Latin America CRO Services Market Size, Share, Trends & Growth Forecast Report By Type, End-User, and Country (Brazil, Mexico, Argentina, Chile & Rest of Latin America) – Industry Analysis From (2025 to 2033)

Latin America CRO Services Market Size

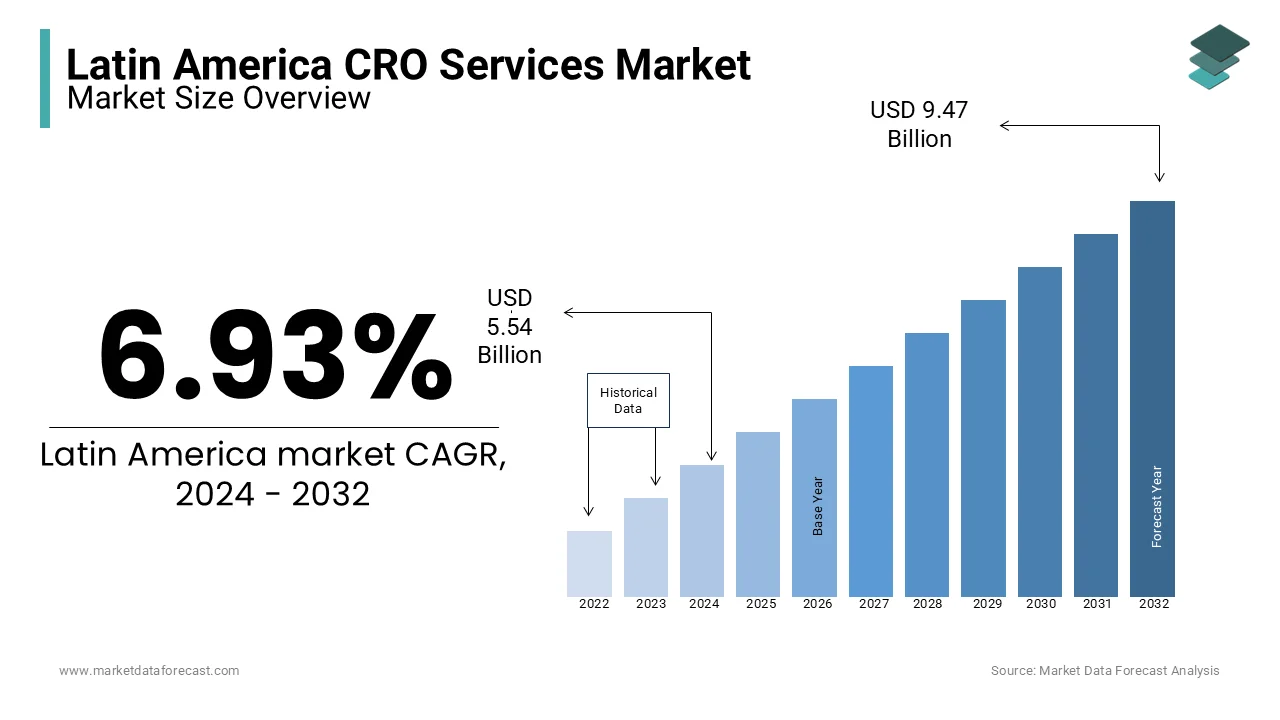

The size of the Latin America contract research organization (CRO) services market was valued at USD 5.54 billion in 2024. This market is expected to grow at a CAGR of 6.93% from 2025 to 2033 and be worth USD 10.13 billion by 2033 from USD 5.92 billion in 2025.

MARKET SCENARIO

The surge in R&D for the creation of novel medications and medical equipment, prominent organizations and healthcare CRO service providers, and the rise in healthcare expenditure are driving the growth of the healthcare Latin America CRO services market. Furthermore, CROs assist manufacturers in saving time and money by reducing the time it takes to run a trial in a private lab against the time it takes to conduct the trial in-house, resulting in significant cost savings. Furthermore, there is a constant demand for advancements in oncology, stem cell research, cancer research, drug discovery, and the study of many small compounds and their mechanisms, such as protein mechanisms for therapeutic purposes. This can be attributable to significant companies' increased attention on biotech and pharmaceutical development.

Companies are continually focusing on performing research to develop new pharmaceutical products to cure various disorders, helping to the growth of the healthcare CRO market. In addition, there is a growing need for outsourcing analytical testing and clinical trial services and an increase in clinical trials. The governing pressure on contract research organization services, on the other hand, is expected to propel the contract research organization (CROs) services market forward.

The growing market for biosimilars and biologics and the increased need for specialized testing services are expected to stifle the contract research organization (CRO) services market's expansion over the forecast period. However, rising competition in the contract research organization business and a scarcity of qualified professionals could also restrict the market for contract research organization (CRO) services in the near future.

SEGMENTAL ANALYSIS

By Therapeutic Area Insights

GEOGRAPHICAL ANALYSIS

Latin America is one of the world's fastest-growing pharmaceutical marketplaces. Brazil is expected to have the largest share among others. Biosimilar development is the key goal in Brazil and Argentina. Local trials may become more common in Mexico due to regulatory restrictions that require clinical studies for bio-comparable products to be undertaken locally. Most pharmaceutical, biopharmaceutical, and medical device businesses continue to put significant resources into developing new medications and technologies.

Furthermore, retention rates in Latin America are often twice as high as in Western Europe and far higher than in the United States and Canada. A convenient time zone for Western biopharmaceutical businesses has also played a vital role. Brazil, Mexico, and Argentina are ahead of Colombia, Peru, and Chile in terms of the number of outsourced clinical trials due to their larger patient populations and more established regulatory environments. In each of the three countries, regulatory documents must first be approved by Ethics Committees, and then by the national Ministry of Health.

Although several Latin American countries, such as Brazil, have streamlined approval processes and reduced timeframes, Peru, Colombia, and Chile continue to use a sequential submission process. For example, the Instituto Nacional de Vigilancia de Medicamentos y Alimentos is Colombia's regulatory authority for clinical research, and the typical period for regulatory approval is 4-5 months. The Instituto de Salud Pública regulates clinical research in Chile, and permission takes about 3-4 months on average.

KEY MARKET PLAYERS

The market is mainly dominated by Quintiles Transnational Holdings Inc., Laboratory Corporation of America Holdings, Pharmaceutical Product Development, PAREXEL International Corporation, ICON Plc, PRA Health Sciences Inc., InVentiv Health Inc., Charles River Laboratories International Inc., INC Research Holdings Inc., and Wuxi PharmaTech.

MARKET SEGMENTATION

This Latin America contract research organization (CRO) services market research report is segmented and sub-segmented into the following categories.

By Type

- Clinical Research Services

- Phase I Clinical Research Services

- Phase II Clinical Research Services

- Phase III Clinical Research Services

- Phase IV Clinical Research Services

- Early-Phase Development Services

- Discovery Studies

- Chemistry, Manufacturing, & Control (CMC)

- Preclinical Services

- Pharmacokinetics/Pharmacodynamics (PK/PD)

- Toxicology Testing Services

- Other Preclinical Services

- Laboratory Services

- Bioanalytical Testing Services

- Analytical Testing Services

- Physical Characterization

- Raw Material Testing

- Batch-Release Testing

- Stability Testing

- Other Analytical Testing Services

- Consulting Services

By Therapeutic Area Insights

- Oncology

- CNS

- Cardiovascular

By End-User

- Pharmaceutical

- Biopharmaceutical

- Medical Device Companies

By Country

- Brazil

- Mexico

- Argentina

- Chile

- Rest of Latin America

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from

$ 1600

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com