Global Jewelry Market Size, Share, Trends, & Growth Forecast Report Segmented By Product (Necklace, Ring, Earring, Bracelet, and others), By Material, Distribution Channel, End-user, and Region (Latin America, North America, Asia Pacific, Europe, Middle East and Africa), Industry Analysis from 2025 to 2033

Global Jewelry Market Size

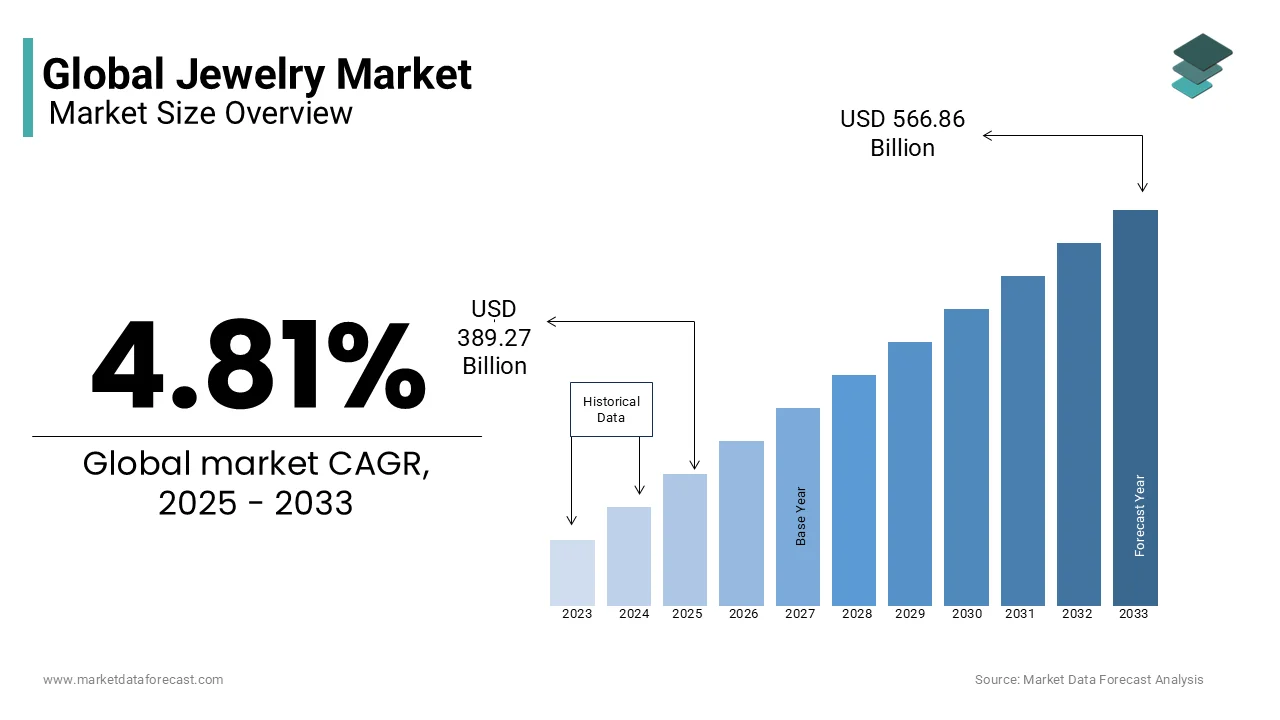

The global Jewelry market size was valued at USD 371.41 billion in 2024 and is expected to reach USD 566.86 billion by 2033 from USD 389.27 billion in 2025. The market is projected to grow at a CAGR of 4.81%.

Jewelry serves as expressions of personal style, markers of cultural heritage, and symbols of emotional milestones such as engagements, weddings, and religious ceremonies. Beyond its aesthetic appeal, it holds intrinsic value as both a wearable art form and a store of wealth and particularly in regions where gold and diamonds are deeply embedded in societal traditions. In 2023, the global fascination with jewelry continues to evolve is driven by shifting demographics, technological advancements and evolving perceptions of luxury.

