Global Jelly Market Size, Share, Trends & Growth Forecast Report Segmented By Product Type (Dietary Jelly, Fruit Jelly, Gourmet Jelly), Packaging Type, Distribution Channel, Consumer Demographics, Flavor Profile, And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Jelly Market Size

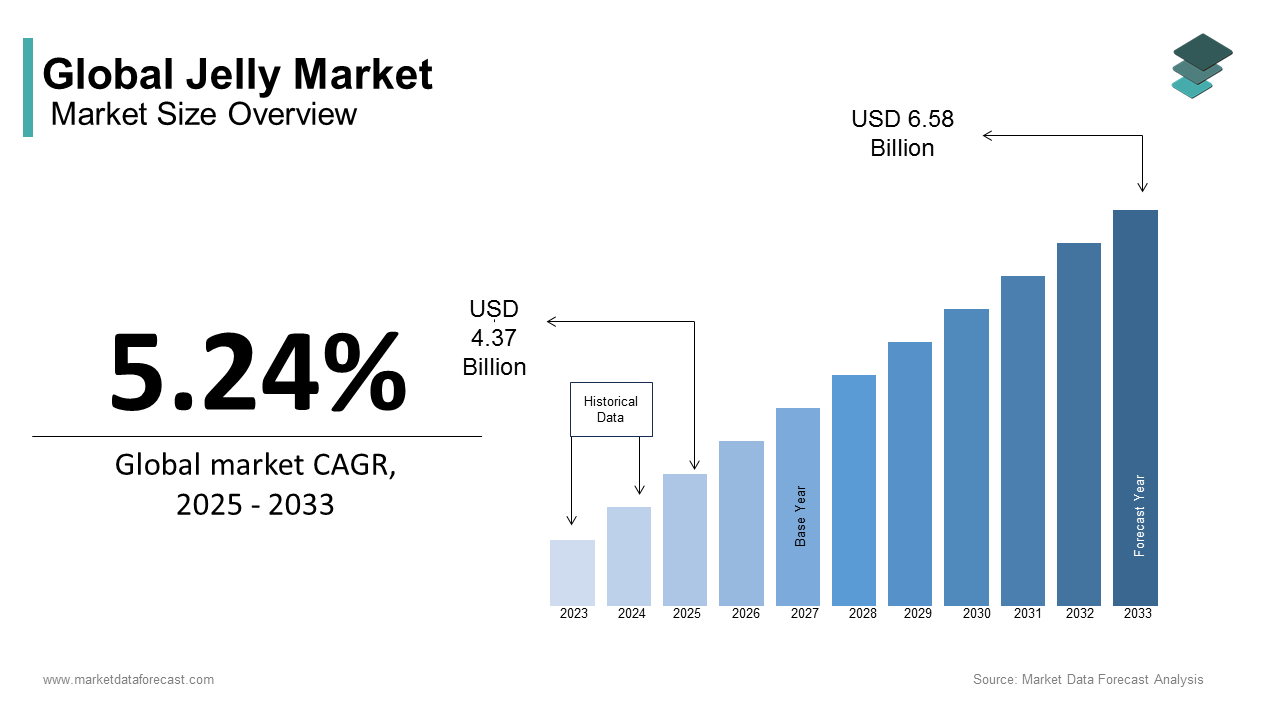

The global jelly market size was calculated to be USD 4.15 billion in 2024 and is anticipated to be worth USD 6.58 billion by 2033 from USD 4.37 billion In 2025, growing at a CAGR of 5.24% during the forecast period.

Jellies are gelatinous sweets such as fruit jellies, gummies, and preserves and are traditionally popular among children. The global jelly market has expanded to appeal to adults and health-conscious consumers due to the product innovation and shifting dietary preferences. The jelly market has seen an increasing demand for vegan, sugar-free, and functional ingredient-based jellies, reflecting broader consumer trends toward clean-label and health-oriented foods.

One of the key components in jelly production is gelatin, primarily sourced from animal collagen. According to the Food and Agriculture Organization (FAO), global gelatin production exceeds 400,000 metric tons annually, with a significant portion used in the confectionery sector. However, the rise of vegan and vegetarian lifestyles has driven the demand for plant-based alternatives such as pectin, agar-agar, and carrageenan. A report by the Plant Based Foods Association highlights that the global plant-based ingredient market has grown by over 27% in the past five years, largely due to increased consumer awareness of dietary choices.

