Global Intrusion Detection and Prevention Systems Market Size, Share, Trends, & Growth Forecast Report By Component (Hardware, Software, and Services), Deployment (Cloud-based IDS/IPS systems and On-premises IDS/IPS systems), Product (Network-based IDS/IPS systems and Host-based IDS/IPS systems), Threat (Network-based threat, Host-based threat, and Application-based threat), End-User (Banking, Financial Services, Insurance (BFSI), Government and Defence, Healthcare, Retail, and E-commerce, IT and Telecom and Others), Service (Managed IDS/IPS services and Professional IDS/IPS services) and Regional, 2024 to 2033

Global Intrusion Detection and Prevention Systems Market Size

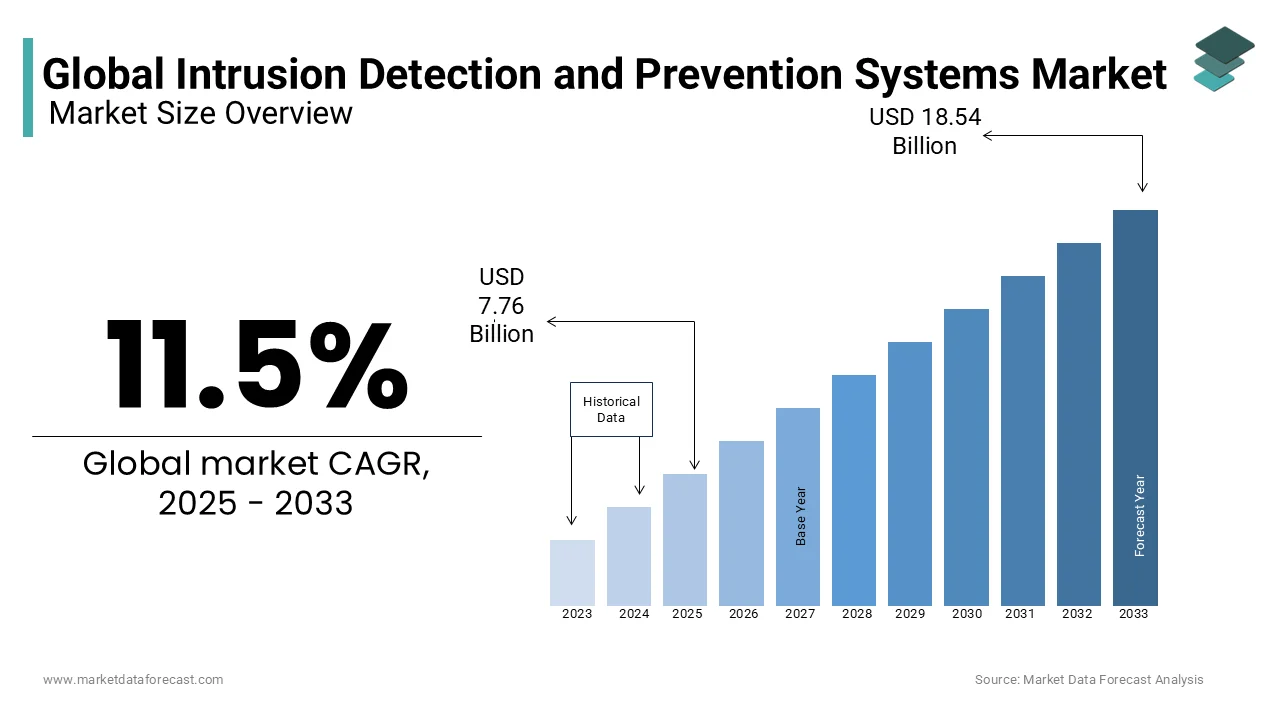

The intrusion detection and prevention systems market was worth USD 6.96 billion in 2024. The global market is predicted to reach USD 7.76 billion in 2025 and USD 18.54 billion by 2033, growing at a CAGR of 11.5% during the forecast period 2025 to 2033.

Intrusion Detection and Prevention Systems are safety tools that detect and prevent unauthorized access, misuse, and malicious activities in computer networks. They analyze network traffic and log data to identify suspicious behavior, such as exploiting vulnerabilities, scanning open ports, or launching DoS attacks. IDPS can be network-based or host-based and take preventive measures such as blocking or quarantining suspicious traffic, closing open ports, or limiting user access. These systems are crucial for network security, protecting data, and maintaining network system integrity and availability. In addition to detecting threats, the Intrusion detection and prevention system can also take preventive measures, such as blocking or quarantining suspicious traffic, closing open ports, and limiting user access to sensitive data. Furthermore, some Intrusion detection and prevention systems can also automatically respond to threats by blocking IP addresses or initiating countermeasures.

MARKET DRIVERS

The rising number of cyber-attacks and data breaches drives the demand.

The Intrusion Detection and Prevention Systems (IDPS) market is projected to experience significant market growth in the forecast period. The rising number of cyber-attacks and data breaches drives the demand for IDPS, which is expected to increase market revenue. Additionally, the growing adoption of cloud-based solutions and the proliferation of mobile devices further fuel the demand for the IDPS market. Moreover, the trend towards advanced persistent threats (APTs) is creating a need for more sophisticated IDPS solutions to detect and prevent such attacks. The rising acceptance of Internet of Things (IoT) devices is also projected to drive market growth as these devices increase the attack surface for cybercriminals. Overall, the IDPS market is likely to experience substantial growth because of the growing demand for advanced security solutions in the face of ever-evolving cyber threats.

The Intrusion Detection and Prevention Systems (IDPS) market is expected to rise due to increasing demand for network security against cyber threats. The trend toward digital transformation, cloud computing, and the Internet of Things (IoT) is driving the market demand. Regulations and compliance necessities for data security also fuel the growth of the intrusion detection and prevention systems market. Businesses invest in cutting-edge security solutions to protect against emerging cyber threats, and the IDPS market revenue is expected to grow. With the rise in sophisticated cyber-attacks, the demand for IDPS solutions is expected to remain strong.