One noteworthy statistic is that approximately 50% of global gold demand stems from jewelry fabrication, according to the World Gold Council which is underscoring the material's enduring allure across cultures. Another compelling fact is that De Beers' research indicates that in 2016, more than a quarter of diamond jewelry purchases in major markets including the U.S., China, Japan, and India were self-purchases by women, totaling over $18 billion that is highlighting the gemstone’s universal appeal. Additionally, sustainable practices are gaining traction, with a 2022 survey by McKinsey & Company revealing that 60% of consumers are willing to pay a premium for ethically sourced jewelry. These figures illustrate the interplay between tradition, innovation, and consumer values, shaping the contemporary landscape of the jewelry industry.

MARKET DRIVERS

Rising Disposable Incomes in Emerging Economies

The growth of disposable incomes in emerging economies serves as a significant driver for the jewelry market. As per the International Monetary Fund, countries like India and China have witnessed an average annual GDP growth rate of over 5% in recent years, leading to increased consumer spending on luxury goods, including jewelry. The World Bank highlights that household consumption in these regions has risen by nearly 30% over the past decade, with jewelry accounting for a substantial portion of discretionary spending. For instance, in India, gold jewelry demand surged by 15% in 2022, driven by higher rural incomes and urban affluence. Similarly, China’s middle class, projected to reach 700 million by 2030 according to McKinsey & Company, is fueling demand for diamond and platinum-based products. This economic upliftment enables consumers to prioritize culturally significant purchases, bolstering the global jewelry industry.

Growing Demand for Sustainable Jewelry

Consumer preferences are shifting toward sustainable and ethically sourced jewelry, creating a major driver for the market. According to a report by the United Nations Environment Programme, over 60% of global consumers now consider sustainability a key factor in their purchasing decisions. This trend is particularly prominent among younger demographics, with Nielsen reporting that 73% of Millennials actively seek eco-friendly products. The Responsible Jewellery Council notes that certifications for ethical sourcing have increased by 40% since 2019, reflecting heightened awareness and demand. Furthermore, the U.S. Department of Commerce highlights that recycled gold now constitutes approximately 30% of the global supply chain, driven by environmental concerns. Brands adopting transparent practices are gaining a competitive edge, as evidenced by a 25% rise in sales for companies promoting sustainability, according to a study by Bain & Company. This shift underscores the growing importance of ethical considerations in shaping consumer behavior.

MARKET RESTRAINTS

Fluctuating Prices of Precious Metals

One of the primary restraints in the jewelry market is the volatility of precious metal prices, which directly impacts production costs and consumer affordability. The U.S. Geological Survey reports that gold prices have fluctuated by over 20% annually in recent years due to geopolitical tensions and currency fluctuations. Similarly, the London Bullion Market Association highlights that silver prices experienced a 15% decline in 2022, affecting the affordability of silver-based jewelry. These price swings create uncertainty for both manufacturers and consumers, leading to reduced demand during periods of high inflation. The World Bank notes that rising interest rates globally have further exacerbated this issue, as investors shift focus from commodities to fixed-income assets. Such economic instability often results in cautious consumer spending, particularly in regions heavily reliant on imported metals. Consequently, price volatility remains a persistent challenge for the jewelry industry, limiting its growth potential.

Stringent Environmental Regulations

Stringent environmental regulations pose another significant restraint on the jewelry market, particularly for mining and manufacturing operations. The Environmental Protection Agency states that mining activities contribute to approximately 10% of global deforestation, prompting stricter compliance requirements. For instance, the European Union’s Conflict Minerals Regulation mandates traceability for tin, tungsten, tantalum, and gold, increasing operational costs for businesses. Additionally, the United Nations Framework Convention on Climate Change emphasizes that carbon emissions from jewelry production must be reduced by 30% by 2030 to meet global sustainability goals. These regulations often lead to higher expenses for small-scale artisans and manufacturers, as noted by the International Labour Organization. Compliance challenges are further compounded by varying standards across regions, making it difficult for companies to maintain uniform practices. As a result, regulatory pressures hinder market expansion and innovation within the industry.

