Global Jams and Preserves Market Size, Share, Trends & Growth Forecast Report By Product Type (Jams, Marmalade, Honey, Sweet Spreads And Others), Flavor Type (Blackberry, Mango, Strawberry, Apricot, Grape, Raspberry And Others), Distribution Channel (Supermarket/Hypermarket, Grocery Stores, Wholesale, Online And Others), And Region (North America, Europe, APAC, Latin America, Middle East And Africa), Industry Analysis From 2025 To 2033

Global Jams and Preserves Market Size

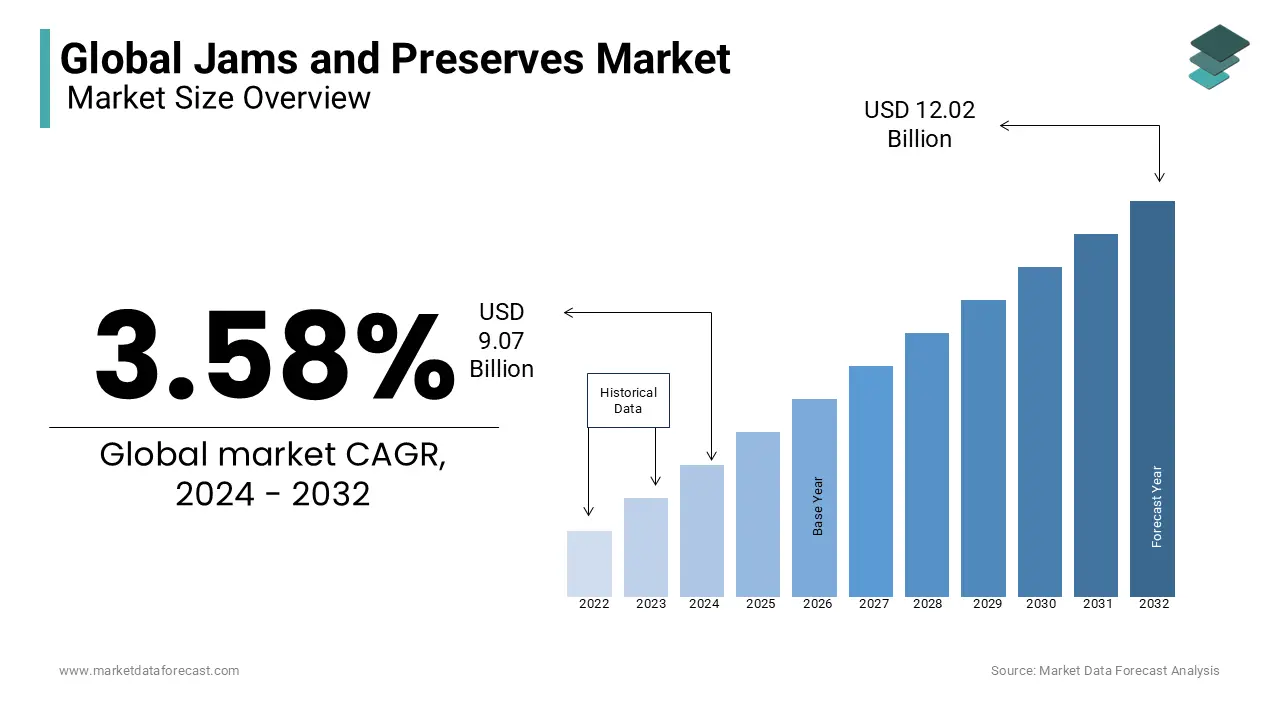

The global jams and preserves market size was worth USD 9.07 billion in 2024 and is predicted to reach USD 12.44 billion by 2033 from USD 9.39 billion in 2025, growing at a CAGR of 3.58% between 2025 to 2033.

As consumers focus on healthy lifestyles, the use of jams and preserves has increased over the years. These products have become a basic requirement in the manufacture of other food products such as cookies, smoothies, cakes, sandwiches, salads, etc. The companies that make these products focus on increasing their fruit content and making their products with sugar to make them attractive to consumers. The increase in the demand for the use of natural and organic ingredients in the preparation of jams and preserves is expected to increase the jams and preserves market growth.

