Global Interventional Oncology Market Size, Share, Trends & Growth Forecast Report By Product, Cancer Type, End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Interventional Oncology Market Size

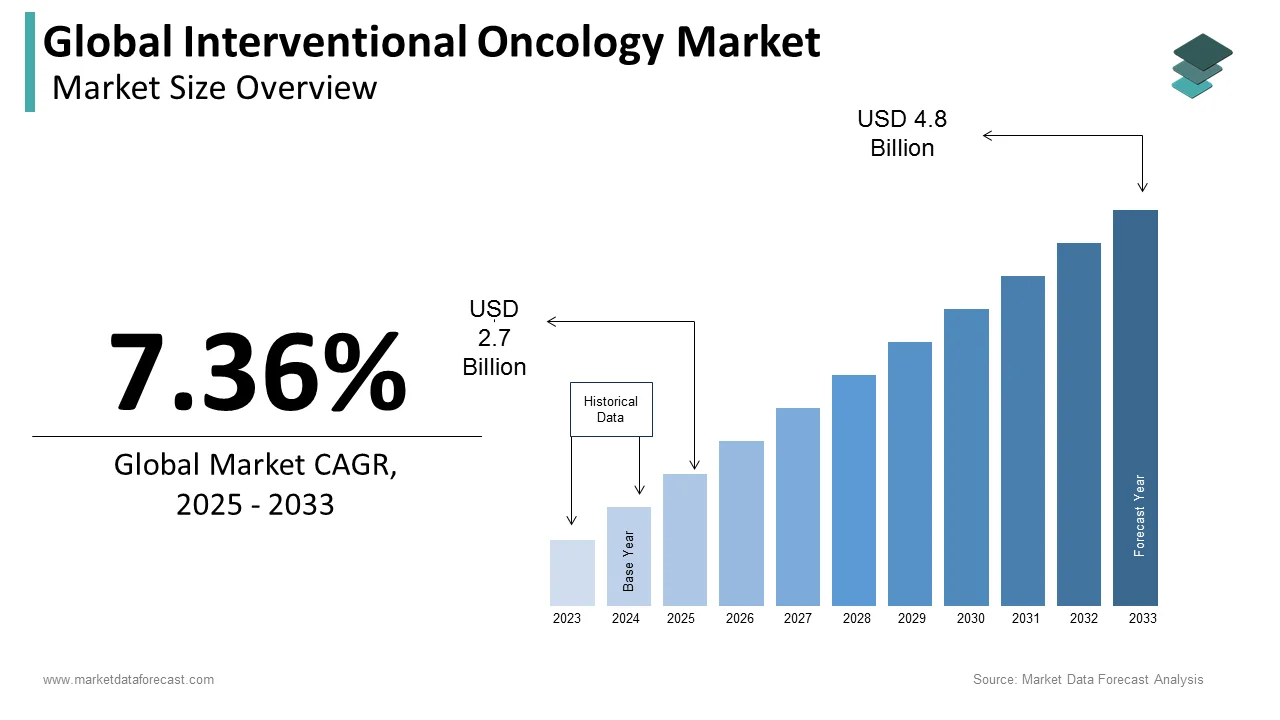

The global interventional oncology market was valued at USD 2.51 billion in 2024. The global market is projected to grow from USD 2.7 billion in 2025 to reach USD 4.8 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 7.36% during the forecast period 2025-2033.

Interventional oncology procedures include cancer diagnosis and therapy using minimally invasive procedures performed under imaging guidance. Guidance is provided by equipment such as x-ray, ultrasound, computed tomography, or magnetic resonance imaging. Interventional oncologists can develop safe ways for doing minimally invasive tumor biopsies to obtain the genetic or proteomic data needed to precisely personalize the chemotherapeutic drugs that are likely to have the optimal therapy impact. Interventional oncology is used to treat cancers such as liver, kidney, lung, bone, prostate, breast, and pancreatic cancer, whether primary or metastatic. Most of these operations can be done as outpatient procedures or require an overnight stay in the hospital.

MARKET DRIVERS

The growing cancer patient population is majorly driving the interventional oncology market growth.

As per the data published by International Agency for Research on Cancer (IARC), an estimated 17 million new cancer cases were recorded in 2018. According to the same source, approximately 27.5 million people are expected to be diagnosed with cancer by 2040, and cancer moralities are expected to be 16.3 million per year. The growing aging population, rising adoption of sedentary lifestyles by people and changes in the environment are some of the major factors behind the growing prevalence of cancer. In addition, the demand for effective cancer treatment procedures has grown with the growing population suffering from cancer, including interventional oncology procedures, resulting in market growth.