MARKET OPPORTUNITIES

Expansion into E-Commerce Platforms

The rapid expansion of e-commerce platforms presents a significant opportunity for the jewelry market, enabling brands to reach a global audience. According to the U.S. Census Bureau, online retail sales grew by 14.3% in 2022, with jewelry being one of the fastest-growing categories. A report by the United Nations Conference on Trade and Development highlights that cross-border e-commerce accounts for 20% of all online transactions, offering immense potential for international growth. Furthermore, Statista reveals that 45% of millennials prefer purchasing jewelry online due to convenience and access to a wider range of designs. This digital transformation is supported by advancements in augmented reality (AR), allowing customers to virtually try on jewelry before purchasing. The Indian Ministry of Commerce notes that online jewelry sales in India grew by 60% in 2022, driven by increased internet penetration. By leveraging e-commerce, brands can tap into underserved markets and enhance customer engagement.

Increasing Popularity of Customization

Customization has emerged as a lucrative opportunity within the jewelry market, catering to the growing demand for personalized products. The U.S. Small Business Administration reports that customized goods account for 25% of all retail sales, with jewelry being a key contributor. According to the United Kingdom’s Office for National Statistics, 60% of consumers are willing to pay a premium for bespoke designs, reflecting a shift toward individuality and exclusivity. Advances in 3D printing technology have further fueled this trend, enabling intricate designs at lower costs. The World Intellectual Property Organization highlights that patent filings for jewelry customization technologies have increased by 35% since 2020. Additionally, a survey by the Australian Bureau of Statistics reveals that personalized jewelry gifts account for 40% of all jewelry purchases during festive seasons. By embracing customization, brands can differentiate themselves and foster deeper emotional connections with consumers.

MARKET CHALLENGES

Counterfeit Products and Brand Dilution

The proliferation of counterfeit jewelry poses a significant challenge to the market, undermining brand credibility and consumer trust. The Organisation for Economic Co-operation and Development estimates that counterfeit goods account for 3.3% of global trade, with jewelry being one of the most commonly replicated items. The U.S. Customs and Border Protection agency reports that seizures of counterfeit jewelry increased by 25% in 2022, highlighting the scale of the issue. These counterfeit products not only erode brand equity but also pose health risks due to the use of substandard materials, as noted by the Food and Drug Administration. Furthermore, the International Trademark Association highlights that small businesses lose approximately USD 1.5 billion annually due to intellectual property theft. This challenge is exacerbated by the anonymity of online marketplaces, making it difficult to regulate unauthorized sellers. Addressing counterfeiting requires robust enforcement mechanisms and consumer education to protect legitimate businesses.

Limited Awareness of Ethical Practices

Despite growing demand for sustainable jewelry, limited awareness of ethical practices remains a significant challenge for the industry. The United Nations Global Compact reports that only 20% of consumers fully understand the implications of ethical sourcing in jewelry production. This knowledge gap is particularly evident in developing regions, where educational initiatives are scarce. The Canadian government’s Natural Resources department highlights that less than 10% of artisanal miners are part of certified ethical programs, leaving a vast segment of the supply chain unregulated. Additionally, the African Development Bank notes that misinformation about recycled metals and lab-grown diamonds often leads to consumer skepticism, hindering adoption. Brands face the dual challenge of educating consumers while ensuring transparency in their operations. Without widespread awareness, achieving meaningful progress toward sustainability and ethical practices becomes increasingly difficult, posing a long-term obstacle for the industry.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.81% |

|

Segments Covered |

By Product, Material, Distribution Channel, End-User, and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis; DROC; PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Tiffany & Co, Pandora, Chow Tai Fook, Louis Vuitton SE, Richemont, GRAFF, Signet Jewelers Limited, H. Stern, Malabar Gold & Diamonds, Swarovski AG, and others |

SEGMENTAL ANALYSIS

By Product Insights

The rings segment dominated the jewelry market by accounting for 40.1% of global market share in 2024. The domination of the rings segment is majorly due to their cultural and emotional significance, particularly in weddings and engagements. In the United States alone, the U.S. Census Bureau estimates that over 2 million weddings occur annually, with engagement rings averaging USD 6,000 per purchase. Rings are also versatile, appealing to both genders and spanning various price points. The enduring demand for diamond rings, which account for 70% of bridal jewelry, further solidifies their leadership. This segment's importance lies in its ability to cater to universal traditions, making it a cornerstone of the jewelry industry.

