Japan Gaming Market Research Report By Game Type (Shooter, Action, Sports, Role Playing, and Others), Device Type, End-User, and Country, Industry Analysis on Size, Share, Trends & Growth Forecast From 2025 to 2033

Japan Gaming Market Size

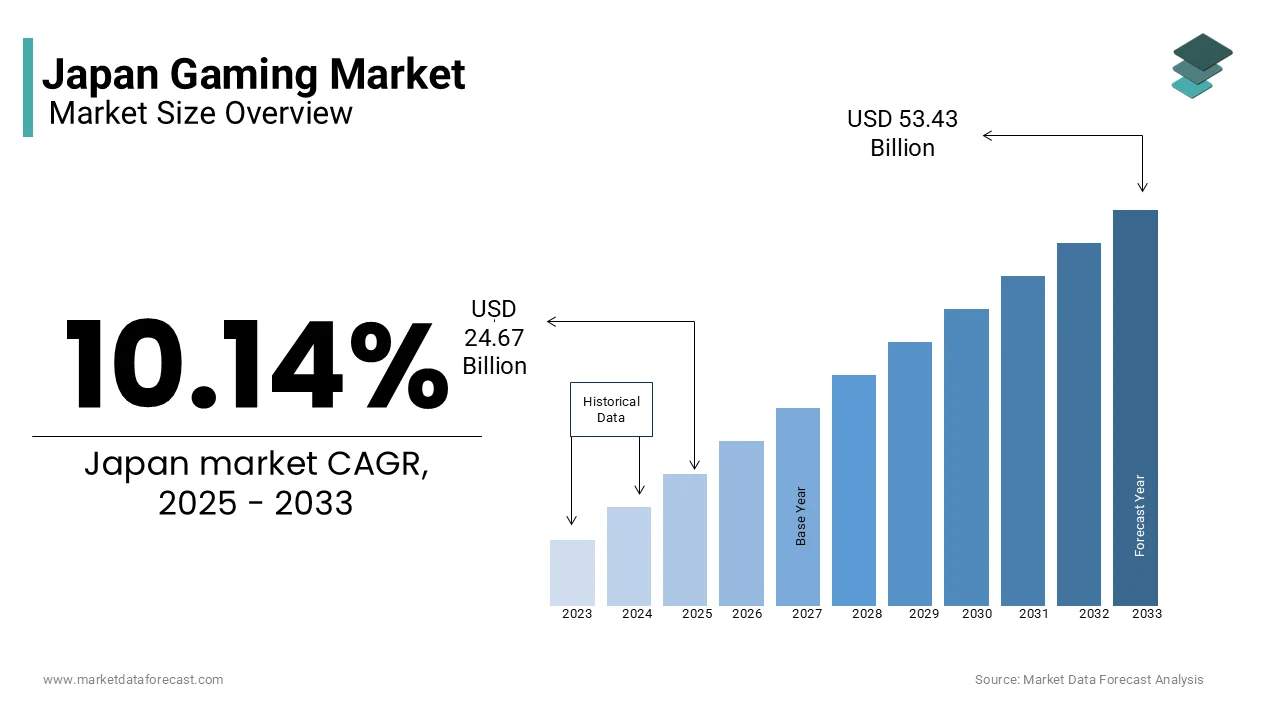

The gaming market size in Japan was worth USD 22.4 Bn in 2024. The Japanese market is estimated to grow at a CAGR of 10.14% from 2025 to 2033 and be valued at USD 53.43 billion by 2033 from USD 24.67 billion in 2025.

The Japanese gaming market is a powerhouse in the global gaming industry and is characterized by its unique blend of tradition and innovation. As per Newzoo, Japan ranks as the third-largest gaming market worldwide, with revenues surpassing $20 billion in 2023, driven by a highly engaged consumer base. Mobile gaming continues to dominate, accounting for approximately 60% of total revenue, reflecting the deep integration of smartphones into daily life. Titles like Fate/Grand Order and Puzzle & Dragons have maintained their stronghold, generating consistent income through microtransactions and seasonal events.