The rising demand for personalized medicine is anticipated to fuel the market’s growth rate.

The adoption of personalized medicine is growing among cancer patients as these treatments are believed to be more effective and have fewer side effects. Personalizing interventional oncology techniques such as tumor ablation and embolization has given promising results recently. This personalization is subject to the tumor size, location, and type. The demand for personalized cancer therapies has grown substantially in several countries due to improved patient care and increasing quality of life for cancer patients.

The growing adoption of minimally invasive surgeries is expected to favor the global interventional oncology market growth.

The popularity and adoption of minimally invasive surgeries have grown significantly in recent years due to the advantages of these surgeries, such as small incisions and quick recovery times compared to traditional surgeries. For instance, BTG International Ltd. joined hands with the Society of Interventional Oncology (SIO) to develop minimally invasive surgical therapies for cancer patients and to explore new interventional oncology treatment methods. As a result, the adoption of minimally invasive surgeries has risen in oncology procedures in recent years. Furthermore, the trend is expected to rise further in the coming years, resulting in market growth. As a result, minimally invasive surgeries in oncology, such as radiofrequency ablation and embolization, have been used considerably to treat cancer patients in recent years.

Furthermore, factors such as increasing healthcare expenditure, growing investments by governmental and non-governmental organizations to conduct R&D around interventional oncology, and an increasing number of partnerships and collaborations between the market players are projected to fuel the growth rate of the interventional oncology market in the coming years.

MARKET RESTRAINTS

Despite the availability of a large target patient population, a shortage of oncologists and radiologists is predicted to affect the adoption of interventional oncology procedures in various countries worldwide. In addition, the lack of clinical evidence supporting the benefits of interventional oncology and implementing techniques to improve therapeutic outcomes and safety of interventional oncology treatments are seen as central challenges to the market's expansion throughout the forecast period.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.36% |

|

Segments Covered |

By Product, Cancer Type, End-user, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Angiodynamics, Inc., Baylis Medical Company, Inc., Becton, Dickinson and Company, Boston Scientific Corporation, Cook Medical, Healthtronics, Inc., Icecure Medical, Imbiotechnologies Ltd., Johnson & Johnson, Medtronic PLC, Medwaves, Inc., Merit Medical Systems, Inc., Profound Medical Corp., Sanarus Technologies, Inc., and Sirtex Medical, and Others. |

