Global Insulin Pump Market Size, Share, Trends & Growth Forecast Report By Type (Traditional Insulin Pumps, Disposable Insulin Pumps), End User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 to 2033.

Global Insulin Pump Market Size

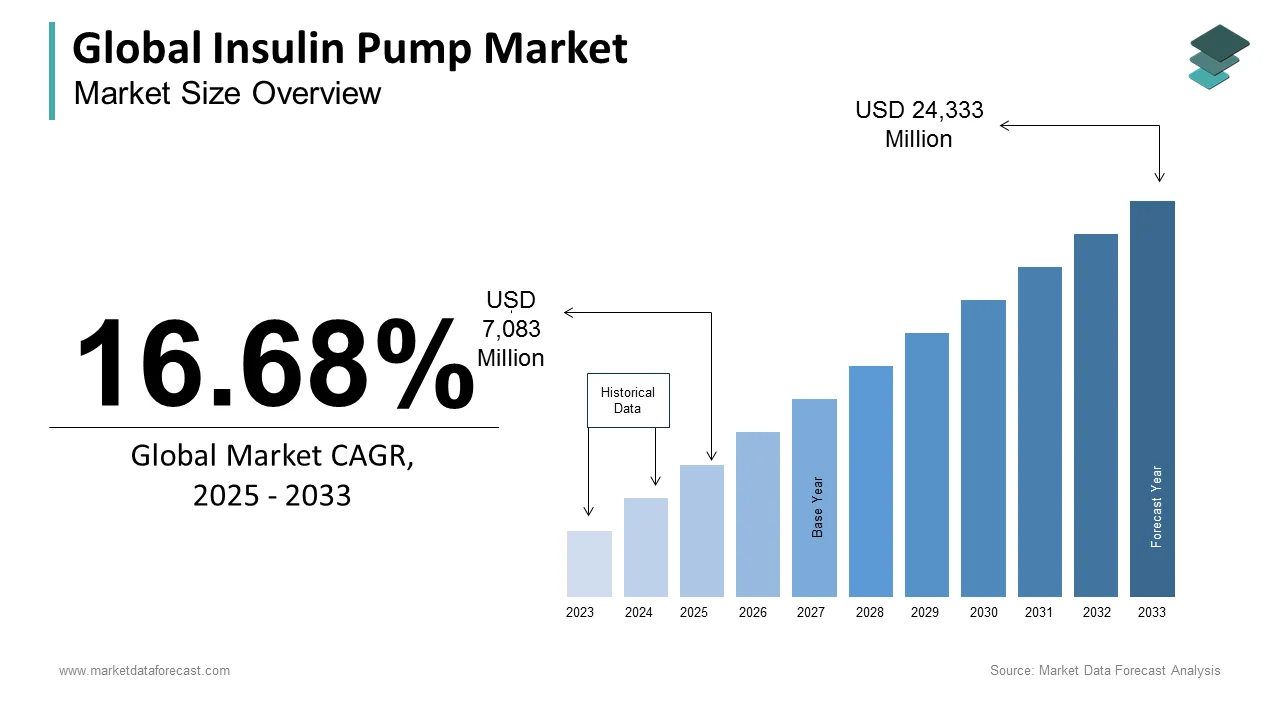

The global insulin pump market was worth US$ 6,071 million in 2024 and is anticipated to reach a valuation of US$ 24,333 million by 2033 from US$ 7,083 million in 2025, and it is predicted to register a CAGR of 16.68% during the forecast period 2025-2033.

An insulin pump is primarily used to inject small insulin doses into the human body to treat diabetes. The need for insulin pumps is growing rapidly worldwide, along with the growing patient population suffering from diabetes. Insulin management in the body is essential for people who have diabetes. The insulin dosages can be administered using insulin pumps; likewise, the sugar levels in the body can be controlled. In the recent past, the market has experienced technologically well-developed insulin pumps. These devices have smart features such as a programmable metabolic rate that assists patients in maintaining the right level of the dosage form.

