Global Industrial Motor Market Size, Share, Trends, & Growth Forecast Report – Segmented By Efficiency (IE1, IE2, IE3, IE4, DC and others), Application (Compressors, Pumps & Fans, Conveyors, Crushers, Extruders, and others), Motor Type (DC Brushed Motor, DC Brushless Motor, Stepper Motor, Traction Motor), End-Use (Commercial HVAC, F & B Manufacturing, Mining, Utilities, and others), & Region - Industry Forecast From 2024 to 2032

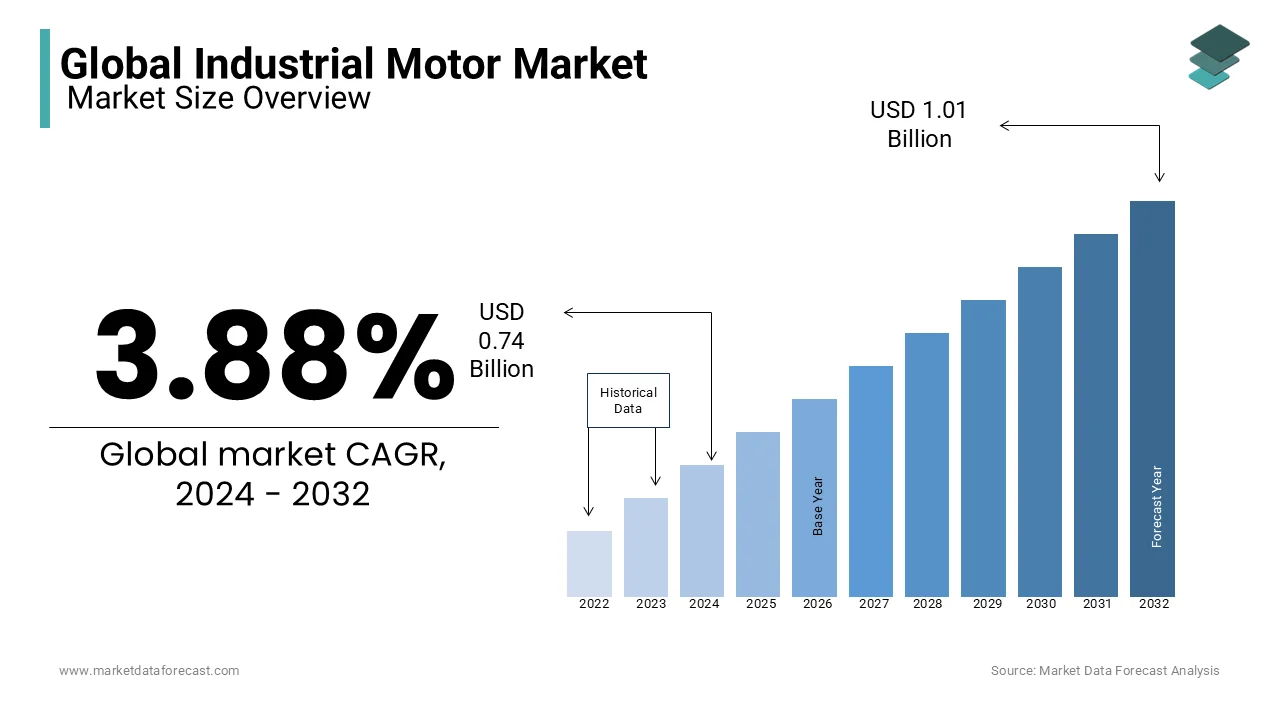

Global Industrial Motor Market Size (2024 to 2032)

The global industrial motor market was worth USD 0.71 billion in 2023. The global market size is expected to be worth USD 1.01 billion by 2032 from USD 0.74 billion in 2024, growing at a CAGR of 3.88% during the forecast period.

An industrial motor is an electric motor that is used in industrial settings, where robust performance is essential. Specifically engineered to do heavy-duty applications, these motors convert electrical energy into mechanical motion. It is found in manufacturing and processing environments, where the power of diverse machinery like conveyor systems, pumps, compressors, and fans is crucial to industrial operations. Induction motors, synchronous motors, and direct current (DC) motors are the common types, each suited for specific tasks.

MARKET DRIVERS

The growth of the global industrial motor market is majorly driven by the adoption of automation in industries.

As automation becomes highly essential to manufacturing processes, the demand for industrial motors has risen. These motors play a very important role in powering automated machinery and processes, also enhancing its operational efficiency and overall productivity. However, the imperative for precision, reliability, and energy efficiency in automated systems has further helped in the market's expansion. As a result, with ongoing advancements in motor technologies and a global trend toward industrialization, the industrial motor market is poised for sustained growth, catering to the evolving needs of modern, automated industries.

