size was valued at USD 1.01 billion in 2024 and is expected to reach USD 1.82 billion by 2033 from USD 1.08 billion in 2025. The market is projected to grow at a CAGR of 6.71%.

Ladders are indispensable in both residential and commercial settings, serving purposes ranging from routine household maintenance to complex industrial applications. They come in various types, including step ladders, extension ladders, telescoping ladders, and platform ladders, each tailored to specific needs such as height requirements, portability, and load-bearing capacity. The modern ladder market has evolved significantly with advancements in materials like aluminum, fiberglass, and carbon fiber, which enhance durability while reducing weight. This evolution aligns with growing consumer demand for safer, more ergonomic designs that comply with stringent safety standards.

In addition to the aforementioned trends, the ladder market is influenced by broader societal and economic factors that underscore its relevance. For instance, the aging global population has led to an increased focus on accessibility solutions, including step stools and support ladders, which are often used in senior living environments. The World Health Organization estimates that the global population aged 60 years and above will reach 2.1 billion by 2050, driving demand for user-friendly and safety-enhanced ladder designs tailored to this demographic. Furthermore, urbanization continues to shape the market dynamics, with over 56% of the world’s population residing in urban areas as of 2023, according to the United Nations. This shift has resulted in a higher concentration of multi-story buildings, where ladders are indispensable for maintenance, repairs, and emergency access.

Another noteworthy statistic comes from the Consumer Product Safety Commission, which reported that nearly 90,000 ladder-related injuries occur annually in the United States alone. The need for improved safety features and consumer education regarding proper ladder usage. Additionally, environmental considerations are gaining traction within the ladder market, as manufacturers increasingly adopt sustainable practices. A report by the Ellen MacArthur Foundation noted that industries incorporating recyclable materials, such as aluminum and fiberglass, are witnessing a 15% annual growth in consumer preference due to heightened environmental awareness. These statistics collectively illustrate how the ladder market is not only shaped by functional demands but also by demographic shifts, safety concerns, and sustainability imperatives, making it a multifaceted and evolving sector.

MARKET DRIVERS

Increased Focus on Workplace Safety Regulations

Stringent workplace safety regulations have become a significant driver for the ladder market, as industries prioritize compliance with standards to mitigate accidents. As per Occupational Safety and Health Administration (OSHA), all ladders used in workplaces must meet specific load-bearing and structural integrity requirements. According to OSHA, falls remain the leading cause of worker fatalities in the construction industry, accounting for 35% of deaths in 2022. This alarming statistic has prompted businesses to invest in high-quality, certified ladders to ensure employee safety and regulatory adherence. According to the National Institute for Occupational Safety and Health (NIOSH), implementing proper ladder safety measures can reduce fall-related injuries by up to 20%. The demand for durable, OSHA-compliant ladders continues to grow, driving innovation and sales within the market.

Rising Demand for Home Improvement and DIY Projects

The surge in home improvement and DIY projects has significantly propelled the ladder market, driven by shifting consumer preferences and lifestyle changes. According to the U.S. Census Bureau, residential renovation spending reached $420 billion in 2022 by reflecting a 12% increase from the previous year. This trend is fueled by homeowners seeking cost-effective ways to enhance property value and functionality. As per the American Housing Survey, over 70% of homeowners aged 25-44 actively engage in DIY activities, often requiring ladders for tasks such as painting, cleaning gutters, and installing fixtures. The rise of online platforms offering DIY tutorials has further amplified this trend, with Google Trends reporting a 30% increase in searches for home improvement guides since 2020. As more individuals embrace DIY culture, the demand for versatile, user-friendly ladders continues to expand, bolstering market growth.

