Global Laboratory Informatics Market Size, Share, Trends & Growth Forecast Report By Product, Component, Deployment, End-user and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Laboratory Informatics Market Size

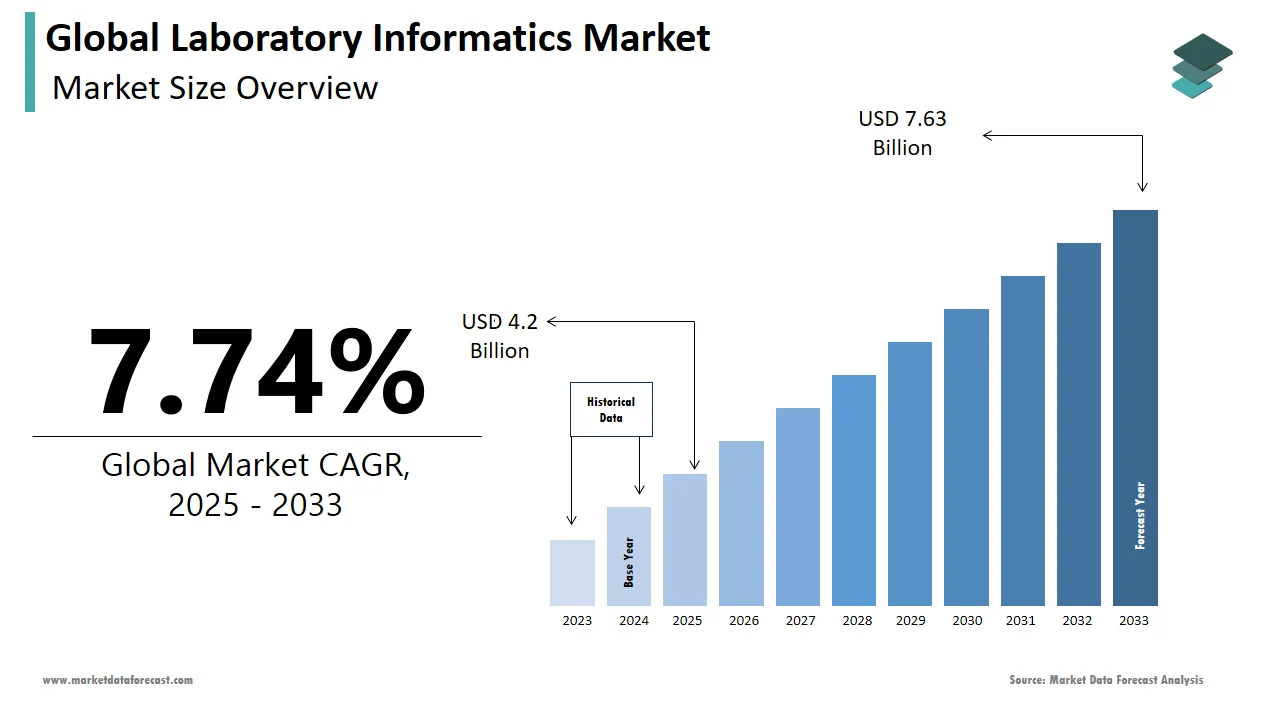

The size of the global laboratory informatics market was worth USD 3.9 billion in 2024. The global market is anticipated to grow at a CAGR of 7.74% from 2025 to 2033 and be worth USD 7.63 billion by 2033 from USD 4.2 billion in 2025.

MARKET DRIVERS

Technical advancements and Increasing errors in laboratory procedures are majorly accelerating the growth of the laboratory informatics market.

The adoption of various advanced technologies, such as artificial intelligence (Al), augmented reality, and virtual reality, is growing rapidly. These advanced technologies for better monitoring systems and more efficient and convenient scanning equipment allow patients to spend less time in hospitals. Laboratory automation is an essential approach to minimizing manual interference in laboratory processes. Automation is also an advanced technology that improves productivity and allows researchers to focus on core work, thereby reducing error rates and enhancing the accuracy of results. Automation in surgeries has resulted from using technology in medical equipment and telehealth since, in some cases, doctors do not even need to be in the operating room with a patient when the procedure is performed. Automation provides high-quality data and makes efficient and precise documentation. Stringent regulations are imposed on the automation of laboratory procedures to ensure optimum efficiency with error-free results, further driving laboratory informatics market growth. The growing use of digital workstations, automated analyzers, and total laboratory automation (TLA) makes it easy to transfer tasks among laboratory workers and improve productivity. The demand for efficient ways to process, evaluate, and communicate data is rising because laboratory systems are generating more data, further propelling the market's expansion.