Console gaming also retains its prominence, bolstered by Nintendo’s enduring influence. The Nintendo Switch, for instance, sold over 5 million units in Japan in 2022 alone, underscoring the enduring appeal of hybrid gaming devices. According to Famitsu, physical game sales in Japan reached 45 million copies last year, with classic franchises like Final Fantasy and Dragon Quest contributing significantly to this figure. Additionally, the rise of esports has introduced fresh dynamics, with competitive gaming tournaments drawing increasing participation and viewership. As per data from the Japan Online Game Association, over 70% of gamers aged 15–34 engage in online multiplayer experiences, showcasing a shift toward community-driven gameplay. This combination of mobile dominance, console loyalty, and emerging trends positions Japan at the forefront of both regional and global gaming innovation.

MARKET DRIVERS

Esports Growth and Competitive Gaming Culture

The rise of esports in Japan has become a significant driver of the Japanese gaming market, fueled by increasing participation and viewership. Historically slower to adopt esports compared to other regions, Japan’s market is now catching up rapidly, with esports revenue projected to grow by 20% annually, reaching $90 million by 2024, according to Newzoo's Global Esports Market Report. This growth is driven by the popularity of competitive titles like Street Fighter, Splatoon, and Tekken, which align with Japan’s arcade gaming heritage. In 2023, the Evolution Championship Series (EVO), one of the largest fighting game tournaments globally, reported over 200,000 attendees and millions of online viewers, with Japanese players and games dominating the scene.

Cultural factors also play a role, as younger audiences embrace gaming as both entertainment and social activity. The Japanese government has actively supported this trend, recognizing esports as a legitimate industry and hosting events like the Japan Esports Championships. A survey conducted by the Japan Online Game Association revealed that over 60% of gamers aged 15–29 are interested in watching or participating in esports tournaments. With advancements in streaming platforms like Twitch and YouTube Gaming, esports content consumption in Japan grew by 35% in 2022 alone, as stated by Niko Partners.

Technological Innovation and VR/AR Adoption

Japan’s gaming market is heavily influenced by its leadership in technological innovation, particularly in virtual reality (VR) and augmented reality (AR). According to a report by PwC, Japan’s AR/VR gaming sector is expected to grow at a compound annual growth rate (CAGR) of 32%, reaching $1.8 billion by 2025. This surge is driven by consumer interest in immersive experiences, with Sony’s PlayStation VR series leading the charge. The PlayStation VR2, launched in early 2023, sold over 1 million units within two months, demonstrating strong demand for cutting-edge hardware.

Japanese developers are also pioneering unique AR applications, leveraging popular IPs like Pokémon GO to create engaging real-world interactions. Niantic, the developer behind Pokémon GO, reported that the game generated $1 billion in revenue from Japan alone in 2022, underscoring the country’s appetite for innovative gameplay. Furthermore, Japan’s robust tech infrastructure supports these advancements, with high-speed internet penetration exceeding 93% nationwide, as per data from the Ministry of Internal Affairs and Communications. By blending advanced technology with culturally relevant content, Japan continues to push boundaries in gaming, attracting tech-savvy consumers and driving market expansion.

MARKET RESTRAINTS

Aging Population and Declining Youth Demographics

Japan’s rapidly aging population poses a significant challenge to the gaming market, as the demographic most likely to engage in gaming is youth aged 15 to 29 years and the number of people of this age group is shrinking in Japan. According to data from Japan’s National Institute of Population and Social Security Research, the country’s population aged 15–29 declined by nearly 10% over the past decade, with projections indicating a further 15% reduction by 2030. This demographic shift has direct implications for gaming demand, particularly for genres reliant on younger audiences, such as fast-paced action or competitive multiplayer games.

The impact is already visible in certain segments. For instance, arcade gaming, once a cornerstone of Japanese gaming culture, has seen a steady decline, with the number of arcades dropping by 40% since 2010, as per the Amusement Machine Association of Japan. Additionally, while mobile gaming remains dominant, its growth rate has slowed to single digits in recent years due to the saturation of the youth market. Older gamers, while increasingly active, tend to favor casual or nostalgia-driven titles, limiting the diversity of revenue streams. The shrinking pool of young gamers also affects innovation, as developers may hesitate to invest in experimental projects targeting a diminishing audience. This demographic constraint threatens long-term sustainability unless the industry adapts by broadening its appeal to older age groups or diversifying its offerings.