MARKET DRIVERS

Growing diabetes management care is one of the key factors propelling the insulin pump market growth. The population suffering from diabetes worldwide is growing rapidly.

As per the data published by the IDF Diabetes Atlas, 537 million adults worldwide had diabetes in 2021, and this number is expected to rise to 643 million by 2030. The incidence of diabetes is more in developing and underdeveloped countries compared to developed countries. Approximately three in every four people have diabetes in low- and middle-income countries. People who have diabetes are required to have good control of their disease management to avoid meeting with risky situations. In recent past years, the awareness among people regarding the advantages of insulin pumps and the importance of diabetes management has grown significantly, which is driving the market growth. Insulin pumps are believed as a better option than traditional insulin injections. They are convenient and easy to use, due to which the adoption and demand levels for insulin pumps are increasing and boosting the market growth.

The rising adoption of insulin pumps is another major factor fuelling the market's growth rate. Furthermore, factors such as the development of the artificial pancreas and home infusion therapy promote this market's growth rate. Moreover, professional and consumer information programs provided by insulin infusion pump manufacturers are encouraging the adoption of insulin-delivering devices and ultimately driving the growth of this market. Additionally, increasing home healthcare infusion therapy, a growing aging population, and rising demand for personalized medicine are lavishing the market's growth rate. Increasing support from the government through investments in healthcare centers and policy changes favoring the public to spur growth opportunities for the market. Growing incidences of cardiovascular diseases, eye disorders, and others are escalating the global insulin pump market's growth.

MARKET RESTRAINTS

There have been a few drawbacks related to the use of insulin pumps. There is a need to enter information into the pump for the entire day. Also, the levels of blood sugar have to be checked frequently to make sure that the pump is working correctly, failing, which might lead to a life-threatening condition called diabetic ketoacidosis. Along with the need to change the infusion set every few days, training is required to learn the mechanism and application of an insulin pump to commit to using it safely. These factors lead to restraining the growth of the market. Furthermore, various concerns associated with insulin delivery devices, such as skin infections and the high cost of insulin analogs and pumps, hamper this market's growth. Further, the high cost of pump supplies makes it expensive to be adopted by people in middle and low-income countries, which further acts as an obstacle to the growth of the insulin pump market.

Besides, the need for more skilled professionals for appropriately handling insulin pumps further restrains this market's expansion to a certain extent. Moreover, research on aerosolized insulin for inhalation, oral insulin, and insulin-producing stem cell implantation is going on, and positive results will hinder the market's growth. In addition, it requires frequent visits with the healthcare team for a full day of outpatient training, a willingness to count carbohydrates, and a risk of skin infection or allergic reaction, which further restraints the market growth. Also, the insulin pump shows that a medical device is visible; several risks due to pump or site malfunction, and they require parental monitoring for quite a long time. Thus, these factors are foreseen to restrain the global insulin pump market growth over the forecast period.

MARKET OPPORTUNITIES

Advancements in Automated Insulin Delivery (AID) systems present potential opportunities for the expansion of the insulin pump market. The incidence of type 1 diabetes in the world is rising, still, only 800,000 patients with diabetes are presently utilising AID systems. Furthermore, there are more than 537 million individuals suffering from type 2 diabetes (T2D) in the world. 10 per cent to 15 per cent of people with T2D need insulin therapy, which is either exhaustion of beta cells or misdiagnosed. As a result, there are several insulin-dependent individuals with diabetes who could gain advantages from an AID system. Yet less than 1 per cent of patients who need insulin are currently utilising AID therapy. This may be partly attributed to limited resources, financial constraints, and difficulties in implementation. Therefore, it provides a huge opportunity for the market growth, particularly Asia pacific region.