The earrings segment is an emerging category and is projected to grow at a CAGR of 6.5% over the forecast period owing to the evolving fashion trends and increasing consumer spending on lightweight, everyday designs. The United Nations Conference on Trade and Development highlights that earrings account for 30% of online jewelry sales, reflecting their popularity among younger demographics. Additionally, the rise of lab-grown gemstones has reduced costs, making earrings more accessible. A report by the Indian Ministry of Commerce notes that earring exports grew by 18% in 2022, underscoring their global appeal. Their versatility, affordability, and suitability for gifting contribute to their rapid growth, positioning earrings as a key driver of market expansion.

By Material Insights

The gold segment led the market by holding 55.8% of the global market share in 2024. Gold is rooted in cultural traditions, particularly in Asia, where gold jewelry symbolizes wealth and prosperity. The Reserve Bank of India reports that gold imports surged by 25% in 2022, driven by festivals and weddings. Gold’s intrinsic value and liquidity further enhance its appeal, with the U.S. Geological Survey estimating that 50% of mined gold is used in jewelry fabrication. Its timeless allure and investment potential make gold a critical pillar of the jewelry industry.

The lab-grown diamonds segment is growing promisingly and is likely to be the fastest growing segment by witnessing a CAGR of 12.3% over the forecast period. The U.S. Department of Energy highlights that these diamonds require 70% less energy to produce compared to mined diamonds, aligning with sustainability trends. Additionally, the International Labour Organization notes that lab-grown diamonds cost 30-40% less, attracting budget-conscious consumers. A survey by De Beers reveals that 70% of millennials prefer lab-grown options due to ethical considerations. Their affordability, eco-friendliness, and rising acceptance among luxury buyers position them as a transformative force in the jewelry market.

By Distribution Channel Insights

The offline retail stores commanded the largest share of 60.3% in the global market in 2024 due to the tactile nature of jewelry purchases, where customers prefer examining pieces in person. Traditional stores also offer personalized services, such as custom designs and repairs, enhancing customer loyalty. The Indian Ministry of Commerce reports that standalone jewelry stores generate 45% of domestic sales, reflecting their cultural significance. Offline channels remain vital for building trust and catering to high-value transactions, ensuring their continued leadership despite the rise of e-commerce.

The online segment is the fastest growing segment and is predicted to register the highest CAGR of 15.2% over the forecast period. The United Nations Conference on Trade and Development highlights that cross-border e-commerce accounts for 20% of all online jewelry sales, driven by global accessibility. Advances in augmented reality enable virtual try-ons, addressing concerns about purchasing unseen items. The U.S. Small Business Administration notes that online platforms reduce operational costs by 25%, allowing competitive pricing. Millennials and Gen Z, who constitute 60% of digital buyers, fuel this growth. The convenience, variety, and innovation offered by online channels make them pivotal for future expansion.

By End-User Insights

The women segment was the dominating segment by end-user and accounted for 75.3% of global jewelry market share in 2024. Their dominance is driven by cultural norms and the symbolic role of jewelry in milestones like weddings and anniversaries. The U.S. Department of Labor highlights that women influence 85% of household purchasing decisions, including luxury goods. Additionally, the Indian Ministry of Commerce notes that bridal jewelry accounts for 60% of annual sales, primarily targeting women. Their affinity for self-adornment and gifting underscores their central role in sustaining market demand.

The men jewelry segment is gaining attention and is predicted to register the fastest CAGR of 8.7% over the forecast period. The United Nations Global Compact attributes this growth to shifting gender norms and increased acceptance of male adornment. The U.S. Census Bureau reports that men’s luxury spending rose by 20% in 2022, with bracelets and rings gaining popularity. Additionally, the European Commission highlights that urbanization and social media influence have normalized bold accessories among younger men. This trend reflects evolving perceptions of masculinity, positioning men’s jewelry as a lucrative opportunity for brands seeking untapped markets.

