Global Knee Reconstruction Devices Market Size, Share, Trends & Growth Forecast Report By Product Type (Primary Cemented, Primary Cementless, Partial and Revision Implants) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Knee Reconstruction Devices Market Size

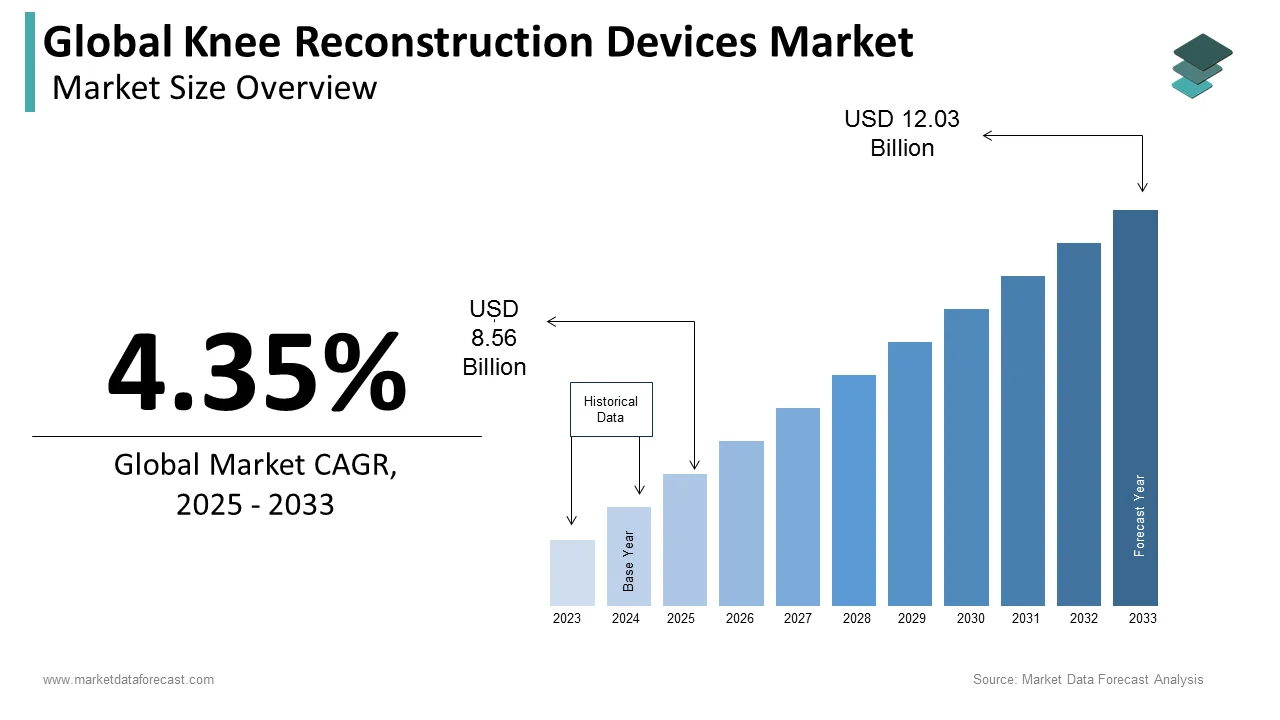

The global knee reconstruction devices market was worth US$ 8.20 billion in 2024 and is anticipated to reach a valuation of US$ 12.03 billion by 2033 from US$ 8.56 billion in 2025, and it is predicted to register a CAGR of 4.35% during the forecast period 2025-2033.

MARKET DRIVERS

The growing aging population suffering from knee-related disorders such as arthritis and osteoarthritis is one of the major factors propelling the growth of knee reconstruction devices in the market.

According to the World Health Organization (WHO) predictions, one in every six people is expected to be more than 60 years old by 2030. According to the Centers for Disease Control and Prevention (CDC), an estimated 58.5 million people in the United States have arthritis. According to the same source, around 32.5 million adults in the United States have osteoarthritis. In addition, factors such as the growing adoption of technological developments and favorable reimbursement policies propel the growth of the knee reconstruction devices market. Many countries worldwide have become medical tourism points for knee reconstruction surgeries, as they provide quality treatment at affordable prices. Total joint replacement of a dysfunctional knee using artificial knee implants has been a reliable and efficient treatment method. It provides a significant improvement in the performance and quality of life of patients across the world. Knee pain, caused by musculoskeletal diseases like osteoarthritis (OA), is a quickly growing disease estimated to increase the substantial demand for knee reconstruction surgeries in the future.

The market players focus strongly on inventing or implementing new devices to reconstruct the knee, growing obesity. Obese people gain more weight, making them unable to walk as the whole-body weight pressurizes the knee. The deep-rooted healthcare structure and high occurrence of arthritis in aged people boost the market growth during the assessment period. The rising patient count is due to the growing number of hospitals with expert professionals, enlarging product approvals, and introducing new devices into the markets. The surging number of knee implants, the growing number of bone-relevant illnesses, and the rising prevalence of accidents leading to the increasing number of knee reconstructions are further fuelling the market’s growth rate. In October 2014, Zimmer Holdings, Inc. obtained ETEX Holdings, which has advanced, produced, and commodified biomaterials for developed orthopedic clinical results. Nearly 67 million people are to be affected by arthritis by 2030, according to the Arthritis Foundation.

