Global Industrial Hemp Market Size, Share, Trends & Growth Forecast Report By Type (Hemp Seed, Hemp Seed Oil, CBD Hemp Oil and Hemp Fiber), Application (Food, Beverages, Personal care products, Textiles, Pharmaceuticals and Others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Industrial Hemp Market Size

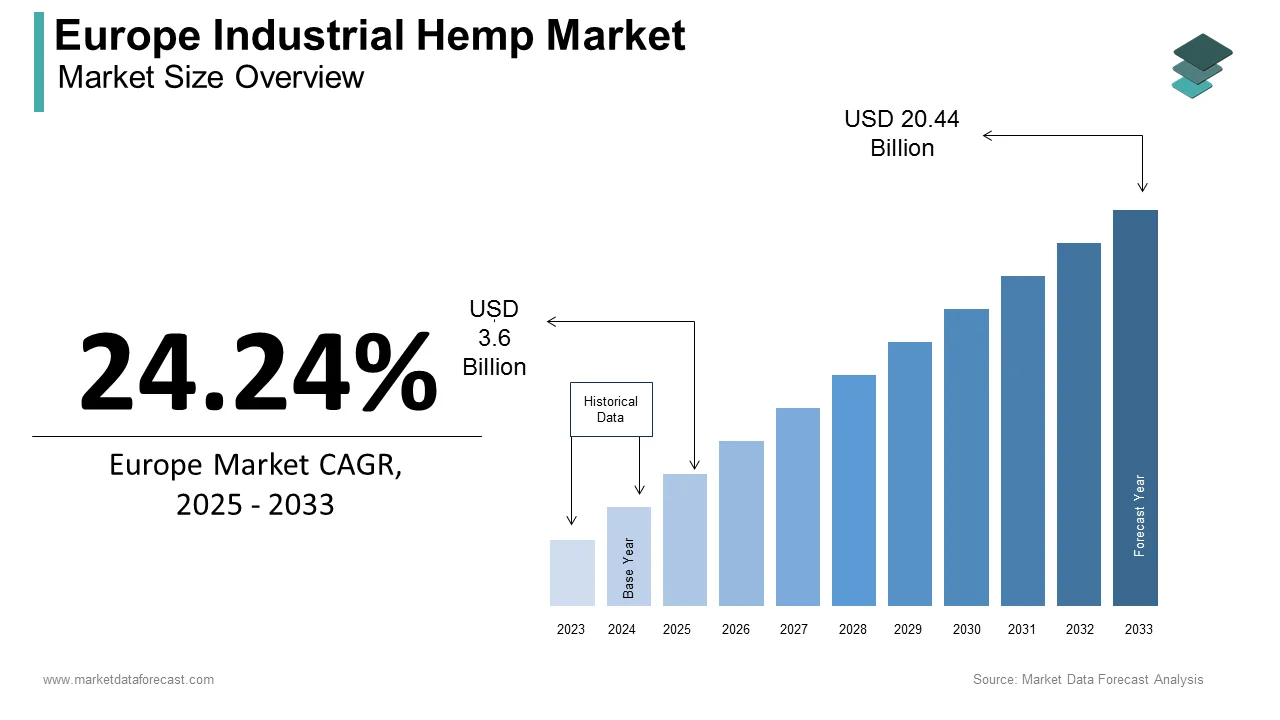

The size of the global industrial hemp market was worth USD 9.6 billion in 2024. The global market is anticipated to grow at a CAGR of 25.2% from 2025 to 2033 and be worth USD 72.57 billion by 2033 from USD 12.02 billion in 2025.

A cannabis plant that has 0.3% THC is called industrial hemp. Industrial hemp cultivation and usage is legal in many countries worldwide and has a wide range of applications, including fiber, paper, rope, textiles, and food. Moreover, the products made with industrial hemp do not cause any environmental impact. Currently, rigorous efforts are being made to find industrial hemp applications in healthcare, bioplastics, and energy production. In recent days, increased demand for industrial hemp products has been noticed. Due to this, the farming activities of industrial hemp are on the rise in many countries. Considering the legalization of industrial hemp and increasing consumption of the products made with industrial hemp, the market participants are investing significant amounts in research and development activities.

MARKET DRIVERS

The growing legalization of industrial hemp in various countries is majorly propelling the global industrial hemp market growth.

Industrial hemp has been legalized in countries such as the U.S., Canada, the European Union, Australia, India, China, South Africa, and Uruguay. However, the cultivation of industrial hemp is legalized in these countries. In addition, each country has imposed several regulations around processing and sales. Owing to global legalization, the number of participants entering the global market is growing considerably and creating intense competition.