Additionally, consumer preference for natural fruit-based jellies has driven an increase in fruit processing. The World Fruit Production Report states that global fruit processing volumes have risen by 6% annually, with tropical fruits such as mango, guava, and passion fruit being increasingly incorporated into jelly formulations. The packaging industry also plays a crucial role in the jelly market’s expansion. The Global Packaging Association estimates that flexible packaging solutions used in the confectionery sector have seen a 9% growth, driven by demand for eco-friendly, resealable, and lightweight packaging options.

MARKET DRIVERS

Health and Wellness Trends

The growing emphasis on health and wellness has significantly driven the jelly market, as consumers increasingly seek healthier snack options. According to a report by the U.S. Department of Agriculture (USDA), there has been a steady increase in demand for low-sugar and fortified food products, with sales of such items growing by approximately 10% annually over the past five years. Jelly manufacturers have responded by introducing variants with reduced sugar content and added nutrients like Vitamin C and calcium. A study published by the Food and Drug Administration (FDA) highlights that jellies made with natural fruit extracts and no artificial additives now account for nearly 20% of the total jelly market share in the United States. This aligns with findings from the USDA’s Economic Research Service, which notes that over 60% of consumers prioritize nutritional value when purchasing snacks, making health-focused jellies a key growth driver.

Innovation in Packaging and Convenience

Advancements in packaging technology have played a pivotal role in boosting the jelly market by enhancing convenience and shelf appeal. According to the Environmental Protection Agency (EPA), sustainable packaging solutions have seen a 20% increase in consumer preference since 2018, driven by the growing demand for eco-friendly products. Jellies packaged in portable, single-serve sachets have gained immense popularity, particularly among working professionals and school-going children. A report by the International Trade Administration (ITA) reveals that flexible packaging formats now contribute to approximately 35% of total jelly sales globally. Furthermore, the ITA emphasizes that innovative designs, such as stand-up pouches, reduce material waste by up to 15%, appealing to environmentally conscious buyers. These trends underscore how modern packaging meets both functional and environmental demands, driving market expansion.

MARKET RESTRAINTS

Rising Health Concerns Over Sugar Content

One major restraint in the jelly market is the growing health concern over high sugar content, which has led to stricter regulations and declining consumer interest. The Centers for Disease Control and Prevention (CDC) reports that excessive sugar consumption is linked to obesity and diabetes, with over 100 million Americans living with diabetes or prediabetes as of 2022. In response, the Food and Drug Administration (FDA) mandated clearer labeling of added sugars on packaged foods starting in 2020, including jellies. According to a USDA Economic Research Service report, sales of traditional high-sugar jellies have declined by approximately 8% annually over the past three years. Consumers are increasingly avoiding products perceived as unhealthy, forcing manufacturers to reformulate recipes. However, challenges such as maintaining taste and texture during reformulation have slowed innovation, making it difficult for the market to meet evolving health-driven demands effectively.

Environmental Impact of Packaging Waste

Another significant restraint is the environmental impact of jelly packaging, which has drawn criticism from regulators and consumers alike. The Environmental Protection Agency (EPA) states that containers and packaging account for 23% of landfill waste in the United States, with plastic packaging being a major contributor due to its low recyclability. A report by the EPA highlights that only 8.7% of all plastic waste was recycled in 2018, raising concerns about the sustainability of single-use jelly packaging. Additionally, the International Trade Administration (ITA) notes that countries like those in the European Union have implemented strict policies, such as the Single-Use Plastics Directive, banning certain non-recyclable packaging materials. These regulatory pressures, combined with shifting consumer preferences toward eco-friendly alternatives, pose a significant challenge for the jelly market to adopt sustainable solutions without increasing production costs.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

The jelly market has a significant opportunity to expand into emerging markets, where rising disposable incomes and urbanization are driving demand for convenience foods. According to the World Bank, the middle-class population in Asia is projected to grow by 50% by 2030, reaching over 2 billion people. This demographic shift presents a lucrative opportunity for jelly manufacturers to tap into new consumer bases. The U.S. Department of Agriculture (USDA) highlights that countries like India and China have seen an annual growth rate of 10% in imported snack foods, including jellies, due to their affordability and appeal to younger consumers. Additionally, the USDA notes that fortified and fruit-based jellies align well with local preferences for nutritious snacks. By leveraging cost-effective production and distribution strategies, companies can capitalize on this growing demand and establish a strong presence in these high-growth regions.

