Global Labels Market Size, Share, Trends, & Growth Forecast Report Segmented By Material (Plastic, Paper, Foil), Product Type, Printing Technology, Ink Type, End-Use, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Labels Market Size

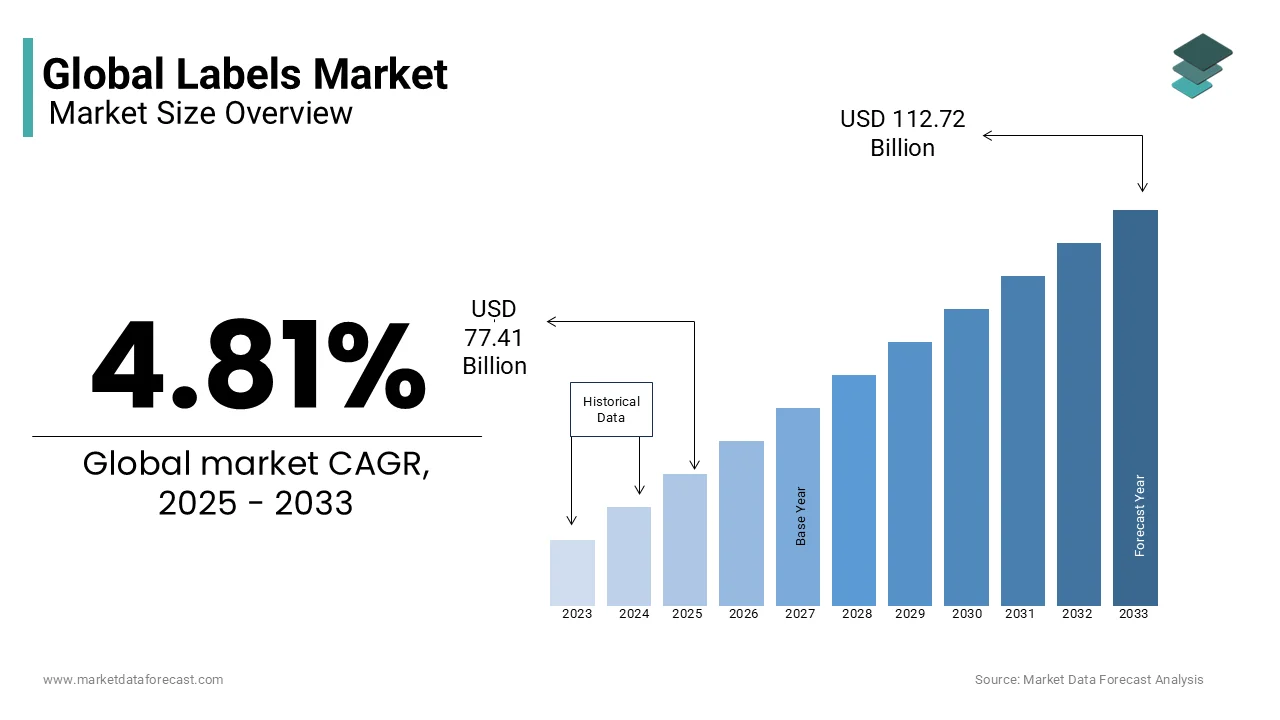

The global Labels market size was valued at USD 73.86 billion in 2024 and is expected to reach USD 112.72 billion by 2033 from USD 77.41 billion in 2025. The market is projected to grow at a CAGR of 4.81%.

Labels are the cornerstone of modern product communication and branding is serving as an essential medium for conveying critical information across industries such as food and beverage, pharmaceuticals, logistics, and consumer goods. These are not merely functional tools for identification but have evolved into sophisticated instruments for storytelling, regulatory compliance, and enhancing user experience. A report by the World Packaging Organization highlights that over 50% of consumers globally make purchasing decisions based on packaging and labeling aesthetics, underscoring the psychological and emotional impact labels have on buyer behavior.

In addition to their commercial importance, labels play a vital role in global health and safety initiatives. For instance, the World Health Organization emphasizes that accurate labeling of pharmaceutical products has reduced medication errors by up to 30% in certain regions, demonstrating the societal value of precise and informative labeling systems. Furthermore, the rise of eco-conscious consumerism has led to a significant shift toward sustainable labeling solutions. According to a study published by the Ellen MacArthur Foundation, nearly 70% of consumers in Europe and North America actively seek out products with environmentally friendly packaging, including recyclable or compostable labels. These statistics reflect the broader implications of the Labels Market beyond commerce, influencing public health, environmental sustainability, and consumer trust on a global scale.

