Global Islamic Finance Market Size, Share, Trends, & Growth Forecast Report Segmented By Financial Sector (Islamic Banking, Islamic Insurance-Takaful, Islamic Bonds ‘Sukuk’, Other Islamic Financial Institutions (OIFI’s) and Islamic Funds) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Islamic Finance Market Size

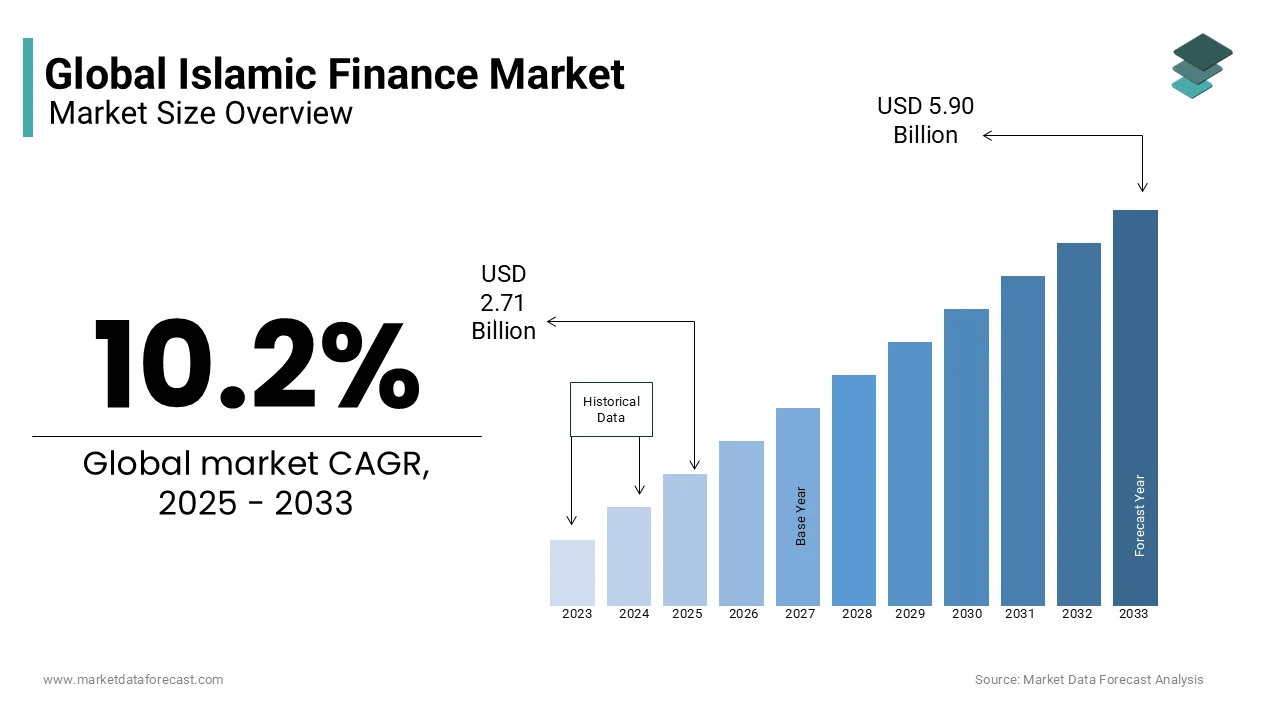

The global Islamic finance market was worth USD 2.46 billion in 2024. The global market is predicted to grow to USD 5.90 billion by 2033 from USD 2.71 billion in 2025, rising at a CAGR of 10.2% from 2025 to 2033,

Islamic finance is the practice of raising cash in line with Sharia, or Islamic law, by enterprises and individuals. Islamic finance is a one-of-a-kind approach to socially responsible investing. This branch of finance is still developing. Even though Islamic finance dates to the seventh century, it has only been codified since the late 1960s. The vast oil wealth stimulated fresh interest in and demand for Sharia-compliant products and practices, which accelerated the process. Risk sharing is an important idea in Islamic banking and finance. Understanding the importance of risk-sharing in raising finance is critical. In Islamic law, a loan with interest payments is viewed as a relationship that benefits the lender, who charges interest at the expense of the borrower. Money, according to Islamic law, is a means for determining worth rather than an asset. As a result, it is necessary that one cannot rely just on money for income. Interest is considered riba, and it is forbidden under Islamic law. It is haram or forbidden because it is deemed usury and exploitative. Islamic banking, on the other hand, exists to help an Islamic society achieve its socioeconomic goals. Because of strong investments in Halal sectors, infrastructure, and Sukuk bonds, the worldwide Islamic financial market industry is quickly expanding, particularly through electronic modes in all products and services.

