Global Interventional Cardiology Devices Market Size, Share, Trends & Growth Forecast Report By Type (Plaque Modification, Angioplasty Stents, Guidewires, Catheters, Hemodynamic Flow Alteration and Introducer Sheath) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Interventional Cardiology Devices Market Size

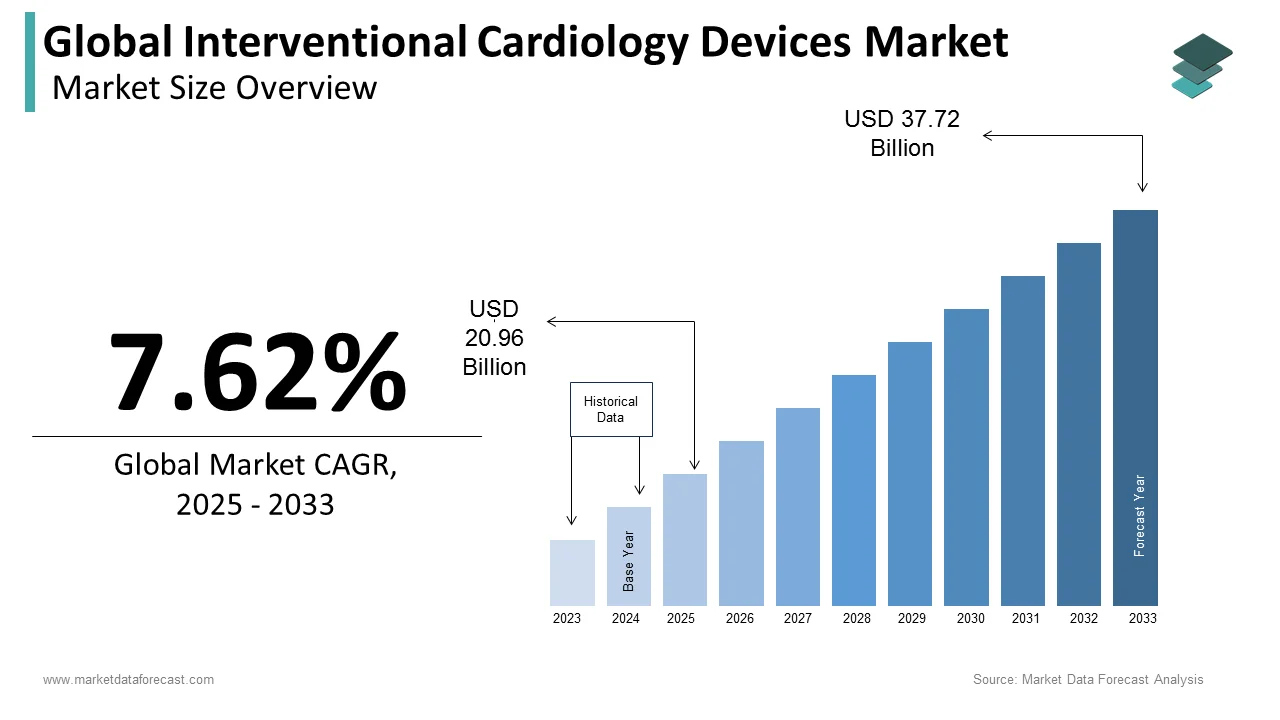

The size of the global interventional cardiology devices market was worth USD 19.48 billion in 2024. The global market is anticipated to grow at a CAGR of 7.62% from 2025 to 2033 and be worth USD 37.72 billion by 2033 from USD 20.96 billion in 2025.

MARKET DRIVERS

The rising prevalence of coronary artery diseases (CADs), technological advances in interventional cardiology devices, and the rising demand for minimally invasive treatment are majorly promoting the global interventional cardiology devices market growth.

The global interventional cardiology devices market is a fast-growing global market driven by the evolving operating procedure on the human heart. For better results and a higher success rate, cardiology's interventional devices help surgeons a lot. Manufacturing companies are expanding their R&D efforts to achieve long-term competitiveness through product innovation and growth. As a result, the demand for advanced goods to improve the patient experience would skyrocket. Treatment effectiveness is improved by combining nanotechnology and drug-eluting stents. It has benefits in treating coronary atrial diseases, such as decreased artery narrowing and improved blood flow, leading to increased product choice. The use of drug-eluting materials also boosts its growth potential.