MARKET DRIVERS

With the growing demand for gourmet varieties of jams and preserves, there will be a positive outlook in the years to come. The market for fruit jams, jellies, and preserves is driven by the convenience of food supplements, the preference for ready-to-use products, different distribution channels, changes in lifestyle and food preferences due to urbanization, and the popularity of various flavored food ingredients. Changes in eating habits, changes in consumer taste preferences, and growing demand for organic foods drive the growth of global jams and preserve market. Consumers recognize that gourmet jams and preserves are an indulgent luxury and are, therefore, widely used as gifts. Also, as disposable income increases, consumers not only want to try new products but are also willing to pay higher prices for premium products. The growing demand for natural and organic products is one of the key trends stimulating the growth prospects of this market during the forecast period. The increasing popularity of natural products has led farmers to increase the prices of their products even more if their products are certified organic. This type of farming can use advanced ecological approaches to better manage its fields and crops.

Also, organic farming is a safe growing method because it does not use pesticides or toxic chemicals. This has led many farmers to switch to organic farming. Additionally, consumers recognize that organic foods provide better nutritional benefits than non-organic foods, driving the growth of this market for years to come. However, with growing health problems, sugar is being replaced by other alternatives, such as artificial sweeteners, fruit concentrates, etc., when low-sugar and sugar-free jams, jellies, and preserves are prepared. Regular jam contains large amounts of sugar, which helps with shelf life, flavor, and texture. Additionally, fruits like raspberries and blueberries are infused with special ingredients like spices, herbs, honey, and chia seeds to produce low-sugar, sugar-free jams, jellies, and preserves. Since low-carb and low-fat diets are prevalent throughout the world, consumers are constantly looking for healthy, tasty, and convenient food options, such as low-sugar and low-fat jams, jellies, and preserves. The convenience of buying such products in stores near you is associated with a constant growth rate. Regular jam contains a large amount of sugar, which helps improve shelf life, taste, and texture. However, as health problems increase, sugar is low in sugar and is being replaced by alternatives such as artificial sweeteners and fruit concentrates for making sugar-free jams, jellies, and preserves.

Factors such as a greater preference for ready-to-eat foods, easy availability, and a changing lifestyle drive sales in the marketplace. Ready-to-eat food is preferred to traditional options as people adopt a busy lifestyle. The high cost of raw materials such as fruit. In mass production processes, some substandard products are very likely to pass the final check. Consumer confidence in a particular brand can be broken by misplacing the product. These mistakes are costly to the market. There are many instances where reliable brands have been called into question due to a poor-quality batch. In addition, the high calorie and nutritional content of these foods leads consumers to these options. Increasing urbanization has a direct impact on jams, jellies, and the preservation of the market. The sale of bread also affects the sale of these products. The higher the sale of bread, the greater the expected growth of this market. As a result, consumers are demanding jams and preserves with improved mortgage, low-fat, and other health-promoting properties.

MARKET RESTRAINTS

Increasing awareness of the damage caused by certain chemicals in preservatives is also a major obstacle to market growth. The main limitations are the growing awareness of health among populations such as obesity, diabetes, etc., and the potential for alternative types of spread in the jams and preserves market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.58% |

|

Segments Covered |

By Type, Distribution Channel, Flavour Type And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bonne Maman, B&G Foods, Inc., Conagra Brands, Inc., The Hain Celestial Group, Inc., F. Duerr& Sons, The JM Smucker Company, Hindustan Unilever Limited, Braswell's, Welch's, Kraft Heinz Company, RochakAgro Food Products Pvt Ltd, Murphy Orchards, Wilkin & Sons Ltd, The Nashville Jam Co, The Hershey Company, WT Lynch Foods Limited |

SEGMENTAL ANALYSIS

By Product Insights

The jams segment is leading with the highest share of the market. Choosing the right kind of jams with clean-label ingredients poses huge health benefits. Rising awareness among people about clean-label ingredients is exceptionally inclined to boost the growth rate of the market. The growing tendency to eat healthy foods that do not take much time to cook, especially among working women, is emphasizing the growth rate of the market.

Honey segment is likely to hit the highest CAGR by the end of the forecast period. Nutritional food like honey plays an important role in healthy diet options. Many diabetic people depend on food products that are particularly made with honey, which helps in diabetes management. Therefore, this segment is leading with the highest growth opportunities for a few years and is likely to have a prominent flow throughout the forecast period.