Stringent Regulatory Environment and Cultural Barriers

The Japanese gaming market faces another major restraint in the form of stringent regulations and cultural barriers that hinder its global competitiveness. The country’s regulatory framework, particularly regarding gambling mechanics like loot boxes, has grown stricter in recent years. In 2022, Japan’s Consumer Affairs Agency issued guidelines requiring game developers to disclose drop rates explicitly, following public backlash over perceived pay-to-win models. While this move aligns with global trends, it has curtailed a significant revenue stream, with some publishers reporting a 20% decline in microtransaction revenues post-implementation, according to a survey by the Japan Game Rating Organization.

Cultural barriers further compound the issue. Japan’s gaming content often reflects niche domestic preferences, making it less accessible to international audiences. As per Niko Partners, only 30% of Japan’s top-grossing games achieve meaningful success outside the country, compared to over 60% for U.S. or Chinese titles. This insular focus limits export potential and exposes the industry to competition from Western and Asian markets. Additionally, Japan’s slower adoption of cloud gaming and subscription-based models reflects resistance to change within both regulatory bodies and consumer habits. These factors collectively constrain the industry’s ability to innovate and expand globally, creating a challenging environment for sustained growth.

MARKET OPPORTUNITIES

Expansion into Cloud Gaming and Subscription Services

Cloud gaming presents a transformative opportunity for Japan’s gaming market, driven by advancements in infrastructure and changing consumer preferences. According to a study by PwC, the global cloud gaming market is expected to grow at a compound annual growth rate (CAGR) of 41% between 2023 and 2027, with Japan positioned as a key player due to its robust internet connectivity and tech-savvy population. Over 93% of Japanese households have access to high-speed broadband, as per data from the Ministry of Internal Affairs and Communications, providing a strong foundation for cloud-based solutions.

Local companies like Sony are already capitalizing on this trend through services such as PlayStation Plus Premium, which offers streaming capabilities for classic and modern titles. In 2023, Sony reported that over 25% of its Japanese subscribers actively used cloud gaming features, signaling growing acceptance among domestic users. Additionally, collaborations with telecom giants like NTT Docomo are enhancing accessibility by bundling cloud gaming with mobile data plans. This synergy could unlock new revenue streams, particularly among urban professionals seeking convenience. With global cloud gaming revenues projected to reach $8 billion by 2025, Japan’s expertise in hardware and software development positions it to lead innovation while addressing local demand for seamless, high-quality experiences.

Cross-Industry Collaborations and IP Monetization

Cross-industry collaborations represent another significant opportunity for Japan’s gaming sector, leveraging the country’s rich intellectual property (IP) portfolio to diversify revenue sources. As per Deloitte, the global gaming merchandise and licensing market is expected to exceed $200 billion by 2025, with Japan’s iconic franchises like Mario, Pokémon, and Final Fantasy poised to capture a substantial share. The Pokémon Company International revealed that non-gaming revenue, including movies, trading cards, and apparel, accounted for nearly 60% of its $10 billion earnings in 2022, underscoring the potential of IP monetization.

Beyond traditional licensing, partnerships with sectors such as fashion, theme parks, and entertainment are gaining traction. For instance, Universal Studios Japan’s Super Nintendo World attracted over 5 million visitors within its first year, generating significant ancillary income. Similarly, Square Enix has partnered with luxury brands to create high-end collections inspired by Final Fantasy, appealing to affluent consumers. These collaborations not only expand brand reach but also attract demographics beyond traditional gamers. By integrating gaming IPs into broader cultural ecosystems, Japan can amplify its global influence while creating sustainable, multi-channel revenue models that transcend the limitations of software sales alone.

MARKET CHALLENGES

Intense Global Competition and Market Saturation

The Japanese gaming market faces significant challenges from intense global competition, as international developers increasingly dominate the market with innovative offerings. According to Newzoo, non-Japanese companies accounted for over 70% of the top-grossing games in Japan in 2023, reflecting a growing preference among Japanese consumers for globally popular titles like Genshin Impact and Fortnite. This trend highlights the difficulty domestic developers face in maintaining their foothold against well-funded foreign competitors who leverage advanced technologies and aggressive marketing strategies.