The need for better and exact procedures on the human heart mainly drives the global market. The increase in the number of cardiac illness cases and the subsequent rise in the number of devices used is also a driving force in the global market. The key market participants of the global interventional cardiology devices market should expect lucrative growth opportunities as the geriatric population grows. According to the United States Census Bureau, the United States' geriatric population is expected to reach 77 million by 2034. Furthermore, the global interventional cardiology devices market is expected to benefit from adopting remote PCI (Percutaneous Coronary Intervention) procedures. For example, in December 2018, five patients at the Apex Heart Institute in Ahmedabad, India, underwent an elective PCI procedure using CorPath technology from approximately 20 miles. These are the opportunities for the interventional cardiology devices market.

MARKET RESTRAINTS

However, the costs associated with these devices concern the growth of global interventional cardiology devices in the projected forecast period. The global market is also concentrated in the North American and European regions; the chances of international expansion are improbable, especially in Africa and the middle east. Additionally, the availability of alternative treatments and product failures and recalls are expected to restrict the market's growth during the forecast period. Furthermore, the market's growth is expected to be limited by strict approval standards and government regulations. The FDA and CE classify interventional cardiology devices as high-risk class III medical devices. This complicates the device approval process, making it longer, stricter, and more expensive. Stent thrombosis, which occurs when blood clots form around the stent, is one of the most common complications associated with interventional cardiology procedures.

Impact of COVID-19 on the global interventional cardiology devices market

COVID-19 is an unprecedented global public health crisis that has impacted almost every sector, with long-term consequences expected to stifle industry growth over the forecast period. The COVID-19 outbreak has had a significant impact on the medical device industry, including the market for interventional cardiology devices. Despite the availability of emergency and outpatient services in cardiology departments, the number of patient visits to hospitals has decreased substantially in the last six months. Patient visits have been greatly reduced due to nationwide lockdowns and social distancing measures. This has resulted in a decrease in interventional cardiology product sales. Many leading interventional cardiology device manufacturers, such as Boston Scientific, Medtronic, and Abbott, have reported sales declines in the second and third quarters of 2020. Even though the COVID-19 pandemic will harm procedure volumes and market growth in 2020, the Asia Pacific IC (Interventional Cardiology) system market will continue to expand rapidly due to the increasing prevalence and diagnosis of CAD (coronary artery diseases) among the patient population. Growing adoption of next-generation DES (drug-eluting stent) and BRS (bare-metal stents), rising PCI (percutaneous coronary intervention) volumes, and the recent rise in the price limit for coronary stents in the broad Indian market would all lead to overall growth through 2033.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

7.62% |

|

Segments Covered |

By Type, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Medtronic (US), Lepu Medical Technology Co. Ltd. (Beijing), Baxter International Inc. (US), Boston Scientific (US), Abiomed, Inc. (the US), Abbott Laboratories (US), GE Healthcare (US), AngioDynamics, Inc. (the US), Terumo (Japan), Smith & Nephew plc (UK), Cordis (US), 3M Company (US), B. Braun Melsungen AG (Germany), Becton-Dickinson & Co. (US), C.R. Bard (US), Siemens AG (Germany), Biosensors (Singapore), Edwards Lifesciences Corporation (US), Sahajananad Medical Technologies Ltd. (India), Biotronik SE & Co. KG (Germany) and HeartWare International, Inc. (the US)., and Others. |