By Distribution Channels Insights

The supermarkets/hypermarket segment accounted for the dominant share of the market. Wide expansion of this distribution channel is more likely in urban cities that provide convenient and flexible access to customers, enhancing the market’s growth rate. Promoting newly launched products through this channel is easy, and top companies are taking advantage of expanding their product portfolio through this.

The online segment is gearing up to hit the highest CAGR owing to the launch of many food delivery applications that are reaching out to customers in innovative ways. The growing prominence of cloud kitchens in emerging countries like India and China is mostly to elevate the growth rate of this segment. According to various reports, India is home to more than 3500 cloud kitchens, where food can be delivered to customers' doorsteps through applications.

By Flavour Type Insights

The grape segment is ruling with the largest share of the market, whereas mango is rising with the dominant growth rate from the past few years. The rapid adoption of advanced technologies in F&B industries is creating huge opportunities for innovative product launches according to the customers' preferences for flavors. The growing awareness among the public to rely on healthy eating habits is making the top companies launch high-quality products only by using quality ingredients.

REGIONAL ANALYSIS

The North American jam and preserves market is expected to post a compound annual growth rate of 2.8% during the conjecture period. North American jam, jelly, and canning manufacturers use boiled, ripe fruits and sugar substitutes like pectin to make their products more colorful and flavorful. The market for jams and preserves has increased as the demand for practical foods has increased. In North America, there is a growing demand for nutritious, innovative, healthy, and organic jams, jellies, and preserves. It has been observed in the market and is a transition from common sweet preserves, jellies, and jams to other varieties such as sweet and spicy, sweet and smoky, sweet and spicy. Various macroeconomic factors and domestic market forces will determine the growth and development of demand patterns in the emerging countries of Asia-Pacific, Latin America, and the Middle East. It is a tradition in many European countries to consume jams and preserves with bread for breakfast. Also, many consumers mix it with a variety of dishes such as smoothies, salads, and desserts. These factors will drive the growth prospects of this market in Europe in the next four years. France is a major contributor in terms of consumption, while Germany and the United Kingdom are two other major countries. Asia and Hispanics are among the top trends affecting jam product innovation.

KEY MARKET PLAYERS

Bonne Maman, B&G Foods, Inc., Conagra Brands, Inc., The Hain Celestial Group, Inc., F. Duerr& Sons, The JM Smucker Company, Hindustan Unilever Limited, Braswell's, Welch's, Kraft Heinz Company, RochakAgro Food Products Pvt Ltd, Murphy Orchards, Wilkin & Sons Ltd, The Nashville Jam Co, The Hershey Company, and WT Lynch Foods Limited are a few of the prominent players in the global jams and preserves market.

RECENT HAPPENINGS IN THE MARKET

- B&G Foods has established a strategic partnership with a third-party logistics provider to manage most warehousing and distribution functions in the United States.

- JM Smucker planned to build a manufacturing plant in Colorado that produced peanut butter and jam to expand his business in the United States.

MARKET SEGMENTATION

This research report on the global jams and preserves market has been segmented and sub-segmented based on product, distribution channel, flavor type & region.

By Product

- Jams

- Marmalade

- Honey

- Sweet Spreads

- Others

By Distribution Channels

- Supermarkets/Hypermarket

- Grocery Stores

- Wholesale

- Online

- Others

By Flavor Type

- Blackberry

- Mango

- Strawberry

- Apricot

- Grape

- Raspberry

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

1. What factors drive consumer preferences in the jams and preserves market?

Factors such as taste, texture, fruit content, sweetness level, health attributes (e.g., natural ingredients, low sugar), brand reputation, price points, convenience (e.g., easy-to-open packaging, portion control), and marketing strategies (e.g., storytelling, sustainability initiatives) influence consumer choices in the jams and preserve aisle.

2. What is the market size and growth trends of the jams and preserves industry?

The market size is influenced by factors such as consumer demand for natural and artisanal products, health consciousness leading to preference for low-sugar or no-sugar-added options, and innovations in flavor combinations and packaging formats. Growth trends also reflect the expansion of the breakfast foods and bakery markets.

3. What are the packaging options available for jams and preserves?

Jams and preserves are commonly packaged in glass jars, plastic containers, squeeze bottles, and single-serve portion packs (e.g., sachets or cups). Packaging may vary based on product type (e.g., premium artisanal vs. mass-market) and target market preferences.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]