Global Industrial IoT Market Size, Share, Trends, & Growth Forecast Report By Devices and Technology (Monitoring, Smart Meter, Sensor, RFID, Industrial Robotics, DCS, Camera Systems and Networking Technology), End-Use (Logistics and Transport, Energy and Power, Manufacturing, Oil and gas, Healthcare and Agriculture) & Region - Industry Forecast From 2025 to 2033

Global Industrial IoT Market Size

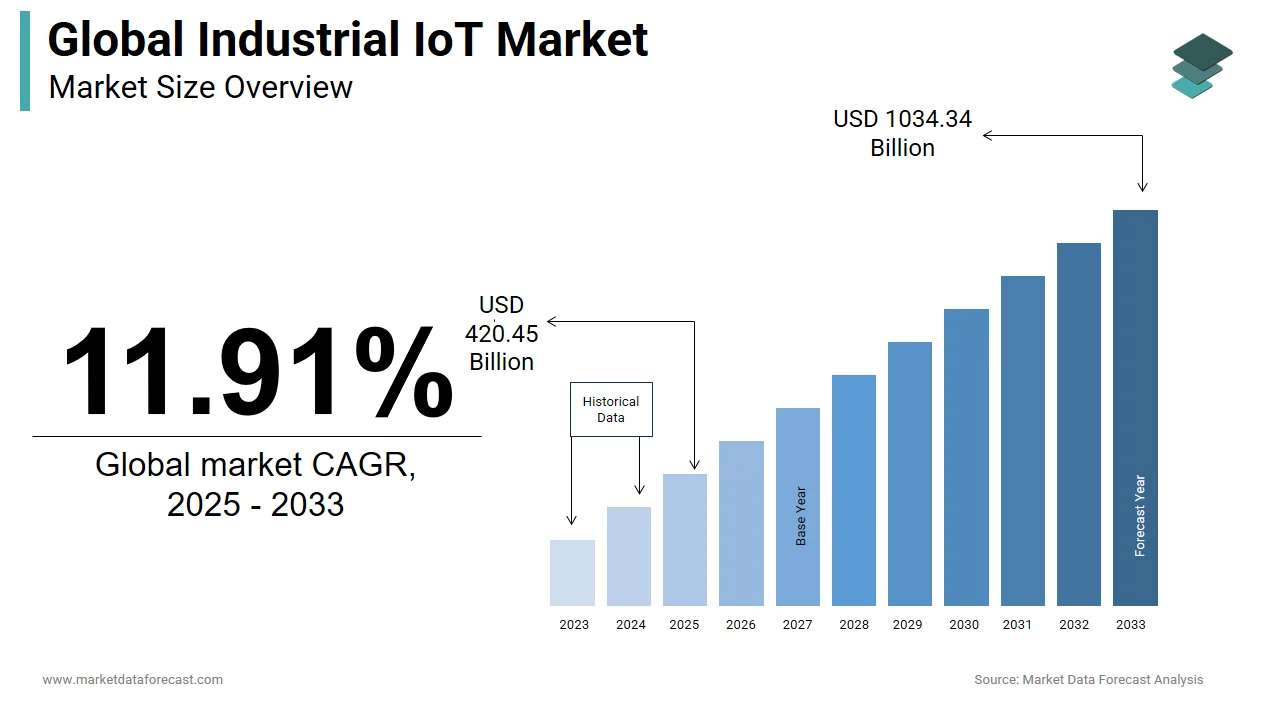

The global industrial IoT market was valued at USD 375.7 billion in 2024. The global market is predicted to grow at a CAGR of 11.91% from 2025 to 2033, and its size is expected to be USD 1034.34 billion by 2033, up from USD 420.45 billion in 2025.

The industrial IoT market experienced both positive and negative developments. Higher performance and extensive connectivity will speed up the market growth. Especially for health applications. Moreover, the United States and various other countries in the West remained exceedingly strong against increased interest rates and high inflation and were able to dodge the recession.

In 2023, the market grew tremendously, with around 16.7 billion IoT device connections, and approximately 235 billion dollars were spent by enterprises in this domain. Currently, several companies are handling millions of devices. For instance, in the fourth quarter of 2023, Nestle reported 2.8 million linked devices and gadgets via the AWS IoT platform. And, as per the latest trends, India is leading in adopting AI. However, mass layoffs in the technology sector destabilized the IoT market, which resulted in a decline in the growth rate of major players like Microsoft, Amazon, and Google.

MARKET DRIVERS

The increase in the formulation and adoption of Internet of Things-related regulations drives the Industrial IoT market growth.

Recognition of IoT solutions and their wide application in various industrial applications helps in promoting the growth of the market. For instance, in March 2023, the United Kingdom Parliament presented the latest Data Protection and Digital Information bill regarding digital information. In January 2023, the European Union declared the implementation of its second Network and Information Security Directive (NIS2) to overcome the challenges of the first version. The United States in July 2023 launched the voluntary cyber certification and labelling program. All these developments in the legal landscape are influencing its demand across industries.

