Global IoT in Utilities Market Size, Share, Trends, & Growth Forecast Report – Segmented By Component (Hardware, Software and Services), Platform (Network Management, Device Management and Application Management), Application (Electricity Grid Management, Gas Management, Water and Wastewater Management), & Region - Industry Forecast From 2024 to 2032

Global IoT in Utilities Market Size (2024 to 2032)

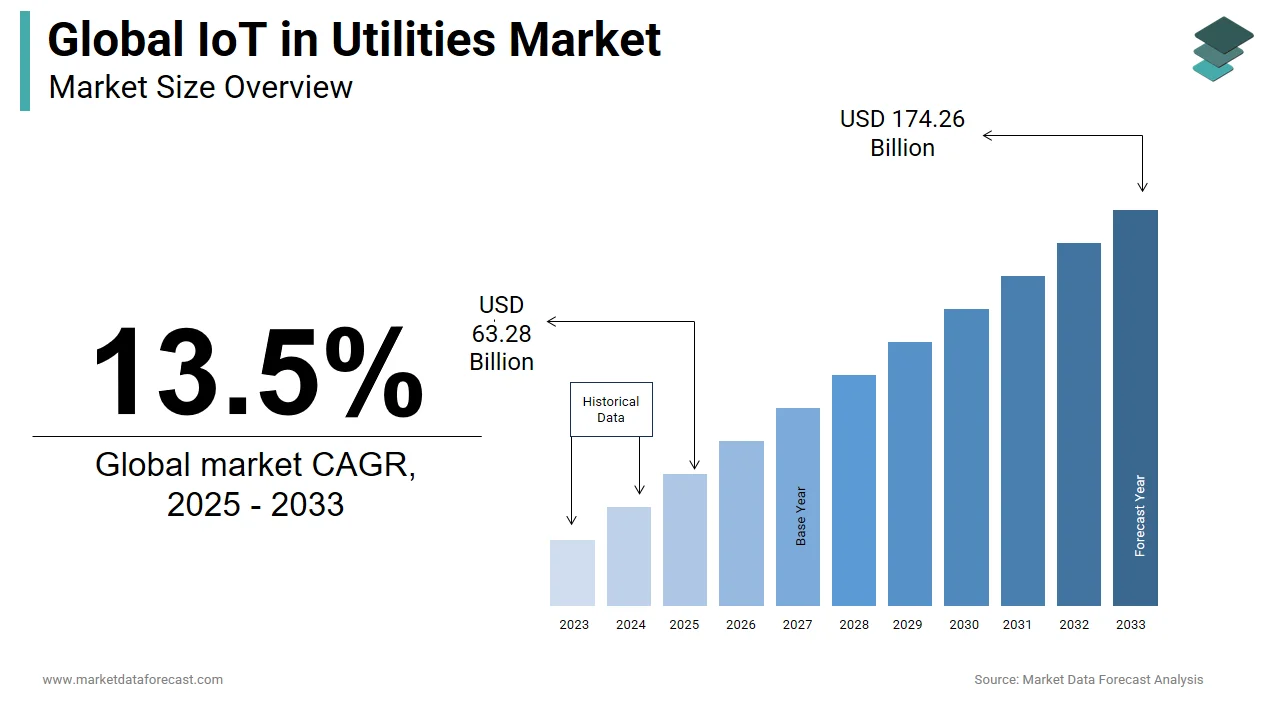

The global Internet of Things (IoT) in the utilities market was valued at USD 49.12 billion in 2023. The global market is anticipated to grow from USD 55.75 billion in 2024 to USD 153.54 billion by 2032, at a CAGR of 13.5% during the forecast period.

IoT is considered the next industrial revolution, i.e., Industry 4.0. The concept of IoT is to develop advanced solutions and services, improve productivity and efficiency, solve critical problems, and improve decisions in real time. IoT is a new trend in all businesses, and the utility sector is funding this technology to modify operations and improve the overall experience of its customers. In the current scenario, the public service industry is mainly governed by policy and the need to comply with legislative regulations. It is also motivated by concerns about cost savings. Thus, the IoT helps the utility industry to overcome challenges and implement advanced services and solutions. In addition, connected IoT utilities monitor compliance with real-time compliance and network power regulations to maximize monitoring and remote control to enable preventive maintenance. Also, the IoT accelerates the digital transformation of benefits.

Current Scenario of the Global IoT in Utilities Market

IoT solutions have led to the conjunction of different business processes, exponentially pushing the public services sector into the growth phase. The mandate for operational control technology is the highest class of software sales. The analytics solution is projected to grow faster due to mobile and smart cloud device trends and factors such as predictive analytics, end-to-end automation, and conductive analytics platforms.