MARKET DRIVERS

Increasing Demand for Sustainable Labeling Solutions

The growing emphasis on environmental sustainability is a significant driver of the Labels Market. Governments and organizations worldwide are advocating for eco-friendly packaging solutions to combat plastic pollution. The United Nations Environment Programme (UNEP) reports that over 13 million tons of plastic waste enter oceans annually, prompting stricter regulations on single-use plastics. This has led to a surge in demand for biodegradable and recyclable labels, with the European Union mandating that 55% of all plastic packaging must be recycled by 2030. As brands strive to meet consumer expectations, the adoption of sustainable labels is projected to grow significantly. These efforts not only align with global sustainability goals but also enhance brand reputation, making eco-friendly labeling a pivotal market driver.

Expansion of E-commerce and Logistics Sectors

The rapid growth of e-commerce has propelled the demand for efficient labeling systems in logistics and supply chain management. According to the U.S. Census Bureau, e-commerce sales accounted for 14.3% of total retail sales in 2022 which is reflecting a steady annual increase of 15%. This surge necessitates advanced labeling solutions for accurate tracking, inventory management, and delivery optimization. The International Trade Administration notes that mislabeled shipments result in losses exceeding $1 billion annually, underscoring the critical role of precise labeling in reducing operational inefficiencies. Additionally, the rise of same-day and next-day delivery services has increased the need for durable, tamper-proof labels that withstand varying environmental conditions. The demand for high-performance labels in logistics is expected to rise further as global trade expands which is driving innovation and market growth in this segment.

MARKET RESTRAINTS

Rising Costs of Raw Materials

One of the major restraints in the Labels Market is the escalating cost of raw materials such as paper, adhesives, and polymers. The U.S. Bureau of Labor Statistics reports that the Producer Price Index (PPI) for paper products increased by 12% in 2022 due to supply chain disruptions and rising energy costs. These price fluctuations directly impact label manufacturers, who face challenges in maintaining profit margins while meeting customer demands for affordable solutions. Moreover, the volatility of raw material costs complicates long-term pricing strategies and thereby leading to uncertainty in the market. Affordability becomes a barrier, particularly for small and medium-sized enterprises reliant on cost-effective labeling options because manufacturers absorb these costs or pass them onto consumers.

Stringent Regulatory Compliance Requirements

Another significant restraint is the increasing complexity of regulatory compliance across regions. The Food and Drug Administration (FDA) mandates that food and pharmaceutical labels include detailed nutritional information, allergen warnings, and traceability data which often requires specialized printing technologies. In the fiscal year 2022 (October 2021 to September 2022), the U.S. Food and Drug Administration (FDA) issued a total of 42 Warning Letters to medicinal product manufacturers, each detailing specific Good Manufacturing Practice (GMP) deficiencies. Additionally, the European Chemicals Agency enforces REACH regulations which restrict the use of hazardous substances in label adhesives and inks. These stringent requirements create operational challenges for manufacturers, especially smaller players with limited resources to invest in compliance infrastructure. Furthermore, differing regulations across countries complicate global supply chains, increasing administrative burdens and production costs. Maintaining compliance remains a persistent challenge for the Labels Market with the evolution of regulatory frameworks.

MARKET OPPORTUNITIES

Growing Adoption of Smart Label Technologies

A significant opportunity in the Labels Market lies in the integration of smart technologies such as RFID tags, NFC chips, and QR codes. These technologies enable real-time tracking, authentication, and enhanced consumer engagement through interactive features. For example, the U.S. Department of Commerce reports that brands using QR codes on labels experienced a 30% increase in customer interaction rates in 2022. Additionally, the global push toward Industry 4.0 and IoT-driven solutions has accelerated the adoption of smart labels in sectors like healthcare and logistics.

Increasing Focus on Personalization and Brand Differentiation

Personalized labeling offers another promising opportunity for the Labels Market, driven by consumer demand for unique and tailored experiences. The U.S. Small Business Administration notes that personalized packaging increases customer loyalty by 25% because it fosters a deeper emotional connection between brands and consumers. Advances in digital printing technologies have made customization more accessible, allowing businesses to produce small batches of bespoke labels cost-effectively. Furthermore, Nielsen reports that 72% of consumers in North America and Europe are willing to pay a premium for personalized products which is highlighting the commercial viability of this trend. Personalized labels provide a strategic advantage due to brands seeking innovative ways to differentiate themselves in competitive markets. This trend is particularly prominent in industries like cosmetics and beverages, where aesthetic appeal and exclusivity drive purchasing decisions and thereby creating a fertile ground for market growth.

