Global Industrial Gas Turbine Market Size, Share, Trends & Growth Forecast Report By Capacity (1-40MW, 40-120MW, 121MW - 300MW & above 300MW), Product Type (Heavy Duty & Aeroderivative), Technology (Open Cycle & Combined Cycle), End-User (Electric Power Utility, Oil and Gas & Others) and Region (North America, Europe, Latin America, Asia Pacific, Middle East and Africa), Industry Analysis From 2024 to 2033

Global Industrial Gas Turbine Market Size

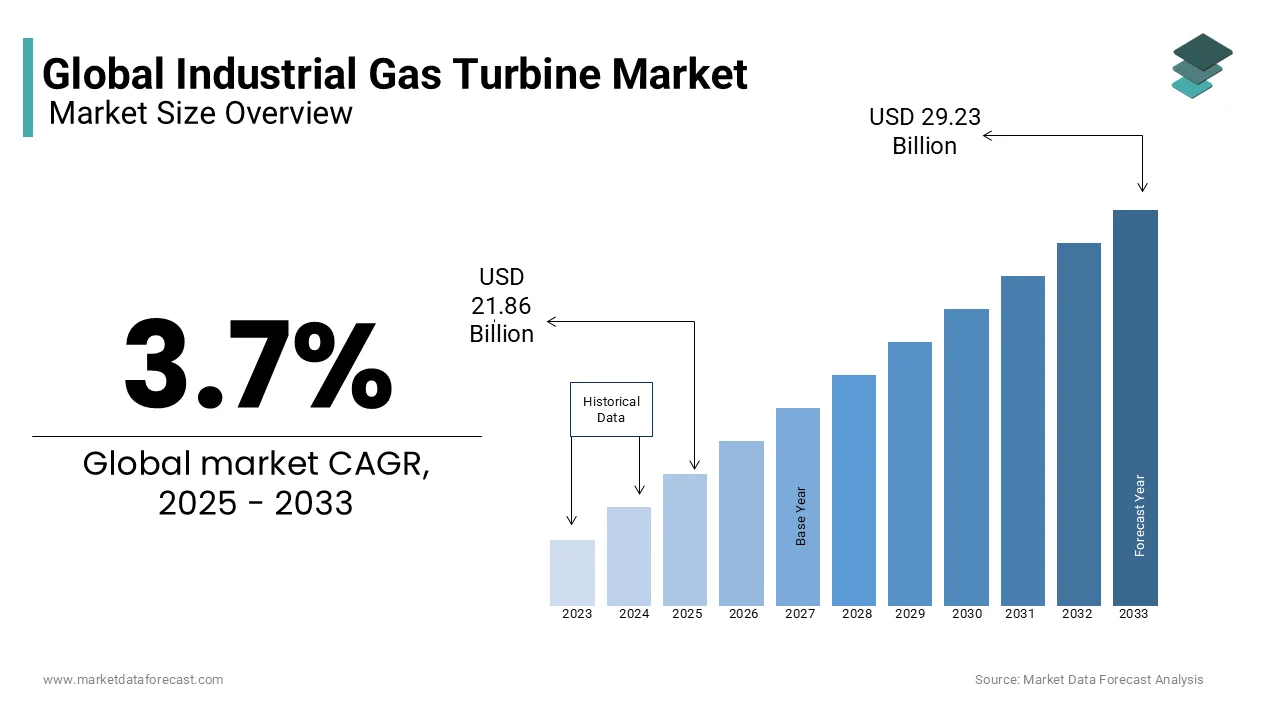

The global industrial gas turbine market was worth USD 21.08 billion in 2024. The global market is estimated to reach a valuation of USD 29.23 billion by 2033 from USD 21.86 billion in 2025, expanding at an annual growth rate of (CAGR) 3.7% between 2025 to 2033.

A gas turbine is a combustion engine at the power plant's heat that can convert natural gas or other liquefied material to mechanical energy. This energy further drives the generator that produces the electrical energy that moves along power lines to homes and businesses. Gas turbines are highly efficient in power generation and reduce environmental pollution compared to coal. The gas turbine can be either Heavy-duty or Aeroderivative. Aeroderivative gas turbines will soon dominate the market as they weigh less, are easy to install, quick to start and stop, and have a diverse portfolio compared to conventional coal. The combined cycle is expected to dominate the gas turbine market as it is highly efficient in power generation compared to the open cycle. The gas turbine is majorly used in the Electricity power utility segment to increase power generation to meet the rising electricity demand.

MARKET DRIVERS

Rapid Urbanization and Growing Demand for Electricity.

The increasing urbanization and industrial activities are demanding an enormous amount of electricity. Due to increasing demand, several countries around the globe are increasing their power generation capacity by installing new plants or expanding the existing ones with low environmental pollution. Thus, the increasing demand for electricity across the globe is driving the growth of the industrial gas turbine market in the future.

