Global Industrial Vegetation Management Market Size, Share, Trends & Growth Forecast Report – Segmented By Product Type (Insecticides, Herbicides, Plant Growth Regulators, and Others), End Use Industry (Utilities, Road ways, Rail Ways, Oil and Gas, Industrial Areas, Forestry, Rangeland and Pastureland) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa) – Industry Analysis From 2024 to 2032

Global Industrial Vegetation Management Market Size (2024 to 2032)

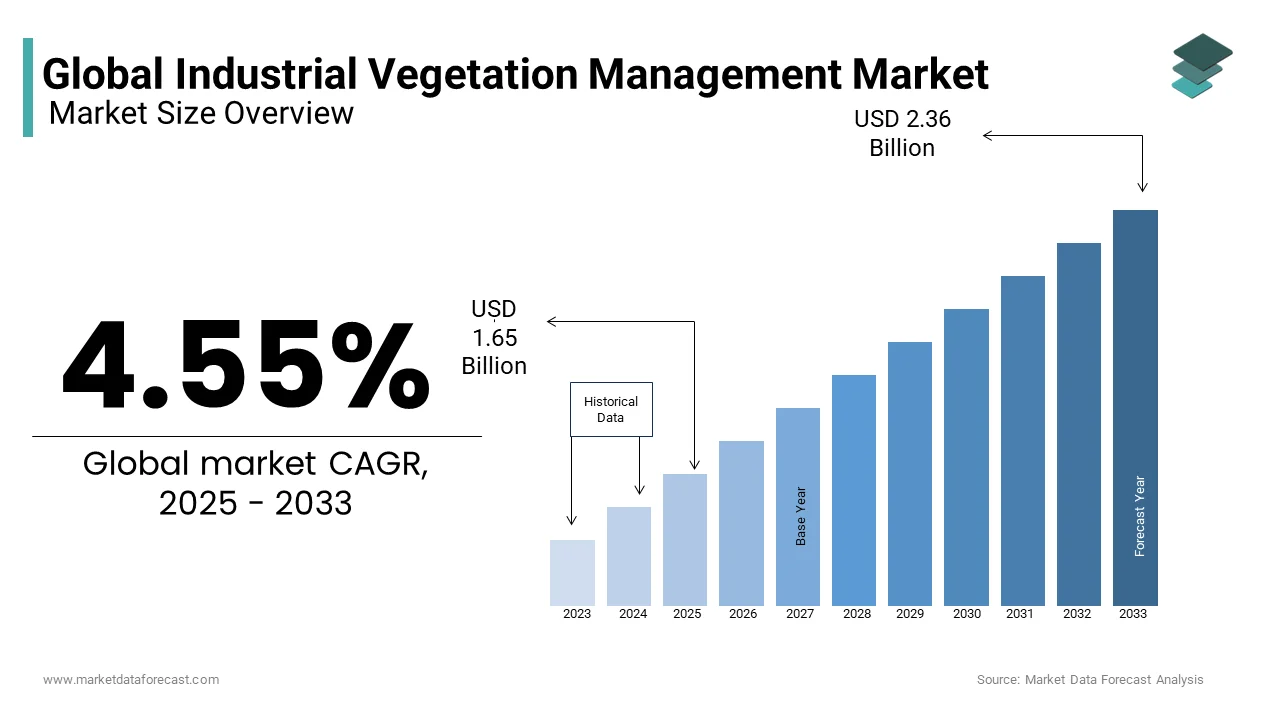

The global industrial vegetation management market size was valued at USD 1.5 billion in 2023 and it is anticipated to reach USD 1.58 billion in 2024, growing at a CAGR of 4.55% from 2024 to 2029 from USD 2.24 billion by 2032.

Industrial vegetation management is the process of clearing unwanted vegetation, such as weeds and grass, surrounding power lines, transportation routes, and industries.

Current Scenario of Global Industrial Vegetation Management Market

The industrial vegetation management market is driving forward with a higher growth rate. The sales of insecticides, plant growth regulators and herbicides are rising. Moreover, the application of hybrid herbicide technology and other similar technologies is rapidly increasing in North American and European countries. These are environment-friendly substitutes for traditional chemical herbicides such as glyphosate because of water pollution. However, these ecological solutions require less energy and enter deeply into the roots easily. In addition, urbanization is another factor boosting the market share of industrial vegetation management. This is clear from the fact that about an 83 percent surge in urbanization level in Europe is anticipated by 2050.