Adoption of E-Commerce Platforms

The rapid growth of e-commerce platforms offers another major opportunity for the jelly market to reach a wider audience and boost sales. The U.S. Census Bureau reports that online grocery and food product sales grew by 30% in 2021, driven by the COVID-19 pandemic and changing consumer shopping habits. This trend is expected to continue, with global e-commerce sales projected to reach $5.4 trillion by 2022, according to the International Trade Administration (ITA). Jelly manufacturers can leverage digital marketing strategies and partnerships with online retailers to enhance visibility and accessibility. For instance, the ITA highlights that small and medium-sized enterprises in the food industry have increased their online sales by 20% annually by adopting e-commerce. By investing in user-friendly packaging and targeted promotions, jelly brands can effectively cater to tech-savvy consumers and expand their market share.

MARKET CHALLENGES

Fluctuating Raw Material Costs

A major challenge for the jelly market is the volatility in raw material costs, particularly for sugar and fruit extracts, which are key ingredients. The U.S. Department of Agriculture (USDA) reports that global sugar prices have fluctuated by up to 15% annually over the past five years due to unpredictable weather patterns and geopolitical tensions affecting supply chains. Similarly, the USDA highlights that the cost of fruit concentrates, such as strawberry and mango, increased by 10% in 2022 due to reduced harvests caused by extreme weather events like droughts and floods. These price fluctuations increase production costs, squeezing profit margins for manufacturers. Smaller companies, in particular, struggle to absorb these costs without passing them on to consumers, which can reduce affordability. This instability poses a significant challenge to maintaining consistent pricing and profitability in the jelly market.

Intense Market Competition

Another significant challenge is the intense competition within the jelly market, driven by the presence of numerous local and international brands. The International Trade Administration (ITA) notes that the global jam, jelly, and preserves market is highly fragmented, with hundreds of players competing for market share. This saturation leads to price wars and reduced profit margins, especially for smaller brands. Additionally, the ITA reports that private-label products now account for approximately 20% of total sales in developed markets like Europe and North America, further intensifying competition. To differentiate themselves, companies must invest heavily in marketing, innovation, and branding. However, this requires substantial financial resources, which smaller firms often lack. As a result, many struggle to sustain growth amidst the dominance of established brands and the rising influence of private labels.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.24% |

|

Segments Covered |

By Product Type, Packaging Type, Distribution Channel, Consumer Demographics, Flavor profile, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

American Spoon, Bonne Maman, Braswell's, Crofters, Dickinson's, Duerr's, Hartley's, Hero Group, Knott's Berry Farm, and Mackays |

SEGMENTAL ANALYSIS

By Product Type Insights

The fruit jelly segment commanded the jelly market by accounting for 30.8% of the global market share in 2024. The domination of fruit jelly segment is majorly driven by its universal appeal, affordability, and widespread availability across regions. The USDA highlights that fruit jellies, particularly those made from popular fruits like strawberries, oranges, and apples, are favored for their natural sweetness and versatility in culinary applications. Additionally, the growing trend of health-conscious snacking has increased demand for fruit-based products perceived as nutritious. Fruit jelly's dominance underscores its role as a staple in households and its importance in driving overall market growth, making it a critical segment for manufacturers to focus on.

Whereas, the organic jelly segment is the rapidly growing segment in the jelly market and is likely to register a CAGR of 7.5% during the forecast period owing to the rising consumer awareness about health and environmental sustainability. More than 55% of consumers in developed markets, such as North America and Europe, are willing to pay a premium for organic products free from synthetic additives and pesticides. Furthermore, government initiatives promoting organic farming, such as subsidies and certification programs in the European Union, have boosted production. This growth highlights organic jelly's potential to cater to this demand and drive innovation in the processed food sector.

By Packaging Type Insights

The plastic containers segment dominated the jelly market by accounting for 40.6% of the global market share in 2024. The lead of the plastic containers segment is primarily due to their affordability, lightweight nature, and convenience for both manufacturers and consumers. The EPA highlights that plastic packaging is widely used in emerging markets, where cost-effectiveness and durability are prioritized. Additionally, advancements in recyclable plastics have improved their environmental appeal, making them a preferred choice for bulk and retail packaging. Plastic containers' dominance underscores their role in ensuring product safety and shelf life, making them critical for market penetration in regions with growing demand for affordable and accessible food products.