Software-defined production processes, robotics, and medical devices are some of the most common examples. Moreover, optimization, networking, maintenance, and automation are a few industrial departments where these IoT have been integrated to improve productivity and reliability in business activities. As a result of high operational performance and efficiency, the market size is expanding.

The rising consumption of electronic devices, demand for semiconductors, and technological advancements further boost the industrial IoT market growth. In addition, the low cost of processors and sensors for real-time data access is pushing the global market forward.

More artificial intelligence support for IoT is expanding the global industrial IoT market share. As per the survey by the Institute of Electrical and Electronics Engineers (IEEE), accelerated software development and additional automated customer services, increased supply chain and warehouse automation efficiencies, real-time cybersecurity vulnerability identification, and attack prevention are the top 4 major uses of AI in 2024. This will significantly evolve the industry as a whole and boost market expansion. Apart from this, the integration of IoT technology to enhance efficiency in the supply chain and warehouse domains is also expected to drive the market worldwide.

MARKET RESTRAINTS

Companies in The IoT market are forced to extend the scheduling of their projects due to issues with device interoperability, network scalability, and security problems. This causes a loss of both time and money, which derails its adoption. Also, these difficulties can discourage the small and medium players from shirting to this technology. Likewise, it is expensive, especially for smaller organizations, to invest in sensors, software platforms, networking equipment, and data analytics knowledge.

Further, it is anticipated the volume of connected devices will be more than 75 billion by 2025. So, ensuring seamless operation and performance will be a bigger hurdle.

Also, the growing proficiency of hackers and online attackers has considerably surged the threat vector, which is restricting the market growth rate. Countering DDoS attacks is the biggest obstacle in front of companies. IoT systems are continuously more vulnerable to DDoS attacks and are rising in complexity and scale. But despite all the acceptance and advancements, there are still many obstacles in the way of the adoption process, with basic cyber hygiene being one of the biggest obstacles.

Connectivity outages are also derailing the growth of the IoT market. For instance, in the context of the IIoT, the Boeing 737 Max disaster serves as an upsetting reminder of how important continuous communication is. The aeroplane model that met a tragic end was plagued by poor data transmission and communication problems.

MARKET OPPORTUNITIES

Co-creation through IoT, cybersecurity, deployment of 5G, and real-time processing with edge IIoT presents immense opportunities for market players. This will help to overcome IoT fragmentation by incorporating different technologies and intensifying industry-wide adoption. It involves the first phase, the integration of sensors and network automation, the second consolidation of OT, Cloud, IT, and AI technologies, and the global co-creation model. The final phase comprises supporting the system integrators in transforming into domain-focused solution unifiers.

The need for specialized device standardization and companies to combine IIoT devices from different manufacturers to build specialized networks are potential market opportunity. Moreover, cybersecurity is another area that holds huge opportunities for the global market. While designing the next-generation industrial IoT, security will be the key factor. So, Matter protocols are dubbed as the next big thing in the Internet of Things connectivity and completely change the industry dynamics. It can protect connected devices and safeguard them from privacy breaches.

MARKET CHALLENGES

The dominance of big companies, poor battery performance, high electricity consumption of systems, and different regulatory requirements are key challenges to the growth of the industrial IoT market. Securing infrastructure is the biggest issue faced by both clients and companies in the industrial IoT market. Also, companies are facing scalability issues, and even if a few succeed in doing so, they face security problems in their ecosystem. The attack surface has increased due to a large network of interconnected systems and devices in industries, so addressing security issues is essential to safeguarding data integrity and operating systems. According to a study, more than 95% of corporate executives recognized how urgently they must increase their investment in industrial security. Furthermore, another obstacle to advancement for professionals is scaling IIoT deployments. 2022 research says that less than 60% of the planned initiatives of 80% of IIoT decision-makers are scaled.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

11.91% |

|

Segments Covered |

By Devices and Technology, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Siemens AG, General Electric (GE), Cisco Systems, Inc., Rockwell Automation, ABB Ltd, IBM Corporation, Honeywell International Inc., Microsoft Corporation, Schneider Electric SE, Bosch.IO (Bosch IoT Suite), PTC Inc., Intel Corporation, Huawei Technologies Co., Ltd., Emerson Electric Co., Dell Technologies Inc., Hitachi Vantara, SAP SE, Oracle Corporation, Amazon Web Services (AWS), and others. |

SEGMENTAL ANALYSIS

By Devices and Technology Insights

The networking technology segment is expected to hold the maximum share of the global industrial IoT market in the future. These technologies connect a large number of machines and sensor nodes to the Internet, enabling machine-to-machine communication. Large-scale data collection is another benefit of these technologies that helps with better decision-making. Based on connectivity range, power requirements, and data transmission speeds, a wide variety of wireless communication methods are available. Cellular technologies are becoming more important for inter-machine communication in the industrial sector.

