Global Insect Protein Market Size, Share, Trends, & Growth Forecast Report - Segmented By Product (Coleoptera, Lepidoptera, Hymenoptera, Orthoptera, Hemiptera, Diptera), Application (Food And Beverages, Personal Care And Cosmetics), And Region(North America, Europe, Asia-Pacific, Latin America, Middle East And Africa) - Global Industry Analysis, Size, Share, Growth, Trends And Forecast 2025 To 2033

Global Insect Protein Market Size

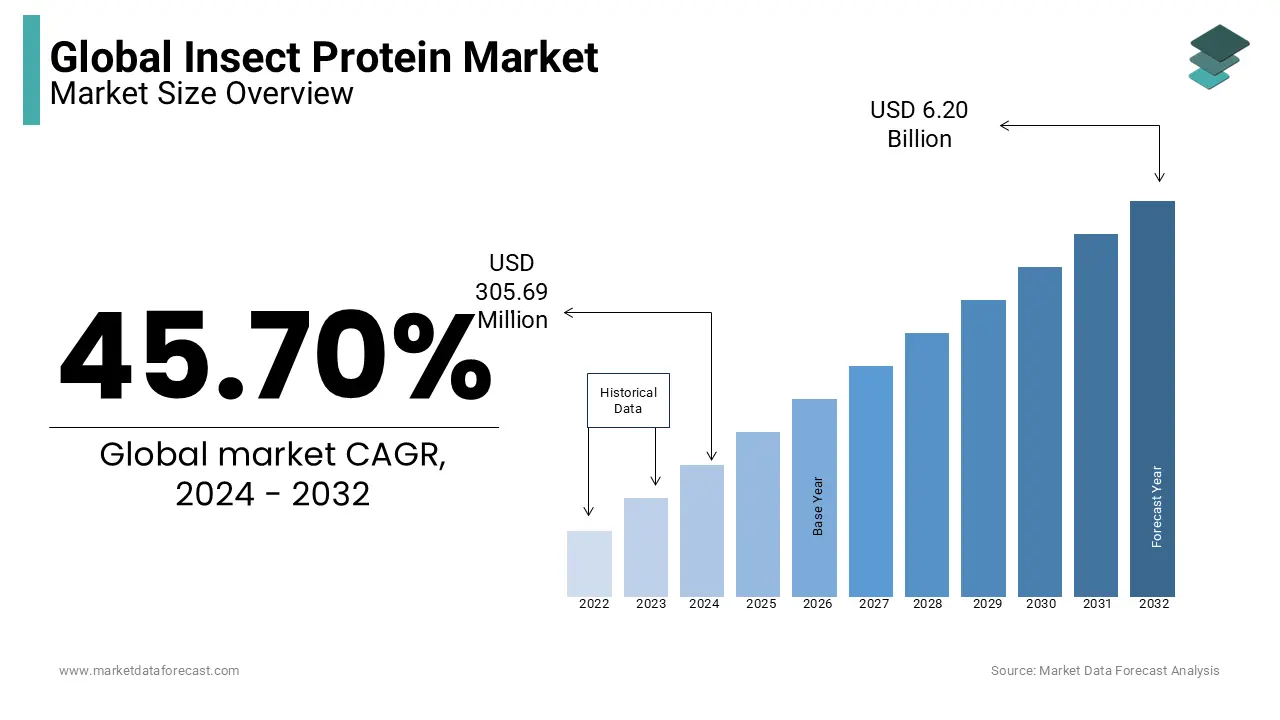

The size of the global insect protein market was expected to be worth USD 305.69 million in 2024 and is anticipated to be worth USD 9.04 billion by 2033 from USD 445.39 million in 2025, growing at a CAGR of 45.70% during the forecast period.Technological advances are accelerating the growth of the market with new ways of including insect proteins in other food and feed.

Insects are known to be a prominent protein source that can be processed in the form of powders to add as a component in the diet of animals and humans. It is an adequate source of protein that is mainly in demand in the food industry. Insect protein is gaining market attention as a sustainable alternative to protein for years to come. Insect protein is a high-quality protein available in various forms, such as insect protein powder and insect protein animal food. Insects, plants, microorganisms, and some fish species produce antifreeze proteins. Whole insects, flour and oil are the most widely used types of protein products against insects. Protein production from fish, poultry and livestock has become a difficult task due to significant inflation of the world population and the high demand for end-user protein-based products. This has changed the possibilities for industry players to produce insect species for protein. As a traditional protein product, all essential components exist, making it a competent protein product on the market.