REGIONAL ANALYSIS

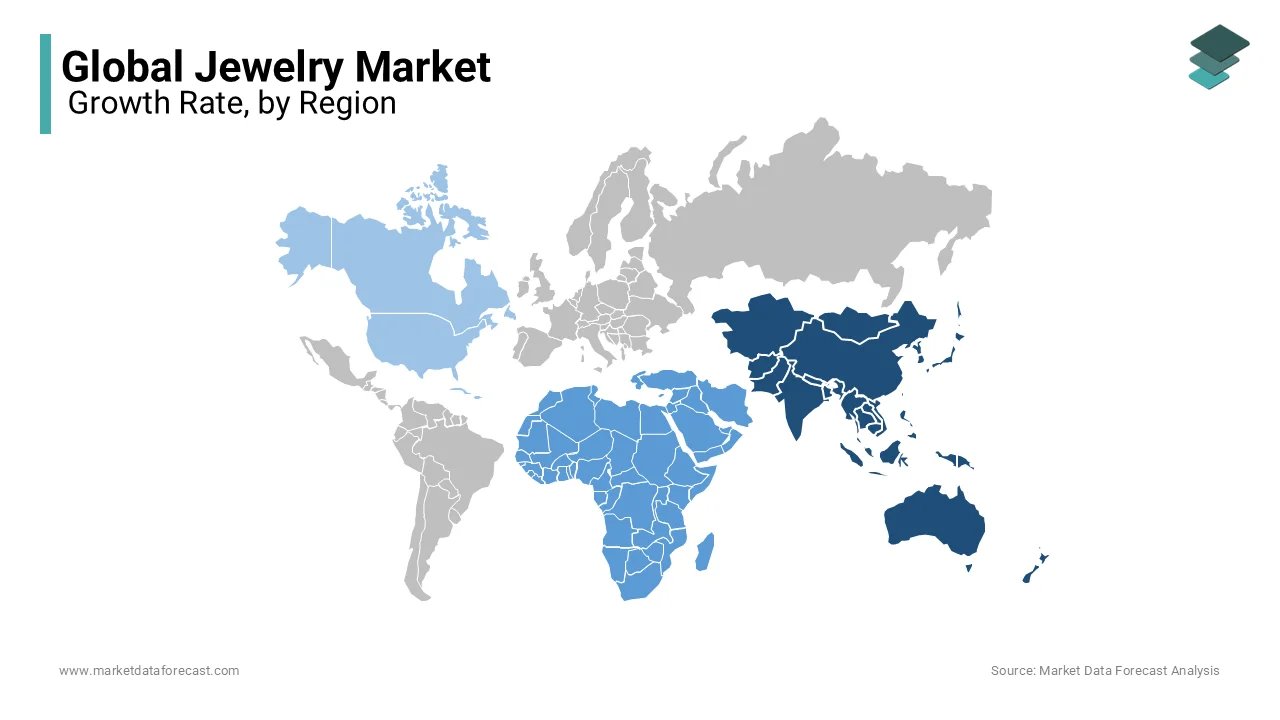

Asia-Pacific led the jewelry market globally by accounting for 55.1% of the global market share in 2024. The domination of the Asia-Pacific region in the global market is originated from cultural traditions deeply intertwined with gold and diamond jewelry, particularly in India and China. The Reserve Bank of India notes that gold imports in India reached 1,000 tons in 2022, driven by weddings and festivals. Similarly, China’s middle class, projected to reach 700 million by 2030 according to McKinsey & Company, fuels demand for luxury jewelry. The region's importance lies in its large population, rising disposable incomes, and strong cultural affinity for ornamental pieces, making it the backbone of the global industry.

The Middle East and Africa is swiftly emerging and is estimated to witness a CAGR of 7.8% over the forecast period . The United Nations Conference on Trade and Development highlights that the UAE alone accounts for 20% of global diamond trade, driven by Dubai’s position as a luxury hub. Additionally, African nations like South Africa and Botswana are major diamond producers, contributing to regional growth. The African Development Bank notes that artisanal mining employs over 10 million people, underscoring the sector’s economic significance. Rising urbanization and increasing affluence among younger demographics further propel demand. This region’s rapid expansion underscores its potential to reshape global jewelry dynamics.

North America is a mature and stable market for jewelry and is characterized by high consumer spending on luxury goods. The U.S. Census Bureau reports that the region accounts for approximately 20% of the global jewelry market, with annual sales exceeding USD 50 billion. Demand is driven by affluent consumers and a strong preference for diamond and platinum-based products. According to the U.S. Department of Commerce, online jewelry sales in the region grew by 18% in 2022, reflecting the increasing adoption of e-commerce. Additionally, the rise of lab-grown diamonds, which now constitute 15% of the U.S. diamond market, as noted by De Beers, highlights shifting consumer preferences toward ethical and affordable options.