The increasing need for laboratory automation, the growing need for patient engagement solutions, and the growing accessibility of cost-effective informatics solutions are further anticipated to fuel the growth rate of the global laboratory automation market. Rising technological advancements in molecular genomics and genetic testing practices, an increasing amount of data generated by laboratories, growing popularity in biobanks, academic research institutes, increasing adoption of biorepositories and biobanks and many research institutes, the growing demand in biobanks, and increasing R&D expenditure in pharmaceutical and biotechnology industries are expected to provide favorable support to the growth rate of the market. In addition, the growing demand for supervisory authorities to implement lab automation systems and the increasing adoption of process automation and robotics in healthcare helps render operations repeatable and reproducible. These are among the significant opportunities in the global laboratory informatics market.

MARKET RESTRAINTS

The high maintenance and service costs of laboratory informatics solutions are factors restraining the growth of the laboratory informatics market. In addition, the shortage of skilled professionals and lack of standards for integrating laboratory informatics solutions challenge the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Product, Component, Deployment, End-user & Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Market Players |

Thermo Fisher Scientific, Inc., Core Informatics, LabWare, PerkinElmer, Inc., LabVantage Solutions, Inc., LabLynx, Inc., Agilent Technologies, ID Business Solutions Ltd., and McKesson Corporation. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the laboratory information management systems (LIMS) segment had the most significant global laboratory informatics market share in 2024. These systems are used in master data management, stability study, system, and security administration, reporting of sample lifecycle, schedules, inventory, instruments, storage capacity and logistics, and analytical workflow. An increase in demand for fully integrated services in the life sciences and research industries to reduce data management errors and improve the qualitative analysis of research information drives the segment growth during the forecast period.

By Component Insights

Based on the component, the services segment led the laboratory informatics market worldwide in 2024, owing to the rise in the outsourcing of LIMS systems. In addition, large pharmaceutical companies are estimated to grow their demand for outsourcing these services as Contract Research Organizations (CROs) emerge with resources to conduct and a qualified workforce.

By Deployment Insights

Based on the deployment, the cloud-based segment is predicted to play a leading role among all during the forecast period. This technology helps store large amounts of data to allow free space on devices, making data retrieval easy for clients. IBM offers Watson Analytics services on the SaaS platform. Other advantages of cloud-based systems include real-time data tracking, remote access to data, and an easy ecosystem.

By End-User Insights

Based on the end-user, the pharmaceutical segment accounted for a significant market share in 2024. Pharma companies are managing large amounts of data to store important information. To provide data scientists and marketing experts with online access to clinical, pharma, and real-world data, Astellas stored 50 TB of data in the cloud. Pharmaceutical companies can boost demand market revenue through the application of informatics.