MARKET DRIVERS

The Rising Prominence of Launching Innovative Financial Services for Muslims According to Islamic Religious Laws.

The Islamic finance market growth is driven by the rising prominence of launching innovative financial services for Muslims according to Islamic religious laws. The rising Islamic economy around the world is also one of the factors that is elevating the growth rate of the market. The majority of the Muslim population lives in the Middle East and Africa, and the population is gradually increasing globally, too, which is a positive sign for the growth rate of Islamic finance. The demand to carefully develop the finance structure as per the law of the Islamic religion and to grab the attention of Muslim people shall drive the market’s growth rate in the coming years.

Many government organizations are greatly supporting Islamic funding through various ways, which are ascribed to showcase huge opportunities for the market to grow during the forecast period. The Islamic banking sector is quietly adopting new methods and systems in the finance sector, where digital payments and consolidation are major aspects. The adoption of innovative technologies in the Islamic banking sector propels the market’s growth rate to an extent.

MARKET RESTRAINTS

Lack of Knowledge about the use of Modern Technologies among the Muslim Population.

However, the lack of knowledge about the use of modern technologies among the Muslim population is likely to decline the growth rate of the market. People in remote areas or undeveloped areas do not have access to new technologies and are not able to adopt these systems, which may negatively impact the market’s growth rate. Many people are not likely to follow modern Islamic financial services as they are completely restricted to following conventional structure in finance services, which additionally impedes the growth rate of the market. The ongoing economic crisis between Ukraine, Russia, and other countries may also degrade the market’s growth rate.

MARKET OPPORTUNITIES

Encouraging Community

The Islamic finance market holds the transformational ability to advance sustainable development goals (SDGs). The market is recognized for its coordination with the SDGs, encouraging community-focused development and connecting economic rise with social welfare. A study stresses that Islamic social finance instruments, involving Qard-hasan, Sadaqat, Waqf and Zakat are vital in attaining SDGs. It was concluded after two decades of literature review that these financing mechanisms can handle several community problems and enhance welfare conditions by making sure of ecological, social and economic sustainability. This approach corresponds with 11 SDGs out of the 17 and at the same time Islamic commercial banks can handle the other pending goals, demonstrating the industry’s considerable ability to bridge the SDG funding space.

In addition, these Islamic financial instruments, especially green sukuk, play an important part in tackling climate change and promoting ecological protection. For instance, 2 billion US dollars were raised by issuing the Sovereign Green Sukuk by Indonesia which showcases how these instruments can fund initiatives or projects that reduce and adjust to climate change, conserve biodiversity and back the nation’s Nationally Determined Contributions within the Paris Agreement. This program emphasizes the importance of transparency in Islamic finance and its capability to lure both traditional investors and sharia. Its chances are further strengthened by the fact that 85 per cent of 26 per cent of Gen Z Muslims, more than a quarter already using Islamic banking, are interested in banking with a financial establishment that provides Shariah-compliant services or products.

MARKET CHALLENGES

Inadequate Regulatory Support

The growth of the Islamic finance market is impeded by inadequate regulatory support. Islamic banks are providing the opportunity for cross-border finance to perform transactions in the global market. However, the services by Islamic banks are available in the entire world arena where it can be done by executing an agreement between two or three banks to give facilities to their clients based on Islamic Shariah. In these conditions, it is highly difficult for these institutions to function and find a substitute method for the cross-border transaction. On the contrary, there are several more traditional banks that are offering to give Islamic banking services to their Muslim customers from international and national perspectives. Hence, it is not simple to perform Islamic banking operations in cross-border nations under the parameter of traditional banking activity in the various conventional regulations, customs and rules. Therefore, these banks are encountering strong regulatory problems in cross-border operations involving risk of contagion and liquidity problems, the danger of documentation and contract, creating the capital market, risk management and diversification, lack of equal fields for Islamic and Conventional banking, cost and competitiveness of cross-jurisdictions, for keeping proper accounting standards, absence of equity institutions, lack of suitable legal framework, and unavailability of institutional framework and financial engineering.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