MARKET DRIVERS

The increasing construction of new pipelines, roads, electrical infrastructure, and railway lines is the primary factor driving the industrial vegetation management market.

In particular, the urbanization trend and the focus on smart cities are improving the need for vegetation management to avoid any interruptions to the infrastructures. According to the statistics, the global population has grown by 2.1 billion people in the last 25 years. A major part of this surge is attributed to the developing countries in Asia and Oceania, contributing 1.1 billion and 0.7 billion by Africa. 5 in 6 individuals in the world belonged to the developing nation. It is estimated that there will be an additional 1.6 billion people in the next 25 years. Since the pandemic, both developed and emerging economies have increased the pace of digitalization, which will require a huge infrastructure like data centers, power grids, server stations, etc. Also, with the uprising of advanced technologies such as artificial intelligence, machine learning, and blockchain, the need for industrial vegetation management solutions is increasing.

The rising emphasis on safety from the governments of several countries is fuelling the growth rate of the global industrial vegetation management market.

In the utility sector, vegetation management is a crucial part of the maintenance to avoid the growth of any unwanted crops around the power lines and pipelines to ensure safety and accurate functionality. Similarly, in the last 20 years, the rate of tree cover loss due to fire in the tropics is close to 36000 hectares annually which is 5 percent. It reported approximately 15 percent of the overall world growth in the forest area loss from wildfires between 2001 and 2022. Recently, in India, in April 2024, a massive wildfire rocked the city of Nainital, destroying a large number of livestock and the environment. Hence, such incidences are fuelling the demand in the industrial vegetation management market. Similarly, in the transportation network, this process helps improve visibility for drivers on roadways, railways, and airports. The rising concern about environmental damage and sustainability is promoting eco-friendly vegetation management solutions around the world.

The advent of several new chemical and biological materials has influenced rapid adoption by the industrial vegetation management market.

In addition, the continuous changes in climatic conditions and weather are proving the need for effective vegetation management to avoid unexpected hazards. On the other hand, the need for proper vegetation to avoid infrastructure-related accidents or fires, along with the offered environmental benefits, is further promoting the industrial vegetation management business. The emergence of biodegradable, eco-friendly, and harmless chemicals has increased the application of the industrial vegetation management market. These methods are more tenable and durable than conventional herbicides and pesticides. The new materials have shown impressive results in dealing with unwanted vegetation in industrial areas. Also, they provide selective and targeted control for the precise management of certain plant types with a reduced effect on desirable vegetation. Furthermore, it also helps in lowering liability, legal fees and compliance. The extensive use of chemical-based products and solutions has decreased the soil quality or even contaminated the surroundings and, coupled with rising public awareness, is forcing companies to progressively adopt sustainable products.

The latest trend in drone technologies, remote sensing, GPS systems, and geographical information systems is another positive aspect of the industrial vegetation management market. Modern research and development activities and supporting government initiatives to promote vegetation management are boosting sales in the business. The need to control invasive plant varieties, create new eco-friendly products, and reduce maintenance costs of infrastructure are predicted to create more opportunities for the industrial vegetation management market in the future.

MARKET RESTRAINTS

The major limitation of the industrial vegetation management market is people's resistance to using chemical herbicides and pesticides that can harm the atmosphere through contamination.

Also, there is a huge requirement for the market players to improve the trust factor for consumers in terms of using several chemical products and having no impact on the environment. In addition, the lack of experienced workers and high expenses associated with the implementation of vegetation management practices are negatively impacting the business. Although herbicides are effectively used in the treatment of weeds and unwanted crops, several species have developed a resistance towards traditional products. As mentioned earlier, the uncertain weather conditions are a great threat to the industrial vegetation management market. Heavy rainfall, floods, and heat can impede performance and result in overgrowth of unwanted crops. Besides, several invasive species cannot be treated with regular procedures and need upgraded products, resulting in additional costs for players in this business. In addition, the challenges associated with vegetation management in remote areas of developing countries are largely affecting the market boom. Besides, the long-term impact of vegetation management processes and the challenges with data privacy due to the applications of GIS and remote sensing are supposed to limit the global industrial vegetation management market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.55% |

|

Segments Covered |

By Product, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional and Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc. Are some major key players involved in the industrial vegetation market. |

SEGMENTAL ANALYSIS

Global Industrial Vegetation Management Market Analysis By Product Type

The herbicides segment accounted for a significant share of the global industrial vegetation management market. The availability of effective and affordable herbicides to control the growth of weeds along with the rise in utility, roadways, and railways projects, are promoting the demand in this segment.