MARKET RESTRAINTS

High Incidence of Ladder-Related Injuries and Safety Concerns

A significant restraint in the ladder market is the persistent issue of ladder-related injuries, which raises concerns about product safety and deters potential buyers. According to the Centers for Disease Control and Prevention (CDC), over 500,000 people in the United States are treated in emergency rooms annually due to ladder accidents, with approximately 300 fatalities occurring each year. These alarming figures escalates the risks associated with improper usage and inadequate safety features in some ladder designs. Furthermore, the National Electronic Injury Surveillance System (NEISS) found that ladder-related injuries account for nearly 20% of all fall-related incidents in non-occupational settings. Such statistics have led to increased scrutiny from consumer advocacy groups and regulatory bodies, pushing manufacturers to invest heavily in safety innovations. However, the cost of implementing advanced safety technologies can increase product prices, potentially limiting accessibility for budget-conscious consumers.

Environmental Regulations on Material Usage

Stringent environmental regulations governing the use of materials have emerged as a key restraint for the ladder market. The Environmental Protection Agency (EPA) has imposed strict guidelines on the production and disposal of materials like aluminum and certain plastics, which are commonly used in ladder manufacturing. According to the EPA, industries generating over 13 million tons of metal waste annually must comply with recycling mandates, increasing operational costs for manufacturers. Additionally, the European Union’s REACH regulation, which restricts the use of hazardous substances in industrial products, has impacted global supply chains, including those for fiberglass and other composite materials. A report by the International Labour Organization (ILO) reveals that compliance with such environmental standards can raise production costs by up to 15%. These regulatory pressures not only challenge manufacturers but also contribute to higher retail prices, potentially stifling market growth in price-sensitive regions.

MARKET OPPORTUNITIES

Growing Adoption of Lightweight and Advanced Materials

The increasing demand for lightweight, durable, and innovative materials presents a significant opportunity for the ladder market. According to the National Institute of Standards and Technology (NIST), industries are shifting toward advanced composites like carbon fiber and reinforced polymers, which offer superior strength-to-weight ratios compared to traditional materials. These materials reduce the physical strain on users while maintaining structural integrity, making ladders more appealing for both professional and household use. According to the U.S. Department of Energy, the global market for advanced materials is projected to grow by 12% annually through 2030, driven by their application in various sectors, including construction and manufacturing. As per the Federal Aviation Administration (FAA), innovations in material science have reduced product weights by up to 40% by enhancing portability and usability. This trend positions the ladder market to capitalize on advancements in material technology, offering products that align with modern consumer preferences for efficiency and safety.

Expansion into Emerging Markets and Urbanization Trends

The rapid urbanization and infrastructure development in emerging economies present another key opportunity for the ladder market. According to the United Nations Department of Economic and Social Affairs, urban areas in developing regions are expected to absorb 95% of global population growth by 2050 by creating a surge in demand for construction and maintenance tools, including ladders. As per the International Labour Organization (ILO), the construction sector in emerging markets is expanding at an annual rate of 7%, driven by government investments in housing, transportation, and public facilities. For instance, India’s Ministry of Housing and Urban Affairs has launched initiatives to build over 20 million affordable homes by 2025 by requiring extensive use of access equipment. As these economies continue to industrialize, the ladder market can leverage this growth by introducing cost-effective, durable products tailored to the needs of rapidly developing urban centers, thereby unlocking new revenue streams.

MARKET CHALLENGES

Counterfeit and Substandard Products in the Market

The proliferation of counterfeit and substandard ladders poses a significant challenge to the ladder market. According to the International Trade Administration (ITA), counterfeit goods account for nearly 2.5% of global trade, with tools and equipment being one of the most affected categories. These products often fail to meet safety standards, leading to increased risks of accidents. According to the Consumer Product Safety Commission (CPSC), over 30% of reported ladder failures are linked to non-compliant or counterfeit items, which are typically priced lower but compromise on quality. As per the World Customs Organization, counterfeit products result in annual losses of approximately $500 billion globally, impacting legitimate manufacturers. This issue not only erodes brand reputation but also forces companies to invest heavily in anti-counterfeiting measures, raising operational costs and complicating market dynamics.