The rapid adoption and growing demand for CBD products are further fueling the growth rate of the industrial hemp market.

Cannabidiol or CBD, is one of the compounds of industrial hemp, which is believed to have many health benefits and has been used in treatment procedures for pain, anxiety, and inflammation. The awareness of CBD benefits has increased notably in recent times. Due to the associated benefits, CBD has been increasingly used in edibles, beverages, topicals, and supplements. The growing demand for CBD products is resulting in the growing farming activities of industrial hemp, as it is one of the primary sources of CBD. In addition, many market participants are investing funds in the research and innovation of CBD products to meet people's growing needs.

In addition, growing concerns about the environment, rising demand for sustainable products, and increasing demand for hemp-based construction materials are anticipated to boost the growth rate of the industrial hemp market. Furthermore, the growing usage of industrial hemp in personal care, F&B, textiles, and bio-composite industries is accelerating market growth. Industrial hemp offers various benefits, so the adoption of industrial hemp in various industries is growing significantly. In addition, the growing patient count suffering from chronic diseases, increasing adoption of industrial hemp, and growing legalization of industrial hemp in various countries are contributing to the growth of the industrial hemp market.

MARKET RESTRAINTS

The presence of complex regulatory structures for the cultivation and usage of industrial hemp worldwide acts as a primary challenge for manufacturers. Different limitations in various regions, as the regulations vary according to the region, will be challenging for the market players focusing on expanding the industrial hemp market for geographical reach. Many countries restrict the use of cannabidiol hemp oil in personal care and cosmetic products, which hampers the global market growth. Hemp-derived cannabidiol is not yet legal for industrial use in certain countries like Australia, Spain, and the Middle East. These complex regulations related to the trading, manufacturing, and prescription of industrial hemp across various countries and regions make the market more restricted and limit the market expansion. The need for proper harvesting equipment and specific industrial hemp cultivation requirements help hinder the market growth opportunities. Even though industrial hemp cultivation is legal in the United States, advanced cultivation and harvest techniques are required to limit market growth. The presence of alternative nutritional value substitutes such as chia and flax seeds to industrial hemp is anticipated to be a moderate threat of substitution in the market, leading to a decline in the market revenue. Limited availability and high production costs associated with hemp farming will impede the market expansion. The availability of high-quality and certified hemp seeds is limited, which is a challenge for farmers and market players.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional and country Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter's Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Hempco, Ecofibre, Hemp Inc., Gencanna, Hempflax BV, Konoplex Group, Hemp Oil Canada, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, Canal International, South Hemp Tecno, Plains Industrial Hemp Processing and MH Medical Hemp. |

SEGMENTAL ANALYSIS

By Type Insights

Based on type, the hemp fiber segment had the major share of the worldwide market in 2023, and the domination of the segment is anticipated to continue during the forecast period. The growing usage of hemp fiber in various applications such as textiles, paper, construction materials, and others is one of the key factors propelling segmental growth. In addition, the rising need for sustainable and environmentally friendly products is another major factor promoting the segment's growth rate.

On the other hand, the CBD hemp seed oil segment is predicted to showcase a notable CAGR during the forecast period and hold a substantial share of the global industrial hemp market.

The hemp seed oil segment is expected to register a healthy CAGR in the coming years.

By Application Insights

During the forecast period, the pharmaceuticals segment is projected to grow at a lucrative growth rate owing to the growing number of R&D activities and increasing investments. In addition, the growing awareness regarding the health benefits associated with cannabidiol is further promoting the segment’s growth rate. Cannabidiol is one of the components of industrial hemp.

In 2023, the textiles application segment accounted for a substantial share of the global industrial hemp market. Factors such as increasing demand for consumer textiles such as clothes, fabrics, denim, fine materials, and industrial textile products such as twine, rope, nets, canvas bags, tarps, carpets, and geotextiles, the textiles segment is predicted to grow at a promising CAGR over the forecast period. Fabrics and textiles, yarns and spun fibers, carpeting, home furnishings, construction products, paper, insulating materials, automobile parts, and composites are just a few of the uses for hemp fibers. In addition, Hurds are used in animal bedding, oil absorbents, and paper production. Furthermore, Hemp seeds and oil cakes are utilized in food and beverages and food and feed as an alternative protein source.

The food segment is anticipated to witness a notable CAGR during the forecast period owing to the increasing awareness among people regarding CBD supplements and snacks.

The personal care products segment had a considerable share of the global market in 2024 and is expected to grow steadily during the forecast period.