Europe represents a significant but slower-growing segment of the global jewelry market. The region’s demand is fueled by its affluent population and cultural appreciation for luxury goods, particularly in countries like Italy, France, and the UK. The European Commission highlights that sustainable jewelry is gaining traction, with 65% of consumers prioritizing ethically sourced products. Additionally, the UK Office for National Statistics reports that bridal jewelry remains a key driver, accounting for 35% of annual sales.The region’s focus on craftsmanship, heritage brands, and eco-friendly practices will likely sustain steady growth in the foreseeable future.

Latin America is an emerging player in the global jewelry market, with Brazil and Mexico leading regional demand. The Brazilian Ministry of Economy reports that gemstone exports from Brazil grew by 12% in 2022, driven by international demand for emeralds and aquamarines. Similarly, Mexico’s jewelry market is bolstered by cultural traditions and rising middle-class incomes, with the Mexican National Institute of Statistics noting a 10% increase in domestic sales during festive seasons. However, economic volatility and currency fluctuations remain challenges, limiting faster expansion. The region’s rich mineral resources and growing urbanization present opportunities for long-term growth in the jewelry sector.

KEY MARKET PARTICIPANTS AND COMPETITIVE LANDSCAPE

Tiffany & Co, Pandora, Chow Tai Fook, Louis Vuitton SE, Richemont, GRAFF, Signet Jewelers Limited, H. Stern, Malabar Gold & Diamonds, Swarovski AG are playing dominating role in the global jewelry market.

The global jewelry market is highly competitive, with well-known luxury brands, independent designers, and online jewelry companies all vying for customers. Leading players like LVMH (Tiffany & Co., Bulgari), Richemont (Cartier, Van Cleef & Arpels), and Chow Tai Fook dominate the industry with their strong brand reputations, high-quality craftsmanship, and global store networks. These brands compete by offering exclusive designs, luxury experiences, and sustainability efforts to attract high-end customers.

At the same time, mid-range and affordable jewelry brands like Pandora, Swarovski, and Signet Jewelers provide stylish and budget-friendly alternatives, appealing to a wider audience. The rise of online jewelry brands and direct-to-consumer (DTC) companies has further increased competition. These digital-first brands use social media, customization, and ethical sourcing to connect with younger, trend-focused shoppers.

Jewelry demand is particularly strong in China, India, and the Middle East, where cultural traditions favor gold and diamond jewelry. Sustainability is also becoming a key factor, with more brands offering lab-grown diamonds, blockchain-based tracking, and ethical sourcing to gain customer trust. As consumer preferences shift, jewelry brands must constantly evolve to stay competitive in this fast-changing market.

STRATEGIES USED BY THE MARKET PLAYERS

Strategic Acquisitions & Expansion

Leading jewelry brands continuously acquire competitors and expand their physical presence to strengthen their market position. LVMH's acquisition of Tiffany & Co. for $15.8 billion in 2021 marked one of the largest luxury deals, significantly boosting its footprint in the North American and Asian jewelry markets. Similarly, Richemont expanded its luxury jewelry division by acquiring Buccellati, adding to its prestigious portfolio, which includes Cartier and Van Cleef & Arpels. Chow Tai Fook follows an aggressive expansion strategy, particularly in Mainland China, where it has opened thousands of retail stores to capture demand in lower-tier cities. This expansion strategy ensures that these brands maintain high visibility and accessibility to their target customers.

Digital Transformation & E-Commerce Expansion

As consumer behavior shifts towards online shopping, jewelry brands have increasingly invested in digital platforms and e-commerce integration. LVMH has incorporated Tiffany & Co. into its digital ecosystem, ensuring a seamless omnichannel experience. Richemont, recognizing the significance of digital luxury retail, owns a majority stake in YOOX Net-a-Porter (YNAP), a leading luxury e-commerce platform, providing customers with an upscale online shopping experience. Chow Tai Fook has implemented a Smart Retail Strategy, utilizing AI-driven recommendations and WeChat Mini Programs to engage with digital-savvy consumers, ensuring personalized and data-driven customer experiences.