On the other hand, the single-serve packs segment is the swiftest-growing segment in the jelly market and is estimated to showcase a CAGR of 8.5% over the forecast period. Factors such as the rising consumer demand for portable, convenient, and portion-controlled snacks are driving the growth of the single-serve packs segment in the global market. The ITA notes that urbanization and busy lifestyles, particularly in Asia-Pacific and North America, have fueled the popularity of single-serve formats. Furthermore, the USDA reports that over 55% of millennials prefer on-the-go food options, boosting demand for compact packaging. While sustainability concerns persist, innovations in biodegradable single-serve packs, such as compostable materials, are addressing environmental challenges. This growth highlights the segment's importance in catering to modern consumption habits and expanding the jelly market's reach among younger demographics.

By Distribution Channel Insights

The supermarket segment led the jelly market by accounting for 40.5% of the global market share in 2024 due to their widespread presence, extensive product variety, and consumer trust in purchasing everyday essentials. The USDA highlights that supermarkets serve as a one-stop solution for households, offering competitive pricing and promotional discounts. Additionally, their robust supply chain networks ensure consistent availability of jellies across urban and rural areas. Supermarkets' dominance underscores their critical role in driving mass-market accessibility and maintaining steady sales volumes, making them indispensable for manufacturers aiming to maximize reach and brand visibility.

On the other hand, the online retail segment is estimated to register a CAGR of 9.5% over the forecast period owing to the increasing adoption of e-commerce platforms, particularly in regions like Asia-Pacific and North America. More than 65% of consumers now prefer online shopping for its convenience, wider product selection, and home delivery options. Furthermore, the U.S. Census Bureau reports that online grocery sales grew by 25% in 2021, driven by pandemic-induced shifts in consumer behavior. Innovations such as subscription models and eco-friendly packaging further enhance appeal. This growth highlights the segment's importance in reaching tech-savvy consumers and expanding market penetration globally.

By Consumer Demographics Insights

The kids segment was the largest consumer demographic in the jelly market by accounting for 30.3% of global market share in 2024. This dominance is driven by the appeal of jellies as a sweet, convenient, and affordable snack that parents frequently purchase for children. Additionally, marketing strategies targeting kids through colorful packaging and fun flavors have further solidified this segment's leadership. Kids' preferences play a pivotal role in driving repeat purchases, making them a critical demographic for manufacturers to focus on to sustain market growth and brand loyalty.

Whereas, the health enthusiasts segment is predicted to register a CAGR of 8.2% during the forecast period due to the rising health consciousness and demand for nutritious, low-sugar, and organic jelly options. Over 55% of health-conscious consumers actively seek products with clean labels and natural ingredients. Furthermore, the Centers for Disease Control and Prevention (CDC) reports that 50% of adults in the U.S. are now focused on healthier eating habits, boosting demand for health-focused jellies. Innovations like fortified and plant-based variants cater to this trend. This segment's growth underscores its importance in shaping product innovation and expanding the market's appeal among affluent, health-oriented buyers.

By Flavor Profile Insights

The sweet jelly led the market and captured 65.7% of global market share in 2024. The domination of the sweet jelly segment is primarily driven by its universal appeal and versatility, making it a staple in households worldwide. The USDA highlights that sweet jellies, often made from fruits like strawberries, grapes, and oranges, are favored for their natural sweetness and compatibility with breakfast items like bread and pancakes. Additionally, the widespread availability and affordability of sweet jellies contribute to their dominance. As a foundational flavor, sweet jelly's popularity ensures consistent demand, making it a critical segment for manufacturers aiming to maintain steady revenue streams and cater to diverse consumer preferences.

On the other hand, the spicy jelly segment is the fastest-growing segment in the jelly market and is predicted to register the fastest CAGR of 8.5% from 2025 to 2033. This growth is fueled by rising consumer experimentation with bold and unconventional flavors, particularly among millennials and Gen Z. A substantial portion of younger consumers are willing to try unique food products, driving demand for spicy variants infused with ingredients like chili or ginger. Spicy jelly's growth underscores its importance in appealing to adventurous eaters and expanding the market's reach into gourmet and specialty segments.

REGIONAL ANALYSIS

The Asia-Pacific region dominated the jelly market by accounting for 35.3% of the global market share in 2024. The domination of the Asia-Pacific region in the global market is primarily attributed to its large population, rising disposable incomes, and increasing demand for convenience foods. Countries like China and India are key contributors, with a combined annual consumption growth rate of 6%, according to the USDA. Urbanization in the region has fueled demand for affordable, ready-to-eat snacks, including jellies. Additionally, the region's focus on fortified and fruit-based variants aligns with local health trends. Asia-Pacific's dominance underscores its role as a hub for both production and consumption, making it critical to the global jelly market's growth trajectory.