MARKET CHALLENGES

Environmental Concerns and Consumer Backlash

A significant challenge facing the Labels Market is the growing consumer backlash against non-recyclable and environmentally harmful labels. The Environmental Protection Agency (EPA) states that only 14% of plastic packaging, including labels, is recycled in the United States, leading to public criticism of brands perceived as unsustainable. Consumer advocacy groups, supported by organizations like Greenpeace, have launched campaigns urging companies to adopt greener alternatives, pressuring businesses to overhaul their labeling practices. Failure to address these concerns risks damaging brand reputation and losing market share. Additionally, the World Economic Forum reports that 60% of consumers globally prioritize sustainability when making purchasing decisions, further amplifying the challenge. As environmental awareness intensifies, companies must navigate the delicate balance between cost-efficiency and eco-friendliness which is requiring significant investments in research and development to meet evolving consumer expectations.

Technological Integration Challenges

The integration of advanced technologies into labeling systems poses another major challenge for the Labels Market. While innovations like RFID and NFC offer immense potential, their implementation requires substantial investment in infrastructure and expertise. A 2023 report by the National Skills Coalition found that 92% of jobs require digital skills, yet one-third of workers lack foundational digital skills, indicating a substantial divide in the labor market. Furthermore, cybersecurity concerns associated with smart labels have emerged as a critical issue. The Cybersecurity and Infrastructure Security Agency (CISA) warns that interconnected devices, including smart labels, are vulnerable to hacking, potentially compromising sensitive supply chain data. These technological barriers hinder widespread adoption, particularly among smaller players with limited resources. As the industry moves toward digitization, addressing these challenges will be crucial to ensuring seamless integration and maximizing the benefits of technological advancements in the Labels Market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.81% |

|

Segments Covered |

By Material, Product Type, Printing Technology, Ink Type, End-Use, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fuji Seal International, Inc., 3M Company, Multi-Color Corporation, AVERY DENNISON CORPORATION, CCL Industries, UPM Global, Toray Plastics (America), Inc., Huhtamäki Oyj, Amcor plc, Klöckner Pentaplast, and others |

SEGMENTAL ANALYSIS

By Material Insights

The polyethylene (PE) segment led the market by capturing 35.3% of the global market share in 2024. The versatility, durability, and cost-effectiveness polyethylene are making it ideal for applications in food, beverages, and pharmaceuticals. The EPA also notes that plastic packaging, including labels, accounts for nearly 40% of all packaging materials globally. Additionally, PE's resistance to moisture and chemicals enhances its suitability for diverse environments. Its widespread adoption underscores its importance in meeting the growing demand for functional and efficient labeling solutions.

The recycled paper segment is growing exponentially and is predicted to be the fastest-growing segment global market by registering a CAGR of 7.8% over the forecast period. The growth of the recycled paper segment is fueled by increasing consumer awareness about sustainability and stringent regulations promoting eco-friendly packaging. UNEP highlights that the global recycling rate for paper reached 58% in 2022 , driving demand for recycled paper labels. Furthermore, the European Union’s Circular Economy Action Plan mandates that 65% of all packaging waste must be recycled by 2030, further boosting this segment. Recycled paper labels are gaining traction due to their reduced environmental impact and alignment with corporate sustainability goals, making them a critical focus for future growth.

By Product Type Insights

The pressure sensitive labels segment dominated the market by holding 57.7% of the global market share in 2024 owing to their ease of application, versatility, and compatibility with various surfaces, including plastic, glass, and metal. The U.S. Department of Commerce reports that pressure sensitive labels are widely used in industries like food, beverages, and logistics, where quick and efficient labeling is essential. Additionally, advancements in adhesive technologies have enhanced their performance, making them indispensable for modern supply chains. Their widespread adoption underscores their role as a cornerstone of the Labels Market.