Focus on Sustainability & Ethical Sourcing

With increasing consumer awareness of ethical practices, major jewelry brands are prioritizing sustainability and responsible sourcing. LVMH has integrated sustainability into its operations through the LVMH Initiatives for the Environment (LIFE) program, ensuring responsible sourcing of diamonds and precious metals. Richemont’s Cartier co-founded the Watch & Jewellery Initiative 2030, promoting industry-wide sustainability standards and ethical practices. Chow Tai Fook leverages blockchain technology for diamond traceability, allowing customers to verify the authenticity and ethical origins of their jewelry, reinforcing trust and transparency.

TOP 3 PLAYERS IN THE MARKET

LVMH Moët Hennessy Louis Vuitton (LVMH)

LVMH is a French multinational conglomerate renowned for its extensive portfolio of luxury brands. In the jewelry sector, LVMH owns prestigious brands such as Bulgari, Chaumet, and Tiffany & Co. In 2023, LVMH reported revenues of €86.2 billion, reflecting a 9% increase from the previous year. The company's jewelry and watches division has been a significant contributor to this growth, bolstered by strategic acquisitions and a strong global presence.

Compagnie Financière Richemont SA

Richemont, headquartered in Switzerland, is a prominent luxury goods holding company with a focus on jewelry and watches. Its portfolio includes esteemed brands like Cartier, Van Cleef & Arpels, and Buccellati. In the third quarter of the 2024/2025 fiscal year, Richemont reported a 10% increase in sales, reaching €6.2 billion. This growth was primarily driven by the jewelry division, which saw a 14% rise in sales, underscoring the enduring appeal of its high-end products.

Chow Tai Fook Jewellery Group

Founded in 1929, Chow Tai Fook is a Hong Kong-based jewelry company that has established a vast retail network, particularly in Greater China. As of December 31, 2024, the group operated 7,065 points of sale, with 6,904 in mainland China. The company's emphasis on product quality and authenticity has solidified its reputation, making it a preferred choice among consumers in the region.

RECENT HAPPENINGS IN THE MARKET

- In August 2024, an affiliate of Warburg Pincus divested a 2.36% stake in India's Kalyan Jewellers for approximately $155 million. The shares were acquired by Trikkur Sitarama Iyer Kalyanaraman, a major stakeholder in the company. This transaction reduced Warburg Pincus's holding in Kalyan Jewellers, reflecting a strategic portfolio adjustment.

- In August 2024, Blackstone-owned IGI filed for an initial public offering (IPO) worth up to $477 million. IGI, renowned for grading diamonds and gemstones, aims to capitalize on the growing demand for lab-grown diamonds, especially in India. The IPO includes the issuance of new shares and a partial exit for Blackstone, indicating a strategic move to monetize its investment.

MARKET SEGMENTATION

This research report on the global Jewelry market has been segmented and sub-segmented based on product, material, distribution channel, end-user, and region.

By Product

- Necklace

- Ring

- Earring

- Bracelet

- Others

By Material

- Platinum

- Gold

- Diamond

- Others

By Distribution Channel

- Offline Retail Stores

- Supermarkets & Hypermarkets

- Jewelry stores

- Others

- Online Retail Stores

By End-user

- Men

- Women

- Children

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What is the projected growth of the global jewelry market from 2025 to 2033?

The global jewelry market is expected to grow from USD 389.27 billion in 2025 to USD 566.86 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 4.81%.

2. Which factors are driving the growth of the jewelry market in emerging economies?

Rising disposable incomes in countries like India and China have led to increased consumer spending on luxury goods, including jewelry. For instance, India's gold jewelry demand surged by 15% in 2022 due to higher rural incomes and urban affluence.

3. How is sustainability influencing consumer preferences in the jewelry industry?

There is a growing demand for sustainable and ethically sourced jewelry, with over 60% of global consumers considering sustainability a key factor in their purchasing decisions. This trend is especially prominent among younger demographics.

4. What role does technology play in the evolving jewelry market?

echnological advancements, such as the integration of augmented reality (AR) for virtual try-ons and blockchain for supply chain transparency, are enhancing the consumer experience and building trust in product authenticity.

5. Which regions are anticipated to lead the jewelry market growth during the forecast period?

The Asia-Pacific region, particularly countries like China and India, is expected to dominate the market due to cultural significance and increasing middle-class populations. Additionally, Europe is anticipated to showcase significant growth, attributed to high per capita income and a strong inclination towards ornament products.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]