Supply Chain Disruptions and Raw Material Shortages

Supply chain disruptions and raw material shortages have emerged as critical challenges for the ladder market, exacerbated by global events such as pandemics and geopolitical tensions. According to the U.S. Department of Commerce, supply chain bottlenecks caused a 15% increase in lead times for essential materials like aluminum and steel in 2022 is directly affecting production schedules. As per the International Monetary Fund (IMF), global trade disruptions have led to a 20% spike in raw material costs, squeezing profit margins for manufacturers. According to the Aluminum Association, aluminum prices surged by over 40% during the past two years due to supply constraints. These disruptions not only delay product availability but also inflate retail prices by making it challenging for manufacturers to maintain affordability and meet consumer demand. Such volatility in the supply chain threatens the stability and growth potential of the ladder market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.71% |

|

Segments Covered |

By Type of Material, Application, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Werner Co., Louisville Ladder, TB Davies (Cardiff), Alaco Ladders, Tri-arc Manufacturing, Sagar Asia, Bauer Ladder Inc., Little Giant Ladder, Tubesca-comabi, Gorilla Ladders, and others |

SEGMENTAL ANALYSIS

By Type of Material Insights

The wood dominated the ladder market with 35.1% of share in 2024 due to its affordability, ease of repair, and widespread use in residential settings for light-duty tasks. Wooden ladders are particularly favored in rural areas, where they are used extensively in agricultural activities. According to the USDA, over 60% of wooden ladders are sold in regions with significant farming communities, underscoring their importance. Additionally, wood’s natural insulating properties make it safer for electrical work compared to conductive materials like aluminum. Wood remains a staple due to its traditional appeal and cost-effectiveness by ensuring its continued leadership in the ladder market.

Fiberglass segment is deemed to witness a fastest CGAR of 8.5% from 2025 to 2033. This impressive growth is driven by fiberglass’s unique properties, including its non-conductive nature, which makes it ideal for electrical and utility work where safety is paramount. According to the Occupational Safety and Health Administration, fiberglass ladders significantly reduce the risk of electrocution, a critical factor in industries handling high-voltage equipment. As per the Environmental Protection Agency, fiberglass is gaining traction due to its lower environmental footprint compared to traditional materials like steel or aluminum. Unlike metals, fiberglass does not rust or degrade under harsh conditions by extending its usability in challenging environments. The demand for fiberglass ladders is expected to surge in sectors requiring specialized safety equipment with increasing investments in infrastructure and utilities globally. For instance, the global utility sector, valued at over $3 trillion, relies heavily on such materials to ensure worker safety and operational efficiency that further propels fiberglass into the spotlight as a transformative material in the ladder market.

By Application Insights

The household segment was the largest and held 45.2% of the total ladder market share in 2024. The rising trend of DIY home improvement projects, with Statista noting that over 60% of homeowners undertook such activities in 2022. The increasing availability of affordable and versatile ladders tailored for residential use further boosts demand. According to the National Association of Home Builders, 75% of households require access to tools like ladders for routine maintenance tasks. This segment remains pivotal by ensuring steady revenue streams and emphasizing its critical role in driving the ladder market.

The industrial segment is expected to grow with a CAGR of 8.5% from 2025 to 2033. This rapid growth is fueled by stringent workplace safety regulations enforced by agencies like OSHA, which mandate the use of certified ladders in hazardous environments. According to the World Economic Forum, global industrial output is expected to expand by 3.5% annually by increasing the need for reliable access equipment. Furthermore, the rise of smart factories and automation has driven demand for specialized ladders designed for complex machinery maintenance. This segment's importance is underscored by its ability to address evolving operational needs while contributing significantly to market expansion.