SEGMENTAL ANALYSIS

By Type Insights

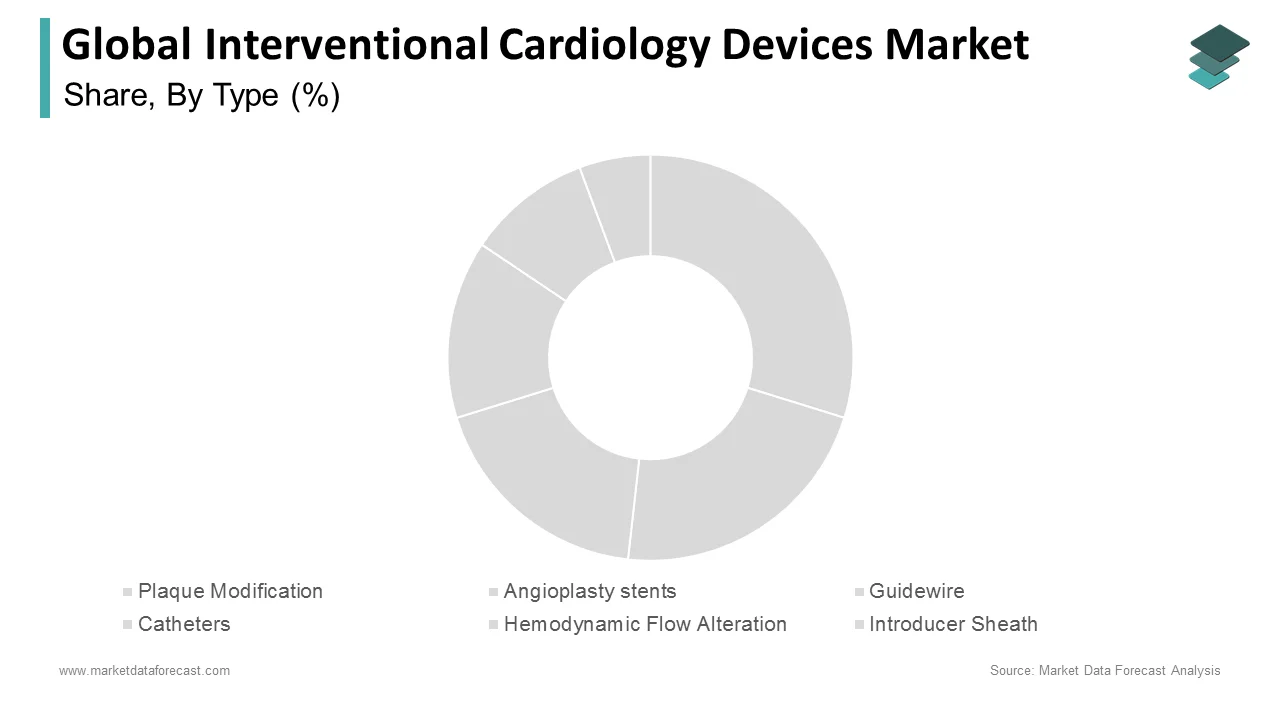

Based on type, Angioplasty stents are the fastest-growing segment in the global market for interventional cardiology devices. This segment held the largest share worldwide in 2023, mainly due to increased cardiology-related illness cases. The plaque modification devices segment is further sub-segmented into thrombectomy and atherectomy devices. Of the two, the thrombectomy devices segment is expected to lead in value and volume. This growth is attributed to the increased demand for plaque removal procedures and incidences of plaque deposition. The Hemodynamic flow alteration segment is further divided into total occlusion and embolic protection. The guidewires segment is expected to follow the lead in the global market for the projected forecast period. The excessive use of guidewires in present-day procedures to help surgeons perform surgery is the main reason for the projected growth of this segment in the global market.