Market saturation further exacerbates the issue, particularly in mobile gaming, where Japan’s app stores are flooded with thousands of titles competing for attention. As per data from Sensor Tower, user acquisition costs in Japan’s mobile gaming sector have risen by 40% over the past three years, making it increasingly expensive for smaller developers to attract and retain players. Additionally, the dominance of established franchises like Monster Strike and Fate/Grand Order leaves little room for new entrants to break through. With limited differentiation and high barriers to entry, many local studios struggle to innovate or secure funding. This competitive pressure threatens the long-term viability of smaller developers, potentially leading to consolidation or stagnation within Japan’s gaming ecosystem.

Resistance to Emerging Business Models

The resistance of Japan to adopting emerging business models, such as subscription services and free-to-play ecosystems with ethical monetization practices, is another major factor that is challenging the growth of the Japanese gaming market. While global markets have embraced platforms like Xbox Game Pass and cloud gaming, Japan’s adoption remains sluggish. According to a report by Niko Partners, only 15% of Japanese gamers actively subscribe to gaming services, compared to over 40% in North America and Europe. This reluctance stems from entrenched consumer habits and skepticism toward recurring payments, which clash with traditional one-time purchase models.

Regulatory scrutiny further complicates this transition. In 2022, Japan’s Consumer Affairs Agency tightened regulations around loot boxes, requiring transparency in drop rates, which has led to a decline in microtransaction revenues for some publishers. Meanwhile, the slow rollout of 5G infrastructure—only 20% of urban areas have widespread access, as per government data—hinders the growth of cloud gaming and streaming services. These factors collectively impede Japan’s ability to keep pace with global trends, leaving its gaming industry at risk of falling behind more adaptive markets. Without addressing these structural and cultural barriers, Japan may struggle to remain competitive in an evolving global landscape.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

10.14% |

|

Segments Covered |

By Game Type, Device Type, End-User, and Region |

|

Various Analyses Covered |

Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Market Leaders Profiled |

Nintendo, Square Enix, Bandai Namco, Namco Bandai Games, Konami, SNK Corporation, Video Game Localization, Konami, Sony, Capcom, Altus and Taito |

SEGMENTAL ANALYSIS

BY Game Type Insights

By game type, the role-playing games (RPGs) segment dominated the Japanese gaming market with a share of 40.1% in 2024. This dominance of the RPG segment in the Japanese market is driven by the genre’s deep storytelling and character development, which align perfectly with Japanese gamers’ preferences. RPGs like Final Fantasy, Dragon Quest, and Persona have become cultural icons, consistently generating billions in revenue. For example, Final Fantasy XVI sold over 3 million copies in Japan within its first month of release, showcasing the enduring popularity of the genre. One key factor behind RPGs’ success is their ability to immerse players in expansive worlds filled with intricate narratives. According to Famitsu, over 65% of Japanese gamers prioritize storylines when choosing games, making RPGs a natural fit. Additionally, RPGs often feature customizable gameplay, appealing to both casual and hardcore audiences. The rise of hybrid RPGs, such as Genshin Impact, which combines action mechanics with traditional RPG elements, has further broadened the genre’s appeal. Sensor Tower reports that Genshin Impact generated $1.2 billion in revenue from Japan alone in 2022, highlighting the financial strength of RPGs. With their focus on storytelling and innovation, RPGs remain the most popular game type in Japan.

The shooter games segment is expected to be the fastest-growing segment in the Japanese gaming market, with a CAGR of 18.7% during the forecast period. The shifting consumer preferences and the global influence of competitive gaming are propelling the expansion of the shooter games segment in the Japanese market. While traditionally less popular in Japan, shooter games are gaining traction due to titles like Call of Duty: Warzone and Apex Legends, which emphasize fast-paced, multiplayer experiences. In 2023, Apex Legends recorded over 5 million active players in Japan, a 30% increase from the previous year, as stated by Electronic Arts. The rise of esports has increased the visibility of shooter games, with tournaments drawing massive audiences, which is one of the major factors boosting the growth of the shooting games segment in the Japanese market. Niko Partners reports that Japan’s esports viewership grew by 25% in 2022, with shooter games accounting for nearly 40% of competitive play. Advancements in hardware, particularly the PlayStation 5 and Xbox Series X, have enabled developers to deliver visually stunning and technically refined shooter experiences, which is also contributing to the growth of the shooter games segment in this country. Sony’s State of Play revealed that sales of shooter games on the PS5 increased by 50% in 2023 compared to the PS4 launch year. Lastly, cross-platform play has expanded accessibility, allowing Japanese gamers to compete globally. These dynamics position shooter games as a rapidly growing force in Japan’s gaming market.