REGIONAL ANALYSIS

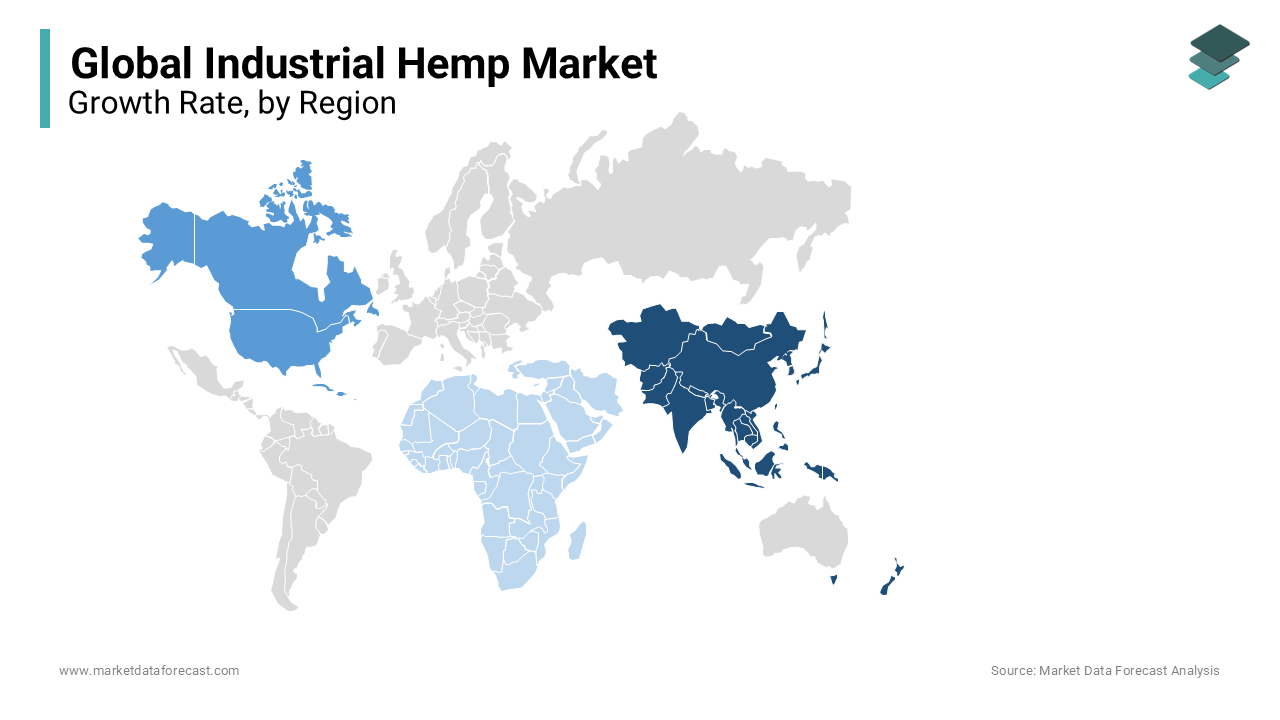

The Asia Pacific industrial hemp market held a significant global market share in 2024.

The region's dominance is expected to continue during the forecast period. Factors such as growing demand for industrial hemp, increasing adoption of technological advancements, and rising harvesting activities in this region propel regional market growth. China occupied the largest share of the Asia Pacific market in 2024. China is one of the biggest cultivators of industrial hemp. The growing number of initiatives from the Chinese government in favor of industrial hemp is primarily driving the market growth. Japan is another promising regional market for industrial hemp in the Asia-Pacific region. Japan legalized industrial hemp in 2019 and has been investing a considerable amount in R&D to find the potential advantages of industrial hemp. As a result, the Japanese market is anticipated to showcase a notable CAGR during the forecast period. Industrial hemp is also legalized in South Korea.

Over the forecast period, the North American industrial hemp market is expected to increase rapidly. Because of an increasing geriatric population and increased consumer awareness, the market for industrial hemp has been growing in countries like Canada and the United States. Furthermore, as worries about skin diseases and chronic diseases increase, the market for industrial hemp is expected to grow. In addition, the market is predicted to rise due to greater awareness of the oil's dietary benefits and increased demand from the cosmetics and personal care industries. Over the forecast period, the market will likely be driven by implementing favorable laws about the production and usage of hemp-based products in the United States. Furthermore, industrial hemp was legalized in the United States in 2018. Therefore, hemp-derived products have good demand in the United States and are the major factors propelling the U.S. industrial hemp market. Canada is another notable region for industrial hemp in the North American region and is anticipated to hold a considerable share of the regional market during the forecast period.