MARKET DRIVERS

The growing adoption of intelligent meters primarily drives IoT in the utility market as they provide real-time information on transmission and power consumption.

It also inspires local and micro-energy production, such as wind turbines and solar panels, forming a platform for new income sources and improving production and distribution efficiency. The decentralization of the energy sector is a crucial IoT factor in the public services market.

IoT technology solutions help utilities integrate various business processes that exponentially push the utility industry into its growth phase. Integrating technologies into existing operations should increase public services' overall operational efficiency with less infrastructure investment. IoT technology is deployed across the total value of public services, such as production, transmission, distribution, asset management, workforce management, security, energy management, consumer-side analysis, infrastructure management, and remote monitoring and surveillance.

The utility industry is associated with the Internet of Things (IoT); for example, smart grids are considered a prominent application of IoT technology.

This industry is expected to grow in the coming years with exponential growth in new IoT applications. The solutions segment maintains the highest IoT in the utility market size over the foreseen period. An electrical network is primarily responsible for efficiently managing and supplying electricity to its end users. Applying IT intelligence and network capabilities to a traditional network can affect an intelligent, automated, and advanced network. Smart sensors, receivers, smart meters, and power boxes are part of an IoT network supporting mutual communication. In an old electrical grid, utility providers have been informed of power failure through customers. Advanced Measurement Infrastructure (AMI) is rising due to Internet Protocol (IP) addresses and two-way communication between all components.

MARKET RESTRAINTS

Major limiting factors that might hinder IoT in the utility market are an absence of technically skilled labor and a lack of standards. The increase in cybersecurity breaches in the industry will likely limit the global IoT in the utility market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

13.5% |

|

Segments Covered |

By Components, Platforms, Applications, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

IBM (United States), Oracle (United States), Verizon (United States), Cisco (United States), Vodafone (United Kingdom), Telit (United Kingdom), Landis Gyr (Switzerland), Itron (United States), Schneider Electric (France), Huawei (China), Trimble (United States), Aclara (United States), Trilliant (United States), Energyworx (Netherlands), HCL (India), Altair (United States), Actility (France), Waviot (Russia), Rayven (Australia), Saviant Consulting (India), ABB (Switzerland), Siemens (Germany), Honeywell (United States), GE (United States) and Others. |

SEGMENTAL ANALYSIS

Global IoT in Utilities Market Analysis By Components

The hardware segment can be separated into sensors, RFID, and connected devices. The software segment can be branched into the local and cloud. The service segment can be subdivided into managed and professional services.