REGIONAL ANALYSIS

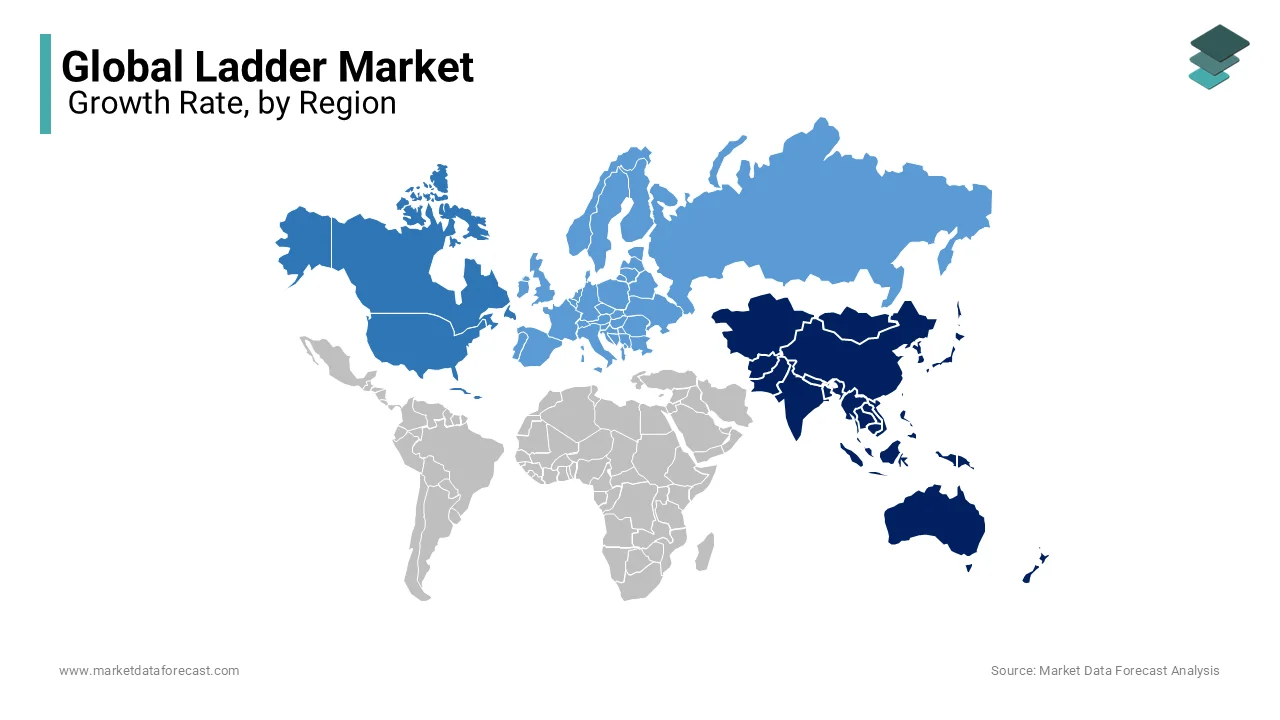

Asia-Pacific dominated the ladder market by capturing 40.1% of the global ladder market share with the rapid urbanization and industrialization, with the Asian Development Bank projecting that urban populations in the region will grow by 60% by 2050. Additionally, massive infrastructure investments, such as China’s $1 trillion annual spending on construction projects, drive demand for ladders across residential, commercial, and industrial sectors. The region's growing middle class, coupled with rising awareness of workplace safety standards, further amplifies growth. Asia-Pacific remains a cornerstone of the ladder market with its vast population and increasing focus on affordable housing and smart cities by shaping global trends and ensuring sustained demand.

North America is the fastest-growing region in the ladder market, with a projected CAGR of 8.7% from 2025 to 2033. This growth is driven by a surge in home improvement activities, with Statista reporting that over 60% of U.S. homeowners undertook DIY projects in 2022. Stringent workplace safety regulations enforced by OSHA also ensure consistent demand for high-quality industrial ladders. Furthermore, advancements in material science, such as lightweight aluminum and fiberglass designs by evolving consumer preferences. According to National Association of Home Builders, residential renovation spending reached $420 billion in 2022.