10.02% |

|

Segments Covered |

By Financial Sector and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Bank Al-Rajhi, Dubai Islamic Bank, Kuwait Finance House, Bank Mellat Iran, Bank Meli Iran, National Commercial Bank Saudi Arabia, Bank Maskan Iran, Qatar Islamic Bank and Abu Dhabi Islamic Bank |

SEGMENTAL ANALYSIS

By Financial Sector Insights

The Islamic banking segment is leading with the dominant share of the market. These days, many countries are predominantly opening doors for Islamic finance even though the Muslim population is not so dominating. Collaboration between government banks and Islamic banking systems that has the scope to improve the economic status eventually levels up the growth rate of the market. The Islamic Insurance-Takaful segment is next in holding the market’s share. The importance of pooling the money over any losses or damages through takaful, an insurance policy with Islamic religious law, is attributed to promoting the growth rate of the market. This pool system allows individuals to protect one another, especially during any loss or damage.

The Islamic bonds segment is likely to have the highest CAGR by the end of 2029. ‘Sukuk’ is more common in the western finance services for Muslims. This is a kind of financial certificate that allows access to the direct ownership interest.

REGIONAL ANALYSIS

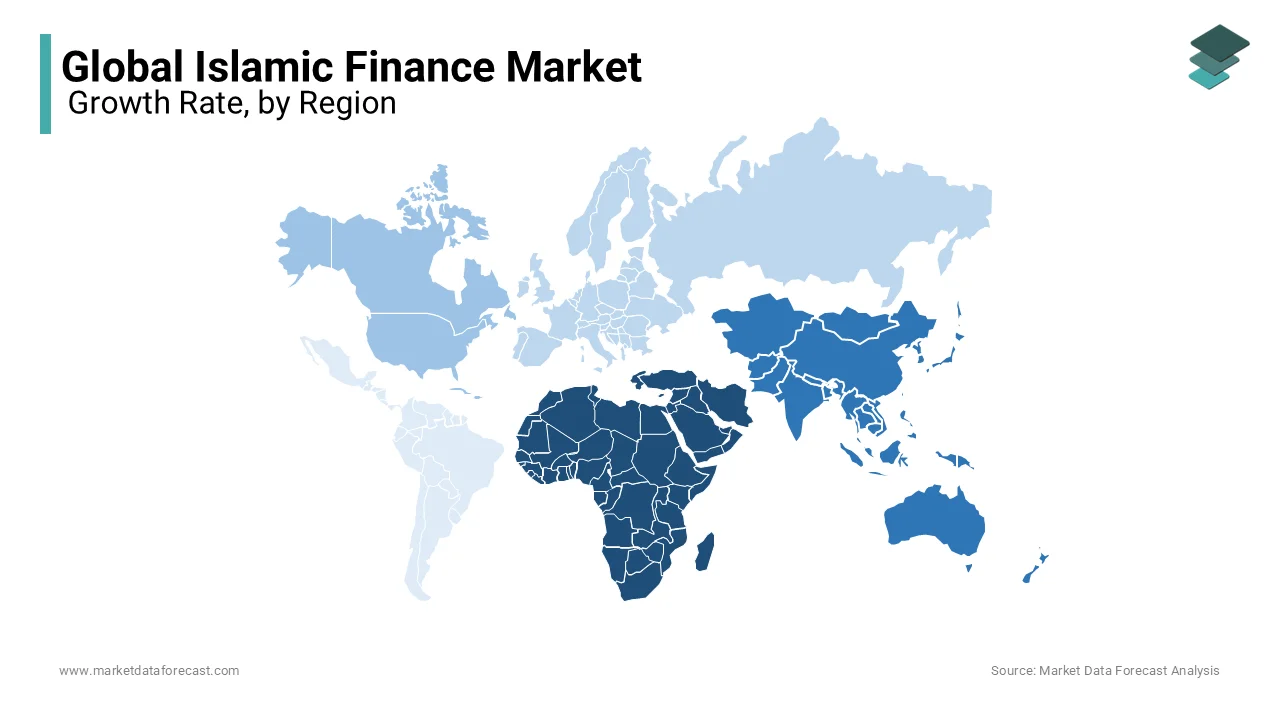

The Middle East & African Islamic Finance market has held the largest share for many years and is expected to continue with the fastest growth rate during the forecast period. There are more than 190 banks in this region with a proper agenda to prompt Islamic banking systems with all the latest technologies. People’s interest in a high standard of living and growing awareness to manage the profit and loss of their business through different strategies are ascribed to bolstering the growth rate of the market in the Middle East and Africa. The unprecedented economic status all across the world has surged the need for Islamic finance services in recent years.

Asia Pacific is next in holding the dominant share of the market next to Middle East & Africa. India and China are the major countries attributed to prompting major growth opportunities for the Islamic finance market. Though the Muslim population in these countries is low comparatively in the Middle East and African region, the demand for Islamic finance services is greatly evolving among the Muslim people living in these countries. Government organizations tied up with the popular Islamic banks are eventually creating new opportunities for the market in India and China.

North America and Europe's Islamic finance market is likely to have a substantial growth rate during the forecast period.

KEY PLAYERS IN THE GLOBAL ISLAMIC FINANCE MARKET