As interest in future sustainability grows, there are factors driving the market, such as shifting preferences from animal proteins to alternative proteins, such as insect proteins, and increasing public and private support for new research projects from insect proteins in developed and developing countries.

CURRENT SCENARIO OF THE GLOBAL INSECT PROTEIN MARKET

The swift rise in human population and escalated demand for animal-based proteins has attracted more attention on the application of arthropods as a sustainable food and feed source to alleviate nutritional deficiencies and food insecurity. Currently, the insect protein market is experiencing greater interest from companies, public establishments, scientific and research institutions in the last few years. Moreover, the business of edible insects provides considerable financial returns, with the worldwide market is projected to hit 1.2 billion U.S. dollars this year. Advances in recent years have resulted in the creation of large-scale arthropod production facilities for feed and food globally, coupled with the development of processed items and extraction of bioactive compounds for diverse applications. The industrial-scale rearing of this produces significant quantities of frass is increasingly advancing towards a circular economy and sustainable agriculture.

The market since the past few years is being witnessing a negative environmental effect caused by the traditional farm animals which has been treated as an important issue over the world. This is because it is a key source for the discharge of greenhouse gas and is related to a substantial reduction of natural resources, like water and land. While the desire or call for dietary proteins is surging, there is urgency for the unification of more tenable or endurable cultivation systems, for example, consumable insects.

MARKET DRIVERS

Growth is primarily driven by the willingness of asset investors to invest in the development of insect protein manufacturers.

Changes in consumer preference for alternative sources of protein, a greater tendency to consume insect-based foods, and the easy availability of edible insects are some of the key drivers of market growth. The benefits of low environmental stress and the high nutritional value of insects are more expected factors to increase demand. Plexanians know more about sustainability and food supply, as do people who eat less meat, buy organic, or eat paleontologists. The adoption of this protein product is expanded by the food sector that handles unmet protein needs. Sales of alternative protein products, such as insect protein, are increasing as the demand for protein increases significantly worldwide. The feed industry is another sector that drives market growth through the rapid consumption of protein products. The market is full of insect protein products, such as mixed insect snacks, protein drinks, and protein bars, creating a strong source of revenue for manufacturers. The food and beverage sector is receiving great attention in the protein market due to the introduction of new protein products. To address these issues, market leaders are turning their attention to competent protein sources, such as animals. Insects are a rich source of protein and are high in protein compared to various animals and plants. Raising edible insects on a commercial scale requires fewer resources, such as land and food. Initially, insect protein was used only as an ingredient in animal feed. This change in attitude towards food is expected to create new opportunities in the insect protein market soon.

Therefore, due to the high protein content, some insects are raised and their application as an alternative source of protein is increasing. As awareness of the high protein content of insects increases, its coverage has diversified into other industries. For example, market players are offering powdered insect proteins to various food and beverage manufacturers, pharmaceuticals, functional foods, cosmetics, pet food, and pet food. In addition to this, insects are used to feed farm animals due to their high nutritional value, which helps to chart the profitable growth curve of the micronutrient sector for animal feed. Market demand will increase as demand for new nutritious food solutions increases for indirect and direct human intake. The reduction in land use for protein production through insect cultivation and the availability of technology for nutritional protein products will provide a new growth path for the market in the coming years. Furthermore, a thriving HI production company has also contributed favorably to the expansion of the insect protein market in recent years. In addition, insects are composed of biologically active residues that contain lauric acid, chitin, and antimicrobial peptides that have immune-enhancing functions, which are consumed in the diet to improve intestinal health.

MARKET RESTRAINTS

Although after the well-known advantages, various obstacles imped the extensive adoption in the insect protein market. There is a considerable void in comprehensive legal frameworks to maintain the quality and safety of arthropod-sourced food items. Also, it is essential for the market players to systematically deal with potential dangers, like allergens, heavy metals, and pathogens. Furthermore, customer’s acceptance remains one of the major hurdles, especially in Western societies that do not have a tradition of entomophagy. Novel and advanced processing technologies and efficient strategies for marketing are important to improving the tastiness and attractiveness of insect-based products. Additionally, environmental and ethical factors are becoming more significant. Numerous countries enacted legal protections for arthropod species, including those historically harvested for food and therapeutic purposes. All these factors are restricting the growth of the insect protein market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

45.70% |

|

Segments Covered |

By Application, Product, And Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC; PESTLE Analysis. Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Aspire Food Group, Protifarm NV Entomo Farms, Protix, Jimini's, Chapul Cricket Protein, Swarm Nutrition GmbH, EnviroFlight LLC, InnovaFeed SAS, AgriProtein Holdings Ltd, and Hexafly |

SEGMENTAL ANALYSIS

Global Insect Protein Market Analysis By Application

Adoption of insect-based proteins is increasing in many food and beverage applications, such as bakeries, dietary supplements, and snacks, as food and beverage producers are increasing the need for protein alternatives to meet growing consumer demands. Insect protein is even more appealing to vegetarian cat owners, as cats need taurine, an essential amino acid found in meat and fish.