MARKET CHALLENGES

-

Underreporting of issues with diabetes monitoring devices is one of the major challenges derailing the growth trajectory of the insulin pump market. This can lead to difficulties in recognizing issues and decreases the potential for improving the safety of these pumps and related diabetes technology

- For instance, in October 2024, the Medicines and Healthcare Products Regulatory Agency (MHRA) of the United Kingdom in a statement stated that it had received less than 300 Yellow Card reports, i.e. 273 reports since January 2023, concerning the devices from both the public and healthcare professionals, pointing out this number was ‘considerably fewer than anticipated, given their extensive usage.

The market also witnessed that in that same time frame, it received an increased count of reports from the producers or makers of these devices. However, the reports received from the manufacturers emphasize that the authorities or agencies are less direct submissions from consumers than typically anticipated. Therefore, it is a key problem impeding the expansion of this market.

- In October 2024, Medtronic, the producer, seller and developer of medical therapy devices, via announcement voluntarily called for a product withdrawal of their MiniMed 700 series or 600 series insulin pumps because of the possible shortened battery life of the pump. This can cause the device to stop the delivery of insulin considerably earlier than expected.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

16.68% |

|

Segments Covered |

By Pump Type, End-User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Animus Corporation (U.S.), Asante (U.S.), Cellnovo Ltd. (U.K.), Insulet Corporation (U.S.), Medtronics, Inc. (U.S.), Nipro Diagnostic, Inc. (Japan), Ypsomed (Switzerland), Roche (Switzerland), Soil Development Co., Ltd. (Korea) and Tandem Diabetes Care, Inc. (U.S.)., and Others. |

SEGMENTAL ANALYSIS

By Pump Type Insights

The disposable insulin pump segment accounted for the major share of the global insulin pump market in 2024. The segmental domination is anticipated to continue during the forecast period owing to the rising prevalence to reduce infections.

The traditional Insulin pump is projected to showcase healthy growth during the forecast period. Traditional insulin pumps have a reservoir and mechanism action with an infusion kit. The insulin path pumps deliver insulin directly into the body's skin. Traditional pumps offer flexibility, adjustable insulin delivery, privacy, improved blood sugar, fewer injections, and continuous insulin delivery.

By End User Insights

The hospital segment is expected to continue its dominance over the forecast period, associated with skilled professionals' availability, increasing government expenditure, and rising private sector investment in the healthcare sector. In addition, the high-profit margin of hospitals, the provision of improved treatment through the adoption of advanced solutions, and the offering of treatments to patients at lower prices due to products bought at a discounted price are other factors driving the market growth under this segment.

The home care segment is anticipated to grow at the fastest CAGR of 10.1% during the forecast period. The sector's growth is attributed to the increasing awareness about insulin pump use and the vast adoption of these products at home due to their usability. Furthermore, the growing use of patch pumps, compact and portable, is also expected to boost the market growth during the forecast timeframe.

The laboratories segment is anticipated to grow profitable over the forecast period. This is attributed to good quality facilities provided by labs and the presence of trained lab specialists. In addition, it helps in treating both types of diabetes, type 1, where the body produces insufficient insulin, and type 2, where the body is unable to absorb and use the insulin available.

