Global IoT Solutions and Services Market Size, Share, Trends, & Growth Forecast Report by Vertical (Data Analytics and Machine Learning, Complex Event Processing, Cybersecurity, and Solution-Based Network Management), Application (Remote Asset Monitoring, Workforce Monitoring, Security And Emergency Management, Identity Access Management, Water Management, Telemedicine, Imaging, And Diagnostics, Patient Remote Monitoring, Energy Transmission And Distribution, Production Optimization, Fleet and Warehouse Management), & Region, Industry Forecast From 2024 to 2033

Global IoT Solutions and Services Market Size

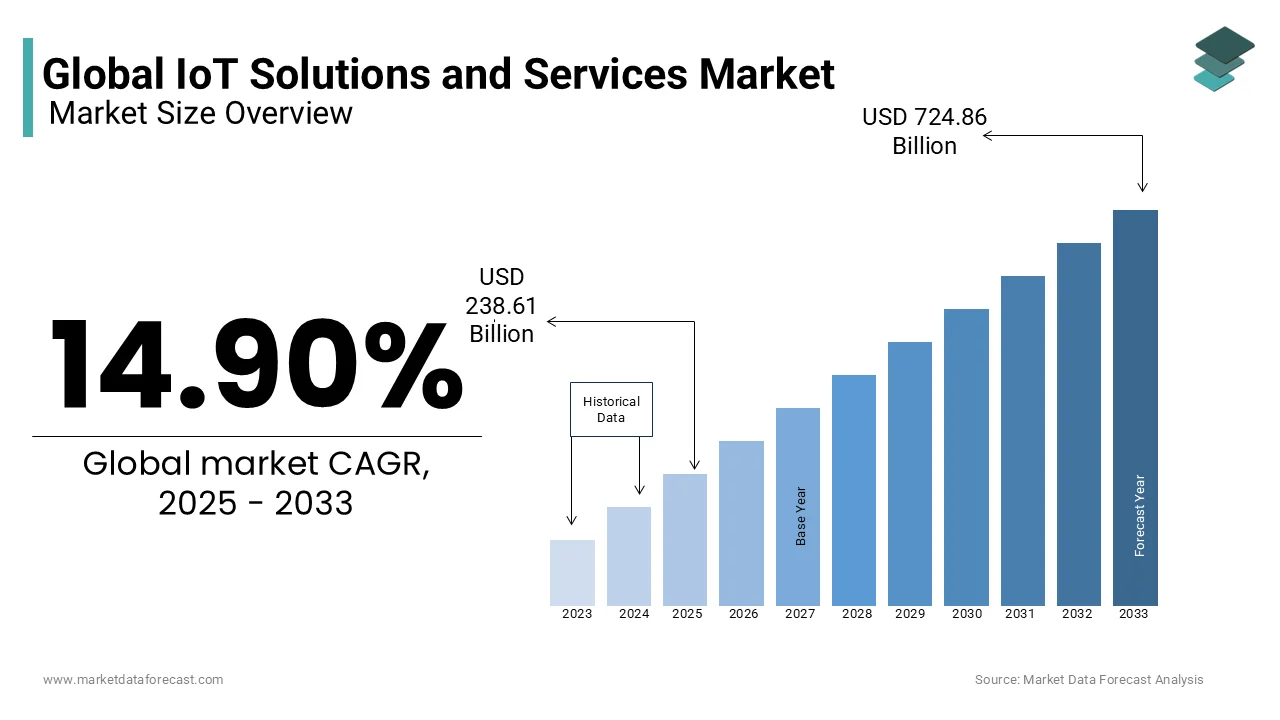

The global IoT solutions and services market was worth USD 207.67 billion in 2024. The global market is predicted to reach USD 238.61 billion in 2025 and USD 724.86 billion in 2033, growing at a CAGR of 14.90% during the forecast period 2025 to 2033.

The Internet of Things (IoT) allows end-user industries to transform their current business needs to the next level in terms of market differentiation by delivering novel solutions that vary from integrating the right sensors and acquiring information to selecting the most suitable platform. The IoT has changed the way businesses operate. Several industries are implementing these IoT solutions to enhance their traditional systems. For example, healthcare facilities use IoT devices to improve their medical outcomes. The manufacturing industry analyzes how its products are used and determines usage patterns. This industry is witnessing a strong adoption of IoT solutions to increase efficiency, facilitate daily operations, optimize production quality, and provide high-level security.

MARKET DRIVERS

Wireless technology plays a crucial role in communications and emerging technologies, including robots, drones, autonomous vehicles, and new medical devices, which will increase the need for such technologies over the next two years.

LPWA networks provide low-bandwidth connectivity for IoT applications in a power-efficient manner to support items that require long battery life. They usually cover large areas, such as cities or entire countries. Current LPWA technologies include Narrow Band IoT (NB-IoT), Long Term Evolution for Machines (LTE-M), LoRa, and Sigfox. The modules are relatively inexpensive so that IoT manufacturers can activate small, low-cost, battery-powered devices such as sensors and trackers. 5G cellular systems will begin to roll out in 2019 and 2020. They will be essential in integrating security into the core network architecture, complementing the global IoT solutions and services market.