By Device Type Insights

The mobile phone gaming segment had the leading share of 61.4% of the Japanese market during the forecast period. This growth is driven by the widespread use of smartphones, with over 95% of Japan’s population owning a mobile device capable of gaming, as reported by the Ministry of Internal Affairs and Communications. Mobile games are preferred for their convenience, allowing users to play anytime, anywhere, especially during commutes or short breaks. The popularity of mobile gaming is further fueled by the "gacha" monetization system, which encourages players to spend money on random rewards like rare characters or items. Games like Fate/Grand Order and Puzzle & Dragons have successfully adopted this model, generating billions in revenue annually. Additionally, mobile games often feature anime-inspired visuals and storytelling, which resonate strongly with Japanese gamers. Their ability to offer frequent updates and seasonal events keeps players engaged, contributing to sustained demand. Compared to other gaming devices, mobile phones provide an accessible and cost-effective way to enjoy gaming, making them the dominant choice in Japan.

On the other hand, the PC/MMO gaming segment is expected to be the fastest-growing segment in the Japanese gaming market and is expected to witness a CAGR of 22.1% during the forecast period. This growth is attributed to advancements in PC hardware and the increasing popularity of massively multiplayer online (MMO) games like Final Fantasy XIV Online and Genshin Impact. These games offer immersive, high-quality experiences that appeal to both casual and hardcore gamers. Other factors contributing to this rapid growth include the rise of cross-platform play, which allows gamers to switch seamlessly between devices and the growing influence of esports and live streaming platforms. According to Niko Partners, PC hardware sales in Japan increased by 30% in 2022 as more people invested in gaming-capable machines. Additionally, MMO games are designed for long-term engagement, with regular updates and expansions that keep players invested. Compared to traditional console gaming, PC/MMO gaming offers greater flexibility and access to global gaming communities, making it an attractive option for tech-savvy gamers in Japan.

By End-User Insights

By end-user, the male gamers segment accounted for the major share of the Japanese gaming market in 2024 due to a strong cultural affinity for gaming among men, particularly in genres like action, sports, and role-playing games (RPGs). Titles such as Final Fantasy, Dragon Quest, and Splatoon have traditionally resonated more with male audiences, contributing significantly to their market leadership. For example, Splatoon 3 sold over 3.45 million copies in Japan within its first three days of release, with males accounting for nearly 65% of its player base, as reported by Famitsu. One key factor behind this dominance is the alignment of gaming content with male preferences for competitive and high-energy gameplay. According to a survey by the Japan Online Game Association, over 70% of male gamers in Japan prioritize multiplayer and competitive features, which are heavily integrated into popular titles. Additionally, the rise of esports has further solidified male gamers’ influence, with shooter games like Apex Legends and Call of Duty: Warzone drawing significant male participation. Electronic Arts reported that male players made up 60% of Apex Legends’ active user base in Japan in 2023. With gaming deeply ingrained in male social culture, this segment continues to lead the market.

The female gamer segment is expected to grow at a promising CAGR in the Japanese market over the forecast period due to the increasing popularity of casual and mobile games, which appeal strongly to women. Titles like Animal Crossing: New Horizons and Puzzle & Dragons have seen significant traction among female players, with Animal Crossing: New Horizons selling over 7 million copies in Japan since its launch, as stated by Nintendo. The accessibility of mobile gaming and focus on bite-sized, engaging experiences align well with female preferences are driving the growth of the female segment in the Japanese market. A study by the Mobile Marketing Association revealed that over 60% of female gamers in Japan prefer mobile games due to their convenience and social features. Second, the gaming industry is increasingly developing content tailored to female audiences, such as narrative-driven RPGs and simulation games. Square Enix reported that 45% of Tears of the Kingdom’s Japanese players were female, reflecting a broader trend of inclusivity. Lastly, social media platforms like TikTok and Instagram have amplified gaming visibility among women, encouraging participation. These dynamics position female gamers as a rapidly growing demographic in Japan’s gaming landscape.

