Global Inorganic Scintillators Market Size, Share, Trends & Growth Forecast Report By Scintillation Material, Type, Application and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Inorganic Scintillators Market Size

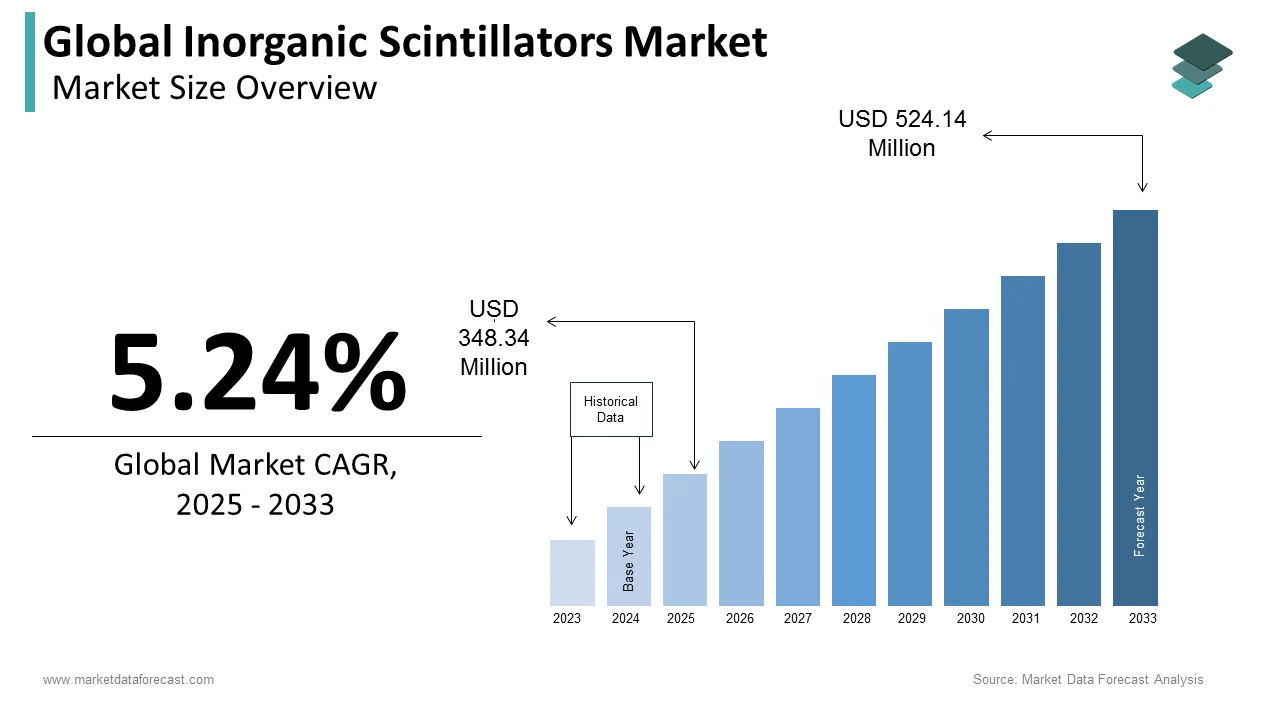

The global inorganic scintillators market was worth US$ 331 million in 2024 and is anticipated to reach a valuation of US$ 524.14 million by 2033 from US$ 348.34 million in 2025, and it is predicted to register a CAGR of 5.24% during the forecast period 2025-2033.

Inorganic Scintillators are transparent crystals whose dimensions range from millimeters to centimeters. These scintillators are commonly used to find ionizing radiation manufactured with alkali halides and oxides and located in the form of crystals at very high temperatures. These crystalline structures create an energy band through which electrons can reach the highest excitation levels through the ionizing emission of photons. These inorganic scintillation materials are used in defense, medical, security, etc. Countries like the U.K., China, UAE, India, and South Korea decided to continue with their plans for building nuclear power plants.

MARKET DRIVERS

Increased usage of scintillating materials in industries such as defense, medical, security, and others primarily boost the global inorganic scintillators market growth.

Market growth is majorly driven by the high level of safety that has been needed since the many nuclear accidents and disasters. The increased security for the homelands and the expansion of nuclear plants are reasons for rising demand levels for the global inorganic scintillators market. Moreover, advancements in radiographic system technology and the increasing number of chronic disease incidents are expected to boost market growth in the coming years. The growing use of C.T. or PET scans in medical treatments is bolstering the market's demand. A PET scan is used in the fields of cardiology, psychiatry, and neurology. Cancer cells need high-intensity radiation after the PET scan, where the physicians can get the images of the cancer tumor. The increasing incidents of cancer will drive the inorganic scintillator market in the forecast period.

