Global Industrial Distribution Market Size, Share, Trends & Growth Forecast Report By Product Type (Machinery & Equipment, Electrical & Electronics, Industrial Supplies, Raw Materials, Safety Products and Others), Industry Type and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2024 to 2033

Global Industrial Distribution Market Size

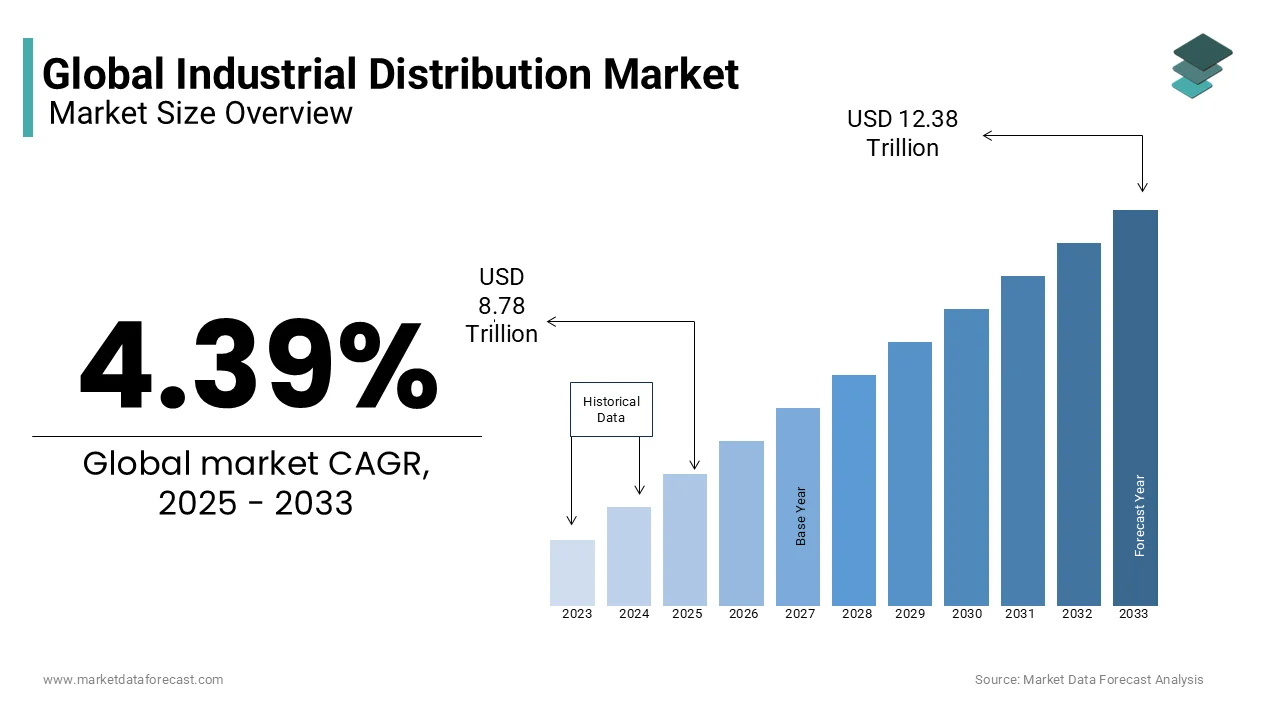

The global industrial distribution market was worth USD 8.41 trillion in 2024 and is expected to reach around USD 12.38 trillion by 2033 from USD 8.78 trillion in 2025, growing at a CAGR of 4.39% over the forecast period. This growth is driven by the increasing demand for industrial supplies in emerging markets, digital transformation, and the adoption of Industry 4.0 technologies, such as IoT and automation.

The industrial distribution market plays a crucial role in the global supply chain by ensuring that essential products such as machinery, maintenance supplies, and safety equipment reach manufacturers and service providers. In North America, the industrial distribution market holds a dominant position, accounting for 36.5% of the global share in 2024. The region’s robust manufacturing base, featuring companies like General Motors and Boeing, coupled with advanced infrastructure and logistics networks, supports efficient supply chains. Recent mergers, such as Rexel’s acquisition of Talley Inc., highlight ongoing consolidation and strategic expansion in the U.S. market. The Asia-Pacific region is the fastest-growing market, driven by rapid industrialization in countries like China and India. Government initiatives such as "Make in India" and "China 2025" are fostering local manufacturing and increasing demand for industrial goods and services. The region’s growth is also supported by significant investments in transportation infrastructure and the establishment of special economic zones.

Market Trends

Digital Transformation in Distribution

- Role of E-commerce Platforms and Digital Sales Channels

E-commerce platforms and digital sales channels have revolutionized the industrial distribution market by expanding reach and enhancing customer engagement. The global B2B e-commerce market is projected to grow from $6.64 trillion in 2020 to $18.57 trillion by 2026, reflecting a CAGR of 18.7%. Platforms like Alibaba, Amazon Business, and Grainger are leveraging digital tools to provide seamless buying experiences, including features such as personalized product recommendations, real-time inventory updates, and easy reordering options. During the COVID-19 pandemic, digital sales channels became essential for business continuity, as traditional sales methods were disrupted. Companies that had already invested in robust e-commerce infrastructures were able to adapt quickly and meet rising demand. For instance, W.W. Grainger reported a significant increase in online sales, accounting for over 70% of their total revenue in 2022, highlighting the importance of digital transformation in distribution.