KEY MARKET PLAYERS

Companies playing a major role in the Japanese gaming market include Nintendo, Square Enix, Bandai Namco, Namco Bandai Games, Konami, SNK Corporation, Video Game Localization, Konami, Sony, Capcom, Altus and Taito.

Nintendo remains one of the most influential players in Japan’s gaming market, commanding a dominant position with its innovative hardware and beloved franchises. The company is best known for its hybrid console, the Nintendo Switch, which has sold over 25 million units in Japan since its launch in 2017, according to Famitsu. The Switch’s versatility as both a home console and portable device appeals to a wide audience, from casual gamers to hardcore enthusiasts. Nintendo’s product lineup includes iconic franchises like Super Mario, The Legend of Zelda, and Pokémon, which consistently top sales charts. For example, The Legend of Zelda: Tears of the Kingdom sold over 3 million copies in Japan within its first week of release, showcasing the enduring popularity of these IPs. Additionally, Nintendo has expanded into subscription services with Nintendo Switch Online, offering access to classic games and multiplayer features. The company’s strategy revolves around creating unique, family-friendly gaming experiences that leverage its proprietary hardware. By focusing on innovation, such as motion controls and touchscreen gameplay, Nintendo differentiates itself from competitors. Furthermore, its partnerships with third-party developers, including Square Enix and Capcom, have broadened its appeal. With plans to invest in cloud gaming and expand its global footprint, Nintendo continues to solidify its leadership in Japan’s gaming industry.

Sony Interactive Entertainment (SIE), a subsidiary of Sony Group, is another key player in Japan’s gaming market, renowned for its cutting-edge consoles and immersive gaming experiences. The PlayStation 5, launched in 2020, has been a major success, with over 5 million units sold in Japan by 2023, according to Sony’s official reports. Its advanced graphics, fast load times, and exclusive titles make it a favorite among core gamers. Sony’s portfolio includes critically acclaimed franchises like Final Fantasy, God of War, and Horizon Zero Dawn, which are often exclusive to PlayStation platforms. Titles like Final Fantasy XVI have generated significant revenue, with over 2 million copies sold in Japan alone during its first month. Additionally, Sony has embraced subscription-based models through PlayStation Plus Premium, which offers access to a vast library of games and streaming capabilities. Sony’s strategy focuses on delivering premium gaming experiences while expanding into digital ecosystems. The company has invested heavily in cloud gaming technologies and partnerships with indie developers to diversify its offerings. By prioritizing high-quality exclusives and fostering a strong community of loyal gamers, Sony maintains its stronghold in Japan’s competitive gaming landscape.

Square Enix is a powerhouse in Japan’s gaming market, particularly in the role-playing game (RPG) genre. Known for its narrative-driven games and iconic franchises, the company holds a significant market position. Titles like Final Fantasy, Dragon Quest, and Kingdom Hearts have become cultural phenomena, generating billions in revenue globally. In 2023, Final Fantasy XVI achieved record-breaking sales in Japan, selling over 3 million copies within its first month, as reported by Square Enix. Beyond traditional RPGs, Square Enix has diversified its portfolio to include mobile gaming and MMOs. Games like Final Fantasy XIV Online have gained immense popularity, with over 2.5 million active subscriptions in Japan, reflecting the growing demand for online multiplayer experiences. The company has also ventured into blockchain gaming and NFTs, exploring new revenue streams despite mixed reception. Square Enix’s strategy centers on storytelling excellence and technological innovation. By leveraging its expertise in crafting immersive worlds, the company continues to captivate gamers worldwide. Additionally, partnerships with Western studios and investments in emerging technologies like AI and VR position Square Enix as a forward-thinking player in Japan’s gaming market. Through a blend of tradition and innovation, Square Enix remains a dominant force in the industry.