The shrink labels segment is rapidly growing and is anticipated to showcase a CAGR of 8.2% during the forecast period due to their ability to provide full-surface branding and tamper-evident packaging which is increasingly demanded by consumers. NIST highlights that shrink labels are particularly popular in the beverage industry, where they account for 30% of labeling solutions for bottled products. Additionally, innovations in heat-shrink technology have improved their recyclability, aligning with sustainability trends. As brands seek innovative ways to differentiate their products, shrink labels offer a unique combination of functionality and aesthetic appeal, positioning them for rapid expansion.

By Printing Technology Insights

The flexographic printing segment commanded for 44.7% of the global market share in 2024 and emerged as the most promising segment. The domination of the flexographic printing segment is primarily attributed to its high-speed production capabilities, cost efficiency, and suitability for large-scale operations. The EPA notes that flexographic printing is widely used in industries like food and beverages, where it accounts for 60% of all printed labels . Additionally, advancements in water-based inks have enhanced its environmental credentials, making it a preferred choice for sustainable labeling. Its widespread adoption underscores its critical role in meeting the demands of mass production while maintaining quality and affordability.

The digital printing is segment is predicted to register a prominent CAGR of 10.5% over the forecast period due to the increasing demand for customization and shorter production runs, particularly in the cosmetics and pharmaceutical sectors. The U.S. Small Business Administration highlights that digital printing allows for cost-effective personalization, enabling brands to create unique designs for niche markets. Additionally, the rise of e-commerce has increased the need for variable data printing, such as QR codes and serialization, further boosting demand. As businesses embrace digital transformation, digital printing offers unparalleled flexibility and innovation and is making it a key driver of future growth.

By Ink Type Insights

The water-based inks segment accounted for the dominating share of 39.5% in the global market in 2024. Their dominance is driven by their eco-friendly properties, low volatile organic compound (VOC) emissions, and compliance with stringent environmental regulations. The EPA reports that water-based inks are widely used in food and beverage labeling, where safety and sustainability are paramount. Additionally, advancements in ink formulations have improved their adhesion and durability, making them suitable for diverse applications. Their widespread adoption underscores their importance in aligning with global sustainability goals.

The UV-based inks segment is growing at a brisk pace and is estimated to grow at a CAGR of 9.3% during the forecast period owing to their rapid curing times, vibrant color output, and resistance to abrasion and fading. NIST highlights that UV-based inks are particularly popular in the pharmaceutical and cosmetics industries, where they account for 25% of all ink usage . Additionally, their compatibility with digital printing technologies has expanded their applications in personalized and high-quality labeling. As brands prioritize aesthetics and durability, UV-based inks offer a compelling solution, positioning them for significant growth.

By End Use Insights

The food segment dominated the market by accounting for 30.3% of the global market share in 2024 due to the stringent labeling regulations, such as nutritional information and allergen warnings, which are mandatory for packaged foods. The FDA notes that the global food packaging market, including labels, is valued at over $300 billion reflecting its critical role in ensuring consumer safety and compliance. Additionally, the rise of e-commerce has increased demand for durable and tamper-evident labels, further boosting this segment. Its widespread adoption underscores its importance in meeting regulatory and consumer needs.

The pharmaceuticals segment is projected to grow at a CAGR of 8.7% during the forecast period due to the increasing demand for traceability and anti-counterfeiting measures, particularly in developing regions. WHO reports that counterfeit drugs account for 10% of the global pharmaceutical market , highlighting the need for advanced labeling solutions like RFID and tamper-evident seals. Additionally, the rise of personalized medicine has increased demand for variable data printing, further boosting growth. As the industry prioritizes safety and innovation, pharmaceutical labeling presents significant opportunities for expansion.

REGIONAL ANALYSIS

The Asia-Pacific region is home to some of the world's largest manufacturing hubs including China and India which collectively account for over 40% of global manufacturing output. This extensive industrial base supports the region's leadership in the Labels Market, as it supplies a significant portion of the world’s packaged goods, driven by high demand in sectors such as food, beverages, and consumer electronics.

The Middle East and Africa region is the emerging segment with a projected CAGR of 7.2%. This growth is fueled by increasing investments in infrastructure, retail modernization, and the expansion of pharmaceutical and FMCG industries. The United Nations Economic Commission for Africa highlights that Africa's retail sector is experiencing rapid growth, driven by urbanization, a rising middle class, and increased consumer spending. By 2030, the continent's consumer business is predicted to grow significantly with household consumption expected to reach $2.5 trillion, according to the African Development Bank. This growth is fueled by expanding retail networks and e-commerce platforms, particularly in countries like Nigeria, Kenya, and South Africa, making the region a key driver of demand for labeling solutions in packaged goods.

