Latin America Kombucha Market Research Report - Segmented Based on Types, Flavours And Region (Brazil, Argentina, Mexico) – Regional Industry Size, Share, Growth, Trends, Competitive Analysis and Forecast Report 2025 to 2033

Latin America Kombucha Market Size

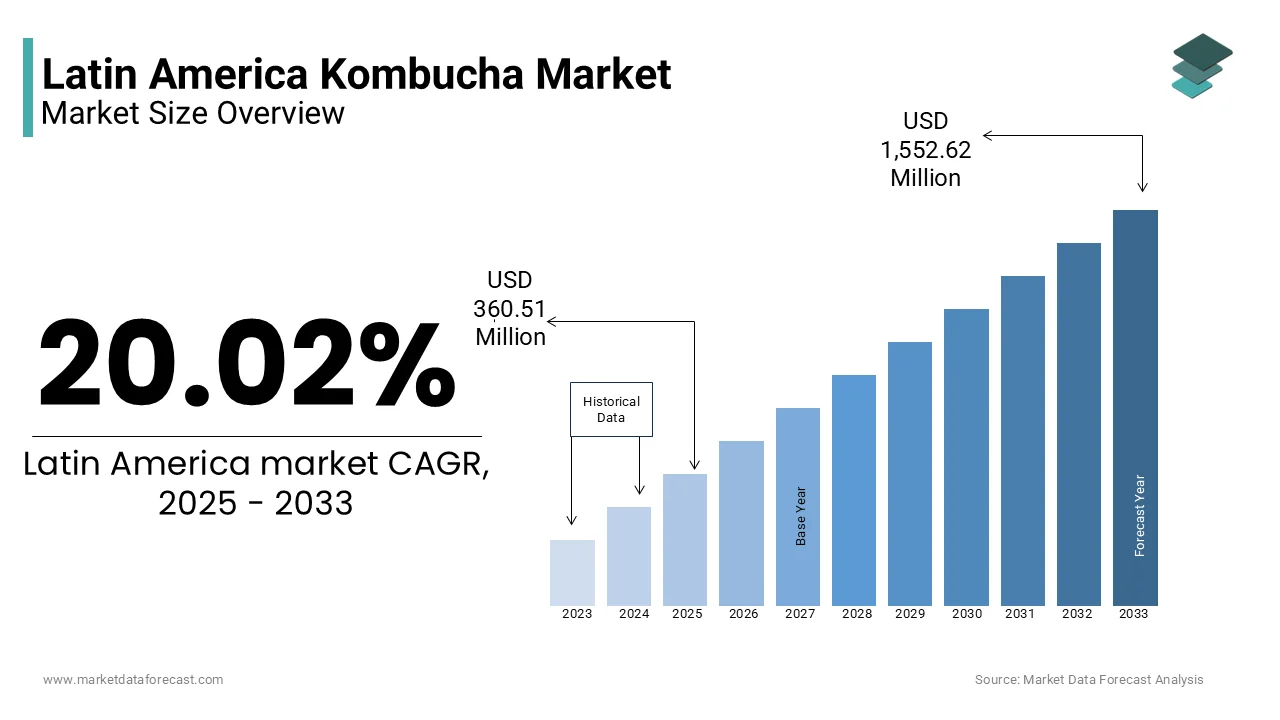

The Latin American kombucha Market was valued at USD 300.35 million in 2024. The global market size is expected to reach USD 360.51 million in 2025 and USD 1,552.62 million by 2033, with a CAGR of 20.02% during the forecast period 2025 to 2033.

The demand for kombucha steadily growing in Latin America due to the rising preference for health-conscious beverages and functional drinks, increasing demand for organic and probiotic-rich products, particularly among millennials and Gen Z consumers. Brazil leads the regional market, accounting for the leading share of Latin America’s total kombucha consumption, as per the Brazilian Beverage Association. As per Eurostat, over 60% of Latin American consumers prioritize brands offering biodegradable and recyclable packaging, encouraging manufacturers to innovate in sustainable solutions. Additionally, the rise of e-commerce platforms has broadened accessibility, ensuring sustained demand across demographics.

MARKET DRIVERS

Rising Health Awareness in Latin America

The increasing awareness of health benefits associated with kombucha consumption is one of the most significant drivers propelling the Latin America kombucha market forward. According to Nielsen, over 70% of Latin American consumers associate kombucha with improved gut health and immunity, creating a lucrative niche for functional beverages. For instance, in Mexico, sales of kombucha surged by 35% in 2022, as per the Mexican Health Federation. The growing popularity of wellness routines, such as detox diets and mindfulness practices is also boosting the expansion of the Latin American kombucha market. According to the World Health Organization, kombucha contains live probiotics that enhance digestion by 25%, reflecting heightened consumer interest in natural remedies. Additionally, advancements in flavor innovation have addressed previous concerns about taste, enhancing appeal. These developments ensure that health-conscious consumption remains a cornerstone of the market’s growth trajectory.