MARKET RESTRAINTS

The intrusion detection and prevention systems market has experienced growth due to rising concerns about cybersecurity. However, some factors could restrain the market. Firstly, competition has increased, leading to a price war and negatively impacting revenue growth. Secondly, the systems' complexity and cost of implementation and maintenance make them challenging for small and medium-sized enterprises with limited budgets. Thirdly, the market faces the challenge of keeping up with the ever-changing threat landscape, which requires continuous upgrades to detect and prevent new threats. Although the market is expected to grow in the long term, these factors may limit its growth and demand shortly.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.5% |

|

Segments Covered |

By Component, Deployment, Product, Threat, End-user, Service, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Cisco Systems Inc., IBM Corporation, McAfee LLC, Check Point Software Technology Ltd., Fortinet, Trend Micro Incorporated, Palo Alto Networks, Inc., Symantec Corporation, Alert Logic Inc., Juniper Networks Inc., and others. |

SEGMENTAL ANALYSIS

By Component Insights

The software segment will likely have the largest market share during the forecast period. With increasing cyber-attack sophistication, organizations seek advanced, intelligent IDPS software solutions that provide real-time threat detection and prevention capabilities.

By Deployment Insights

The growing trend towards cloud-based IDPS solutions in recent years is that they offer many benefits, such as scalability, flexibility, and cost-effectiveness.

By Product Insights

Network-based IDS/IPS systems typically have a higher demand than host-based IDS/IPS systems. This is because network-based IDPS solutions effectively identify and prevent external attacks, a significant concern for many organizations. Network-based IDPS solutions are also easier to deploy and manage than host-based IDPS solutions, which require installation and management on individual devices.

By Threat Insights

The network-based threat is gaining traction over the IDPS solutions market shares. Generally, it is considered to have the highest demand because it can provide comprehensive network protection against widespread threats, including malware, hacking attempts, and denial-of-service attacks.

By End-User Insights

The financial services industry is estimated to hold the largest market share, and it has been one of the most significant adopters of IDPS solutions due to the high volume of financial transactions they handle and the increasing sophistication of cyber-attacks targeting financial institutions.

By Service Insights

Managed IDS/IPS services are becoming increasingly popular, particularly among small and medium-sized enterprises (SMEs) that may not have the resources to maintain an in-house security team. As a result, the managed IDS/IPS services will likely have prominent shares in the coming years.

REGIONAL ANALYSIS

North America’s intrusion detection and prevention market is leading with prominent shares solutions also driven by the need for organizations to protect their networks and data from cyber threats. The region is also home to several large cybersecurity vendors that offer a range of IDPS solutions to meet the requirements of organizations of all sizes.

Europe is estimated to have the most significant growth rate during the forecast period, and the adoption of IDPS solutions is driven by the need for organizations to comply with the General Data Protection Regulation (GDPR) and other cybersecurity regulations.

KEY PARTICIPANTS IN THE MARKET

The major companies operating in the global intrusion and prevention system market include Cisco Systems Inc., IBM Corporation, McAfee LLC, Check Point Software Technology Ltd., Fortinet, Trend Micro Incorporated, Palo Alto Networks, Inc., Symantec Corporation, Alert Logic Inc., and Juniper Networks Inc.

MARKET SEGMENTATION

This research report on the global intrusion detection and prevention systems market has been segmented and sub-segmented based on the component, deployment, product, threat, end-user, service, and region.

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud-based IDS/IPS systems

- On-premises IDS/IPS systems

By Product

- Network-based IDS/IPS systems

- Host-based IDS/IPS systems

By Threat

- Network-based threat

- Host-based threat

- Application-based threat

By End-User

- Banking

- Financial Services

- Insurance (BFSI)

- Government and Defence

- Healthcare

- Retail and E-commerce

- IT and Telecom

- Others

By Service

- Managed IDS/IPS services

- Professional IDS/IPS services

By Region

-

North America

-

The United States

-

Canada

-

Rest of North America

-

-

Europe

-

The United Kingdom

-

Spain

-

Germany

-

Italy

-

France

-

Rest of Europe

-

-

The Asia Pacific

-

India

-

Japan

-

China

-

Australia

-

Singapore

-

Malaysia

-

South Korea

-

New Zealand

-

Southeast Asia

-

-

Latin America

-

Brazil

-

Argentina

-

Mexico

-

Rest of LATAM

-

-

The Middle East and Africa

-

Saudi Arabia

-

UAE

-

Lebanon

-

Jordan

-

Cyprus

-

Frequently Asked Questions

What are the key technological trends influencing the evolution of Intrusion Detection and Prevention Systems globally?

Machine learning and artificial intelligence are playing a pivotal role in enhancing the capabilities of IDPS by enabling more accurate threat detection and rapid response.

How are businesses adopting IDPS solutions to address the challenges posed by remote work and increased mobile device usage?

The rise in remote work and mobile device usage has led to a surge in demand for IDPS solutions that offer robust endpoint protection and real-time threat intelligence to safeguard distributed networks.

How is the global IDPS market expected to evolve over the next five years?

The market is anticipated to witness steady growth, driven by increased awareness of cybersecurity threats, advancements in threat intelligence, and the integration of IDPS with other security solutions for a holistic approach.

How do regulatory frameworks impact the deployment of Intrusion Detection and Prevention Systems on a global scale?

Stringent data protection regulations and compliance requirements, such as GDPR in Europe and HIPAA in the United States, are compelling organizations to invest in robust IDPS solutions to ensure data security and regulatory compliance.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]