By End-Use Insights

The manufacturing segment is the leading market under this category of the global industrial IoT market. The widespread implementation of digital manufacturing technology and IoT solutions in various production facilities can be credited to the segment's growth. On the other hand, the logistics and transport segment is the fastest-growing market due to rapid acceptance and focus on the use of asset management and smart transportation. Furthermore, segmental growth is further supported by the logistics industry's application of internet-connected trackers instead of RFID tags.

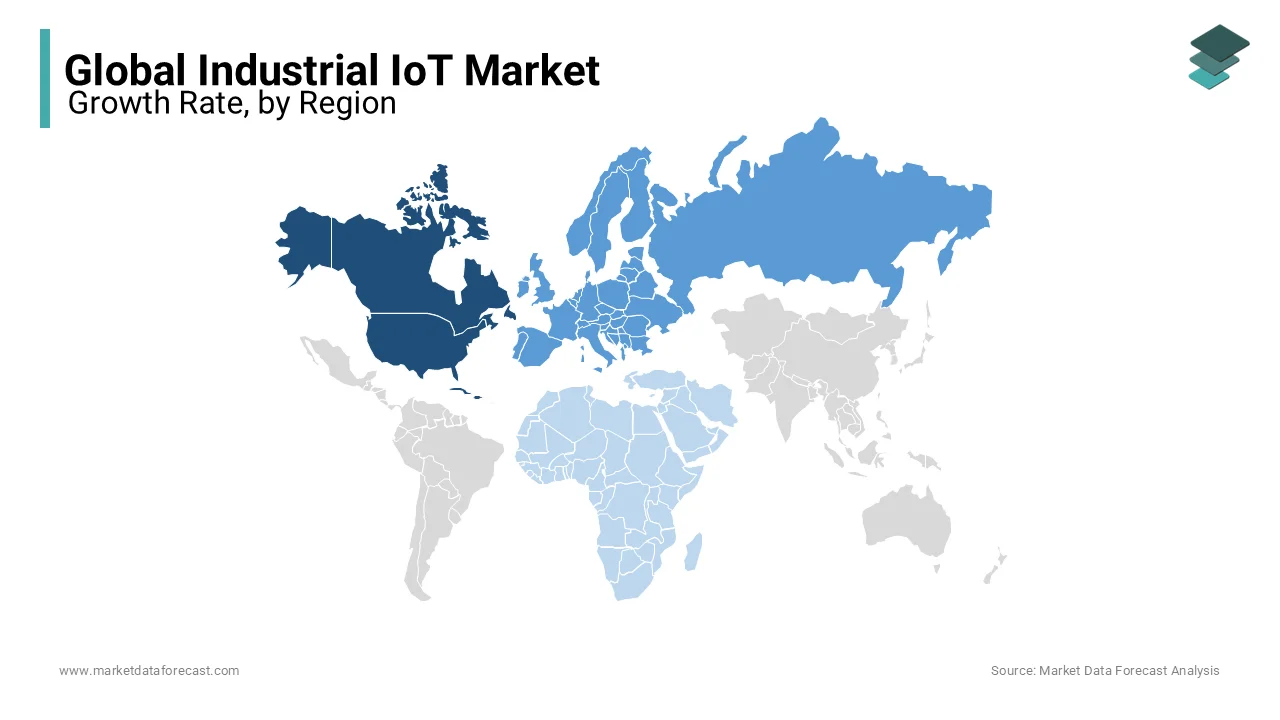

REGIONAL ANALYSIS

North America industrial IoT market is expected to generate a revenue of more than 86 billion dollars by 2024. The regional market is expanding quickly despite the recent slowdown in growth, owing to the formulation of multiple laws and regulations related to connected devices and incident reporting. Also, the developments in already advanced automation and connectivity are further benefiting the market. The United States is projected to be the primary revenue generator worldwide, with an estimated revenue of over 75 billion dollars in 2024. The rising demand to increase productivity and efficiency is propelling the North American market. A survey found that about 35% of American manufacturers gather and utilise data from smart sensors to improve their manufacturing procedures. Furthermore, in 2023, Microsoft Azure and AWS extended their scope of IoT cloud services, whereas Google closed down its IoT Core services.

Europe is expected to expand during the forecast period. The IoT solutions industry is growing all over Europe. The region made noticeable progress with the EU’s NIS2 cybersecurity directive across 15 sectors. Moreover, by October 2024, every member country will have to adopt the laws and regulations of NIS2. Hence, the regional market will witness a rapid growth rate in the coming years. The EU is also believed to commence implementation of its Cyber Resilience Act in 2024, which will further accelerate the IIoT demand. The Nordic region and Eastern Europe are closely trailing behind Germany, the UK, and the Netherlands in terms of IoT adoption in Europe. The leading industries in IoT adoption include manufacturing, home, health, and finance, with retail and agricultural sectors quickly rising.