The growing number of advancements in surgical techniques and implant materials, rapid adoption of minimally invasive surgeries, rising demand for personalized and patient-specific knee implants, and technological advancements in knee reconstruction devices fuel the growth rate of the knee reconstruction devices market. Favorable reimbursement policies for knee reconstruction procedures, growing awareness about the benefits of knee reconstruction surgeries, increasing participation in sports and recreational activities leading to knee injuries, and the growing number of strategic collaborations and partnerships between medical device manufacturers and healthcare providers further promote the knee reconstruction devices market growth.

MARKET RESTRAINTS

High costs associated with knee reconstruction procedures and devices, limited reimbursement coverage for knee reconstruction surgeries, stringent regulatory requirements, and lengthy approval processes for new devices primarily limit the growth rate of the knee reconstruction devices market. Lack of skilled healthcare professionals specialized in knee reconstruction procedures, risks and complications associated with knee reconstruction surgeries, limited access to healthcare facilities, especially in rural and underdeveloped regions, and rising preference for non-surgical or conservative treatment options for knee conditions impede the growth of the knee reconstruction devices market. Challenges in post-operative rehabilitation and recovery for patients and product recalls or safety concerns related to knee reconstruction devices further inhibit the market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.35% |

|

Segments Covered |

By Product Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Zimmer, Inc., Stryker, DePuy Synthes, Smith & Nephew plc, Arthrex, Exactech, Inc., Corin, DJO Global, Japan Medical Dynamic Marketing, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

Based on product type, the primary cemented segment is anticipated to account for the leading share of the global market during the forecast period. Long-standing clinical success and an established track record of primary cemented implants are one of the major factors driving the growth of the primary cemented segment. High stability and immediate weight-bearing capability provided by cement fixation, favorable outcomes and patient satisfaction associated with primary cemented implants and growing demand for knee reconstruction procedures in aging populations further fuel the growth rate of the primary cemented segment in the global market. The partial implants segment is expected to witness a healthy CAGR during the forecast period owing to technological advancements in implant design and instrumentation, improved surgical techniques, and enhanced patient outcomes. The growing trend towards personalized medicine and the preference for preserving natural knee anatomy when feasible further boost the growth rate of the partial implants segment in the worldwide market.