Europe is expected to exhibit steady growth, supported by aging infrastructure and strict safety regulations, with Eurostat forecasting a 4.5% annual rise in renovation activities through 2030. Latin America shows moderate potential due to urbanization but faces challenges from economic instability. The Middle East and Africa are likely to experience gradual growth, driven by large-scale projects like Saudi Arabia’s Vision 2030, which aims to invest $1 trillion in construction. As per the African Development Bank, urbanization rates in Africa will reach 50% by 2035 by boosting demand for affordable access equipment. While these regions face hurdles such as limited industrialization, their emerging markets present long-term opportunities for the ladder market.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Werner Co., Louisville Ladder, TB Davies (Cardiff), Alaco Ladders, Tri-arc Manufacturing, Sagar Asia, Bauer Ladder Inc., Little Giant Ladder, Tubesca-comabi, Gorilla Ladders are playing dominating role in the global ladder market.

The ladder market is highly competitive, driven by innovation, safety regulations, and evolving consumer demands. Major players such as WernerCo, Little Giant Ladder Systems, Louisville Ladder, and Tubesca-Comabi dominate the industry, leveraging advanced product development, global expansion, and strong brand positioning to maintain their market share. These companies focus on high-performance materials, multipurpose designs, and enhanced safety features to differentiate their offerings.

Competition is particularly intense in the construction, industrial, and residential segments, where demand for lightweight, durable, and OSHA-compliant ladders continues to grow. Manufacturers compete by offering fiberglass ladders for electrical safety, telescoping models for portability, and hybrid designs for multifunctionality. Additionally, companies are integrating smart features such as load sensors and anti-slip technology to appeal to safety-conscious buyers.

Smaller and regional manufacturers challenge industry leaders by offering cost-effective solutions and targeting niche markets, such as DIY consumers and specialized trades. Meanwhile, the rise of e-commerce platforms like Amazon, Home Depot, and Lowe’s has intensified competition, as digital visibility and customer reviews influence purchasing decisions.

TOP 3 PLAYERS IN THE MARKET

Werner Co.

Werner Co. is a global leader in the ladder market, widely recognized for its innovative designs and unwavering commitment to safety. Headquartered in the United States, the company has established itself as a dominant force in the industry through its diverse range of products, including aluminum, fiberglass, and steel ladders tailored for residential, commercial, and industrial applications. Werner’s leadership is rooted in its adherence to stringent safety standards and continuous investment in research and development. The company’s "Safety Step" initiative has played a pivotal role in promoting workplace safety, earning it widespread acclaim. By leveraging advanced manufacturing techniques, Werner ensures its products are durable, reliable, and affordable, reinforcing its reputation as a key contributor to the global ladder market.

Louisville Ladder

Louisville Ladder is another major player in the ladder market, known for its high-quality wooden and fiberglass ladders that cater primarily to North American and European consumers. The company distinguishes itself through its focus on sustainability, utilizing responsibly sourced materials that align with environmental regulations. Louisville Ladder’s robust distribution network and partnerships with leading retailers have enabled it to maintain steady growth and a strong market presence. Its emphasis on ergonomic designs and load-bearing innovations has made it a trusted brand among professionals and homeowners alike. By prioritizing quality and user-centric solutions, Louisville Ladder continues to play a significant role in shaping the evolution of the ladder market.

Little Giant Ladder Systems

Little Giant Ladder Systems is renowned for its versatility and innovation, offering multi-functional ladders that can adapt to various tasks, appealing to both DIY enthusiasts and industrial users. The company’s patented hinge-and-rung system has revolutionized ladder design, enhancing portability and usability. Little Giant’s commitment to safety and customer-centric solutions has positioned it as a trailblazer in the market. By addressing modern challenges such as urbanization and space constraints, Little Giant has expanded the scope of traditional ladder applications. Its ability to anticipate future demands and deliver cutting-edge products has solidified its status as a key innovator and contributor to the global ladder market.