North America holds a significant share of the Labels Market, driven by advanced technological adoption and stringent regulatory frameworks. The region’s focus on sustainability and digital transformation ensures its steady growth, although its mature market limits rapid expansion compared to emerging regions. For instance, Nestlé Waters reduced their bottle label sizes by 35% across North American operations, resulting in annual savings of approximately 30,000 metric tons of plastic and 4,500 tons of paper.

Europe is a key player in the Labels Market, characterized by strict environmental policies and high consumer awareness. The European Union’s Circular Economy Action Plan mandates that 55% of all plastic packaging, including labels, must be recycled by 2030, driving demand for eco-friendly solutions. According to the European Environment Agency, the region recycles nearly 42% of its plastic waste, the highest globally, underscoring its commitment to sustainability. Additionally, the rise of premium products in sectors like wine, spirits, and cosmetics has increased demand for high-quality, aesthetically pleasing labels. Europe’s emphasis on innovation and compliance ensures its continued relevance in the global market.

Latin America is poised for steady growth in the Labels Market, supported by rising consumer awareness and industrial development. The region’s growing middle class, which expanded by 50% between 2000 and 2020 , according to the World Bank, has significantly increased demand for packaged goods, including food, beverages, and personal care products. Additionally, the International Labour Organization (ILO) notes that manufacturing employment in Latin America grew by 12% over the past decade , reflecting industrial modernization efforts. These factors highlight the region’s potential despite challenges like economic volatility.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Fuji Seal International, Inc., 3M Company, Multi-Color Corporation, AVERY DENNISON CORPORATION, CCL Industries, UPM Global, Toray Plastics (America), Inc., Huhtamäki Oyj, Amcor plc, Klöckner Pentaplast are playing a dominating role in the global labels market

The global labels market is highly competitive, driven by technological advancements, sustainability trends, and regulatory requirements across industries such as food & beverage, pharmaceuticals, retail, and logistics. Major players, including CCL Industries, Avery Dennison, and Multi-Color Corporation (MCC), dominate the market with their extensive product portfolios, strong manufacturing capabilities, and global distribution networks.

Competition in the market is shaped by innovation in smart labeling technologies like RFID, NFC, and barcode systems, which enhance product tracking, authentication, and supply chain efficiency. Companies invest heavily in research and development (R&D) to create high-performance and cost-effective labeling solutions that cater to evolving consumer and industry demands.

Sustainability has also become a major competitive factor, with manufacturers developing eco-friendly labels using recyclable materials and water-based adhesives to align with environmental regulations and consumer preferences. Players that offer sustainable and biodegradable labeling options gain a competitive edge, especially in markets with strict environmental policies.

Additionally, regional and niche players create further competition by focusing on customized labeling, digital printing, and localized production. As the market matures in North America and Europe, companies are expanding into Asia-Pacific, Latin America, and Africa, where demand for labels continues to rise due to industrial growth and increasing consumer goods packaging needs.

STRATEGIES USED BY THE MARKET PLAYERS

Strategic Acquisitions and Expansions

To strengthen their market dominance, major label companies acquire smaller players to expand their product offerings and global reach. CCL Industries has made multiple acquisitions, including Avery and Checkpoint Systems, to diversify its labeling solutions and enhance RFID technology offerings. Avery Dennison also focuses on mergers and acquisitions (M&A) to expand its portfolio, acquiring companies that specialize in digital printing and adhesive labeling technologies. MCC, on the other hand, has expanded its presence in key global markets by acquiring smaller regional label producers, allowing it to serve local brands and international corporations more effectively.

Adoption of Smart Labeling Technologies

The rise of smart labeling has led major companies to invest in RFID (Radio Frequency Identification) and NFC (Near Field Communication) technology to improve product tracking and authentication. Avery Dennison has positioned itself as a leader in RFID-enabled labels, helping retailers improve supply chain efficiency and reduce losses. CCL Industries has also incorporated RFID and barcode technology into its labels, ensuring better inventory management and anti-counterfeiting measures.