The increase in natural gas production has changed the global focus on developing gas-fired power plants. This is because the greenhouse gas emitted from gas-fired plants is comparatively lower than from coal-fired plants. However, conventional coal-fired power plants emit many pollutants that affect our environment and heat it. Due to increasing environmental pollution, the governments of several countries have imposed stringent norms to reduce pollution; thus, the demand for gas turbines is rising to lower environmental pollution while generating Power, which further drives the market's growth.

Gas turbines are much more efficient than conventional coal-fired power plants and meet the increasing electricity demand without toxic emissions. Owing to these reasons, the demand for gas turbines is increasing, which will boost the growth of the industrial gas turbine market.

MARKET RESTRAINTS

The increasing shift towards renewable energies such as wind and solar for power generation will shortly hamper the growth of the industrial gas turbine market.

IMPACT OF COVID-19

The COVID-19 outbreak has significantly impacted the global industrial gas turbine market. Due to the pandemic, industrial activities have slowed down, which results in lower electricity demand. This decreased graph of electricity demand by industries also affected the expansion and refurbishment of power plants which further decreased the demand for gas turbines. New projects have stalled throughout the world, which, in turn, has led to a decline in demand for new gas turbines. Furthermore, due to pandemics, global factories have struggled a lot due to the unavailability of the workforce which disrupted the global supply chains. Post-COVID, I expected that there would be an increase in production, supply chain, and demand for gas turbines.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3.7% |

|

Segments Covered |

By Capacity, Product Type, Technology, End User, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Kawasaki Heavy Industries, Ltd. (Japan), Siemens Energy (Germany), Capstone Green Energy Corporation (US), General Electric (US), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), United Engine Corporation (Russia), Rolls-Royce plc (England), Harbin Electric Machinery Company Limited (China), OPRA Turbines (Netherlands), Solar Turbines Incorporated (US), Bharat Heavy Electricals Limited (India), and Others. |

SEGMENTAL ANALYSIS

By Capacity Insights

The above 300 MV segment is expected to drive market growth due to the rising focus on high power generation with low emissions.

By Product Type Insights

The aero-derivative segment is expected to dominate the product type segment in the projected period between 2025 to 2033 due to the availability of highly flexible and mobile technologies. Aero-derivate gas turbine technology is based on aviation gas turbines. This gas turbine has less weight, is easy to install, and is faster to start and stop than the heavy-duty gas turbine. Moreover, aero-derivative gas turbines have a diverse portfolio, including district heating, marine propulsion, and utility generation.

By Technology Insights

The combined cycle segment is estimated to account for the major share of the global market over the forecast period due to its high operational efficiency, low environmental pollutants, and effective waste heat utilization. Additionally, a combined power plant requires less water and requires minor infrastructure than conventional plants.

By End-User Insights

The Power and utility segment will dominate the market because the gas turbine is highly efficient in power generation, which meets the increasing electricity demand. Furthermore, the growing electrification of automobiles will boost the growth of the Gas turbine market in the forecasted period.