Asia Pacific industrial IoT market is anticipated to grow at a faster rate in the coming years. The increasing demand for factory-level controls to improve productivity and supply chain activities primarily drives the APAC industry. Both international and domestic companies are emphasizing establishing an interface between industrial equipment and their virtual controls by adding programmable logic controllers (PLC) and supervisory control and data acquisition software. Moreover, favourable government policies, programs, and initiatives by China and other competing economies in the manufacturing industry have significantly boosted regional market growth. In addition, market players are also incorporating Industry 4.0 technologies such as IoT, AI, robotics, cloud, and analytics into practice. Additionally, automation in the automotive industry is estimated to continue at a faster rate, coupled with hyper-scalers and cloud service providers in this industry, will remain at the top across the most active foreign direct investment (FDI) sectors.

Latin America is still expected to grow during the forecast period, considering its current circumstances. The primary factors behind the market growth are the growing need for real-time streaming and remote monitoring solutions, the rising industrial deployment of modern technologies, the increasing urbanization of the region, and the improving state of the economy. To take advantage of the burgeoning e-commerce sector in developing nations in SAM, as well as the expanding reach of 5G networks and the Internet, many startups have entered the IoT market in this region.

Middle East and Africa are expanding mainly due to the adoption of IoT across organisations, as a result, industrial IoT connections have surpassed consumer IoT connections. Smart metres are being installed by utility companies in the area to assist in balancing supply and demand by tracking customers’ energy usage in real-time. The region has been focusing on the potential that these technologies make possible.

KEY MARKET PLAYERS

Companies playing a dominating role in the global industrial IoT market include Siemens AG, General Electric (GE), Cisco Systems, Inc., Rockwell Automation, ABB Ltd, IBM Corporation, Honeywell International Inc., Microsoft Corporation, Schneider Electric SE, Bosch.IO (Bosch IoT Suite), PTC Inc., Intel Corporation, Huawei Technologies Co., Ltd., Emerson Electric Co., Dell Technologies Inc., Hitachi Vantara, SAP SE, Oracle Corporation, Amazon Web Services (AWS), and others.

RECENT MARKET HAPPENINGS

- In April 2024, Qualcomm and Qt Group entered into a partnership to modernize the design and development of advanced graphical user interfaces (GUIs) and high-quality industrial IoT systems and equipment.

- In April 2024, Telit Cinterion, an IoT solutions provider, introduced a Global Navigation Satellite System (GNSS) SE868K5-RTK receiver module with the ability to deliver centimetre-level positioning accuracy.

- In November 2023, a new 150-million-dollar smart factory in Dallas-Fort Worth, Texas, was launched by Siemens to serve critical infrastructure and data centers in the United States with electrical equipment. The plan is to use different AI and IoT applications in its new facility, especially digital twin and factory automation technologies. German firm invests over 500 million dollars in US manufacturing, creating 1,700 jobs, which brings its total investment to over $500 million since the start of the year.

- In October 2023, Microsoft Corp and Rockwell Automation Inc. announced the extension of their long-standing partnership to use generative artificial intelligence (AI) to speed up the design and development of industrial automation.

MARKET SEGMENTATION

This research report on the global industrial IoT market has been segmented and sub-segmented based on technology, end-user, and region.

By Devices and Technology

- Monitoring

- Smart meter

- Sensor

- RFID

- Industrial Robotics

- DCS

- Camera System

- Networking Technology

By End-Use

- Logistics and Transport

- Energy and Power

- Manufacturing

- Oil and gas

- Healthcare

- Agriculture

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the main drivers of growth in the Industrial IoT market?

The primary drivers include the increasing demand for automation in industries, advancements in sensor technology, the proliferation of connected devices, the need for operational efficiency, and the adoption of advanced data analytics.

How does the Industrial IoT contribute to sustainability and energy efficiency?

IIoT contributes to sustainability by enabling real-time monitoring and optimization of energy usage, reducing waste through predictive maintenance, and enhancing resource efficiency through better supply chain management.

How is 5G technology expected to impact the Industrial IoT market?

The rollout of 5G technology is expected to significantly impact the IIoT market by providing faster data transfer rates, lower latency, and improved connectivity, which are essential for real-time monitoring and control of industrial processes.

What are some key trends to watch in the Industrial IoT market over the next five years?

Key trends include the increasing adoption of edge computing, the rise of digital twins, advancements in AI and machine learning, greater emphasis on cybersecurity, and the expansion of IIoT applications in smart cities and connected infrastructure.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]