Global Industrial Vegetation Management Market Analysis By End-Use Industry

The utilities sector recorded a notable share of the industrial vegetation management market because of the current modifications to the traditional power lines and utility infrastructure. In addition, the transportation segment is likely to register significant growth in the coming years owing to the expanding transportation and logistics sector that requires roadways and railways for the movement of goods. Similarly, the rangeland and pastureland segment is also estimated to witness steady growth in the following years.

REGIONAL ANALYSIS

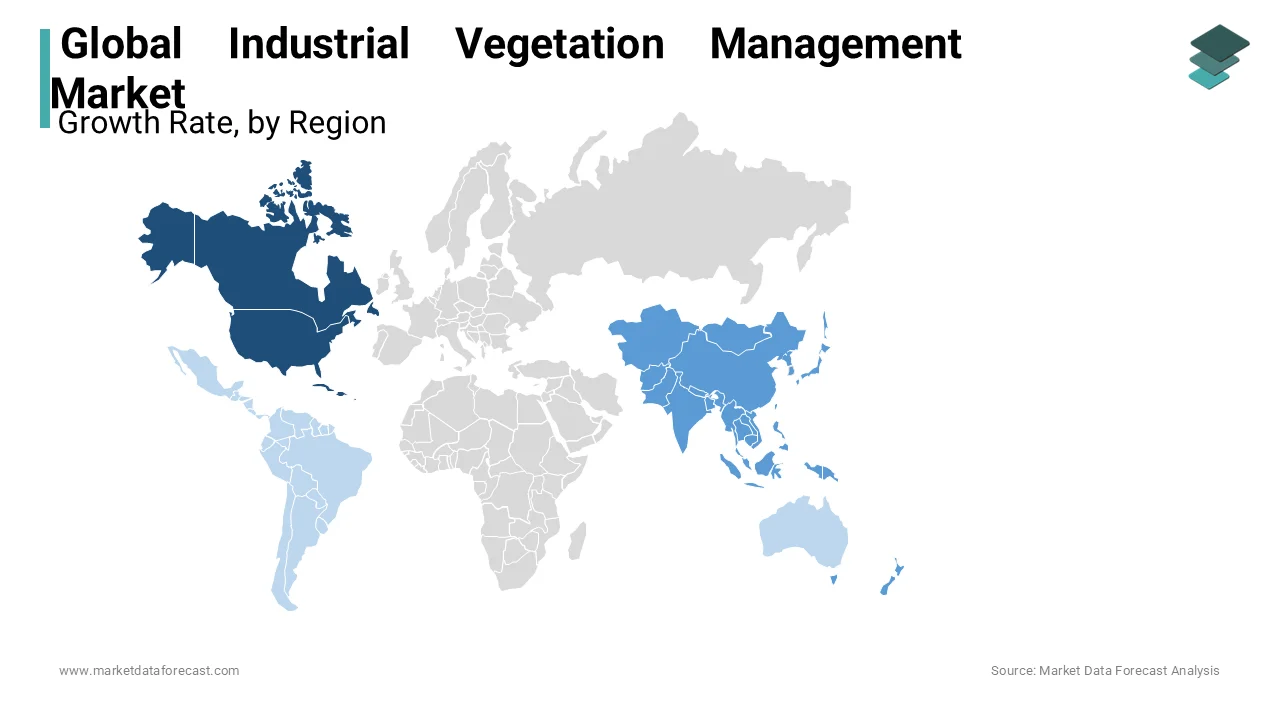

North America dominated the global industrial vegetation management system market due to the rising demand for advanced transportation and utility infrastructure within the area. Canada and the USA are the leading nations in this region. California is a prominent state in the USA that spends huge amounts on vegetation management. In addition, the supportive government initiatives coupled with the adoption of the latest technologies are contributing to the US industrial vegetation management system market. Similarly, Canada is also an emerging market in North America, and with harsh climatic conditions, there is a huge need for continuous maintenance of industrial sites, transportation, and utilities, which will benefit the industrial vegetation management business in this locale.