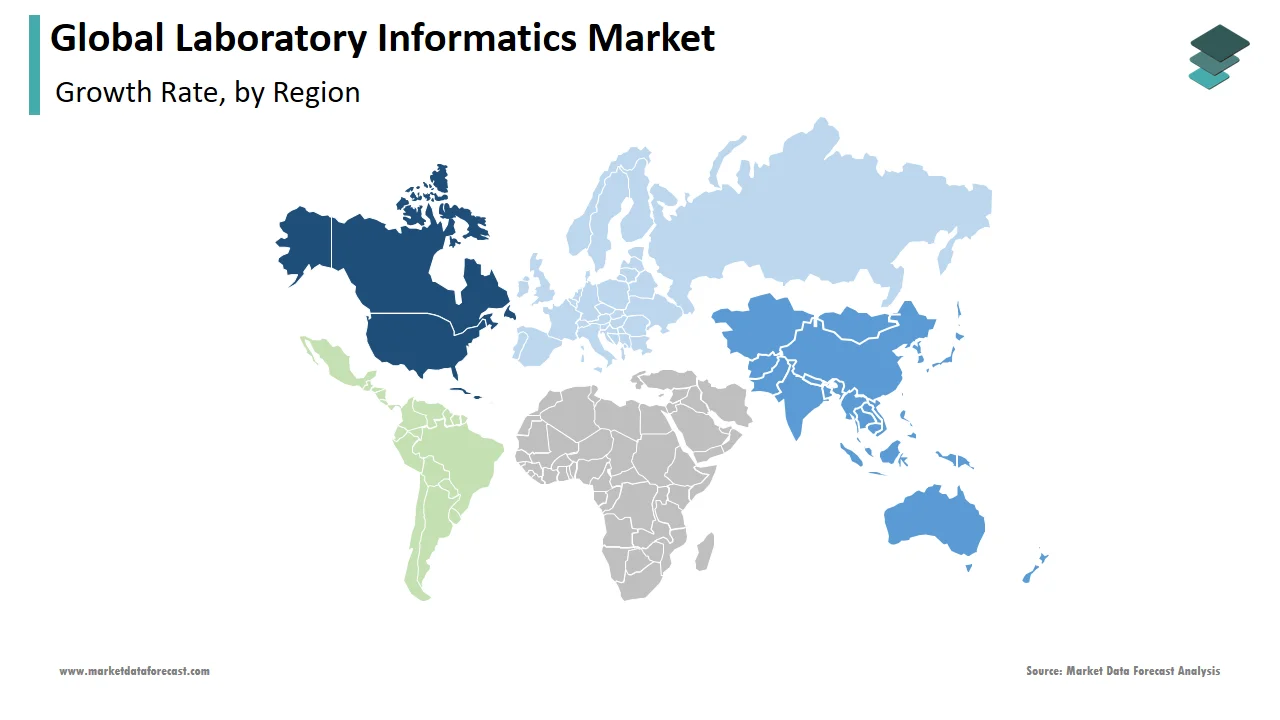

REGIONAL ANALYSIS

Geographically, the North American region led the market for laboratory informatics worldwide in 2024. The domination of this region in the world market is anticipated to be continuing throughout the forecast period owing to the strong economies of the US and Canada, which have allowed for significant investments in new technologies, growth in biobanks, easy availability of lab informatics products, and services, and stringent rules across industries. Other factors include policies supporting the deployment of laboratory information systems and the availability of infrastructure with high digital literacy, the presence of well-established pharma companies, and the growing requirement to contain operational costs incurred in information management and analysis. The U.S. dominates the market due to the demand for quality diagnosis and check-ups across this region, the growth of IT companies in the region, the deployment of laboratory setups for providing cost-effective solutions, and technological innovations.

Asia Pacific is expected to witness lucrative growth in the coming years due to the increasing number of CROs offering LIMS solutions. Developing nations like China and India are dominating areas. The main factors driving the market forward are the high frequency of infectious and cardiovascular disorders and providing the necessary infrastructure for carrying out clinical trials.

In the European region, Germany comprised the largest share. This is due to factors such as an increasing number of researchers, increased public & private R&D spending, advanced laboratory infrastructure, easy availability of laboratory informatics products, growing demand for integration of laboratory systems, growing digitalization, and rising government funding for research activities and services.

KEY MARKET PLAYERS

Companies playing a significant role in the global laboratory informatics market are Thermo Fisher Scientific, Inc., Core Informatics, LabWare, PerkinElmer, Inc., LabVantage Solutions, Inc., LabLynx, Inc., Agilent Technologies, ID Business Solutions Ltd., and McKesson Corporation.

RECENT MARKET DEVELOPMENTS

- In 2020, LabVantage Solutions, Inc., the leading laboratory informatics solutions and services provider, released the 8.5 edition of its industry leading LabVantage platform, offering a fully integrated Scientific Data Management System.

- In 2021, CTI Clinical Trial and Consulting Services (CTI) announced a partnership with LabWare, Inc. CTI is working to provide laboratory services to allow research on rare diseases and cell and gene therapies worldwide.

MARKET SEGMENTATION

This research report on the global laboratory informatics market has been segmented and sub-segmented into the product, component, deployment, end-user, and region.

By Product

- Laboratory Information Management System (LIMS)

- Electronic Lab Notebook (ELN)

- Scientific Data Management System (SDMS)

- Chromatography Data System (CDS)

- Laboratory Execution System (LES)

By Component

- Services

- Software

By Deployment

- On-premises

- Cloud-based

- Remotely Hosted

By End-User

- Biotech companies

- Pharmaceuticals

- Clinical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What was the size of the laboratory informatics market worldwide in 2024?

The APAC region is anticipated to showcase the fastest CAGR among all the regions in the global market.

Which region is growing the fastest in the global laboratory informatics market?

The European laboratory informatics market is expected to witness a CAGR of 6.91% from 2025 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]