Global IT Outsourcing Market Size, Share, Trends, & Growth Forecast Report By Service Model (Software as a Service (SaaS), Platform as a Service (PaaS), and Infrastructure as a Service (IaaS)), Implementation (Public, Private, and Hybrid), Business Size (Small and Medium, Large), Industry (Banking, Financial Services, and Insurance (BFSI), IT & Telecommunications, Retail, Healthcare, Energy and Public Services, and Others), & Region - Industry Forecast From 2025 to 2033

Global IT Outsourcing Market Size

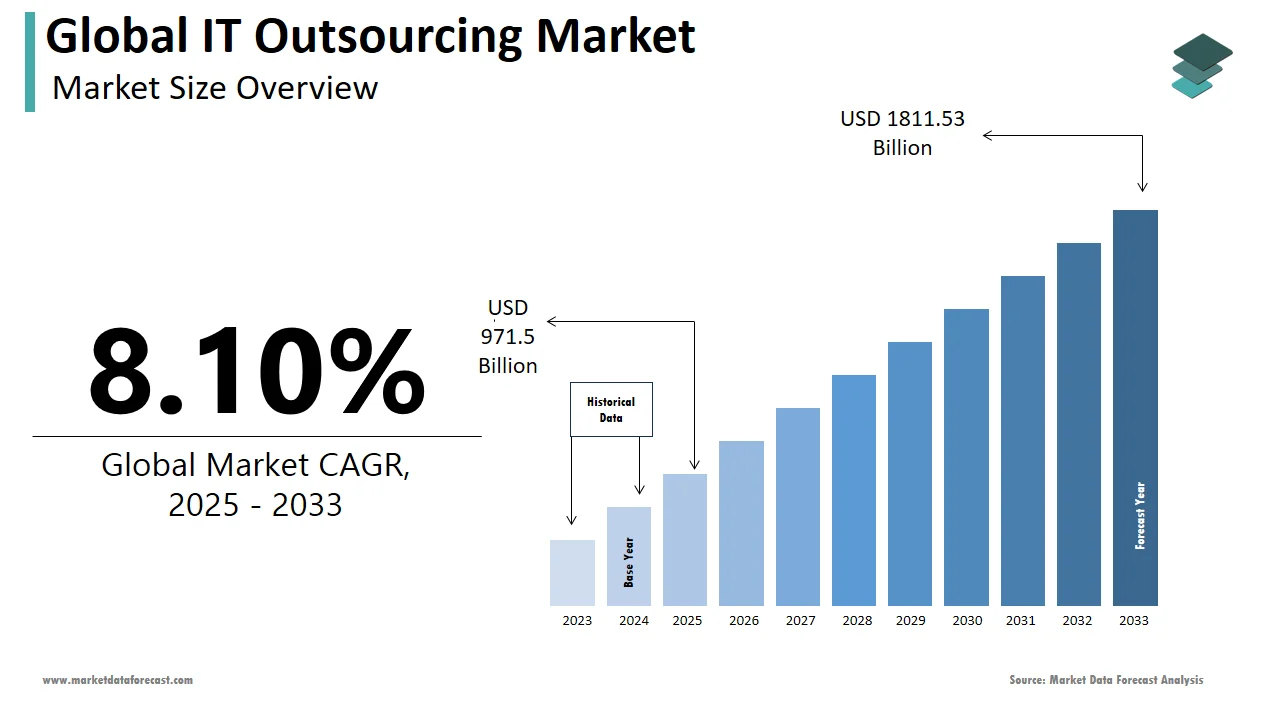

The global IT outsourcing market was valued at USD 898.7 billion in 2024. The global market is projected to reach USD 971.5 billion in 2025 and USD 1811.53 billion by 2033, growing at a CAGR of 8.10% during the forecast period.

Software development and IT outsourcing continue to propel despite a decline in external hiring in other segments like recruitment, BPO, etc. As per a 2024 survey, 50 per cent of customers opted not to increase their number of outsourced activities another 42 per cent refused to do so in the next 12 to 24 months and only 8 per cent said that they would increase. Currently, most companies hire contractors for IT support, followed by software application & development. Moreover, financial institutions and establishments i.e. 62 per cent are at the forefront of contracting out their operations and technology organisations are at the second spot with 32 per cent.