The Middle East and Africa is the fastest-growing segment in the jelly market and is projected to expand at a CAGR of 7.8% during the forecast period. This rapid growth is fueled by urbanization, a youthful population, and increasing access to modern retail formats. The AfDB highlights that over 60% of Africa’s population is under 25, driving demand for affordable and appealing snacks like jellies. Furthermore, government initiatives to improve food security and promote local manufacturing have encouraged investments in the processed food sector. The region’s middle class, expected to grow by 50% by 2030, further boosts consumption. This growth highlights the region's potential as an emerging hotspot for jelly manufacturers seeking untapped markets.

North America represents a mature and stable segment of the jelly market. This growth is driven by increasing consumer demand for premium, health-focused products such as low-sugar, organic, and fortified jellies. The USDA highlights that over 55% of North American consumers prioritize nutritional value in their food choices, leading manufacturers to innovate with natural ingredients and clean-label formulations. Additionally, the region's well-established retail infrastructure supports steady sales through supermarkets and e-commerce platforms. While growth may be slower compared to emerging markets, North America remains a key revenue generator due to its high per capita spending on processed foods, ensuring sustained profitability for the jelly market.

Europe is another mature market for jellies. The region’s growth is fueled by a strong emphasis on sustainability and eco-friendly packaging, aligning with stringent environmental regulations. The European Commission notes that over 65% of European consumers prefer products with recyclable or biodegradable packaging, pushing manufacturers to adopt sustainable practices. Additionally, the demand for gourmet and artisanal jellies has risen among affluent consumers, particularly in Western Europe. Countries like Germany and France lead in innovation, focusing on organic and fruit-based variants. While growth is moderate, Europe’s focus on quality and sustainability ensures its importance in shaping global trends within the jelly market.

Latin America shows moderate but promising growth in the jelly market. This growth is driven by rising urbanization, economic recovery post-pandemic, and increasing disposable incomes, particularly in countries like Brazil and Mexico. The IDB highlights that the region’s young population is a key driver of demand for affordable and convenient snacks, including jellies. Additionally, the growing presence of international retailers and e-commerce platforms has improved product accessibility. While challenges like economic instability persist, government initiatives to support small-scale food producers are expected to boost local manufacturing and consumption, positioning Latin America as an important emerging market for jelly manufacturers.

KEY MARKET PLAYERS AND COMPETITIVE LANDSCAPE

Major Players of the global jelly market include American Spoon, Bonne Maman, Braswell's, Crofters, Dickinson's, Duerr's, Hartley's, Hero Group, Knott's Berry Farm, and Mackays

The global jelly market is highly competitive, with numerous key players striving to capture consumer attention through product innovation, branding, and distribution expansion. The competition is driven by the growing demand for confectionery products, particularly gelatin-based and fruit-flavored jellies, across different age groups. Established brands such as Fini, Roshen, and Vidal Golosinas dominate the market, leveraging their extensive distribution networks, strong brand recognition, and diversified product offerings.

Product differentiation is a major competitive factor, with companies continuously innovating by introducing sugar-free, organic, and exotic-flavored jelly products to cater to evolving consumer preferences. The rise of health-conscious consumers has also pushed brands to develop plant-based, vegan-friendly jellies using pectin instead of gelatin.

Global players face competition from regional and local manufacturers, who often offer cost-effective alternatives and target niche markets with unique flavors and localized branding. E-commerce and digital marketing have intensified competition, allowing smaller brands to expand their reach and challenge larger players.

The industry also sees strategic mergers, acquisitions, and partnerships as leading companies seek to expand their global footprint and enhance production capabilities. Sustainability efforts, such as eco-friendly packaging and ethical ingredient sourcing, are becoming key differentiators in the highly competitive jelly market.

TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Product Diversification and Innovation: Companies are expanding their product lines to include a variety of flavors, formulations, and packaging options to cater to diverse consumer preferences. This includes the development of sugar-free, organic, and exotic fruit jellies to appeal to health-conscious consumers and those seeking unique taste experiences.

Strategic Partnerships and Acquisitions: To enhance their market reach and capabilities, leading firms are engaging in partnerships and acquisitions. These collaborations enable companies to access new markets, leverage established distribution networks, and integrate advanced technologies into their production processes.