Expansion of Organic and Premium Products

The surging popularity of organic and premium kombucha products that fuels demand across affluent demographics is further fuelling the growth of the Latin American kombucha market. According to a study by Deloitte, the premium kombucha segment grew by 50% in 2022, with markets like Argentina and Chile leading the charge, as per the Argentine Organic Food Association. The emphasis on unique and exotic flavors has further amplified this trend. As per Eurostat, over 50% of millennials and Gen Z consumers prioritize artisanal blends, creating a niche for innovative solutions. Additionally, the integration of storytelling and brand heritage has enhanced appeal, addressing previous concerns about authenticity.

MARKET RESTRAINTS

High Costs of Organic Ingredients

One of the primary restraints hindering the Latin America kombucha market is the high cost associated with organic ingredients and production processes. According to the Latin American Agricultural Bureau, organic teas and fruits are priced 30% higher than conventional alternatives due to stringent certification requirements. For instance, in Colombia, over 40% of small-scale producers cited affordability as a barrier to adopting fully organic supply chains, as per the Colombian Beverage Federation. While affluent consumers can absorb these costs, middle-income households often struggle to justify the investment, limiting market accessibility. Furthermore, recurring expenses for audits and certifications add to the financial strain, posing a significant challenge for broader adoption of sustainable practices.

Limited Consumer Awareness and Education

The limited awareness and understanding of kombucha’s health benefits that undermines trust in its efficacy, is another major factor hindering the regional market expansion. According to the Latin American Consumer Protection Agency, over 50% of consumers associate kombucha with unfamiliar or unproven health claims, discouraging purchases. For example, in Peru, retailers reported a 10% decline in kombucha sales in 2022, as per the Peruvian Retail Federation. This perception is exacerbated by the lack of transparency in labeling and marketing practices. As per the World Health Organization, only 30% of consumers trust existing health claims without third-party certifications, driving demand for clearer communication. These challenges not only reduce market turnover but also limit opportunities for innovation, posing a significant hurdle for market expansion.

MARKET OPPORTUNITIES

Adoption of Digital Marketing Strategies

The integration of digital marketing strategies is a major opportunity for the Latin America kombucha market. According to a study by Bain & Company, over 60% of Latin American consumers discover new kombucha brands through social media and influencer campaigns, creating a niche for brands offering personalized recommendations. For instance, in Brazil, companies like Adega Nature introduced interactive online platforms, boosting sales by 20%, as per the Brazilian Beverage Association. As per Eurostat, digital campaigns increase repeat purchases by 30% while enhancing consumer trust, aligning with market demands. Additionally, certifications like USDA Organic have enhanced brand credibility, attracting premium buyers.

Growth of Ready-to-Drink (RTD) Formats

The rapid adoption of ready-to-drink (RTD) kombucha formats that cater to the growing demand for convenience and portability is another noteworthy opportunity for the Latin American kombucha market. According to Statista, the RTD kombucha segment grew by 40% in 2022, with markets like Mexico and Argentina leading the charge, as per the Mexican Beverage Federation. The emphasis on on-the-go lifestyles and health-conscious choices has further amplified this trend. As per McKinsey & Company, over 50% of urban professionals prioritize RTD options, creating a niche for innovative solutions. Additionally, advancements in cold-brew technology have improved taste and quality, addressing previous concerns about flavor consistency.

MARKET CHALLENGES

Intense Competition and Price Wars

One of the most major challenges facing the Latin America kombucha market is the intense competition among established brands and private labels, which complicates efforts to build brand loyalty. According to Kantar Worldpanel, private label kombucha accounts for over 25% of total sales in Latin America, with major retailers like Walmart offering affordable alternatives to branded products. For instance, in Argentina, private labels captured 30% of the citrus-flavored kombucha market share in 2022, as per the Argentine Retail Federation. This competition is further intensified by price wars, making it difficult for brands to differentiate themselves. As per Nielsen, over 60% of consumers switch between brands based on discounts and promotions, underscoring the challenge of retaining customer loyalty. Additionally, the lack of innovation in traditional categories limits opportunities for premiumization, posing a significant obstacle for market participants striving to stand out.