The services segment comprises consulting, integration and implementation, support and maintenance, and managed services. The global managed IoT services market is driven by adopting IoT technologies across the industry, the increased availability of managed cloud services, and increased government investment in smart cities and other projects. Managed services are in strong demand from the manufacturing industry. The manufacturing industry faced challenges in selecting and implementing the correct set of IoT solutions that meet business goals, multi-vendor ecosystem, and interoperability, lack of skills requirements to configure, manage, implement and integrate IoT solutions, manage connectivity of thousands of devices, skeptical about RoI and the high initial cost of implementation, high initial cost and continuous investment in operating expenses (OPEX) for operational process and data management, applications and device security.

MARKET RESTRAINTS

Several competing technologies and standards at the connectivity layer of the IoT stack cause interoperability issues that can result in vendor lockdowns and difficulty connecting non-interoperable IoT devices across various platforms and, ultimately, prevent the emergence of technology in general. The automation industry must operate in various industrial and manufacturing environments. The main problem is that several protocols, such as BLE, ZigBee, Z-Wave, and Thread, are used, and no standardization guarantees interoperability. Over 50% of organizations face challenges in adopting IoT due to uncertain standards.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

14.9% |

|

Segments Covered |

By Vertical, Application, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Accenture (Ireland), Atos (France), IBM (United States), DXC Technology (United States), Deloitte (United Kingdom), Cisco (United States), Huawei (China), Sierra Wireless (Canada), ARUBA HPE (United States), Microsoft (United States), AWS (United States), PTC (United States) and Oracle (United States) and Others. |

SEGMENTAL ANALYSIS

By Vertical Insights

The IoT solutions and services market is segmented by vertical into data analytics and machine learning, complex event processing, cybersecurity, and solution-based network management. The data analytics and machine learning segment will record the most substantial market share over the outlook period because of the demand for performing analytics on massive data generated by devices co-connected in vertical sectors.

By Application Insights

The IoT solutions and services market by application has been segmented into remote asset monitoring, workforce monitoring, security and emergency management, identity access management, water management, telemedicine, imaging and diagnostics, patient remote monitoring, energy transmission and distribution, production optimization, fleet and warehouse management, etc. Most manufacturing companies face significant challenges in implementing the right IoT-based solution targeting specific business outcomes. Therefore, to create an IoT-based solution using a combination of IoT components provided by different vendors, managed service providers provide the skills to assess, acquire, integrate, and implement IoT-based solutions.

REGIONAL ANALYSIS

North America, the United States, and Canada are the two major contributors to the overall growth of the IoT solutions and services market. The number of IoT connections in North America will reach 5.9 billion by 2025. The most significant demand for IoT in North America comes from the manufacturing, transportation, and healthcare industries. The main challenges in these industries include data analytics, IoT device security, and complex event processing. This has encouraged IoT companies to focus more on solving these challenges.

KEY PARTICIPANTS IN THE MARKET

The major companies operating in the global IoT services and solutions market include Accenture (Ireland), Atos (France), IBM (United States), DXC Technology (United States), Deloitte (United Kingdom), Cisco (United States), Huawei (China), Sierra Wireless (Canada), ARUBA HPE (United States), Microsoft (United States), AWS (United States), PTC (United States) and Oracle (United States).

RECENT HAPPENINGS IN THE MARKET

-

In October 2019, Microsoft announced new capabilities to offer highly secure IoT solutions to improve security and solve social problems by predicting and preventing equipment failures and optimizing smart buildings for space and energy management.

-

In February 2020, Cisco announced advancements to its IoT portfolio by introducing innovations to improve manageability and reduce deployment complexities. This includes ML to improve management, provide smart billing to optimize pricing plans and support global supply chains.

-

In May 2019, Oracle Malaysia launched its cloud solutions center to support small and medium-sized enterprises (SMEs) for emerging technologies such as blockchain, IoT, ML, AI, data analytics. and independent databases to drive business growth and value.

MARKET SEGMENTATION

This research report on the global IoT solutions market has been segmented and sub-segmented based on the vertical, application, and region.

By Vertical

-

Data Analytics and Machine Learning

-

Complex Event Processing

-

Cybersecurity

-

Solution-Based Network Management

By Application

-

Remote Asset Monitoring

-

Workforce Monitoring

-

Security And Emergency Management

-

Identity Access Management

-

Water Management

-

Telemedicine

-

Imaging And Diagnostics

-

Patient Remote Monitoring

-

Energy Transmission and Distribution

-

Production Optimization

-

Fleet And Warehouse Management

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

How does the IoT security landscape impact the market, and what measures are being taken to address security concerns globally?

IoT security concerns have led to increased investments in cybersecurity solutions. Global initiatives are underway to establish standardized security protocols, and companies are implementing robust encryption, authentication, and access control measures to secure IoT ecosystems.

How is the 5G rollout impacting the IoT solutions and services market on a global scale?

The deployment of 5G networks is significantly enhancing IoT connectivity, enabling faster data transfer and low-latency communication. This, in turn, accelerates the adoption of IoT solutions, especially in applications requiring high-speed and real-time data processing.

How are emerging technologies such as edge computing influencing the architecture of IoT solutions globally?

Edge computing is gaining prominence in IoT to process data closer to the source, reducing latency and enhancing real-time analytics. This technology is shaping more efficient and scalable IoT architectures, especially in applications where low latency is crucial.

What are the key challenges faced by the IoT solutions and services market, and how are industry players addressing them on a global scale?

Common challenges include interoperability issues, security concerns, and the need for standardized protocols. Industry players are collaborating to establish open standards, enhance security measures, and improve interoperability to foster the sustainable growth of the IoT solutions and services market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com