Global Industrial Furnaces Market Size, Share, Trends, & Growth Forecast Report – Segmented by Arrangement (Tube or Clamshell Type, Box Type, and Car Bottom Type) Operation, (Gas/Burner Operated, and Electrically Operated), Application (Atmosphere, and Vacuum), Structure (Batch, and Continuous), End User (Automotive Manufacturing, Oil and Gas, Metallurgy, Steel and Iron Production, and Food Processing) & Region - Industry Forecast From 2024 to 2032

Global Industrial Furnaces Market Size (2024 to 2032)

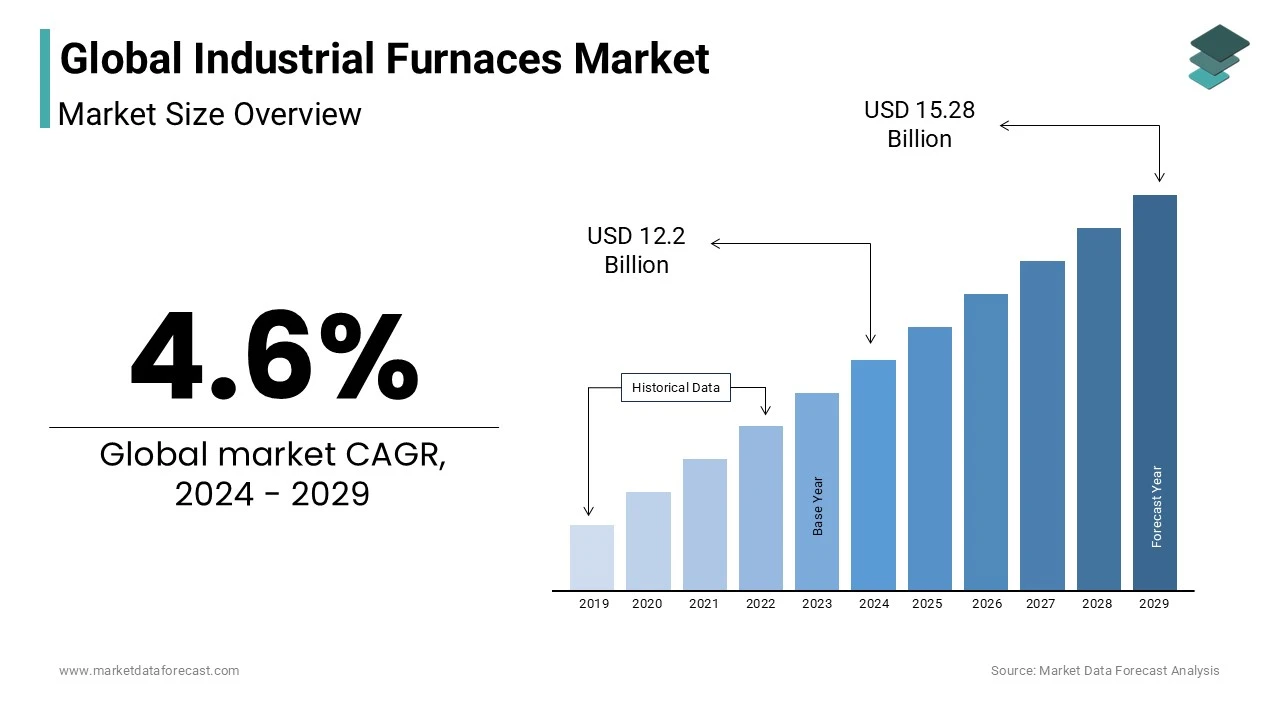

The global industrial furnaces market was worth USD 11.66 billion in 2023. The global market is predicted to reach USD 12.2 billion in 2024 and USD 17.48 billion by 2032, projecting at a CAGR of 4.6% during the forecast period.

Current Scenario of the Market

Industrial furnaces can provide heat higher than 400 degrees Celsius for various applications in the industry. The furnace is designed in such a way that the heat shall be distributed to specific places using ducts. In fact, the furnace will be designed according to the specifications required for the application, such as heating duty, type of fuel, and function. For instance, the industrial furnace plays an important role in the chemical industry for the thermal process. At higher temperatures, the furnace brings out the changes physically and chemically for raw materials, intermediates, or finished chemical products. Also, the industrial furnace is used to melt or change the shape of the metals and is becoming a major part of the metal industry.

MARKET DRIVERS

The industrial furnace market growth rate has been increasing rapidly in the past few years with the increasing scale of the industries worldwide.