STRATEGIES USED BY THE MARKET PARTICIPANTS

Focus on Exclusive Content and Iconic Franchises

One of the most effective strategies used by key players in Japan’s gaming market is the development and promotion of exclusive content and iconic franchises. Companies like Nintendo and Square Enix have built their success on beloved IPs that resonate deeply with Japanese audiences. For instance, Nintendo’s Super Mario and The Legend of Zelda franchises are cultural staples, while Square Enix’s Final Fantasy and Dragon Quest series are synonymous with high-quality storytelling. According to Famitsu, games from these franchises consistently rank among the top-selling titles in Japan, with Tears of the Kingdom and Final Fantasy XVI each selling over 3 million copies in their debut weeks. By focusing on exclusivity, these companies create a strong competitive edge. Sony Interactive Entertainment (SIE) has similarly capitalized on this strategy with PlayStation exclusives like God of War and Horizon Zero Dawn. These games not only drive console sales but also foster brand loyalty. To strengthen their position, companies invest heavily in high-budget productions, cutting-edge graphics, and immersive narratives, ensuring their IPs remain relevant in an increasingly competitive market.

Expansion into Subscription Services and Digital Ecosystems

Another major strategy is the expansion into subscription-based models and digital ecosystems, which has become a cornerstone for revenue growth. Nintendo and Sony have both launched subscription services—Nintendo Switch Online and PlayStation Plus Premium, respectively—to provide gamers with access to a library of games, multiplayer features, and exclusive content. According to Sony’s official reports, PlayStation Plus subscriptions in Japan grew by 20% in 2023, driven by the inclusion of cloud gaming and classic titles. This shift toward digital ecosystems allows companies to establish recurring revenue streams while enhancing user engagement. Additionally, it enables them to collect valuable data on player preferences, which can inform future game development and marketing strategies. By bundling subscription services with hardware purchases or offering tiered pricing models, these companies make their platforms more attractive to a wider audience. This strategy not only strengthens their market position but also aligns with global trends toward digitalization and convenience.

Investment in Emerging Technologies and Innovation

Key players in Japan’s gaming market are also investing heavily in emerging technologies such as cloud gaming, virtual reality (VR), and artificial intelligence (AI) to stay ahead of the curve. Sony has been a pioneer in this area, leveraging its expertise in hardware to develop advanced VR headsets and cloud gaming solutions. The PlayStation VR2, launched in 2023, sold over 1 million units in Japan within two months, underscoring the growing demand for immersive gaming experiences. Similarly, Square Enix has explored blockchain gaming and NFTs, despite facing some backlash, as part of its efforts to innovate and diversify revenue streams. According to PwC, the global cloud gaming market is expected to grow at a CAGR of 41% through 2027, and Japanese companies are positioning themselves to capitalize on this trend. By integrating these technologies into their offerings, companies aim to enhance gameplay experiences, attract tech-savvy consumers, and differentiate themselves from competitors. This forward-thinking approach ensures they remain relevant in an evolving industry.

Localization and Cultural Relevance

Localization and cultural relevance are critical strategies for strengthening the market position in Japan. Japanese gamers have unique preferences, such as a love for anime-inspired visuals, intricate storylines, and social gaming elements. Companies like Square Enix and Nintendo excel at tailoring their games to meet these expectations. For example, Animal Crossing: New Horizons incorporates seasonal events and Japanese holidays, making it highly relatable to local audiences. According to Nintendo, the game sold over 7 million copies in Japan, driven by its cultural resonance. Additionally, partnerships with local developers and influencers help companies deepen their connection with Japanese consumers. By prioritizing cultural nuances and creating region-specific content, these players ensure their products remain appealing and accessible to domestic audiences, further solidifying their dominance in the market.

Strategic Partnerships and Cross-Platform Play

Finally, strategic partnerships and cross-platform play have emerged as powerful tools for expanding reach and enhancing user experience. Sony and Nintendo have collaborated with telecom providers like NTT Docomo to bundle gaming services with mobile data plans, making gaming more accessible. Similarly, Square Enix has partnered with Western studios to co-develop games, blending global appeal with Japanese craftsmanship. Cross-platform play is another growing trend, enabling gamers to switch seamlessly between devices. Titles like Final Fantasy XIV Online and Apex Legends support cross-platform functionality, attracting a broader audience. According to Electronic Arts, cross-platform play increased Apex Legends’ active user base in Japan by 30% in 2023. By embracing collaboration and flexibility, key players are able to adapt to changing consumer behaviors and strengthen their foothold in the market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 1200

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com