The energy efficiency regulations are further promoting the growth of the global industrial motors market. With a growing emphasis on sustainable practices, industries worldwide are prioritizing the adoption of energy-efficient motors. This shift in has regulatory landscape, marked by stringent standards, compels industries to upgrade their motor systems with energy efficiency requirements. However, these energy-efficient motors not only align with environmental goals but also offer good economic benefits through reduced energy consumption and operating expenses. As a result, industries recognize the dual advantage of cost savings and environmental responsibility, and the market for energy-efficient industrial motors continues to expand.

The industrial motor market is undergoing a transformative opportunity that is the integration of Industry 4.0 technologies. The convergence of the IoT and artificial intelligence has covered the way for smart and connected industrial motors. These intelligent motors serve as data-centric assets by providing real-time insights for predictive maintenance and rising operational efficiency. By leveraging advanced sensors and connectivity features, these motors enable bold identification of potential issues, reducing downtime and enhancing overall reliability.

MARKET RESTRAINTS

High initial costs are a pivotal restraint for the downfall of the market's growth. The substantial investment required for acquiring and implementing these cutting-edge systems can be an obstacle, especially for smaller enterprises operating on high budgets. While these advanced motors promise for long-term energy savings and operational efficiencies, the initial financial burden may affect the widespread adoption. However, overcoming this hurdle necessitates strategic measures such as programs, subsidies, or financing options to make energy-efficient motor technologies more accessible to a broader range of industries.

The industrial motor market confronts a noteworthy challenge in the form of limited awareness and education. Some businesses may not fully grasp how these technologies can profoundly enhance their operational efficiency and reduce long-term costs. Bridging this knowledge gap is most important for the broader adoption of energy-efficient motors. However, initiatives focused on education and awareness, including seminars, industry conferences, and targeted marketing campaigns, are essential. Therefore, collaborative efforts between manufacturers, industry associations, and regulatory bodies can play a pivotal role in diffusing information about the economic and environmental advantages of energy-efficient motors.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

3.88% |

|

Segments Covered |

By Efficiency, Application, Motor Type, End Use, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Shandong Huali Electric Motor Group Co. Ltd, CG Power and Industrial Solutions Limited, Regal Beloit Corporation, Nidec Corporation, Hyosung Corporation, Toshiba Corporation, TECO Electric & Machinery Co. Ltd, WEG SA, Siemens Aktiengesellschaft, ABB Limited and Others. |

SEGMENTAL ANALYSIS

Global Industrial Motor Market Analysis By Efficiency

The IE4 segment is expected to lead under this category of the industrial motor market. These motors represent the highest standard currently available, with efficiencies exceeding 96 per cent and lower energy losses compared to IE3 motors. In addition, the market share is increasing due to favourable regulations and policies. For instance, with industries worldwide facing pressure on energy consumption and reducing carbon emissions, the EU in February 2024 introduced an extensive framework aimed at improving the efficiency of electric motors used in various industrial processes. This phased approach has been steadily raising the minimum efficiency standards for new motors, while also widening the scope of machines and applications that fall under these regulations.

Global Industrial Motor Market Analysis By Application

Pumps & fans are the largest segment of the industrial motor market. One of the key drivers of this segment is the technological advancements. Continuous innovations in pump technology enhance their performance. Modern pumps are designed to consume less energy while delivering higher performance, which is critical in lowering operation costs. Moreover, the incorporation of sensors and automation allows for real-time monitoring and control of their operations, improving reliability and decreasing downtime, ultimately expanding the segment’s market size.

Global Industrial Motor Market Analysis By Motor Type

DC brushless motors (BLDC) are currently the trend in the industrial motor market. Moreover, the market growth of the segment can be credited to the escalating demand for this type of motor in electric vehicles, industrial automation, and consumer electronics. Apart from these, drone manufacturers are turning to BLDC motors. It is because of their excellent power-to-weight ratio, which allows for longer flight times and faster speeds, and at the same time, maintains great manoeuvrability. Consumer electronics is another extensive user of this motor type.

Global Industrial Motor Market Analysis By End-Use

Utilities is the biggest end-user in the industrial motor market. Its diverse applications in this sector is among the major propellers of the market size of this segment. These motors are integral to various processes within the utilities sector, including electric power generation, water and wastewater treatment, and HVAC systems. Further, globally, this segment stands out as one of the largest consumers of electricity. It uses a significant share of that energy in electric motors. Additionally, the progressive adoption of advanced motor technologies, like Variable Frequency Drives (VFDs), to improve performance and efficiencies.