Sustainability and Eco-Friendly Labeling

As sustainability becomes a global priority, leading label manufacturers are developing recyclable and biodegradable labeling materials. Avery Dennison has introduced eco-friendly adhesive solutions that enable easier recycling of labels and packaging. CCL Industries focuses on reducing plastic waste by promoting shrink sleeve labels made from recyclable materials. MCC also invests in water-based printing technologies, which reduce harmful emissions and waste. These initiatives align with government regulations and growing consumer demand for environmentally responsible products.

TOP 3 PLAYERS IN THE MARKET

CCL Industries Inc.

CCL Industries is one of the world's largest label manufacturers, based in Canada. The company operates nearly 200 manufacturing facilities worldwide, serving industries such as consumer goods, healthcare, electronics, and automotive. CCL specializes in pressure-sensitive labels, RFID labels, and shrink sleeves, which help brands improve product identification and security. Through key acquisitions like Avery and Checkpoint Systems, CCL has expanded its capabilities, reinforcing its leadership in the global labels market.

Avery Dennison Corporation

Avery Dennison, headquartered in the United States, is a major player in labeling and packaging materials. The company is known for pressure-sensitive labels, RFID inlays, and sustainable packaging solutions. Avery Dennison is also a leader in developing eco-friendly labels, helping companies reduce waste and improve recyclability. The company’s labels are widely used in retail, food & beverage, automotive, and pharmaceuticals, improving product tracking, branding, and regulatory compliance.

Multi-Color Corporation (MCC)

Multi-Color Corporation (MCC) is one of the oldest and largest label producers, specializing in shrink sleeves, pressure-sensitive labels, and in-mold labels. The company caters to industries such as wine & spirits, food & beverage, and personal care. MCC’s expertise in high-quality printing and decorative labels helps brands enhance their visual appeal and differentiate themselves in the market. With a strong global presence, MCC continues to support businesses by providing customized labeling solutions.

RECENT HAPPENINGS IN THE MARKET

- In January 2024, Resource Label Group, backed by Ares Management, acquired Majestic Labels, the digital label printing division of Majestic Printing Systems. This acquisition enhances Resource Label Group’s digital printing capabilities and broadens its market reach.

MARKET SEGMENTATION

This research report on the global labels market has been segmented and sub-segmented based on material, product type, printing technology, ink type, end-use, and region.

By Material

- Plastic

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others (PA, EVOH, Etc.)

- Paper

- Kraft Paper

- Recycled Paper

- Foil

By Product Type

- Pressure Sensitive Labels

- Shrink Labels

- Stretch Labels

- Wet Glue Labels

- Others (In-Mold, Pre-Gummed, Etc.)

By Printing Technology

- Flexographic Printing

- Digital Printing

- Gravure Printing

- Offset Printing

- Letterpress Printing

By Ink type

- Solvent Based

- Water Based

- UV Based

- Others (Latex Based, Etc.)

By End-Use

- Food

- Bakery and Confectionery

- Dairy Products

- Baby Food

- Chilled Or Frozen Foods

- Others (Snacks, Etc.).

- Beverages

- Alcoholic

- Non-Alcoholic.

- Pharmaceutical

- Tablet/Capsules

- Cream & Ointment

- Liquid Syrup

- Others.

- Cosmetics & Personal Care,

- Homecare & Toiletries

- Chemicals

- Automobiles

- Other Industrial

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the global labels market from 2025 to 2033?

The global labels market is expected to grow from USD 77.41 billion in 2025 to USD 112.72 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.81%.

2. Which factors are driving the demand for sustainable labeling solutions?

Increasing environmental concerns and stringent regulations are pushing brands to adopt eco-friendly labels. For instance, the European Union mandates that 55% of all plastic packaging must be recycled by 2030, leading to a surge in demand for biodegradable and recyclable labels.

3. How is the expansion of e-commerce influencing the labels market?

The rapid growth of e-commerce has heightened the need for efficient labeling systems in logistics and supply chain management. Accurate tracking, inventory management, and delivery optimization rely heavily on advanced labeling solutions to meet the demands of online retail.

4. What role do labels play in consumer purchasing decisions?

Labels significantly impact consumer behavior, with over 50% of consumers globally making purchasing decisions based on packaging and labeling aesthetics. This underscores the importance of labels in branding and conveying critical product information.

5. Which industries are the primary consumers of labels?

Key industries utilizing labels include food and beverage, pharmaceuticals, logistics, and consumer goods. Labels serve as essential tools for identification, regulatory compliance, and enhancing user experience across these sectors.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]