Sustainable and Ethical Practices: There is a growing emphasis on sustainability within the industry. Companies are adopting eco-friendly packaging solutions and implementing ethical sourcing practices to meet consumer demand for environmentally responsible products. This approach not only appeals to environmentally conscious consumers but also helps in building brand loyalty.

TOP 3 PLAYERS IN THE MARKET

Fini

Founded in 1971 by Manuel Sánchez Cano in Murcia, Spain, Fini has evolved into one of the world's leading confectionery companies. Specializing in gummy candies, marshmallows, popsicles, tubes, and other jelly-based products, Fini has established a strong global presence. Brazil stands as the company's primary market, with products available in over 85,000 points of sale, securing Fini's position as the market leader in the country. The company's commitment to innovation is evident through its expansion into health-oriented confectionery lines and strategic partnerships, such as the 2019 collaboration with Froneri to launch an ice cream line in Brazil.

Roshen Confectionery Corporation

Established in 1996, Roshen is a Ukrainian confectionery manufacturing group with facilities in Ukraine, Hungary, and Lithuania. The company produces over 350 types of confectionery products, including chocolate and jelly sweets, caramel, toffee, and biscuits. With an annual production volume of approximately 410,000 tonnes, Roshen exports to numerous countries across Europe, Asia, and North America. In 2023, the company reported revenues of €803 million, underscoring its significant role in the global jelly market.

Vidal Golosinas

Founded in 1963 in Molina de Segura, Murcia, Spain, Vidal Golosinas specializes in the production of liquorice and gummy candies. With over five decades of experience, the company produces approximately 50 million units daily and exports to more than 60 countries. Vidal is renowned for its innovative products, including filled jelly sweets with 3D designs, center-filled gummies, and pectin-filled sweet foams. The company's strongest markets include the UK, France, Portugal, and Spain, highlighting its extensive contribution to the global jelly market.

RECENT MARKET DEVELOPMENTS

- In December 2024, the U.S. Food and Drug Administration (FDA) announced that the European Union (EU) implemented Regulation (EU) 2023/2652, which took effect on November 29, 2024. This regulation mandates that all establishments importing apiculture products, including honey, beeswax, royal jelly, propolis, and pollen, into the EU be registered in the EU’s Trade Control and Expert System (TRACES).

- In December 2024, the UK government published an Import Information Note outlining updated requirements for importing honey, royal jelly, and other apiculture products for human consumption. The new regulations specify approved countries of origin, establishments, and necessary health certifications to ensure product quality and safety.

MARKET SEGMENTATION

This research report on the global jelly market has been segmented and sub-segmented based on product type, packaging type, Distribution Channel, Consumer Demographics, Flavor profile, and region.

By Product Type

- Dietary Jelly

- Low-sugar Jelly

- Organic Jelly

- Sugar-free Jelly

- Fruit Jelly

- Berry Jelly

- Citrus Jelly

- Mixed Fruit Jelly

- Gourmet Jelly

- Exotic Fruits Jelly

- Specialty Flavors Jelly

By Packaging Type

- Glass Jars

- Plastic Containers

- Single-serve Packs

- Squeeze Bottles

By Distribution Channel

- Convenience Stores

- Online Retail

- Specialty Stores

- Supermarkets

By Consumer Demographics

- Age Group

- Adults

- Kids

- Seniors

- Teenagers

- Health Consciousness

- Casual Consumers

- Dieters

- Health Enthusiasts

- Income Level

- High Income

- Low Income

- Middle Income

By Flavor Profile

- Bitter

- Sour

- Spicy

- Sweet

- Umami

By Region

- North America

- Europe

- The Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

1. Who are the key players in the jelly market?

The key players in the jelly market include major food manufacturers such as The J.M. Smucker Company, Kraft Heinz, Conagra Brands, Nestlé, and Dr. Oetker. These companies dominate the market with a wide range of jelly products catering to various consumer preferences.

2. What are the major factors driving the growth of the jelly market?

The growth of the jelly market is driven by increasing consumer demand for convenient and ready-to-eat food products, innovations in flavors and packaging, rising health-consciousness leading to demand for sugar-free and organic jelly, and expanding retail distribution channels.

3. How do manufacturers ensure the quality of jelly products?

Manufacturers ensure quality by sourcing high-quality ingredients, using advanced food processing technologies, adhering to food safety regulations, and conducting regular quality checks during production and packaging.

4. Which factors influence consumer preferences in the jelly market?

Consumer preferences are influenced by flavor variety, health benefits, price, brand reputation, packaging convenience, and availability in retail and online stores.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]