Global Kefir Market Size, Share, Trends & Growth Forecast Report - Segmented By Composition (Water Kefir And Milk Kefir), Type (Greek Style, Frozen, Organic, Low Fat And Others), Flavour (Regular And Flavoured), Distribution Channel (Supermarkets, Convenience Stores, Grocery Stores, Online Retailers And Others), And Region (North America, Europe, Asia Pacific, Latin America, Middle East And Africa) – Industry Analysis 2024 To 2032

Global Kefir Market Size (2024 to 2032)

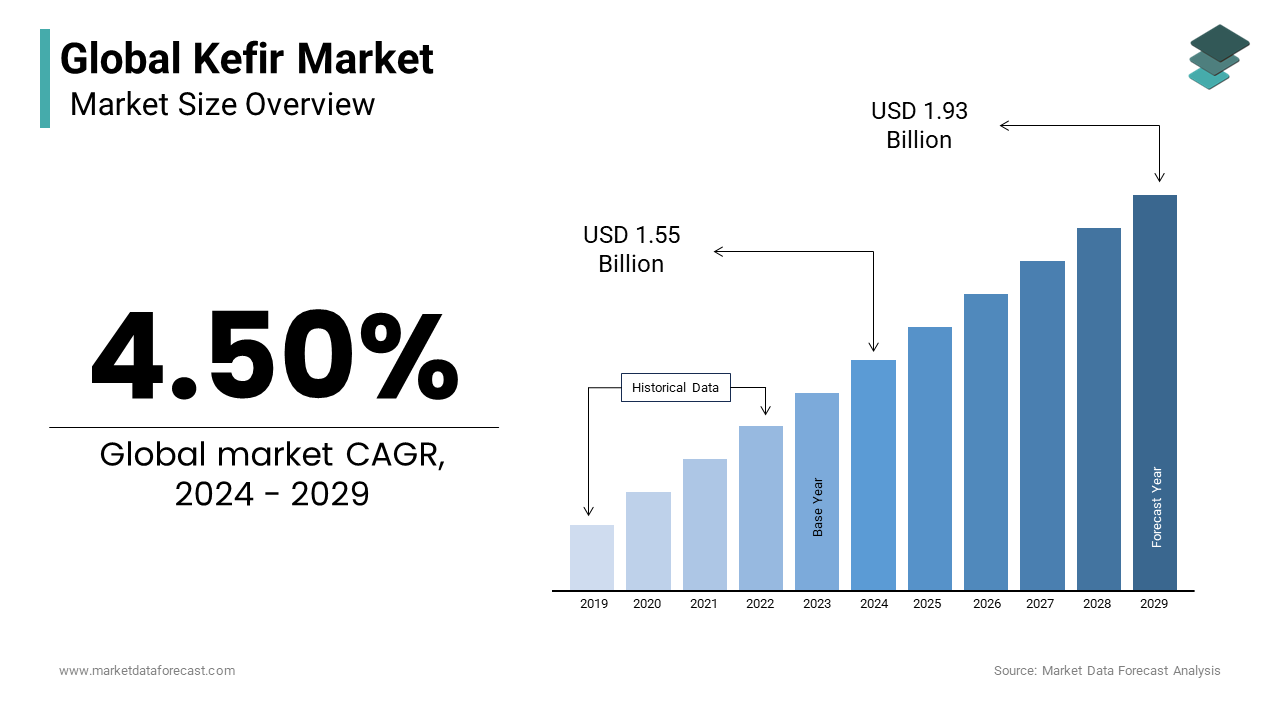

The global kefir market size is expected to reach USD 1.55 billion in 2024 to USD 2.20 billion by 2032 with a CAGR of 4.50% throughout the forecast period 2024 to 2032.

Kefir is a dairy product that is grown in a unique way and is considered primarily a rich source of probiotic foods. It is a combination of fermented milk, which has a slightly sour taste. Kefir is believed to have medicinal properties because it helps heal leaky intestines. The word kefir is derived from the Turkish word "keif" which means "good feeling". Kefir tastes like drinking yogurt made from fermented dairy products. It can be prepared with goat, sheep, or cow milk. Kefir contains the right amount of calcium, biotin, vitamin B12, magnesium, folic acid, vitamin K2, probiotics, and enzymes. Since kefir does not have an appropriate standardized nutritional content, the value of ingredients can be determined according to the region where it is produced, cows and crops. Kefir is loaded with Bifidobacterium Bifidum and Lactobacillus acidophilus, and it also provides a good amount of beneficial yeast and lactic acid bacteria. Kefir is rich in nutrients and a beneficial microbiota, which is determined to increase its market demand and consumption during the forecast period.