MARKET DRIVERS

The rising demand for improved digitalisation and productive digital solutions and the growing application of the Internet of Things and their incorporation with different platforms are driving the IT outsourcing market forward.

Presently, digital technologies have secured their position throughout every sector. Customers and other end-users have completely adopted online applications in their daily lifestyles, forcing companies to make changes in their sales funnel, integrate modern technologies, and optimize their activities. Today, outstanding client service, customer relationship management (CRM), data analytics, sales improvement, and ROI with automation all need IT. This amplifies the complexity level, which in turn pushes the other industry players to hire external contractors.

Most companies understand the significance of having an ecosystem of IoT devices, which is another factor propelling the growth of the IT outsourcing market. For all the associated purposes, IT expenditure in 2023 was around 4.6 trillion dollars worldwide, and considering this industry pattern, it is estimated to cross 5.1 trillion dollars in 2024. This surge in budget will boost the market value in the coming years.

Additionally, roughly 63 per cent of the world’s IT subcontracting is made of three categories: web hosting, software development outsourcing and administration. Therefore, all the factors are accelerating the market expansion.

MARKET RESTRAINTS

Communication problems, cultural differences, lack of control over the team and processes, and cost management are decreasing the growth rate of the IT outsourcing market.

The lack of proper communication is one of the prime issues related to contracting out IT operations. Cultural variations, different time zones, and language barriers are causing project delays, misconceptions, confusion, and total dissatisfaction with the external contractor and making effective communication with the offshore teams tough.

Another factor often ignored by many is cultural differences and beliefs. This is a major barrier to the market expansion. Also, it creates misinterpretations and errors because of different communication styles and company practices.

MARKET OPPORTUNITIES

The growing threat or attack vectors are presenting potential prospects for the IT outsourcing market growth in the projection period.

This needs specialised services and professionals to mitigate the risks. Moreover, the IT sector is in the middle of a momentous invention cycle that is on par with the emergence of home internet access and smartphones. The demands emphasizing the IT hiring team have reached a high level. There is an urgent need to manage the staggering amount of transactions at any time. Also, the pace at which these transactions are being carried out to fulfil the mounting requirements is accelerating. This opens a huge opportunity for the market players to strengthen their industry position.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.10% |

|

Segments Covered |

By Service Model, Implementation, Business Size, Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BMC Software Inc., Hewlett Packard Enterprise Company, IBM Corporation, Red Hat Inc., VMware Inc., Accenture plc, Adaptive Computing Enterprises Inc., CA Technologies, Cisco Systems Inc., Citrix Systems Inc., CloudBolt Software Inc., Conviture Inc., CSC Computer Sciences Limited, Dell EMC, Egenera Inc., Embotics Corporation, GigaSpaces Technologies Inc., Micro Focus International plc, and Others. |

SEGMENTAL ANALYSIS

By Service Model Insights

The Software as a Service (SaaS) segment is expected to outpace other sub-categories in the IT outsourcing market during the forecast period. The fact that past few years have witnessed increased SaaS expenditure surpassing traditional software investments with more than 64 per cent of companies selecting this against about 34 per cent choosing on-premise. As per the projections, the segment revenues are predicted to spike up to 282 billion dollars in 2024 and further rise to over 374 billion dollars by 2028. In addition, possibly, there is a strong trend among enterprise software vendors to phase down perpetual licenses entirely. However, high acquisition costs versus renting may affect the SaaS segment’s market growth rate.

By Implementation Insights

The hybrid segment is dominating the IT outsourcing market and is anticipated to grow at a higher CAGR during the forecast period. This can be attributable to the technological developments and breakthroughs that enhance the product’s performance and position it as the most broadly used downstream application. In addition, the ever-growing demand from large enterprises is fuelling the adoption of hybrid infrastructure outsourcing services. Furthermore, because of the sharply rising implementation of artificial intelligence and related data training, there is predicted to be an even greater emphasis on state-of-the-art data management in the coming years. Also, they are progressively favored for their capacity to store huge data sets and closely incorporate them into the company’s activities either in a private cloud or on-premises setting.