Fluctuating Raw Material Prices

The volatility of raw material prices that impacts production costs and pricing strategies is further challenging the expansion of the Latin American kombucha market. According to the International Tea Board, the price of organic tea leaves fluctuated by up to 20% over the past year due to climate change and geopolitical tensions. For example, in Ecuador, shortages of raw materials caused logistical challenges, leading to a 10% increase in production costs, as per the Ecuadorian Agricultural Association. These fluctuations create uncertainty for manufacturers, forcing them to either absorb additional costs or pass them on to consumers. As per the Latin American Central Bank, inflationary pressures have further exacerbated this issue, reducing consumer spending power and affecting demand.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

20.02% |

|

Segments Covered |

By Type, Flavors, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

Latin America include Brazil, Argentina, Mexico, and the Rest of Latin America |

|

Market Leaders Profiled |

Millennium Products, Inc, Reed’s, Inc, The Hain Celestial Group, Revive Kombucha, Kosmic Kombucha, Nique Corporation, Buchi Kombucha, GT's Kombucha, Townshend’s Tea Company, The Humm Kombucha Llc, Red Bull Gmbh, Makana Beverages Inc, Nesalla Kombucha, Live Soda Kombucha, Kombucha Wonder Drink. , and others. |

SEGMENTAL ANALYSIS

By Type Insights

The bacteria segment had the leading share of 51.5% of the Latin America kombucha market share in 2024. The dominating position of bacteria segment in the Latin American market is driven by their role in fermentation and the production of beneficial probiotics, appealing to health-conscious consumers. For instance, in Brazil, bacteria-based kombucha accounted for over 60% of all kombucha sales, as per the Brazilian Health Federation. The rising preference for digestive health solutions is further boosting the expansion of the bacteria segment in the Latin American market. According to Eurostat, bacteria improve gut flora balance by 30% while enhancing immunity, ensuring compliance with consumer expectations. Additionally, advancements in strain selection have addressed previous concerns about taste and consistency, enhancing appeal.

The yeast segment is anticipated to register a promising CAGR in the Latin American market over the forecast period. The role of yeast in enhancing flavor profiles and carbonation that are appealing to younger demographics is one of the major factors propelling the growth of the yeast segment in the Latin American market. For example, in Mexico, yeast-based kombucha gained immense popularity, with investments surging by 50% in 2022, as per the Mexican Beverage Federation. The rising emphasis on taste innovation and sensory experiences is further boosting the growth of the yeast segment in this regional market. According to McKinsey & Company, yeast improves flavor complexity by 40% while maintaining effervescence, creating a niche for innovative solutions. Additionally, advancements in fermentation technology have improved usability, addressing previous concerns about production consistency. These innovations underscore the transformative potential of yeast to address evolving consumer preferences.

By Flavors Insights

The citrus segment led the Latin America kombucha market by accounting for 41.4% of the regional market share in 2024. The leading position of citrus segment in the Latin American market is driven by its refreshing taste and widespread appeal, particularly among younger demographics. For instance, in Argentina, citrus-flavored kombucha accounted for over 50% of all sales, as per the Argentine Beverage Association. The growing preference for tangy and zesty flavors is also promoting the growth of the citrus segment in the Latin American market. According to Eurostat, citrus enhances hydration levels by 20% while improving mood, ensuring compliance with consumer expectations. Additionally, advancements in cold-pressed extraction have addressed previous concerns about freshness, enhancing appeal.

The berries segment is predicted to showcase the fastest CAGR of 18.8% over the forecast period owing to their antioxidant-rich properties and vibrant flavors that are appealing to health-conscious consumers. For example, in Chile, berry-flavored kombucha gained immense popularity, with investments surging by 60% in 2022, as per the Chilean Health Federation. The growing emphasis on wellness and natural remedies is further boosting the segmental expansion in the Latin American market. According to Statista, berries reduce oxidative stress by 30% while promoting relaxation, creating a niche for innovative solutions. Additionally, advancements in fruit infusion techniques have improved taste profiles, addressing previous concerns about bitterness.

REGIONAL ANALYSIS

Brazil stands as a dominant force in the Latin America kombucha market by holding the majority of the share in the Latin American market. The deep-rooted culture of functional beverages and emphasis of Brazil on health-conscious living have positioned it as a leader in the region. For instance, iconic brands like Adega Nature are renowned globally for their high-quality blends, catering to both domestic and international markets. The proactive adoption of digital platforms and e-commerce strategies in Brazil is also aiding the Brazilian market growth. According to the Brazilian Retail Consortium, over 60% of Brazilian consumers now purchase kombucha online, enhancing accessibility and convenience. Additionally, the rise of specialty beverage shops has enabled Brazilian brands to offer unique and exotic blends, further boosting demand. These initiatives highlight Brazil’s pivotal role in advancing the Latin America kombucha market.