SEGMENTAL ANALYSIS

By Product Insights

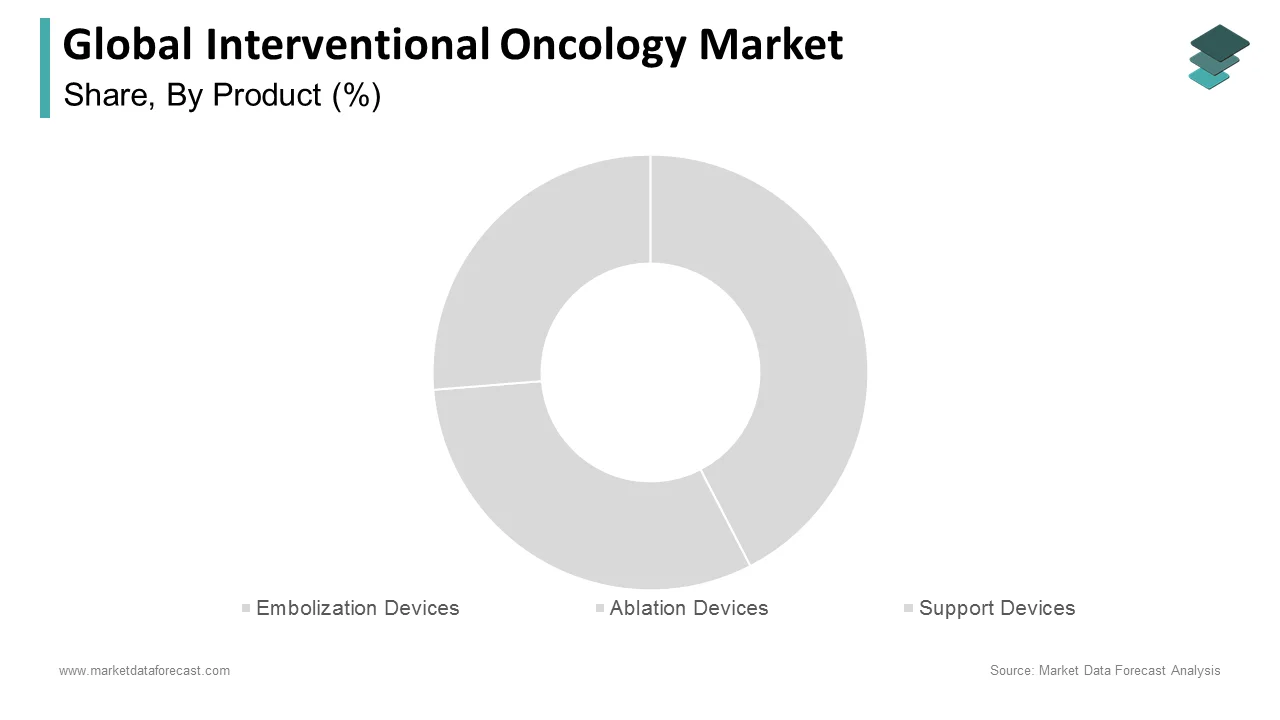

The embolization devices segment had the major share of the interventional oncology market in 2024. The domination of the segment can be attributed to the growing usage of minimally invasive treatments for liver cancer patients, as these devices are mostly used in embolization procedures for liver cancer patients.The ablation devices segment is expected to grow at a promising CAGR during the forecast period. Factors such as the growing adoption of these devices in cancer centers and hospitals for minimally invasive surgeries propel segmental growth.The support devices segment had a moderate share of the worldwide market in 2024 and is expected to grow at a considerable CAGR during the forecast period. Support devices are essential in the execution of interventional oncology treatments, which is majorly contributing to the segment's growth.

By Cancer Type Insights

The liver cancer segment held the largest share of the global interventional oncology market in 2024. The domination of segment is expected to continue dominating the market throughout the forecast period as interventional oncology procedures such as transarterial chemoembolization (TACE) and radiofrequency ablation (RFA) are the most preferred treatment procedures for liver cancer. The growing patient count suffering from liver cancer and rising demand for minimally invasive surgical procedures are expected to drive segmental growth. According to the American Cancer Society, an estimated 800,000 new liver cancers occur yearly. Liver cancer is the second most dangerous cancer among all types. The population suffering from liver cancer is gradually rising with each passing, resulting in the segment's growth rate.

The lung cancer segment accounted for the second-largest share of the global interventional oncology market in 2024 and is expected to grow at a notable CAGR during the forecast period. The growing lung cancer patient population is one of the key factors driving the segmental growth. According to the statistics published by the American Cancer Society, an estimated 238,340 new lung cancer cases are expected in the United States in 2024. In addition, factors such as the rising demand for minimally invasive surgical procedures such as microwave ablation, cryoablation, and brachytherapy to treat lung cancer and the increasing need for effective and accessible treatment options are promoting the growth of the lung cancer segment.

The breast cancer segment is another lucrative segment among the available and is predicted to register a healthy CAGR during the forecast period. The growing prevalence of breast cancer and the rising need for minimally invasive treatment options to treat breast cancer are majorly driving segmental growth. WHO says an estimated 685,000 people died of breast cancer in 2020.

By End User Insights

The hospital segment occupied the largest share of the global interventional oncology market in 2024. The segment’s domination is anticipated to continue during the forecast period as hospitals are equipped with the advanced medical infrastructure required to perform interventional oncology procedures. In addition, factors such as the presence of highly skilled professionals who have expertise in interventional oncology working at the hospitals, the growing number of cancer patients visiting hospitals for treatments, and strong referral networks are contributing to the segment's growth. On the other hand, the ambulatory surgical centers segment is predicted to grow rapidly during the forecast period.

REGIONAL ANALYSIS

The North American region held the leading share of the worldwide market in 2024. The domination of the North American region is expected to continue during the forecast period. Factors such as the growing cancer patient population in the North American region, the presence of sophisticated healthcare infrastructure, rapid adoption of technological developments in the healthcare system of North American countries, and the presence of key market participants are propelling the interventional oncology market growth in the North American region. In addition, the rising adoption of minimally invasive surgeries in cancer therapies is another noteworthy factor contributing to the growth of the North American market. The U.S. market captured the major share of the North American market in 2024, followed by Canada.