Industrial furnaces have huge applications in many industries, and there is no alternative to replace this equipment. Therefore, the expansion of the industrial scale worldwide is attributed to the level of the growth rate of the market. The latest trend in industries to opt for automated manufacturing processes, the subject of industrial furnaces, is giving scope to scale up the efficiency of the application. For instance, IIOT (Industrial Internet of Things) is highly prominent in optimizing the performance of equipment, which helps boost productivity. IIoT is making a huge difference in the performance of the equipment by swiftly noticing failure and minimizing downtime, especially in real-time applications, which is a major aspect of the application running smoothly. Therefore, the overall prominence of the installation of industrial furnaces is rising year on year with the growing scale of industries worldwide.

In addition, the rising need for the supply of various raw materials, such as steel or iron, for the construction of buildings substantially promotes the growth rate of the market. In India, construction activities are going on at a higher rate with the growing support from the government. India is an emerging country that is spending more on the construction of buildings, road infrastructure, and many other things. According to reports, more than 2,70,000 crore rupees were spent on constructing the national highways in India during 2023-2024. The government is seeking major attention in supplying the raw materials by dominantly producing the required amount using automation equipment, where industrial furnaces play a crucial role in reaching the target.

MARKET RESTRAINTS

The industrial furnace is designed more effectively and cannot be easily replaced as the life expectancy of this equipment is very high, which means there is no chance of replacing the total equipment for many years. This attribute slightly limits the growth rate of the industrial furnace market. The economic crisis is hitting hard in every country, which is also one of the factors that may hinder the growth rate of the market. In undeveloped countries, small-scale industries do not have easy support from the public or private sector to install the automation process, where the challenges in traditional equipment may also contribute to limiting the growth rate of the industrial furnace market.

MARKET OPPORTUNITIES

The world is evolving in a modern way, and the demand for complete automation of systems is rising in every industry. Increasing awareness of the use of non-corrosive materials like steel and copper to promote the efficiency of equipment operations is a substantial step in adopting modern engineering equipment and materials. Also, government initiatives to encourage industries in various regions through permissions for better production of various products according to the needs of the growing population are creating scope for the market in the coming years. Companies' goal in launching innovative products at affordable costs to reach a huge number of customers is additionally to leverage the growth rate of the market.

MARKET CHALLENGES

Though the industrial furnace has a long lifespan the cost to install and maintenance of the equipment is very high where small and medium scale industries could not afford is a big challenging factor for the industrial furnace market key players. The companies need to invest a high initial amount for this equipment where the lack of support from the government in a few countries is likely to impede the market’s growth rate.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024 to 2032 |

|

CAGR |

4.6% |

|

Segments Covered |

By Arrangement, Operation, Application, Structure, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Epcon Industrial Systems, LP; International Thermal Systems; Industrial Furnace Company; Nutec Bickley; L&L Special Furnace Co. Inc.; Thermcraft Inc.; SCHMIDT + CLEMENS GMBH + CO. KG; ANDRITZ; LÖCHER Industrieofen; Carbolite Gero Limited |

SEGMENTAL ANALYSIS

Global Industrial Furnaces Market Analysis By Arrangement

Tube or clamshell type is leading with the largest share of the industrial furnace market. The arrangement for heat treating, calcining, and annealing that allows the crane loading or unloading of the parts in a more convenient way is greatly influencing the growth rate of the tube/clamshell type market. Box type segment is likely to have significant growth opportunities in the coming years.

Global Industrial Furnaces Market Analysis By Operation

The electrically operated segment is gaining huge traction over the market share due to the growing preference to provide precision heating temperature control and uniformity. This option delivers controlled heat temperature that results in manufacturing high and effective products. The gas/burner-operated segment is also having prominent growth opportunities during the forecast period. Reluctance to adopt new technologies in many countries, especially in undeveloped areas, the gas/burner operated system has high demand which is projected to have the highest growth rate for this segment during the forecast period.

Global Industrial Furnaces Market Analysis By Application

Atmosphere segment is leading with the prominent share of the market. There is high need to control atmosphere and air flow in the overall process. The atmospheric application helps in naturally escaping the gas from the orifice that has to mix up with the primary air during the combustion process for effective results. Vacuum segment is likely to have the prominent growth opportunities through put the forecast period.