REGIONAL ANALYSIS

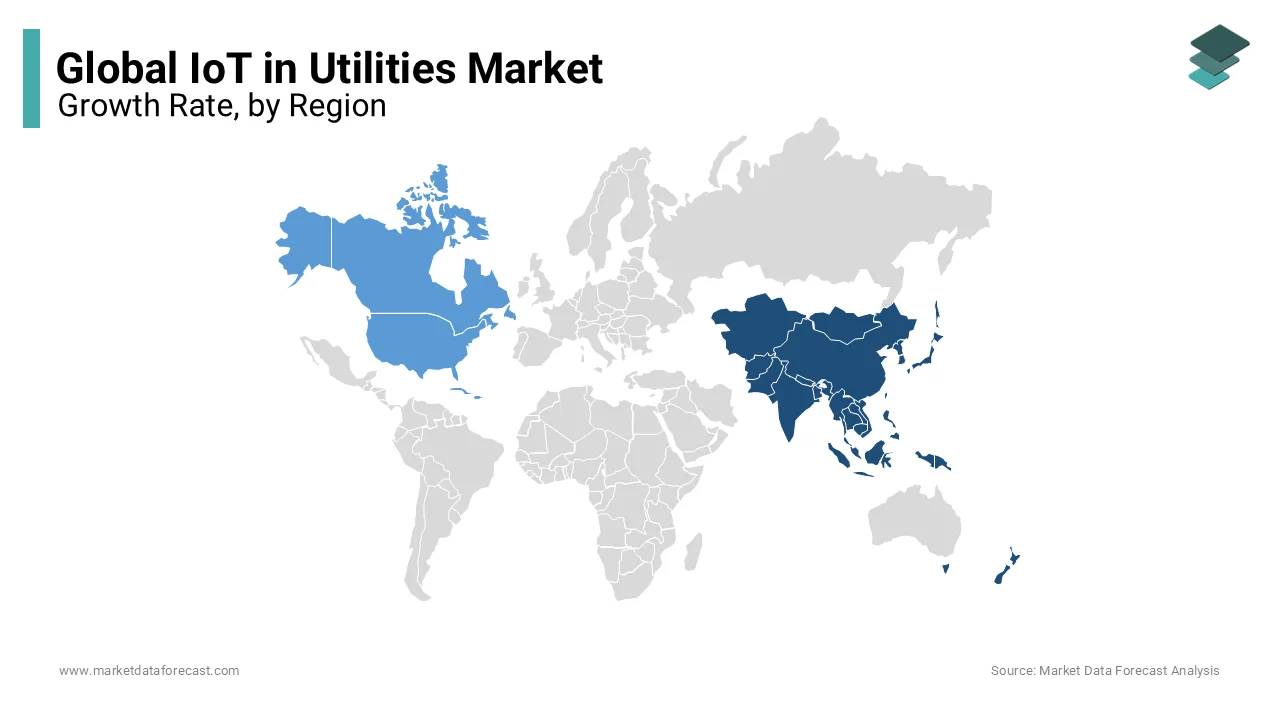

IoT in the utility market in developing economies, mostly in Europe and Asia Pacific, is expected to grow considerably during the forecast period. The Asia Pacific regional market is expanding because of the rising necessity for smart metering solutions and efforts to promote smart buildings and smart cities. Also, the IoT market for public services in the APAC region is projected to grow due to the presence of a significant number of gas and electricity generation facilities in the region.

North America will likely rule the global IoT in the utility market over the estimation period due to the rising application of connected smart devices and technological progressions.

The United States will contribute a substantial share of North American IoT in the utility market owing to consumer awareness related to the benefits of this technology in managing resources. Moreover, the presence of leading gas production facilities in the nation raises the call for such technological solutions. Several power generation facilities, followed by gas generation facilities in the Asia-Pacific region, offer significant growth opportunities for the market. The growing digitization trend, coupled with the surge in industry use cases, is likely to fuel demand in the future. The rise in investment in advanced technologies by utilities contributes to growth.

KEY PARTICIPANTS IN THE GLOBAL IoT IN UTILITIES MARKET

The main providers in the public services IoT market include IBM (United States), Oracle (United States), Verizon (United States), Cisco (United States), Vodafone (United Kingdom), Telit (United Kingdom), Landis Gyr (Switzerland), Itron (United States), Schneider Electric (France), Huawei (China), Trimble (United States), Aclara (United States), Trilliant (United States), Energyworx (Netherlands), HCL (India), Altair (United States), Actility (France), Waviot (Russia), Rayven (Australia), Saviant Consulting (India), ABB (Switzerland), Siemens (Germany), Honeywell (United States), GE (United States) and Others.

RECENT HAPPENINGS IN THE GLOBAL IoT IN UTILITIES MARKET

-

In November 2019, Schneider Electric declared introducing the EcoStruxure distributed energy resource management system (DERMS), which will be crucial in automating the peak load management, discharge, voltage optimization, and control of the value-added distributor (VAR).

-

Itron signed a deal with a Brazilian utility company in December 2019 to modernize the water distribution system in the Consolidated Service District. As per this contract, the latter company will install Itron's intelligent water communication modules on its 1,400 miles of water pipes.

-

In October 2019, Light, an electricity service provider in Brazil, collaborated with Landis Gyr for South America's most substantial smart grid project.

DETAILED SEGMENTATION OF THE GLOBAL IoT IN UTILITIES MARKET INCLUDED IN THIS REPORT

The global utilities IoT market can be segmented and sub-segmented based on the components, platforms, applications, and region.

By Components

-

Hardware

-

Software

-

Services

By Platforms

-

Network Management

-

Device Management

-

Application Management

By Applications

-

Electricity Grid Management

-

Gas Management

-

Waste Management

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What are the primary drivers of IoT adoption in the utilities sector globally?

The primary drivers include the need for improved operational efficiency, regulatory pressure for smart grid deployment, rising energy demand, the push for renewable energy integration, and the need for better customer service and engagement. Global trends toward sustainability and reducing carbon footprints also play a crucial role.

How does IoT improve energy efficiency in utilities?

IoT improves energy efficiency by enabling real-time monitoring and control of energy usage, predictive maintenance of equipment, automated grid management, and better demand response. It helps utilities optimize energy distribution, reduce losses, and enhance the integration of renewable energy sources.

How is IoT used in water management within the utilities sector?

IoT is used in water management to monitor water quality, detect leaks, manage water distribution, and optimize resource usage. Smart meters and sensors provide real-time data on water consumption, helping utilities reduce wastage and improve the efficiency of water distribution systems.

What is the future outlook for the IoT in Utilities Market?

The future outlook is very positive, with the IoT in Utilities Market expected to grow significantly due to increasing demand for smart solutions, the global push for sustainability, and advances in IoT technology. The market will likely see greater integration of AI, machine learning, and blockchain technologies, further enhancing efficiency and security.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]