Current Scenario of the Global Kefir Market

The COVID-19 pandemic, declining immunity and increased instances of gut-related health conditions or diseases are driving the demand for the kefir. Moreover, the rising trend of launching new flavours years in different food expos around has gathered customer's attention and they are eagerly waiting for the arrival of the food products is also propelling the market forward. For instance, in March 2024, Lifeway Foods Inc. presented its most popular and trending products at Natural Products Expo West 2024 involving Farmer Cheese and various other types of newly launched Organic Grassfed Kefir flavours.

Moreover, the key marketplace for probiotic Yogurt is Asia Pacific followed by the European Union, while the sour milk industry which includes kefir, buttermilk, ayran and conventional yoghurt is dominated by the EU. Another segment is the probiotic supplement that the United States is leading and Asia Pacific in second place. So, we can say that there is a big market for probiotic products in APAC, US and Europe. The industry in the EU in recent years has seen a decline in growth rate but it remains the biggest market for probiotics.

Another factor influencing the market expansion is the packaging design. Companies are investing a significant amount in product design, shape and colours. This is the first element that any customer’s eye goes on

MARKET DRIVERS

The global kefir market is stimulated by the increasing popularity of kefir among lactose-intolerant consumers due to its low lactose content. Kefir contains many beneficial bacteria that aid in the digestion of lactose.

It should be a better option than yogurt for the lactose-intolerant population. Although yogurt and kefir are good sources of calcium and protein, kefir also contains a broader range of bacteria that stimulate digestion. Kefir is a rich source of probiotics that should act as a growth factor for the market. Probiotics aid digestion with other potential benefits, such as improving immunity and intestinal health, preventing obesity, and controlling weight. Increased awareness of the health benefits associated with kefir and increased spending on health-promoting foods are expected to drive the global kefir market in the coming years. The excellent taste and availability of various flavors of the product may be another important reason that should increase the popularity and consumption of kefir among consumers. Increased investment in research and development by leading companies is expected to be a growth engine for this market. For example, in August 2018, DuPont de Nemours, Inc. introduced a new culture of kefir for the South American market. The high upfront investment and storage costs associated with kefir production are supposed to slow market growth. High storage and preservation costs are linked to the high price of the final product, which should make it difficult for consumers to accept the product in developing regions.

MARKET RESTRAINTS

The lack of awareness and Unique taste and texture are primarily decreasing the growth of the kefir market.

Despite the increase in knowledge and understanding of healthy lifestyles and eating the cognizance of kefir is still limited. This is due to insufficient marketing activities or poor promotional strategies and programs for public awareness about probiotic goods.

Another factor adding to this is its short or limited shelf life which also requires big storage and is coupled with packing expenses. This trend of keeping kefir in dry form is restricting its demand. Also, the two methods used for quick dryness are freezing and spraying. Spray drying is the most popular approach utilized in the dairy powder sector because of its low expenditure, fast dry time, and efficient and effective removal of moisture. But, this method also causes the loss of flavour, and aroma and at the same time, microorganism viability also happens. As per a study, the survival of kefir bacteria is shortened by spray drying inlet and outlet temperatures, direction of airflow, atomization type and initial microorganism counts. And, freeze drying is costly and takes more duration to process.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.5% |

|

Segments Covered |

By Type, Composition, Flavour, Distribution Channel And Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Lifeway Foods Inc, The Greek Gods, Helios Ingredients, Fresh Made Inc, Groupe Danone, Krasnystaw OSM, Nestle SA, Danisco, Danlac Canada Inc, The KEFIR Company. |

SEGMENTAL ANALYSIS

Global Kefir Market Analysis By Composition

The milk kefir accounts for the maximum share and is anticipated to attain a higher CAGR during the forecast period. This could be linked to the rising consumption of lactose free items. There is an increasing need for dairy substitutes such as milk kefir sourced from non-dairy milks. In addition, customers are progressively finding foods that provide extra health advantages apart from normal nutrients.

Global Kefir Market Analysis By Type

Greek segment is leading with the dominant share of the market whereas frozen kefir segment is likely to gain huge traction over the market growth rate during the forecast period. Adoption of the innovative technological developments is majorly influencing the growth rate of the segment towards positive.

Global Kefir Market Analysis By Flavour

The flavoured kefir is more popular in this category. This can be attributed to the availability of several flavours which are popular among kids and adults. Whereas the regular kefir is projected to grow in the coming years due to people’s preference for products without artificial additives and flavours since it is free from those things.

Global Kefir Market Analysis By Distribution Channel

The supermarkets or hypermarkets segment holds a significant share of the kefir market. The wide chain network of these stores over Europe and the North American region is the main driver of the segment’s growth. For example, during the first wave of COVID-19, the sales of kefir drastically surged in the United Kingdom. On the other hand, the online retailer’s segment is quickly capturing the market share with the personalised shopping experience.