Global Industrial Furnaces Market Analysis By Structure

The batch segment is clearly growing with the largest share of the market owing to the rapid adoption of the latest technological developments in the new entrants. With the growing specific requirements from the people to launch varied products, the demand to adopt the changes is increasing in the industries. A batch structure has the capability to heat treat one load at a time. It may also be termed as semi-continuous furnace as it carries out more than one process at a time. A continuous structure furnace has the capacity to handle the continuous workflow without any breaks.

Global Industrial Furnaces Market Analysis By End User

The automotive manufacturing segment is gearing up with the largest share of the market. The growing prominence for the high production of numerous vehicles like cars and bikes across the world will certainly create a huge scope for the industrial furnace in coming years. The growing scale of the oil and gas companies and the high demand for industrial furnaces for various applications greatly influence the market’s growth rate. The demand to increase the production of steel and iron is rapidly increasing with the growing prominence of construction activities at a higher pace.

REGIONAL ANALYSIS

The North American industrial furnace market has been leading with the dominant share for the past few years and is likely to continue the same during the forecast period. The US industrial furnace market is expected to grow at a CAGR of 22.1% during the forecast period. The demand for the automobile industry is engraved in the North American region, which is featured in promoting the market’s growth rate to the next level. The presence of the topmost automobile manufacturing industries in the US is escalating the prominence to launch innovative cars by expanding the product portfolio, which is likely to promote the market’s growth rate.

Europe is next to North America, holding the highest share of the industrial furnace market. The growing per capita income and rising urban population are majorly scribed in fuelling the growth rate of the industrial furnace market in the European region. The industrial furnace has great scope in Europe due to the presence of the topmost key players. The rising prominence to emphasize the most advanced technology in every industry with the growing support from the government shall level up the huge growth rate of the market. In Europe, the demand to increase the power distribution services using industrial furnaces can additionally level up the market’s growth rate.

Asia Pacific industrial furnace market is all set to hit the highest CAGR by the end of 2029. India and China are the major countries contributing the highest share of the market during the forecast period. The industries are gradually expanding in various countries like India and China. Feasible government regulations that contribute huge support through investments in the companies are likely to bolster the growth rate of the industrial furnace market.

RECENT HAPPENINGS IN THE MARKET

- In 2023, L&L Special Furnace Co. Inc. delivered an XLC3348 furnace model to the Midwestern US, one of the leading manufacturers of aerospace components. This furnace model is set to deliver lightweight aerospace components with the help of an industrial furnace, which will be part of a ceramic matrix composite. The advanced furnace model is all set to conquer new innovations in the aircraft industry in the coming years.

KEY MARKET PLAYERS

Epcon Industrial Systems, LP; International Thermal Systems; Industrial Furnace Company; Nutec Bickley; L&L Special Furnace Co. Inc.; Thermcraft Inc.; SCHMIDT + CLEMENS GMBH + CO. KG; ANDRITZ; LÖCHER Industrieofen; Carbolite Gero Limited

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL FURNACES MARKET INCLUDED IN THIS REPORT

This research report on the global industrial furnaces market has been segmented and sub-segmented based on the arrangement, operation, application, structure, end user, and region.

By Arrangement

- Tube or Clamshell Type

- Box Type

- Car Bottom Type

By Operation

- Gas/Burner Operated

- Electrically Operated

By Application

- Atmosphere

- Vacuum

By Structure

- Batch

- Continuous

By End User

- Automotive Manufacturing

- Oil and Gas

- Metallurgy

- Steel and Iron Production

- Food Processing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Frequently Asked Questions

What are the key factors influencing the demand for industrial furnaces globally?

Key factors include rising demand for energy-efficient and low-emission furnaces, technological advancements in furnace design, and the growth of end-use industries like automotive, aerospace, and metallurgy. Environmental regulations are also pushing companies to upgrade to more sustainable furnace technologies.

How is the shift towards sustainable and energy-efficient technologies impacting the industrial furnaces market?

The shift towards sustainability is driving significant innovation in the industrial furnaces market. Manufacturers are increasingly focusing on developing furnaces that consume less energy and produce fewer emissions, which is not only meeting regulatory requirements but also reducing operational costs for end-users.

How is the automotive industry influencing the demand for industrial furnaces?

The automotive industry is a major consumer of industrial furnaces, particularly for processes like heat treatment, forging, and casting. The growing demand for lightweight and high-strength materials in automotive manufacturing is driving the need for advanced furnace technologies.

What role does automation play in the industrial furnaces market?

Automation is increasingly being integrated into industrial furnaces to enhance operational efficiency, improve safety, and reduce human error. Automated furnaces also offer better control over temperature and process parameters, leading to improved product quality and energy savings.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]