Global Insect Protein Market Analysis By Product

The beetle's neck refers to the sequence of insects consisting of beetles and worms. It is the largest insect and represents approximately 40% of the species. Edible beetles have been traditionally consumed in many countries due to their high protein content. Consumption of live insects from such species is widespread, but extracting protein from them is a relatively new concept.

REGIONAL ANALYSIS

Africa is expected to gradually grow during the forecast period for the insect protein market. This progress can be linked to the becoming apparent edible insect industry in the region. These consumable arthropod gives a diverse array of bioactive compounds, minerals, fats, carbohydrates, and proteins. The abundance of nutrients, easy availability, affordability in production have boosted their adoption as a substitute protein source in animal feed, contributing the growth of its market share. In addition, over 2,000 species of edible insects have been documented around the world, with 470 species found in Africa.

KEY PLAYERS IN THE GLOBAL INSECT PROTEIN MARKET

Major key Players in the global insect protein market are Aspire Food Group, Protifarm NV Entomo Farms, Protix, Jimini's, Chapul Cricket Protein, Swarm Nutrition GmbH, EnviroFlight LLC, InnovaFeed SAS, AgriProtein Holdings Ltd, and Hexafly

RECENT HAPPENINGS IN THE MARKET

- In December 2024, Arthro Biotech received the EU TRACES certificate. With this, it is the first Indian producer of Black Soldier Fly (BSF) insect protein. The certification enables the business to export superior-quality ingredients derived from insects to Europe and other global markets. Moreover, it previously created the biggest BSF breeding program for garbage removal in the world. Now, it concentrates on making BSFL ingredients through the utilization of clean and verifiable or trackable plant-sourced input materials from farming sectors like the distillery and starch industries. Also, it emphasizes on supply via its pilot-scale production to the pet food companies operating at international level. In addition, its pilot factory in Hyderabad (India) possess yearly manufacturing capacity of 500 tons (alongside content of crude protein surpassing 55 per cent), and also satisfies all legal obligations for export, comprising enrolment with the EU TRACES system. Additionally, it revealed its aim to open 5000 ton facility by September 2025 for decreasing costs and situated near raw material sources.

- In May 2024, HiProMine, a Polish company, introduced a big insect facility in Karkoszow (Lubuskie Voivodeship), situated just 100 km away from Berlin (Germany). The factory has a 25,0000 tons per annum production capacity for both organic fertilisers and livestock. This makes it the largest in the central Europe. Further, it takes advantage of proprietary technologies for insect rearing and breeding, and employs many scientists engaged in comprehensive research on nutritional value of protein for various animal species.

DETAILED SEGMENTATION OF THE GLOBAL INSECT PROTEIN MARKET INCLUDED IN THIS REPORT

This research report on the global insect protein market has been segmented and sub-segmented based on application, product, and region.

By Application

- Food and Beverages

- Personal Care

- Cosmetics

- Animal Nutrition

By Product

- Lepidoptera

- Coleoptera

- Hymenoptera

- Hemiptera

- Orthoptera

- Diptera

By Region

- North America

- Middle East and Africa

- Europe

- Asia and Pacific

- Latin America

Frequently Asked Questions

1. What are the current trends driving the growth of the insect protein market?

The current trends driving the growth of the insect protein market are Increasing consumer awareness and acceptance of alternative protein sources, and Growing demand for sustainable and environmentally friendly food options.

2. What are the key factors influencing consumer purchasing decisions in the insect protein market?

The key factors influencing consumer purchasing decisions in the insect protein market are Taste and sensory appeal of insect-based products, Price competitiveness compared to traditional protein sources, and Brand transparency, sustainability practices, and ethical considerations in insect sourcing and production.

3. How is the insect protein market expected to grow in the future?

The insect protein market is projected to experience significant growth due to increasing demand for sustainable protein sources, rising awareness of the environmental impact of traditional livestock farming, and advancements in insect farming and processing technologies.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]