Global Laboratory Centrifuge Market Size, Share, Trends & Growth Analysis - By Product, Application, End-User & Region – Industry Forecasts (2024 to 2033)

Global Laboratory Centrifuge Market Size

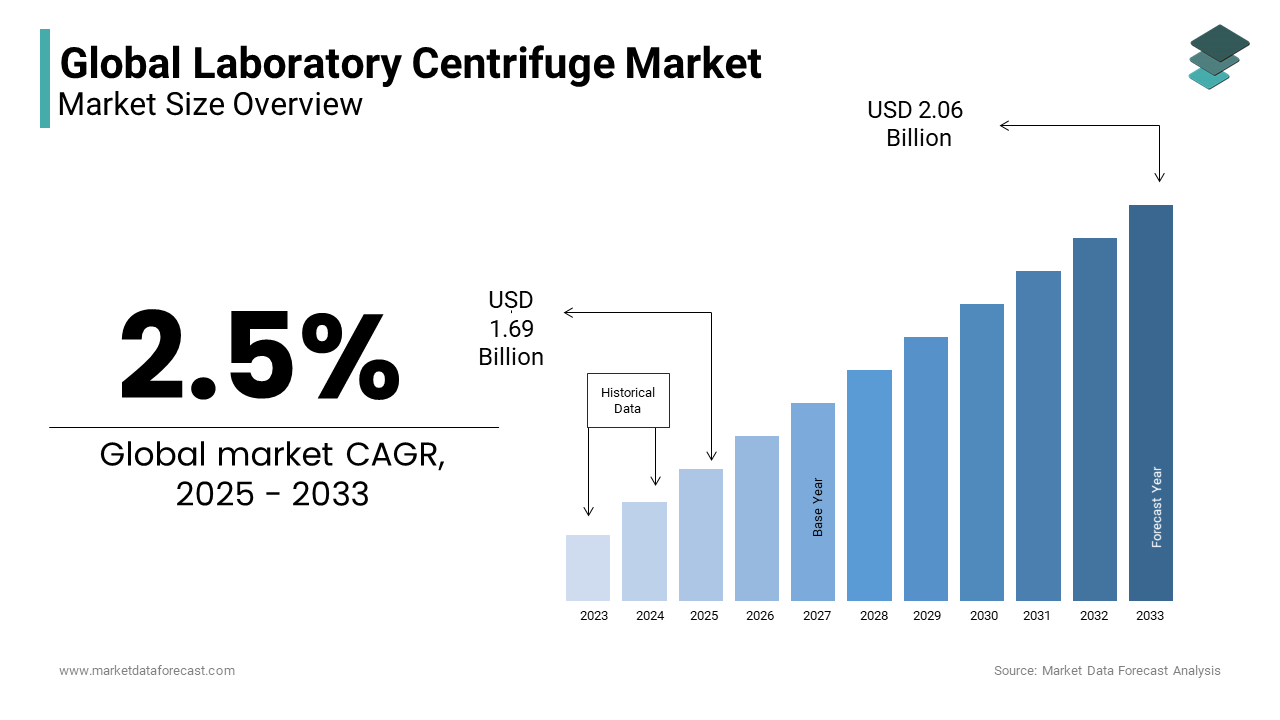

In 2024, the global laboratory centrifuge market was valued at USD 1.65 Billion and it is expected to reach USD 2.06 Billion by 2033 from USD 1.69 Billion in 2025, growing at a CAGR of 2.5% during the forecast period.

A laboratory centrifuge is equipment used to separate different materials from the liquid medium according to their density, shape, size, and viscosity from the liquid medium in which they are dissolved. Centrifugation equipment works on the centrifugation principle, in which the densest material is deposited at the bottom of a centrifuge tube. The centrifuge is used in various applications, such as separating cellular elements like red blood cells and white blood cells from a blood sample, in the hematology laboratory for determining the volume of concentrated cells (mainly for the purpose of diagnostic), removal of cellular components microscopic study (research objective), removal of precipitated proteins from the analytical sample, isolation of macromolecules such as DNA, RNA, and lipids from the cell, and separation of the solid or semi-solid precipitant of the analytical sample or two fluids immiscible with each other in suspension (aim of the investigation).

MARKET DRIVERS

An increase in the number of advancements in centrifugation devices is propelling the growth of the global laboratory centrifuge market.

The increasing advancements in centrifugation devices for wide application in diagnostics, clinical, veterinary, and analytical laboratories, such as increasing instrument capacity and integrated refrigeration compressors without increasing instrument size, are expected to drive the global laboratory centrifuge market growth. Besides, recent advancements in benchtop centrifuge systems, such as the touch screen feature for ease of use and the rapid response system eliminate user errors and streamline tasks. In turn, it is attributed to a smooth workflow in laboratories using centrifugal equipment. It is expected to drive the growth of the global Laboratory Centrifuge market in the near future.

The increasing demand for reliable and durable multi-function laboratory centrifugation equipment to perform a variety of laboratory work, as mentioned above, is driving the growth of the laboratory centrifugation equipment market. According to the World Health Organization (WHO) fact sheet, in 2018, 71% of deaths worldwide were due to non-communicable diseases (NCDs) such as cardiovascular disease, cancer, and diabetes, leading pharmaceutical companies to invest more in research and development of cost-effective therapies, which ultimately increases the demand for essential laboratory equipment, such as centrifuges. According to statistics from the World Economic Forum 2015, pharmaceutical companies invest mainly in research and development.