The European industrial hemp market is anticipated to showcase a healthy CAGR during the forecast period. The growing awareness across the European region regarding the advantages associated with hemp consumption and increasing demand for industrial hemp from countries such as Germany and the Netherlands are majorly driving the European industrial hemp market. France is anticipated to play a vital role in the European market during the forecast period. The government of France has been supporting hemp farmers for the last few years and investing significant amounts in the R&D of industrial hemp products to explore their advantages. Such factors are expected to boost the French market growth. In addition, European countries such as Germany and the Netherlands are predicted to showcase a healthy CAGR during the forecast period. Furthermore, countries such as the UK, Spain, Portugal, and Greece are expected to hold a considerable share of the European market during the forecast period.

The Latin American industrial hemp market accounted for a moderate global market share in 2024 and is anticipated to register a healthy growth rate in the coming years owing to the increasing awareness among people regarding the advantages of industrial hemp products and the growing adoption of industrial hemp products in industrial and commercial activities.

The MEA industrial hemp market is predicted to grow at a steady CAGR in the coming years.

KEY MARKET PLAYERS

Some of the notable companies dominating the global industrial hemp market profiled in this report are Hempco, Ecofibre, Hemp Inc., Gencanna, Hempflax BV, Konoplex Group, Hemp Oil Canada, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, Canal International, South Hemp Tecno, Plains Industrial Hemp Processing and MH Medical Hemp.

RECENT HAPPENINGS IN THIS MARKET

- In February 2024, Hempz, an innovative company in the industrial hemp market, introduced two new products that will pique the interest of consumers and industry players alike. The Beauty Actives Vanilla Lux Herbal Body Moisturizer with Niacinamide and Beauty Actives Tea Tree Herbal Body Moisturizer with Tea Tree Oil are not just new additions to their product line, but they are also developed from 100% pure hemp seed oil, showcasing the company's commitment to harnessing the full potential of industrial hemp.

- In January 2023, Bast Fibre Technologies Inc., a Canadian natural fiber manufacturer, made a strategic move that is set to bolster the industrial hemp market in North America. They acquired Lumberton Cellulose LLC, a North Carolina, U.S.-based natural fiber processing facility. This acquisition is not just a business transaction but a clear indication of the market's growth potential and the industry's commitment to meeting sustainable natural fiber demand.

- In January 2023, HempMeds Brazil launched two new full-spectrum products. These products are expected to meet the requirements of Brazilian doctors when prescribing for patients.

- In April 2023, Manitoba Harvest, the world's leading hemp foods brand and a wholly-owned subsidiary of Tilray Brands, Inc., will debut its first regenerative organic certified hemp hearts exclusively at selected whole foods market stores across the United States.

- In February 2023, Hemp, Inc. announced its largest industrial product sale. Four semi-trucks hauled 120,000 pounds of Hemp Inc.'s DrillWall, the only all-natural hemp Loss Circulation Material blend of its kind on the market for oil and gas well drilling industries.

MARKET SEGMENTATION

This research report on the global industrial hemp market has been segmented and sub-segmented based on the type, application, and region.

By Type

- Hemp Seed

- Hemp Seed Oil

- CBD Hemp Oil

- Hemp Fiber

By Application

- Food

- Snacks & Cereals

- Soup, Sauces and Seasonings

- Bakery

- Dairy & Frozen Desserts

- Others (Cold Cereals, Pasta, Chocolate Spreads and Pet Food)

- Beverages

- Hot Beverages

- Sports & Energy Drinks

- Ready To Drink

- Others (Meal Replacement Drinks, Beverage Mixes, Beverage Concentrates, And Juice Drinks)

- Personal Care Products

- Textiles

- Pharmaceuticals

- Others (Paper, Automobiles, Construction & Materials and Furniture)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How much is the global Industrial Hemp Market going to be worth by 2032?

As per our research report, the global Industrial Hemp Market size is projected to be USD 72.57 Billion by 2033.

At What CAGR, the global Industrial Hemp Market is expected to grow from 2025 to 2033?

The global Industrial Hemp Market is estimated to grow at a CAGR of 25.2% during the forecast period.

Which region is anticipated to witness considerable growth in the Industrial Hemp Market?

Geographically, the APAC Industrial Hemp Market is predicted to have the fastest growth rate in the global market during the forecast period.

Which are the significant players operating in the Industrial Hemp Market?

Hempco, Ecofibre, Hemp Inc., Gencanna, Hempflax BV, Konoplex Group, Hemp Oil Canada, BAFA, Hemp Poland, Dun Agro, Colorado Hemp Works, Canal International, are some of the significant players operating in the Industrial Hemp Market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]