Asia Pacific is predicted to record the highest growth rate in the forecast period. The spike in the number of highway projects and utility infrastructure modernization in several nations like India, China, Japan, and others is propelling business growth in this area. In particular, India has the longest railway network that requires continuous maintenance, providing a huge scope for the industrial vegetation management market. Similarly, the implementation of new electric lines, pipelines, and highway networks is foreseen to boost sales in the local business.

Europe is also a notable player in the global industrial vegetation management market. The region has a well-connected network of roadways and railways, which, if not properly maintained, can lead to several mishaps. Therefore, industrial vegetation management is essential to avoid any such events and ensure the safety of the drivers.

Latin America is an emerging player in the worldwide market owing to the recent changes in the economic conditions and expanding developments in nations like Brazil and Argentina. Similarly, the Middle East and Africa are untapped markets for industrial vegetation management with huge growth potential. Nations like Saudi Arabia, South Africa, and Dubai are focusing on exploring different options other than the tourism sector to strengthen their economies. This results in new construction and infrastructure projects that need constant maintenance, which will offer lucrative opportunities for the global industrial vegetation management market in the predicted timeframe.

KEY PLAYERS IN THE GLOBAL INDUSTRIAL VEGETATION MANAGEMENT MARKET

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc. Are some major key players involved in the industrial vegetation management market.

RECENT HAPPENINGS IN THE GLOBAL INDUSTRIAL VEGETATION MANAGEMENT MARKET

- In April 2024, Terex revealed the introduction of Green-TecTM. It is the latest brand which facilitates an extensive product line of vegetation management solutions and tree care. This will consist of a sturdy range of trommels, chippers, shredders, mulchers, dedicated tree care administrators and lifting equipment.

- In April 2024, Portland will revise its urban forest management plan, which was previously altered in 2004.

- In April 2024, BurnBot declared they raised 20 million dollars to stop wildfires in a series A funding round. This will be executed with the help of mechanized vegetation management and fuel treatment products.

- In March 2024, the Austin Energy press released that it will receive more financial support to handle vegetation management. The utility company will be provided with an extra 28 million dollars by the Austin City Council for their tree trimming efforts which will extend its contract till this year's end.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL VEGETATION MANAGEMENT MARKET INCLUDED IN THIS REPORT

This research report on the global industrial vegetation management market is segmented and sub-segmented based on product type, end-use industry, and region.

By Product Type

- Herbicides

- Insecticides

- Plant Growth Hormones

By End-Use product

- Utilities

- Roadways

- Railways

- Oil & Gas

- Industrial Areas

- Forestry

- Rangeland and Pastureland

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which factors contribute to the growth of the industrial vegetation management market in Europe?

The growth in the European market is driven by increasing awareness of environmental conservation and stringent regulations regarding vegetation control in industrial areas.

What trends are shaping the industrial vegetation management market in Latin America?

In Latin America, the market is witnessing a shift towards sustainable and eco-friendly vegetation management practices, driven by a growing emphasis on environmental stewardship.

What is the expected compound annual growth rate (CAGR) of the global industrial vegetation management market over the next five years?

The global industrial vegetation management market is projected to grow at a CAGR of 4.55% from 2024 to 2029.

What are the major growth drivers for the industrial vegetation management market in Latin America?

Increasing industrialization, coupled with a rising focus on sustainable development, is propelling the growth of the industrial vegetation management market in Latin America.

What Is The Current Size Of The Industrial Vegetation Management Market?

The current size of the Industrial Vegetation Management Market is USD 1.58 billion in 2024.

What Are The Key Market players Involved In Industrial Vegetation Management Market?

BASF, DuPont, Dow Agro Sciences, Monsanto, Nufarm, Helena, Boultbee Vegetation Management, DBI Services, Ferrosafe, Lewis Services, Corteva Canada, VegClear, and Aquatic Vegetation Control Inc. Are some major key players involved in the industrial vegetation market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]