REGIONAL ANALYSIS

In terms of revenue, Europe kefir market maintained a dominant position in the global market in 2018, accounting for more than 45% of the market share, and should remain dominant throughout the outlook period. This is mainly due to its wide range of applications in various food products, such as sauces, sauces, and ice cream. Furthermore, kefir is highly preferable for obese and gastric patients, as it improves metabolism and softens the stool.

Furthermore, the increase in the number of gastric patients and the increase in the obese population in the region are contributing to the overall growth of the kefir market. According to the World Health Organization (WHO), in 2017, obesity or being overweight is considered the leading cause of around 2.8 million deaths every year worldwide. Furthermore, obesity in Europe has increased considerably in recent years. In 2016, about 30% of the total population in England was obese, most of them belonging to the age group of 55 years or older. Furthermore, the United Kingdom ranks higher in terms of obesity compared to France and Germany, with a share of 27.3%, while Germany represents 24.6% and France 17.5%. Moreover, the UK registered around 6,980 cases of stomach cancer in 2016, which prevailed mainly among the male population. Increasing cases of stomach and stomach cancer should increase the demand for kefir, as it is very effective against gastritis and gastric ulcers. This, in turn, should drive market growth in the near future.

Asia Pacific had a kefir market share of less than 20% due to the low penetration of the leading kefir manufacturers operating in the region, resulting in low availability. Furthermore, kefir is positioned as a substitute for dairy products, such as processed cheese, butter, cottage cheese and clarified butter, but the region's population is more inclined to consume these products than kefir. This, in turn, slows the growth of the kefir market in the area. However, this trend is anticipated to change in the future due to the growing awareness of the benefits associated with kefir, such as anti-cancer, anti-allergic and many other properties. Furthermore, the changing consumption patterns of the population in this region and the increasing trend towards healthier food consumption, which is mostly influenced by Western culture, should pave the way for kefir in the near future.

In 2017, the overweight and obese population in Asia-Pacific reached 1 billion, prompting the region to spend more than $ 160 billion on health care. This factor should pave the way for kefir in the area. Furthermore, the strengthening of the economic situation in countries such as India, China, and Japan, among others, should encourage the leading manufacturers operating in this field to penetrate these markets to obtain better investment opportunities and respond to a broader clientele. In addition, the Asia-Pacific is foreseen to present a higher growth rate for the kefir market compared to other regions during the prediction period.

KEY PLAYERS IN THE GLOBAL KEFIR MARKET

Key Players In Kefir Market are Lifeway Foods Inc, The Greek Gods, Helios Ingredients, Fresh Made Inc, Groupe Danone, Krasnystaw OSM, Nestle SA, Danisco, Danlac Canada Inc, The KEFIR Company.

RECENT HAPPENINGS IN THE MARKET

-

In April 2024, Pure Culture Organics launched the Lactose-Free Kefir. This latest product line provides a tasty solution for routine dairy liquid consumers with probiotic benefits and is lactose-free. The company with this launch is meeting customer demands as well without compromising on nutrients and other values.

-

In January 2024, the Straus Family Creamery made a new addition to its product range with the launch of organic low-fat kefir. They used reusable glass bottles for packing. Also, it emphasises its promise of using sustainable organic farming, target of zero-waste and climate-proof practices.

- In March 2024, at Natural Products Expo West 2023 Lifeway Foods Inc, presented the Guava Lowfat, Organic Black Cherry and Organic Strawberry Banana whole milk kefir coupled with the seasonal flavors Rainbow Cake Lowfat Kefir and Campfire S'mores Lowfat Kefir.

DETAILED SEGMENTATION OF GLOBAL KEFIR MARKET INCLUDED IN THIS REPORT

This research report on the global kefir market has been segmented and sub-segmented based on type, composition, flavour, distribution channel & region.

By Composition

- Water Kefir

- Milk Kefir

By Type

- Greek Type Kefir

- Frozen Kefir

- Organic Kefir

- Low fat Kefir

- Others

By Flavour

- Regular Kefir

- Flavoured Kefir

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Grocery Stores

- Online Retailers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1.What are the different types of kefir?

Besides traditional cow's milk kefir, there are various types of kefir made from alternative milks such as goat's milk, sheep's milk, coconut milk, or nut milks. Additionally, water kefir, which is made with sugar water or fruit juice, is another popular option for those seeking non-dairy alternatives.

2.Where can I find kefir?

Kefir is available in most grocery stores, health food stores, and specialty markets. It can also be homemade using kefir grains and milk

3.What are the different types of kefir?

Besides traditional cow's milk kefir, there are various types of kefir made from alternative milks such as goat's milk, sheep's milk, coconut milk, or nut milks. Additionally, water kefir, which is made with sugar water or fruit juice, is another popular option for those seeking non-dairy alternatives.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]