Bank Al-Rajhi, Dubai Islamic Bank, Kuwait Finance House, Bank Mellat Iran, Bank Meli Iran, National Commercial Bank Saudi Arabia, Bank Maskan Iran, Qatar Islamic Bank and Abu Dhabi Islamic Bank are some of the key companies in the global Islamic finance market.

RECENT HAPPENINGS IN THE MARKET

- The HBKU hosted a webinar titled "Islamic FinTechs and the Halal Economy," which discussed the prospects in the halal economy, which was valued $1.9 trillion in 2020 and is predicted to reach $3.2 trillion by 2024, generating significant opportunities in food, cosmetics, fashion, and tourism.

- Fitch Ratings has raised Emirates Islamic Bank's (EI) Viability Rating (VR) to 'bb' from 'bb-' and affirmed its Long-Term Issuer Default Rating (IDR) at 'A+' with Stable Outlook. The VR has been upgraded to reflect increased asset quality that is now comparable to peers.

MARKET SEGMENTATION

This research report on the global Islamic finance market has been segmented and sub-segmented into the following categories.

By Financial Sector

- Islamic Banking

- Islamic Insurance – Takaful

- Islamic Bonds ‘Sukuk’

- Other Islamic Financial Institutions (OIFI’s)

- Islamic Funds

By Region

- North America

- The Middle East and Africa

- South Asia

- Asia-Pacific

- Europe

Frequently Asked Questions

What are the main instruments used in Islamic finance?

Key instruments in Islamic finance include Sukuk (Islamic bonds), Murabaha (cost-plus financing), Ijarah (leasing), Musharakah (joint venture), and Mudarabah (profit-sharing). These instruments are designed to avoid interest and ensure compliance with Islamic principles.

How does Islamic finance promote ethical and sustainable investments?

Islamic finance emphasizes ethical investment, prohibiting involvement in activities harmful to society, such as gambling, alcohol production, and interest-based lending. Additionally, Islamic finance encourages investments in projects that benefit the community, such as infrastructure, education, and healthcare, aligning with the principles of sustainable finance.

What challenges does the global Islamic finance market face?

The Islamic finance market faces several challenges, including a lack of standardization in regulations, limited awareness and understanding of Islamic financial products, and the need for skilled professionals. Additionally, there is a need for more innovation in Islamic financial products to compete effectively with conventional finance.

What is the future outlook for the global Islamic finance market?

The global Islamic finance market is expected to continue its robust growth, driven by increasing demand for ethical financial products, demographic trends in Muslim-majority countries, and supportive regulatory environments in key markets. The market is also likely to see more innovation in digital Islamic financial products and services, expanding its reach to a global audience.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]