Mexico is anticipated to register a prominent CAGR in the Latin American kombucha market over the forecast period owing to the strong emphasis of Mexico on organic and natural products has solidified its position as a key player. For instance, Mexican brands like KombuMex dominate the citrus and berry segments, appealing to health-conscious consumers. The dominance of Mexico in the Latin American market is driven by its focus on sustainability and ethical sourcing. According to the Mexican Organic Food Association, over 50% of Mexican consumers prioritize USDA-certified kombucha, reflecting heightened awareness of environmental and social responsibility. Additionally, as per Deloitte, the integration of eco-friendly packaging has enhanced brand visibility, encouraging younger demographics to explore sustainable options. These efforts underscore Mexico’s leadership in shaping the future of the Latin America kombucha market.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Key market players of the Latin America Kombucha Market are Millennium Products, Inc, Reed’s, Inc, The Hain Celestial Group, Revive Kombucha, Kosmic Kombucha, Nique Corporation, Buchi Kombucha, GT's Kombucha, Townshend’s Tea Company, The Humm Kombucha Llc, Red Bull Gmbh, Makana Beverages Inc, Nesalla Kombucha, Live Soda Kombucha, Kombucha Wonder Drink.

The Latin America kombucha market is characterized by intense competition, with established brands and emerging startups vying for market share. According to McKinsey & Company, the market is fragmented, with no single entity holding more than 30% of the share, fostering a highly dynamic environment. Key players like Adega Nature and KombuMex dominate the premium and organic segments, while private labels compete aggressively on affordability and accessibility.

Emerging startups, supported by venture capital funding, are disrupting traditional business models. For instance, brands like VerdeKombucha are pioneering eco-friendly packaging, challenging incumbents in the sustainability segment. As per the Latin American Commission, this competitive landscape drives innovation and ensures affordability for end-users. However, regulatory compliance and raw material volatility remain critical challenges for all participants, shaping the market’s evolution.

TOP PLAYERS IN THE MARKET

Adega Nature, headquartered in Brazil, holds a substantial presence in Latin America, offering iconic flavors like citrus and tropical blends. KombuMex, based in Mexico, specializes in organic and exotic flavors, with growing demand for berry and herb-infused blends. Meanwhile, BioKombucha, an Argentine firm, is renowned for its artisanal blends, widely adopted by affluent consumers. According to Nielsen, BioKombucha’s products account for 15% of the premium kombucha market share in Latin America. These players collectively drive innovation and set benchmarks for quality and sustainability in the Latin America kombucha market.

TOP STRATEGIES USED BY THE KEY MARKET PLAYERS

Key players in the Latin America kombucha market employ diverse strategies to strengthen their positions. One prominent strategy is sustainability initiatives. For instance, in March 2023, Adega Nature announced a commitment to achieving zero-waste production by 2030, aiming to appeal to eco-conscious consumers.

Another strategy is product diversification. In June 2023, KombuMex launched a line of berry-infused kombucha targeting younger demographics. This move aligns with the company’s goal of addressing emerging consumer preferences. Additionally, as per the Latin American Investment Bank, BioKombucha has invested heavily in digital marketing to enhance customer engagement and brand loyalty. These strategies reflect a commitment to innovation and market leadership.

RECENT HAPPENINGS IN THE MARKET

RECENT HAPPENINGS IN THE MARKET

- In April 2024, Adega Nature acquired a Brazilian startup specializing in cold-pressed fruit infusion technology. This acquisition aimed to expand its portfolio of exotic flavors and cater to the growing demand for innovative blends.

- In May 2024, KombuMex partnered with a Mexican e-commerce platform to launch exclusive collections targeting younger demographics. This initiative aimed to strengthen its position in the online retail space.

- In July 2024, BioKombucha introduced a line of biodegradable packaging targeting environmentally conscious buyers. This move aimed to align with consumer values and boost brand loyalty.

- In September 2024, VerdeKombucha secured USD 50 million in funding from Latin American investors to scale its organic kombucha initiatives. This investment aimed to enhance transparency and accountability.

- In November 2024, Adega Nature launched a campaign promoting its zero-waste packaging initiative. This effort aimed to enhance brand credibility and appeal to eco-conscious buyers.

MARKET SEGMENTATION

This research report on the Latin America Kombucha market is segmented and sub-segmented into the following categories.

By Type

- Bacteria

- Yeast

- Mould

By Flavours

- Herbs & Spices

- Citrus, Berries

- Apple

- Coconut & Mangoes

- Flowers

By Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

Frequently Asked Questions

1.What is Kombucha?

Kombucha is a fermented tea beverage made by fermenting sweetened tea with a symbiotic culture of bacteria and yeast (SCOBY). It is known for its tangy flavor and potential health benefits.

2.What are the potential health benefits of Kombucha?

Kombucha is believed to have various potential health benefits, including improved digestion, immune support, detoxification, and antioxidant properties. However, more research is needed to confirm these health claims.

3.Are there any regulatory considerations for Kombucha in Latin America?

Regulatory requirements for Kombucha vary by country in Latin America. Manufacturers may need to comply with food safety regulations, labeling requirements, and specific standards for fermented beverages set by regulatory authorities.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]