The APAC interventional oncology market is estimated to register the highest CAGR among all regions worldwide during the forecast period. The growing aging population is expected to fuel the market growth in APAC as cancer incidence is high among people aged. In addition, the growing number of favorable initiatives from the governments of APAC countries, a consistent number of developments in the healthcare infrastructure, and rising access to cancer care are expected to support the regional market growth. As a result, countries such as India and China are anticipated to hold the major share of the APAC market during the forecast period.

The European interventional oncology market occupied a substantial share of the global market in 2024 and is expected to grow considerably during the forecast period. The growing population suffering from cancer across the European region and the rising adoption of advanced medical technologies propel the European market growth. In addition, a well-advanced healthcare system in many European countries is another notable factor contributing to regional market growth.

The Latin American market is expected to hold a moderate share of the global market during the forecast period. The cancer patient population is growing gradually in Latin America, which is expected to create an increasing need for interventional oncology treatment procedures and boost regional market growth.

The MEA market is expected to register a steady CAGR in the coming years.

KEY MARKET PLAYERS

Angiodynamics, Inc., Baylis Medical Company, Inc., Becton, Dickinson and Company, Boston Scientific Corporation, Cook Medical, Healthtronics, Inc., Icecure Medical, Imbiotechnologies Ltd., Johnson & Johnson, Medtronic PLC, Medwaves, Inc., Merit Medical Systems, Inc., Profound Medical Corp., Sanarus Technologies, Inc., and Sirtex Medical are some of the prominent companies operating in the global interventional oncology market profiled in this report.

RECENT HAPPENINGS IN THE MARKET

-

Boston Scientific (U.S.) launched the TheraSphere Y-90 Glass Microspheres in 2021. TheraSphere is the most effective and potent HCC therapy that provides high-dose radiation safely and with the best possible results for patients.

-

In December 2023, A research article titled Early Phase Trial of Intracystic Injection of Large Surface Area Microparticle Paclitaxel for Treatment of Mucinous Pancreatic Cysts in Endoscopy International Open was just published, according to NanOlogy LLC, a clinical-stage interventional oncology drug company.

- In December 2023, Delcath Systems (Nasdaq: DCTH) disclosed that the company had completed the previously disclosed $6.2 million private placement. Nearly 1.45 million shares of the interventional oncology company's common stock were issued and sold at $2.90 each. In addition, it sold 692,042 pre-funded warrants to buy common stock instead of common stock. Each warrant costs $2.89 in total.

- In January 2023, the following letter to shareholders was published today by IceCure Medical Ltd. (Nasdaq: ICCM) (TASE: ICCM), developer of the ProSense® System, a minimally invasive cryoablation procedure that freezes malignancies to death.

MARKET SEGMENTATION

This research report on the global interventional oncology market has been segmented and sub-segmented based on product, cancer type, end-user, and region.

By Product

- Embolization Devices

- Radioembolic Agents

- Non-Radio embolic Agents

- Microspheres

- Coated Beads

- Microparticles

- Ablation Devices

- Radiofrequency (R.F.) Ablation Devices

- Microwave Ablation Devices

- Cryoablation Devices

- Other Ablation Devices

- Support Devices

- Microcatheters

- Guidewire

By Cancer Type

- Liver Cancer

- Lung Cancer

- Bone Metastasis

- Kidney Cancer

- Breast Cancer

- Prostate Cancer

- Other Cancers

By End User

- Hospitals

- Ambulatory Surgery Centers

- Research & Academic Institutes

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- The Middle East and Africa

Frequently Asked Questions

How much is the global interventional oncology market going to be worth by 2033?

As per our research report, the global interventional oncology market size is projected to be USD 4.8 billion by 2033.

Which region is growing the fastest in the global interventional oncology market?

Geographically, the North American interventional oncology market accounted for the largest share of the global market in 2024.

At What CAGR, the global interventional oncology market is expected to grow from 2025 to 2033?

The global interventional oncology market is estimated to grow at a CAGR of 7.36% from 2025 to 2033.

Which are the significant players operating in the interventional oncology market?

Baylis Medical Company, Inc., Becton, Dickinson, and Company, Boston Scientific Corporation, Cook Medical, Healthtronics, Inc., Icecure Medical, Imbiotechnologies Ltd., Johnson & Johnson, Medtronic PLC, Medwaves, Inc., Merit Medical Systems, Inc. are some of the significant players operating in the global interventional oncology market

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]