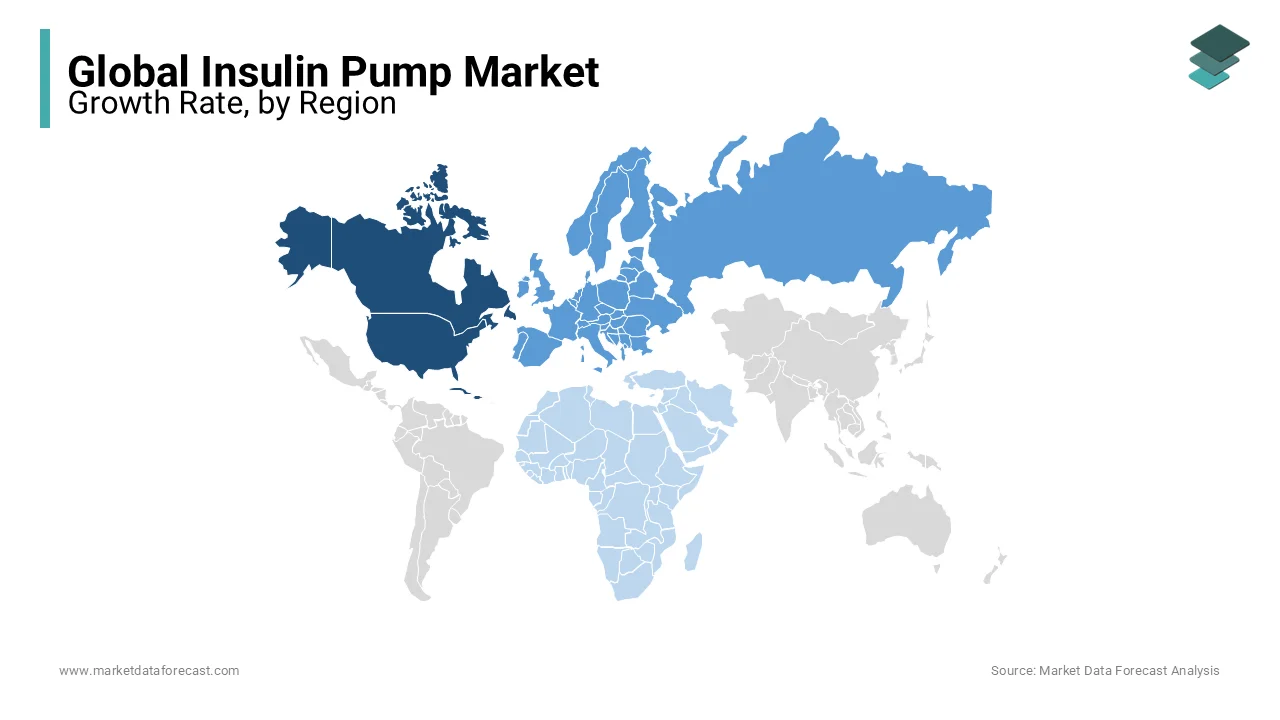

REGIONAL ANALYSIS

North America held the largest share of the global market in 2024, and the regional domination of the global market is anticipated to register a promising CAGR during the forecast period.

This is due to the presence of prominent market players, the increasing prevalence of diabetes, the rising adoption of technological advancements, and a surging number of product launches. In 2024, the U.S. insulin pump market held the major share of the North American market, followed by Canada.

- According to the National Diabetes Statistics Report for 2022 by the Centers for Disease Control, diabetes cases have climbed to an anticipated 37.3 million or 11. 3 per cent of the U.S. population. Out of these, 8.6 million people have diabetes but are still undiagnosed, and on the other hand, 28.7 million people are the ones who are diagnosed.

The Europe insulin pump market is expected to hold a substantial share of the global market over the forecast period owing to the growing ageing population prone to diabetes.

- As per the Medicines and Healthcare Products Regulatory Agency (MHRA), more than 5.6 million individuals in the United Kingdom are suffering from diabetes and the rate of prevalence is increasing. The latest statistics indicate that 549,000 more individuals have been identified over the last year, i.e. 2024, as being at risk of developing type 2 diabetes.

In addition, an increasing number of improvements in the healthcare system of various European countries and the implementation of advanced medical products augment the regional market growth. With the adoption of the latest technologies and innovative devices in favor of the patient's health condition, the European insulin pump market is anticipated to hold promising occupancy in the global market during the forecast period. Furthermore, increasing awareness of the availability of the Insulin pump among the European population is likely to outshine the demand for insulin pumps and drive the growth rate of the European market.