REGIONAL ANALYSIS

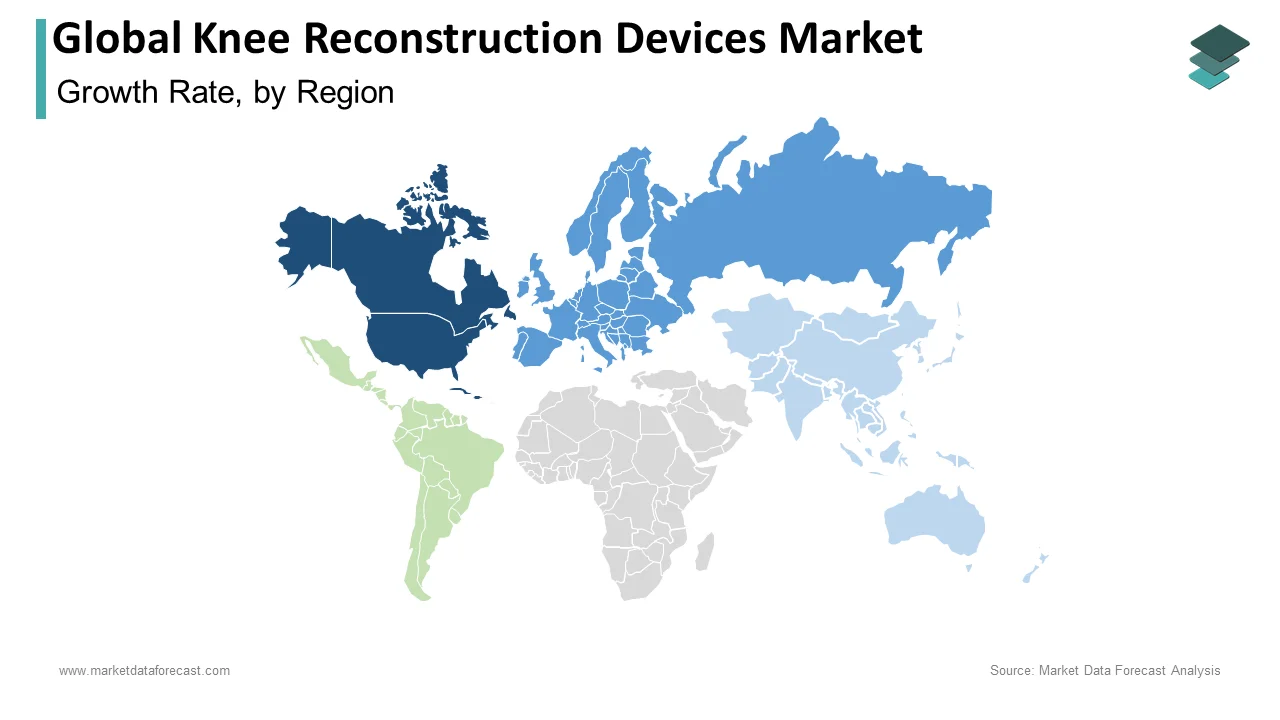

The North American knee reconstruction devices market held the largest share of the global market in 2024. The lead of the North American region is predicted to continue during the forecast period. The growing awareness about knee conditions, higher preference for minimally invasive surgeries, the availability of innovative and technologically advanced implant options, and strategic collaborations and partnerships between healthcare providers and medical device manufacturers contribute to market growth and drive the growth of the North American market growth. The U.S. market is predicted to lead the North American region, followed by Canada during the forecast period owing to the presence of key market participants and favorable reimbursement policies.

The European knee reconstruction devices market is another lucrative region worldwide for knee reconstruction devices. It is expected to account for a substantial global market share during the forecast period. The growing aging population across the European region and the rising incidence of arthritis majorly promote European market growth. In the coming years, an increasing number of people suffering from chronic diseases and the rising affordability of knee implants boost the knee reconstruction devices market in the European region. The German market is expected to dominate during the forecast period and account for 35% of the European market share in 2024, followed by France.

However, the Asia-Pacific knee reconstruction devices market is expected to showcase a robust CAGR during the forecast period. The growing geriatric population, changing lifestyle patterns, higher incidence of knee-related disorders, and increasing number of improvements in the healthcare infrastructure across the Asia-Pacific region drive the growth of the APAC market. The rapid adoption of advanced medical technologies, improved healthcare access in rural areas, and increased initiatives from the APAC governments to improve healthcare facilities support the APAC market growth. In APAC, the Chinese market is the most promising regional market and is expected to witness a CAGR of 10% during the forecast period. In addition, the rising incidence of obesity and osteoporosis in people is significantly boosting the market. Since 2019, 10 major hospitals in India have acquired robotic surgeries for knee reconstruction. In Japan, in 2015, knee replacement devices were the quickest, with a hiking number of active patients increasing the demand for knee joint market growth. On March 01, 2021, the iTotal PS knee replacement device by Conformis, Inc. received a clearance form from Therapeutics Goods and Administration and launched in the U.S in 2016.

The Latin American knee reconstruction devices market is forecasted to showcase a stable CAGR during the forecast period. Aging people with osteoarthritis reduce the knee's pain and advance the patient's comfort. Mexico has earned familiarity over its potential to provide excellently reasonable orthopedic treatment options. The Brazilian knee reconstruction devices market is to have a tremendous growth rate in the region.

The knee reconstruction devices market in MEA has a notable growth rate due to the growing demand, advanced technologies, and appropriate healthcare reimbursement policies. The number of knee surgeries is increasing in the UAE, which has become a medical hub. The state-of-art technology, well-qualified and experienced professionals, and authorized medical centers. Anterior Cruciate ligament (ACL) reconstruction surgery is one of the most familiar and successful treatment options as people travel abroad for this surgery. The ACL provides the patient with a better quality of life.

KEY MARKET PLAYERS

Companies dominating the Global Knee Reconstruction Devices Market profiled in this report are Zimmer, Inc., Stryker, DePuy Synthes, Smith & Nephew plc, Arthrex, Exactech, Inc., Corin, DJO Global, Japan Medical Dynamic Marketing, Inc.

RECENT HAPPENINGS IN THE MARKET

-

The FDA approved the novel Bridge-enhanced ACL Repair Implant by Miach Orthopedics Inc. as an anterior cruciate ligament implant to treat ACL injuries in December 2020.

-

DJO LLC announced the availability of two new EMPOWR systems, the EMPOWR Partial Knee and EMPOWR Acetabular, in August 2020. These systems are meant to restore kinematics by single tray implantation.

MARKET SEGMENTATION

This research report on the global knee reconstruction devices market has been segmented and sub-segmented based on the product type and region.

By Product Type

- Primary Cemented

- Primary Cementless

- Partial

- Revision Implants

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How big is the global knee reconstruction devices market?

As per our research report, the global knee reconstruction devices market size is projected to be USD 12.03 billion by 2033.

Who are the major companies in the knee reconstruction devices market?

Zimmer, Inc., Stryker, DePuy Synthes, Smith & Nephew plc, Arthrex, Exactech, Inc., Corin, DJO Global, and Japan Medical Dynamic Marketing, Inc. are some of the noteworthy companies in the knee reconstruction devices market.

Which region will lead the knee reconstruction devices market in the future?

During the forecast period, the Asia-Pacific is expected to witness the highest CAGR in the global market.

At What CAGR, the global home healthcare software market is expected to grow in the coming years?

The global knee reconstruction devices market is estimated to grow at a CAGR of 4.35% from 2025 to 2033.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]