MARKET RESTRAINTS

The smaller workforce and the reduced number of power plants in Japan and Europe hinder the growth of the global inorganic scintillators market. Nowadays, current labor laws protect workers' health rights. As a result, in some cases, some personnel who were not correctly trained accidentally come in contact with toxic radiation and are unable to control the particular situation. Also, there have been many failures in radiological screening, but there have been no executions for corrective actions.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.24% |

|

Segments Covered |

By Scintillation Material, Type, Application, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Saint Gobain S.A., Hamamatsu Photonics K.K., Dynasil Corporation of America, Hitachi Metals Group, Rexon Components Inc., Detec, Toshiba Materials Co., Ltd., Scintacor, EPIC Crystal Company Limited, Amcrys, Alpha Spectra, Inc., Shanghai SICCAS High Technology Corporation and Nihon Kessho Kogaku Co. Ltd., and Others. |

SEGMENTAL ANALYSIS

By Scintillation Material Insights

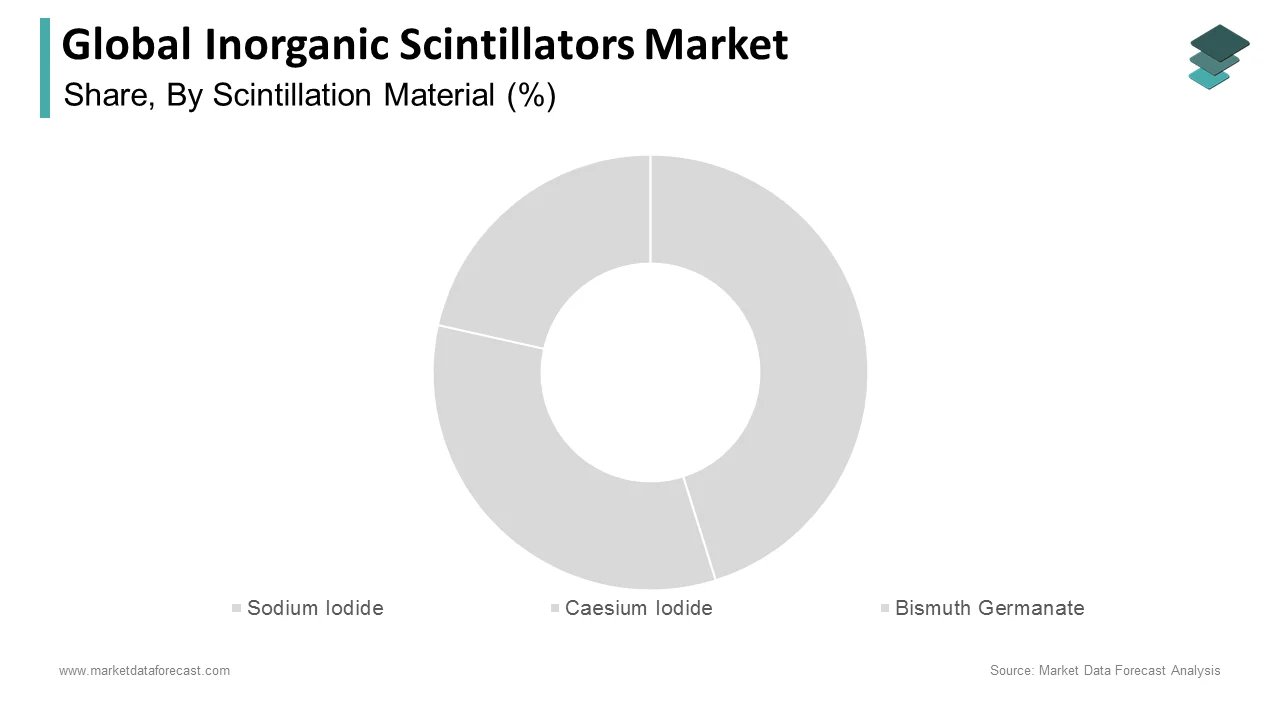

Based on scintillation material, the Sodium iodide segment has the largest share in the Inorganic Scintillators Market. Thallium-activated sodium iodide is the most predominant scintillation material used. It is a consequence of its superior properties at an extremely affordable price. Its excellent light yield, coupled with its luminescence spectrum, is well-matched to present photomultiplier tubes. Cesium iodide is another chief material used in medical imaging and security industries. Its hygroscopic nature and shock sensitivity have increased its market penetration in various mobile detection systems. It is frequently used where low, and high-energy gamma rays are involved.

By Type Insights

The Alkali halides segment has the largest share in this market based on type. Its superior properties, such as high resolution, sensitivity, and efficiency, have led to its extensive use in the medical imaging and devices sector. It is anticipated to be a result of the growing market. Rare earth metals held the second-largest share in this market segment due to their extensive radiation detection material use. The excellent properties of these materials have resulted in an increase in their level of market penetration over the coming years.

By Application Insights

Based on application, the healthcare sector held the largest share of this market. The X-ray imaging industry is transitioning from thin film to digital, which has taken place in the photography sector over the past decade. Early adoption in the medical industry regarding a move towards digital and digital x-ray imaging has become the latest trend. Detector prices have dropped over the past few years, which has caused the lowering of prices for scintillating materials. The nuclear power plant sector was the second-largest segment. It can be attributed to the growth in nuclear energy, henceforth leading to an increase in the penetration of radiation detection materials.