REGIONAL ANALYSIS

Asia Pacific stands as a powerhouse for the Industrial Motor Market growth. Due to the rapid industrialization, extensive manufacturing activities, and infrastructure development in countries contribute to the dominance of this region. The demand for these motors in industries such as automotive, electronics, and heavy machinery is particularly high. In addition, this region is going through a rapid growth in the adoption of IE4 motors. Also, countries like China and India are ramping up their efforts to promote energy efficiency through initiatives. For instance, in India, there has been a notable increase in the sale of IE4 motors, with a reported surge of more than 100 per cent in 2023. So, we can say that the region’s quick industrialisation and urbanisation are some of the key drivers of its progress. Besides this, the Asian automotive industry today is a global powerhouse, which is leading in the development of EVs, advancements in battery technologies, hydrogen-powered vehicles, and self-driving systems.

North America is the second significant player in the industrial motor market. The region is identified by the advanced manufacturing capabilities and industries, technological innovations, and a focus on energy efficiency. In addition, the region also focuses on energy standards and guidelines encouraging the acceptance of more productive motor technologies, such as IE3 and IE4 motors. As a result, it expands the APAC’S market size. Additionally, the United States and Canada are the main players in this business on the continent. Also, the presence of major manufacturing industries, comprising aerospace and automotive, ultimately fuelling the demand for high-performance motors.

Europe industrial motor market has a well-established industrial base. The demand for these motors is robust across various sectors, including manufacturing, automotive, and renewable energy. Further, the continent prioritises energy efficiency and sustainability, driving the application of advanced motor technologies. Besides this, the region’s favourable regulatory framework is taking this market forward. Recent legislation has been implemented, which stipulates that all the new non-Ex eb 3-phase, 2-6 pole, single-speed electric motors in the range of 75 kW to 200 kW must comply with IE4 standards. Moreover, most ATEX motors are required to have at least an IE3 rating, and all single-phase motors should meet a minimum efficiency of IE2.

Latin America also exhibits a growing demand for industrial motors, driven by infrastructure projects, mining activities, and manufacturing.

The Middle East and Africa region is propelled by investments in infrastructure, oil and gas projects, and mining activities. The region's industrial motor market is influenced by the energy sector and ongoing development projects.

KEY MARKET PLAYERS

Companies playing a notable role in the global industrial motors market include Shandong Huali Electric Motor Group Co. Ltd., CG Power and Industrial Solutions Limited, Regal Beloit Corporation, Nidec Corporation, Hyosung Corporation, Toshiba Corporation, TECO Electric & Machinery Co. Ltd., WEG SA, Siemens Aktiengesellschaft and ABB Limited.

RECENT HAPPENINGS IN THE MARKET

- In 2023, GE has been involved in the development of intelligent motor technologies, leveraging sensors and data analytics to enable predictive maintenance and improve overall system efficiency.

- In 2023, Rockwell Automation has been incorporating smart technologies into its motor offerings. Their solutions often focus on connectivity and data analytics for better system management.

- In 2023, Schneider Electric has been incorporating smart technologies into its motor products, aiming to improve efficiency and reliability through advanced monitoring.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL MOTOR MARKET INCLUDED IN THIS REPORT

This research report on the global industrial motor market has been segmented and sub-segmented based on efficiency, application, motor type, end-use and region.

By Efficiency

- IE1

- IE2

- IE3

- IE4

- DC

- Others

By Application

- Compressors

- Pumps & Fans

- Conveyors

- Crushers

- Extruders

- Others

By Motor Type

- DC Brushed Motor

- DC Brushless Motor

- Stepper Motor

- Traction Motor

By End-Use

- Commercial HVAC

- F & B Manufacturing

- Mining

- Utilities

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What is the current size of the global industrial motor market?

The global industrial motor market is expected to be valued at USD 0.74 billion in 2024.

What factors are driving the growth of the global industrial motor market?

Growth in the global industrial motor market is driven by increased industrial automation, rising demand for energy-efficient motors, and advancements in manufacturing technologies.

What role does Industry 4.0 play in the evolution of the global industrial motor market?

Industry 4.0 technologies, such as IoT integration and data analytics, are influencing the development of smart industrial motor, enhancing efficiency, and facilitating predictive maintenance.

Who are the key players in the global industrial motor market?

Shandong Huali Electric Motor Group Co. Ltd., CG Power and Industrial Solutions Limited, Regal Beloit Corporation, Nidec Corporation, Hyosung Corporation, Toshiba Corporation, TECO Electric & Machinery Co. Ltd., WEG SA, Siemens Aktiengesellschaft and ABB Limited are some of the notable companies in the global industrial motor market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]