STRATEGIES USED BY THE MARKET PLAYERS

Product Innovation & Safety Enhancements

Leading manufacturers such as WernerCo, Little Giant Ladder Systems, and Louisville Ladder prioritize innovation in ladder design and materials to improve safety, durability, and versatility. For example, WernerCo has integrated smart safety features such as slip-resistant steps and shock-absorbing stabilizers to reduce workplace accidents. Additionally, the incorporation of lightweight yet strong materials like fiberglass and carbon fiber has improved ladder portability while maintaining strength.

Expansion Through Mergers & Acquisitions (M&A)

Market leaders leverage strategic acquisitions to expand their product portfolios and geographical reach. For instance, WernerCo acquired Green Bull and Keller Ladder, strengthening its dominance in both professional and household ladder segments. Such acquisitions enable companies to gain advanced manufacturing capabilities, patented technologies, and wider distribution networks.

Diversification of Product Offerings

Companies are increasingly developing multi-purpose and hybrid ladders that cater to multiple applications, such as extension ladders that convert into scaffolding systems. Little Giant Ladder Systems, for example, has introduced adjustable ladders with multiple configurations, catering to both professional contractors and DIY consumers.

Digital Transformation & E-commerce Expansion

With rising online shopping trends, ladder manufacturers have embraced digital sales channels. Companies optimize their presence on Amazon, Home Depot, and Lowe’s platforms, offering detailed product specifications, customer reviews, and virtual demonstrations. Some brands have also integrated augmented reality (AR) tools, allowing customers to visualize ladder sizes before purchasing.

Sustainability & Eco-friendly Initiatives

Growing environmental concerns have pushed manufacturers to adopt sustainable production methods and recyclable materials. Many companies are reducing carbon footprints by using aluminum sourced from recycled materials and implementing energy-efficient production processes.

Geographic Expansion & Partnerships

To tap into emerging markets, companies establish regional manufacturing units and distribution partnerships. For example, WernerCo has expanded its manufacturing plants across North America, Europe, and Asia to reduce transportation costs and enhance market penetration.

Compliance with Safety Standards & Certifications

Key players align their products with Occupational Safety and Health Administration (OSHA) and American National Standards Institute (ANSI) standards to ensure compliance and gain customer trust. Certified ladders are preferred by professionals and large-scale industries, reinforcing brand credibility.

Aggressive Marketing & Brand Positioning

Major brands invest in targeted marketing campaigns, trade shows, and sponsorships to showcase their product superiority. Digital advertising, influencer partnerships, and engaging video content demonstrating ladder safety and efficiency boost brand recognition and consumer confidence.

RECENT HAPPENINGS IN THE MARKET

- In October 2023, TB Davies (Cardiff) scaled up its production of aluminum extension ladders at its facility in Cardiff, as reported by AlCircle. This move is anticipated to meet the rising demand for lightweight and durable ladders, particularly in the construction and industrial sectors. By increasing production capacity, TB Davies aims to strengthen its market position and cater to growing infrastructure projects across Europe and beyond.

MARKET SEGMENTATION

This research report on the global ladder market has been segmented and sub-segmented based on type of material, application, and region.

By Type of Material

- Aluminum

- Steel

- Wood

- Fibreglass

- Other material Types

By Application

- Household

- Commercial

- Industrial

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected size of the global ladder market in the future?

The global ladder market is expected to reach USD 1.82 billion by 2033.

2. What factors are driving the growth of the ladder market?

Key growth factors include the increasing demand in construction and industrial applications, the rise in home improvement and DIY activities, and a growing focus on workplace safety standards.

3. Which regions are expected to dominate the global ladder market?

North America, Europe, and Asia-Pacific are expected to be the key regions contributing to market growth.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]