By Business Size Insights

The large segment holds the majority portion and is believed to advance further at a steady rate in the coming years. This is clear from the fact that the United States freelance workforce is more than 75 million. Together North and South America captured about 42 per cent of overseas outsourcing customers. Moreover, the decrease in implementation expenses, drop-in lead time, and rising efficiency are the main contributors to the segment’s development. In addition, the extensive use of cloud-related operations and services throughout the five regions is fuelling the demand for IT source vendors.

By Industry Insights

The banking, financial services, and insurance (BFSI) segment is leading the IT outsourcing market. Considering the current instability in the global economy, it is expected to increase its market share during the forecast period. The growing digital ecosystem has led the banks to subcontract IT operations for digital transformation, omnichannel solutions, blockchain technology, CRM, business intelligence, and analytics. According to a 2023 survey, around 29 per cent of organizations plan to apply IT to enhance access and approachability for employees and clients. Other 23 per cent want this for modernising and upgrading old systems. Moreover, BFSI players are extensively contracting out cloud-based services to speed up the data extraction and loading time with online storage for increased suitability.

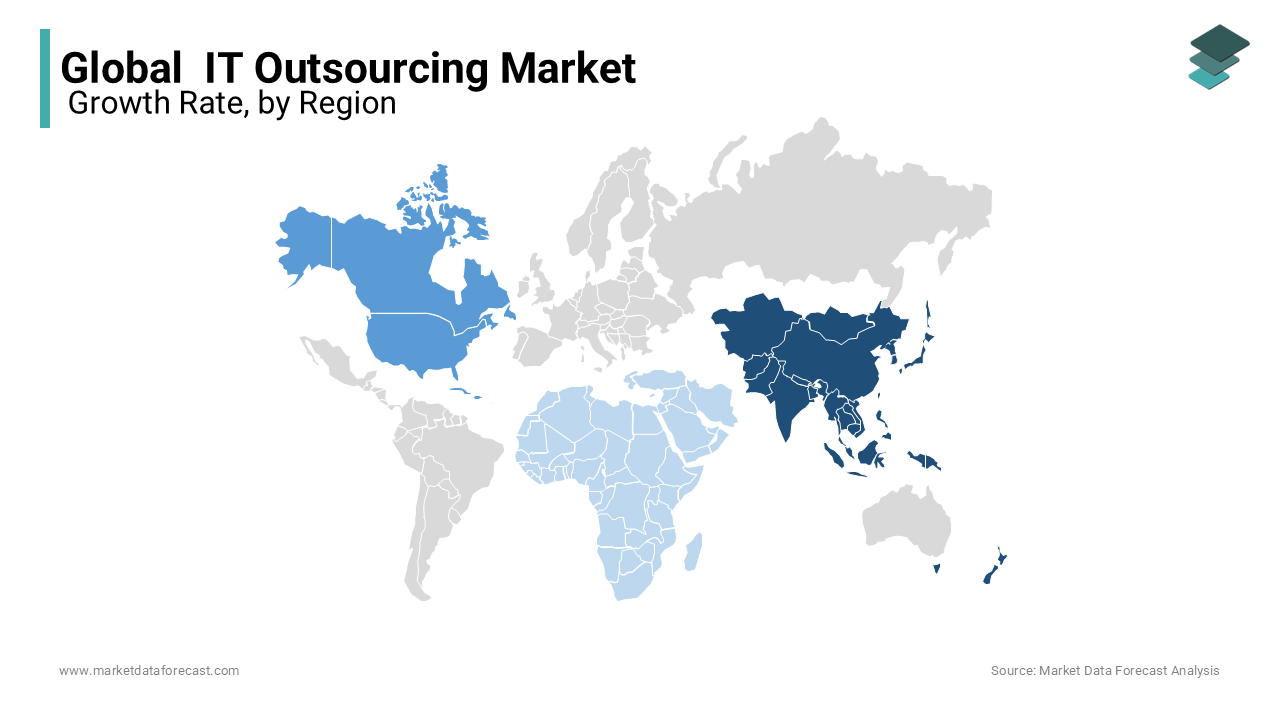

REGIONAL ANALYSIS

Asia Pacific is dominating the IT outsourcing market and is the fastest-growing industry with a significant share. Reduced expenditure and a proficient workforce are the two main reasons behind the region's growing market value. India is the biggest contributor to the industry’s expansion. Asian nations such as China, India, and the Philippines provide a giant pool of highly trained and affordable IT professionals. Moreover, IT outsourcing and services are adding about 9 per cent to the GDP of the Philippines which is now regarded as a capable country providing IT contractual services and stands as one of the main pillars of its economy.