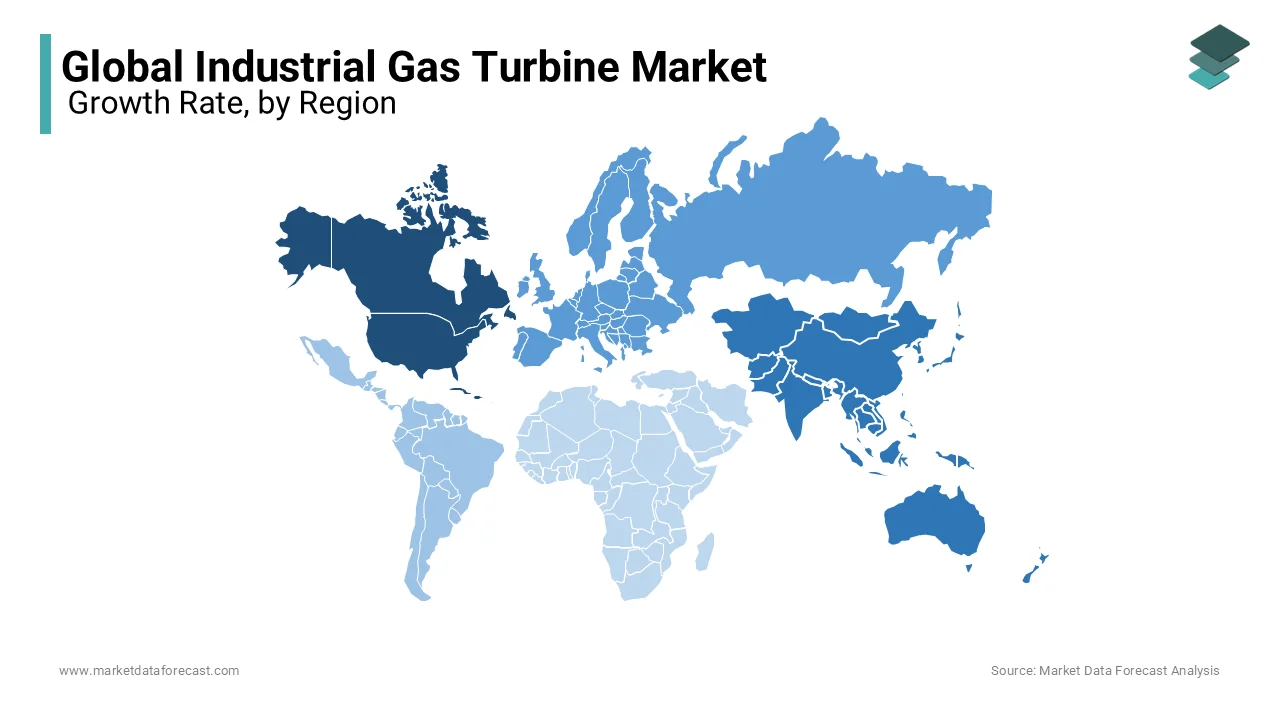

REGIONAL ANALYSIS

North America holds the largest share of the industrial gas turbine market due to a large number of industrial gas turbines operating on natural gas used in the oil and gas sector. In addition, the increasing exploration of shale gas will require more gas turbines for power generation, which will further boost the growth of this market in the forecasted period.

Asia-Pacific is a promising regional segment in the global market and is estimated to register the highest CAGR over the forecast period due to the majority of electricity demand coming from China and India, owing to factors like economic growth in emerging nations, an increase in the number of gas-based power generation plants, and rising industrial activities. The increasing electricity consumption and stringent government norms regarding environmental emissions drive the growth of the gas turbine market in the period between 2025 to 2033. It is anticipated that the Asia-Pacific region will show a significant growth rate during the forecast period due to rapid industrialization, a significant rise in energy demand, and natural gas usage in this region. Coal is used for power generation in this region, which causes a lot of environmental pollution. In this region, the governments of several countries like Japan, China, India, Australia, and South Korea have imposed strict regulations regarding environmental pollution, leading to an increase in the demand for gas turbines to reduce carbon emissions. With the growing environmental pollution concerns worldwide due to rapid industrialization, especially in Asia-Pacific, shifting the focus toward clean energy generation from gas turbines has gained considerable momentum.

The European region is expected to have healthy growth in this region due to the government's increasing focus on replacing coal with either gas turbines or other renewable sources to reduce greenhouse gas emissions. Moreover, the energy demand is considerably increasing, which requires more power generation. Therefore, the increasing energy demand and rising focus on replacing coal with gas turbines drive the growth of the gas turbine market in the forecasted period between 2025 to 2033.

KEY MARKET PLAYERS

Companies playing a prominent role in the global industrial gas turbine market include Kawasaki Heavy Industries, Ltd. (Japan), Siemens Energy (Germany), Capstone Green Energy Corporation (US), General Electric (US), Ansaldo Energia (Italy), Mitsubishi Heavy Industries, Ltd. (Japan), United Engine Corporation (Russia), Rolls-Royce plc (England), Harbin Electric Machinery Company Limited (China), OPRA Turbines (Netherlands), Solar Turbines Incorporated (US), Bharat Heavy Electricals Limited (India), and Others.

RECENT HAPPENINGS IN THE MARKET

- In June 2021, GE and IHI signed an agreement to develop an Ammonia Gas Turbine Business Roadmap to achieve a mutual goal of reducing carbon emissions from gas turbine power installations. Ammonia roadmap supports ammonia as a carbon-free fuel to lower carbon emissions in existing and new gas turbines.

- In March 2021, Clayfield Construction Ltd. (one of the leading construction companies in Cyprus and Siemens Energy are working together on gas turbine technology to support cleaner, more energy-efficient energy production on the island of Cyprus.

MARKET SEGMENTATION

This research report on the global industrial gas turbine market has been segmented and sub-segmented based on capacity, product type, technology, end user and region.

By Capacity

- 1-40MW

- 40-120MW

- 120MW - 300MW

- Above 300MW

By Product Type

- Heavy Duty

- Aero derivative

By Technology

- Open Cycle

- Combined Cycle

By End-User

- Electric Power Utility

- Oil and gas

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What are the main applications of industrial gas turbines?

Industrial gas turbines are primarily used in power generation and the oil and gas industry.

What factors are driving the growth of the industrial gas turbine market?

Rapid urbanization, increasing electricity demand, and a shift towards cleaner energy sources are key growth drivers.

Which technology types are prevalent in industrial gas turbines?

Open-cycle and combined-cycle technologies are commonly used in industrial gas turbines.

What role do aero-derivative turbines play in the market?

ero-derivative turbines are favored for their flexibility and efficiency, making them suitable for applications requiring variable power output.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]