MARKET RESTRAINTS

The high cost of the centrifuge device, which is complex in its design, restrains the global laboratory centrifuge market.

The lengthy process of product usage and strict regulations for the approvals of new products and maintenance of the devices is likely to hamper the market growth. This centrifugation releases some dangerous samples, which may result in disclosure to chemical, biological, and radioactive agents, which have the capacity to affect personnel or operators' health, which hinders the market. The lifespan of the equipment is so high as it decreases the centrifuges sales obstruct the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

2.5% |

|

Segments Covered |

By Product, Rotor design, Intended Use, Application, End User, Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leader Profiled |

Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific |

SEGMENTAL ANALYSIS

By Product Insights

The equipment segment is estimated to register notable growth during the forecast period based on product analysis. The growing need for high throughput assays ahead with enhancements in molecular biology drives the segment's growth.

By Rotor Design Insights

The swing-out bucket rotors segment is likely to witness the highest growth rate as an increasing number of healthcare amenities, particularly for lab centrifuges, and growth in life sciences augments the market growth.

By Intended Use Insights

The clinical centrifuges are projected to have the highest CAGR. This procedure is seen in most laboratory studies to clinical research and is also used to filter the cells, virus, proteins, and nucleic acids.

By Application Insights

The proteomics segment is observed to have potential growth in the market during the historical period. This procedure is easy to adapt according to the growing requirements, increasing R&D activities in the segment.

By End User Insights

The hospital segment accounted for dominating the market and retains to lead the market over the forecast period. The growing incidence rate of diseases, increasing awareness about early-stage diagnosis and treatment, growing requirement for blood, and obtainment for advanced technologies and new centrifuges for separation of blood are likely to propel the market growth of this segment globally.

REGIONAL ANALYSIS

North America is dominating the market with important growth in the laboratory centrifuge throughout the analysis period. Growing research and development activities towards the healthcare sector and the huge requirement for advanced devices for centrifuge in the region. U.S and Canada are the major contributors to the region.

Europe is projected to stand as the second-largest share in the market, followed by North America in terms of revenue. The rise in the number of infectious diseases has increased consciousness among people regarding the initial diagnosis of the diseases. The UK is leading the market in this region.

The Asia-Pacific market is anticipated to have the highest growth in the forthcoming years in the market. Research and development of new products can be utilized for clinical trials and favorable government proposals to develop healthcare infrastructure. Japan is leading the market, whereas China is predicted to witness a mounting growth rate during the period.

Latin America is anticipated to have stable market growth in the upcoming years during the period. Growing improvements in the biotechnology and pharmaceutical industries of this region. The rising need to develop effective solutions to prevent the growing frequency of chronic diseases worldwide escalates the laboratory centrifuge market throughout the assessment period.

The market in Middle East & Africa is anticipated to have a slow growth rate during the assessment period. South Africa is leading the market in having profitable outcomes. Improving healthcare infrastructure incorporated with growing expenses in healthcare, rising consciousness relevant to an initial diagnosis of the diseases, and growing occurrence rate of the different diseases like HIV, boost the market.

KEY MARKET PLAYERS

Some of the noteworthy companies dominating the global laboratory centrifuge market profiled in this report are Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., INC., Sigma Laborzentrifugen GmbH, Negation, Hitachi Koki Co., Ltd., and Harvard Bioscience, Inc.

MARKET SEGMENTATION

This market research report on the global laboratory centrifuge market has been segmented and sub-segmented based on the product, rotor design, intended use, application, end-user, and region.

By Product

- Equipment

- Microcentrifuge

- Ultracentrifuge

- Accessories

By Rotor Design

- Swinging Bucket Rotors

- Fixed Angle Rotors

- Vertical Rotors

By Intended Use

- General-purpose Centrifuges

- Clinical Centrifuges

- Preclinical Centrifuges

- Preparative Ultracentrifuges

By Application

- Diagnostic

- Microbiology

- Proteomics

- Genomics

By End User

- Hospital

- Biotech

- Pharmaceutical

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

- Rest of EU

- Asia Pacific

- India

- China

- Japan

- Australia

- New Zealand

- South Korea

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

- The Middle East and Africa

Frequently Asked Questions

At What CAGR, the global laboratory centrifuge market is expected to grow from 2024 to 2033?

The global laboratory centrifuge market is estimated to grow at a CAGR of 2.5% from 2024 to 2033.

What is the projected market value of laboratory centrifuge market by 2033?

As per our research report, the global laboratory centrifuge market size is projected to be USD 2.06 billion by 2033.

Which are the significant players operating in the laboratory centrifuge market?

Becton, Dickinson and Company, Danaher Corporation, Thermo Fisher Scientific, Inc., QIAGEN, Bio-Rad Laboratories, Inc., Agilent Technologies, Inc., INC., Sigma Laborzentrifugen GmbH are some of the significant players operating in laboratory centrifuge market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]