The North American IT Outsourcing market is expected to grow at a high rate during the forecast period. Close to 275397 companies in the United States were involved in outsourcing, as per the study. Also, around 90 per cent of small US companies had aimed to contract out a department process in 2022 which is on par with the European industry.

Europe is projected to witness a surge in its share of the IT outsourcing market. The current situation in the region, which includes high inflation, increased cyberattacks, and layoffs, will boost the demand for cost-effective and skilled staff to weather the tough times. Apart from this, small and medium enterprises are gradually opening up to outsourcing, which is mostly dominated by big organisations in the area. This is due to the recognition of the advantages of subcontracting for small companies as well.

Latin America is estimated to account for a noticeable portion of the IT outsourcing market. The region is witnessing an increase in revenue due to growing demand for its software development groups. Its close cooperation with the United States and other developed economies is adding to its advantage, but it still has a long way to go in this market because of the presence of strong markets like India, China, etc.

Middle East & Africa has the smallest industry owing to its reliance on the oil and gas industry. However, the United Arab Emirates and Saudi Arabia have started to explore other industries and are also developing their niche capability in providing IT services for their client countries.

KEY MARKET PLAYERS

The major companies operating in the global IT outsourcing market include BMC Software Inc., Hewlett Packard Enterprise Company, IBM Corporation, Red Hat Inc., VMware Inc., Accenture plc, Adaptive Computing Enterprises Inc., CA Technologies, Cisco Systems Inc., Citrix Systems Inc., CloudBolt Software Inc., Conviture Inc., CSC Computer Sciences Limited, Dell EMC, Egenera Inc., Embotics Corporation, GigaSpaces Technologies Inc., Micro Focus International plc.

RECENT MARKET HAPPENINGS

- In February 2024, EPAM Systems Inc. was accorded as the best IT Sourcing Vendor in Europe. This was given for their extraordinarily robust segment performance and customer satisfaction ranking throughout various examination parameters by Whitelane Research.

- Microsoft Fabric was launched in May 2023. This is an end-to-end, integrated analytics platform that combines all the analysis and data tools that companies demand, including technologies such as Power BI, Azure Synapse Analytics, and Azure Data Factory.

MARKET SEGMENTATION

This research report on the global IT outsourcing market has been segmented and sub-segmented based on the service model, implementation, business size, industry, and region.

By Service Model

- Software as a Service (SaaS)

- Platform as a Service (PaaS)

- Infrastructure as a Service (IaaS)

By Implementation

- Public

- Private

- Hybrid

By Business Size

- Small and Medium

- Large

By Industry

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecommunications

- Retail

- Healthcare

- Energy and Public Services

- Others

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- The United Kingdom

- Spain

- Germany

- Italy

- France

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

What services dominate the IT outsourcing sector globally?

Software development and maintenance services are the primary drivers of the IT outsourcing market, accounting for a substantial share, followed by infrastructure outsourcing and support services.

How are data security concerns addressed in the IT outsourcing industry on a global scale?

The industry employs advanced encryption technologies, robust cybersecurity protocols, and compliance with international standards like ISO 27001 to address and mitigate data security concerns.

What role do emerging technologies like AI and blockchain play in the future of IT outsourcing globally?

Emerging technologies are reshaping the IT outsourcing landscape by enabling automation, enhancing efficiency, and providing innovative solutions, making them integral to the industry's future.

What trends are shaping the future of the global IT outsourcing market in the coming years?

The future of IT outsourcing is expected to be influenced by trends such as increased focus on digital transformation, the rise of hybrid and multi-cloud solutions, and a growing emphasis on outcome-based and collaborative outsourcing models.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]