REGIONAL ANALYSIS

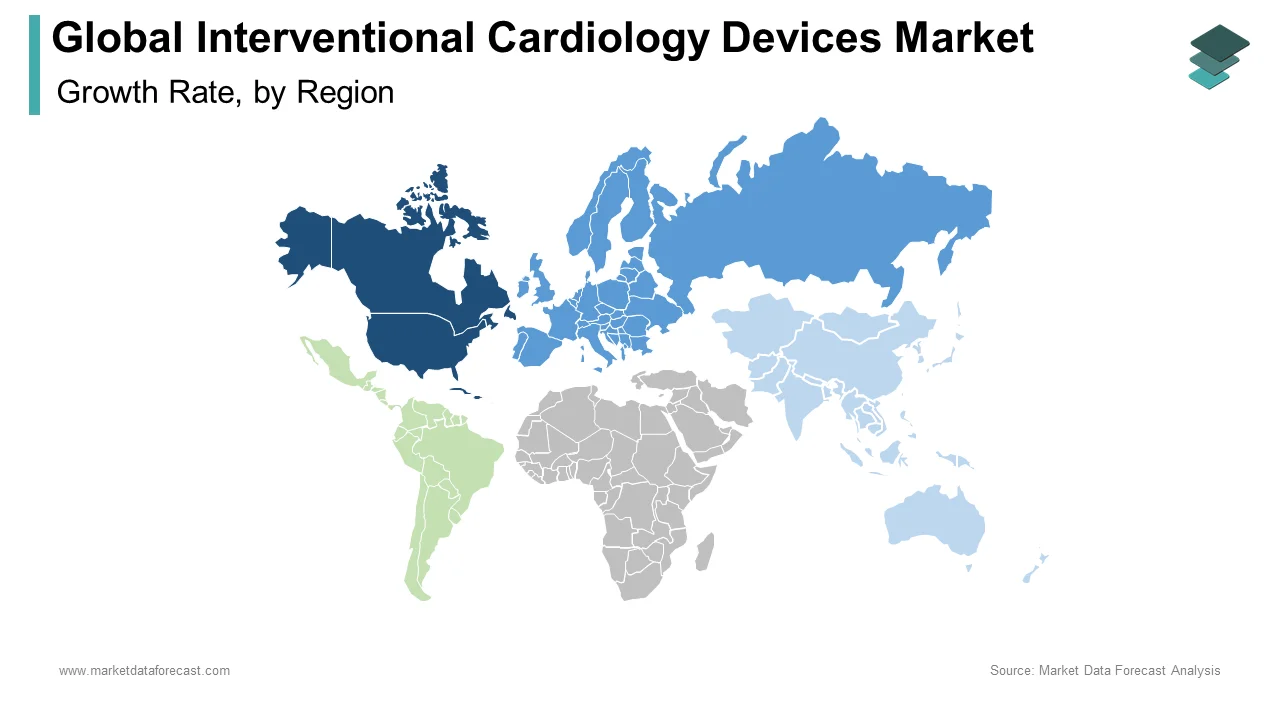

Geographically, North America leads the global interventional cardiology devices market by value and volume as of 2024. The situation of all the market key players in this region is the main reason for its leading market position. However, this region is the second-fastest growing in the world, following the Asia Pacific region.

Europe is next in the lead in the global market in the year 2024. The presence of a considerable customer base in and around this region helps grow the Interventional Cardiology Devices market in Europe. Also, the technological supremacy of Europe and North America over the rest of the world is the necessary condition that facilitates them to develop in this emerging field, creating an eye-catching performance in the global market. The Asia Pacific region has the next most significant market share in 2024 in value and volume. This region is expected to be the fastest-growing regional Interventional Cardiology Devices market owing to the future opportunities offered in this region and interest shown by the top leading key companies in the Asia Pacific region, mainly towards India, China, and Japan, which is the cause for such growth rate. The regional advantages offered in this region, such as ease of setup, cheap resources, and many skilled populations, are significant for this region’s advancement in the global market.

On the other hand, the Middle East & Africa, and Latin America regions, being in the low developing countries due to low GDP countries' contribution, have fewer opportunities for market growth. Hence, the Interventional Cardiology Devices Market grows slowly in these regions.

KEY MARKET PLAYERS

Companies that are playing a dominating role in the global interventional cardiology devices market profiled in this report are Medtronic (US), Lepu Medical Technology Co. Ltd. (Beijing), Baxter International Inc. (US), Boston Scientific (US), Abiomed, Inc. (the US), Abbott Laboratories (US), GE Healthcare (US), AngioDynamics, Inc. (the US), Terumo (Japan), Smith & Nephew plc (UK), Cordis (US), 3M Company (US), B. Braun Melsungen AG (Germany), Becton-Dickinson & Co. (US), C.R. Bard (US), Siemens AG (Germany), Biosensors (Singapore), Edwards Lifesciences Corporation (US), Sahajananad Medical Technologies Ltd. (India), Biotronik SE & Co. KG (Germany) and HeartWare International, Inc. (the US).

There is constant competition between these companies regarding the pricing and quality of the product. They are currently focused on providing expansion strategies to improve their market value and position.

RECENT MARKET HAPPENINGS

- Level X, a creator of medical video games for physicians, has entered cardiology with its fourth video game Cardio Ex. It will provide interventional cardiologists with breath-taking situations, which will help them prepare for real-life applications.

MARKET SEGMENTATION

This market research report on the global interventional cardiology devices market has been segmented and sub-segmented based on type and region.

By Type

- Plaque Modification

- Angioplasty stents

- Guidewire

- Catheters

- Hemodynamic Flow Alteration

- Introducer Sheath

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the interventional cardiology devices market?

The global interventional cardiology devices market was valued at USD 19.48 billion in 2024.

Who are the main players in the interventional cardiology devices market?

Abbott Laboratories, Boston Scientific, Medtronic, and Terumo Corporation are some of the notable players in the interventional cardiology device market.

What factors are driving the growth of the interventional cardiology devices market?

The growing prevalence of cardiovascular diseases, technological advancements in interventional cardiology devices, and the growing demand for minimally invasive procedures are driving the growth of the interventional cardiology devices market.

What are some of the challenges facing the interventional cardiology devices market?

Some of the challenges facing the interventional cardiology devices market include the high cost of interventional cardiology procedures, regulatory hurdles in gaining approval for new devices, and the competition from alternative treatments such as bypass surgery.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]