The APAC insulin pump market is considered the hot spot for insulin pumps, and the market in this region is anticipated to showcase the fastest CAGR during the forecast period. The growing investments from governmental and non-governmental organizations to promote awareness of diabetes in the APAC countries and the increasing number of initiatives from the governments of APAC countries in favor of insulin pumps are expected to aid the regional market growth. China occupied the largest share of the APAC market in 2024 and is expected to witness a healthy CAGR in the coming years owing to the increasing patient population suffering from diabetes. In addition, the rapid adoption of technological developments in the manufacturing of effective insulin pumps in the developing countries of the APAC region is expected to support market growth in the Asia-Pacific region. Furthermore, the growing aging population in the APAC countries and increasing manufacturing activities of insulin pumps are estimated to promote the growth rate of the APAC insulin pump market.

During the forecast period, the Latin American insulin pump market is predicted to showcase a steady CAGR owing to the rising diabetic population, increasing adoption of insulin pumps, an increasing number of products entering the market, and rising adoption of sedentary lifestyles.

The MEA insulin pump market had a moderate global market share in 2024 and is expected to grow at a sluggish CAGR during the forecast period. Factors such as an increasing number of developments in the healthcare system among the MEA countries, a growing ageing population, and the rising prevalence of diabetes are favouring the insulin pump market growth in the MEA region. In addition, growing awareness regarding the benefits of insulin pumps among people and healthcare providers in the MEA countries, growing incidence of obesity, and increasing number of initiatives from the governments of MEA to make these devices more affordable and accessible are propelling the MEA market growth.

KEY MARKET PLAYERS

Notable companies playing a dominant role in the global insulin pump market profiled in this report are Animus Corporation (U.S.), Asante (U.S.), Cellnovo Ltd. (U.K.), Insulet Corporation (U.S.), Medtronics, Inc. (U.S.), Nipro Diagnostic, Inc. (Japan), Ypsomed (Switzerland), Roche (Switzerland), Soil Development Co., Ltd. (Korea) and Tandem Diabetes Care, Inc. (U.S.)., and Others.

RECENT MARKET HAPPENINGS

- In September 2024, Medtronic Diabetes revealed that they are providing financial support to the biopharmaceutical company Arecor Therapeutics to create an innovative, highly concentrated, thermostable insulin tailored for application in implantable insulin pumps. Both Arecor and Medtronic partnered to develop this new type of insulin.

- In September 2024, Embecta Corp. announced that the Food and Drug Administration (FDA) has approved 510 (K) clearance for an insulin patch pump designed for adults with type 2 or type 1 diabetes. According to a press release from the company, the FDA has authorised Embecta’s disposable insulin delivery system, which comprises a tubeless patch pump with a 300 U insulin reservoir designed for adjustable basal and bolus insulin use for up to three days. Moreover, the system comes with a protected controller that incorporates a colour touchscreen interface and Bluetooth wireless connectivity.

- In May 2024, the U.S. FDA approved the Beta Bionics iLet ACE Pump and the iLet Decision Software for individuals aged six and older with type 1 diabetes. Together with a compatible FDA-cleared integrated continuous glucose monitor (iCGM), these devices will create a new system known as the iLet Bionic Pancreas. This automated insulin dosing (AID) system utilises an algorithm to manage and direct its delivery.

MARKET SEGMENTATION

This global insulin pump market research report has been segmented based on the pump type, end-user, and region.

By Pump Type

- Traditional

- Disposable

By End User

- Hospitals & Clinics

- Homecare

- Laboratories

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

Does this report include the impact of COVID-19 on the insulin pump market?

Yes, we have studied and included the COVID-19 impact on the global insulin pump market in this report.

Which segment by pump type held the significant share in the insulin pump market?

Based on pump type, the disposable pump type occupied the largest share of the insulin pump market in 2024.

Which are the major players operating in the insulin pump market?

Animus Corporation (U.S.), Asante (U.S.), Cellnovo Ltd. (U.K.), Insulet Corporation (U.S.), Medtronics, Inc. (U.S.), Nipro Diagnostic, Inc. (Japan), Ypsomed (Switzerland), Roche (Switzerland), Sooil Development Co., Ltd. (Korea) and Tandem Diabetes Care, Inc. (U.S.) are some of the prominent companies operating in the insulin pump market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]