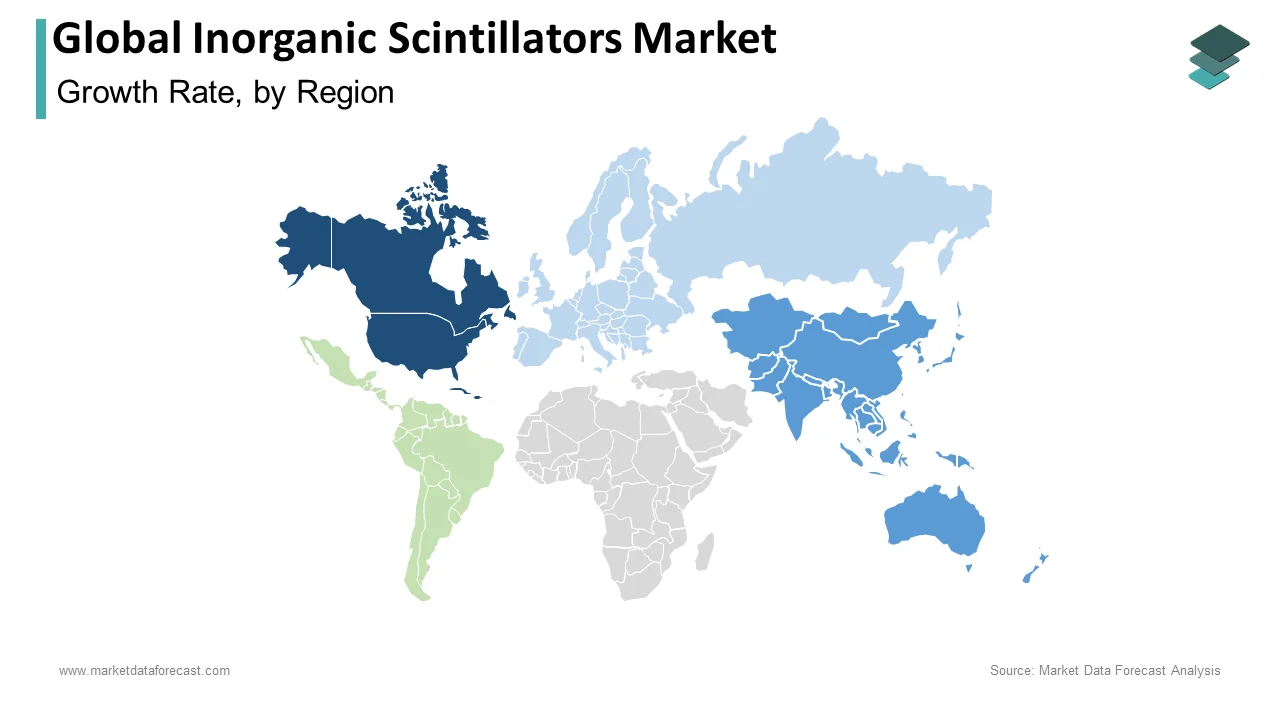

REGIONAL ANALYSIS

Regionally, the North American region held the largest share globally, followed by Europe in 2020. Growth in the demand for advanced medical equipment coupled with an increasing focus on nuclear power and improvement in security is expected to expand the market over the forecast period.

Asia-Pacific is expected to register the highest growth rate in the coming years. Emerging economies, including India and China, are improving their security systems at stations, ports, and airports by installing radiation detection systems. The emerging markets are expected to offer high potential over the coming years.

KEY MARKET PLAYERS

Noteworthy companies leading the global inorganic scintillators market profiled in this report are Saint Gobain S.A., Hamamatsu Photonics K.K., Dynasil Corporation of America, Hitachi Metals Group, Rexon Components Inc., Detec, Toshiba Materials Co., Ltd., Scintacor, EPIC Crystal Company Limited, Amcrys, Alpha Spectra, Inc., Shanghai SICCAS High Technology Corporation and Nihon Kessho Kogaku Co. Ltd.

RECENT MARKET DEVELOPMENTS

-

RMD, a division of Radiation Monitoring Devices, was selected in August 2018 to acquire two Phase II grants worth $2 million from the U.S. Department of Energy. The Department of Energy runs two programs: Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR).

-

In October 2018, Scintacor acquired Photonic Science Limited, a high-tech, independent manufacturer of scientific detector devices ranging from visible light to X-ray and neutron detection.

- Saint-Gobain Crystals launched extended Life Plastic detectors for radiation portal control (RPM) applications in July 2018. RPM devices can run with a low probability of escape, high uptime, and low cost due to the genius Extended Life Plastic for gamma energy detection.

MARKET SEGMENTATION

This research report on the global inorganic scintillators market has been segmented based on the scintillation material, type, application, and region.

By Scintillation Material

- Sodium Iodide

- Caesium Iodide

- Lutetium Oxyorthosilicate & Lutetium–Yttrium Oxyorthosilicate

- Bismuth Germanate

- Other Scintillation Materials

By Type

- Alkali Halides

- Oxide Compound

- Rare Earth Metals

By Application

- Healthcare

- Nuclear Power Plants

- Industrial Applications

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: sales@marketdataforecast.com