- Use of AI and IoT in Inventory Management and Logistics

Artificial Intelligence (AI) and the Internet of Things (IoT) are transforming inventory management and logistics by enabling real-time monitoring and data-driven decision-making. According to Gartner, by 2025, over 50% of large global companies will use AI and IoT in their supply chains to improve efficiency and reduce costs. IoT sensors and RFID tags provide real-time visibility into inventory levels, while AI algorithms optimize stocking and replenishment processes. For example, companies like Amazon use AI-powered robots and IoT-enabled systems in their warehouses to streamline operations and reduce human error. This technology reduces stockouts and overstock situations, ensuring optimal inventory levels. The combination of AI and IoT is also improving last-mile delivery by predicting traffic patterns and optimizing delivery routes, significantly reducing delivery times and operational costs.

Automation in Warehousing and Logistics

- Adoption of Robotics and Automation in Warehouses

The adoption of robotics and automation in warehouses is accelerating as companies strive to enhance efficiency and reduce labor costs. The global warehouse automation market is expected to reach $30 billion by 2026, growing at a CAGR of 14%. Automated systems, including Automated Guided Vehicles (AGVs), robotic arms, and sorting robots, are being increasingly used to handle tasks like picking, packing, and sorting. For example, Ocado, a UK-based online grocery retailer, uses an advanced robotic grid system to process customer orders, achieving efficiency levels that are unmatchable by manual processes. Similarly, Amazon employs over 200,000 mobile robots in its fulfillment centers, which has improved order accuracy and reduced processing times. These robots can work alongside human workers, handling repetitive and physically demanding tasks, thereby enhancing overall productivity and safety in the warehouse environment.

- Benefits of Automated Supply Chain Solutions

Automated supply chain solutions offer numerous benefits, including reduced operational costs, increased speed and accuracy, and improved scalability. A McKinsey report suggests that companies can reduce logistics costs by up to 30% by adopting automated systems. Automated solutions such as robotic process automation (RPA) and machine learning algorithms help in demand forecasting, inventory management, and order processing. For instance, DHL has implemented automated sorting systems in its logistics centers, resulting in a 25% increase in sorting capacity and a significant reduction in labor costs. Automated solutions also enhance scalability, allowing companies to manage seasonal demand fluctuations more effectively. The use of predictive analytics in automated systems can anticipate disruptions and enable proactive adjustments, ensuring a resilient and responsive supply chain.

Sustainability and Green Practices

- Adoption of Sustainable Distribution Methods

The adoption of sustainable distribution methods is gaining traction as companies aim to reduce their environmental impact. The global green logistics market is expected to grow at a CAGR of 6.4% from 2021 to 2026. Companies are investing in electric and hybrid delivery vehicles, optimizing delivery routes to reduce fuel consumption, and implementing green packaging solutions. For example, UPS has committed to purchasing 10,000 electric delivery vehicles by 2024 and aims to operate a zero-emission fleet by 2050. Similarly, FedEx is investing in carbon-neutral shipping options and has set a goal to achieve carbon neutrality by 2040. These initiatives are not only reducing the carbon footprint but also helping companies meet the growing consumer demand for sustainable business practices.

- Impact of Green Logistics on Market Dynamics

Green logistics is reshaping market dynamics by influencing consumer behavior and regulatory policies. According to a report by the International Transport Forum, implementing green logistics practices could reduce global CO2 emissions from freight transport by 60% by 2050. Companies adopting sustainable practices are gaining a competitive edge as consumers and businesses increasingly prefer environmentally responsible partners. For instance, IKEA has pledged to deliver 100% of its products using electric vehicles by 2025 in select cities, aligning with its broader sustainability goals. Regulatory bodies are also imposing stricter emissions standards and incentivizing green logistics investments, driving the industry towards more sustainable practices. This shift is encouraging the development of new technologies and business models that prioritize environmental sustainability.

MARKET DRIVERS

Growing Demand for Industrial Supplies in Emerging Markets

Emerging markets, particularly in Asia-Pacific and Africa, are witnessing increased demand for industrial supplies due to rapid industrialization and infrastructure development. Countries like India and Vietnam are investing heavily in manufacturing and construction projects, driven by government initiatives such as "Make in India" and "Vietnam 2030." In Africa, the African Continental Free Trade Area (AfCFTA) is expected to boost intra-regional trade, further increasing the need for industrial goods. This surge in demand is complemented by investments in logistics infrastructure, facilitating better supply chain management and distribution channels.

Technological Advancements in Logistics and Supply Chain Management

The integration of advanced technologies like Artificial Intelligence (AI), the Internet of Things (IoT), and blockchain is revolutionizing logistics and supply chain management. For instance, IoT devices are used for real-time tracking of shipments and inventory management, reducing operational costs and improving efficiency. Companies like DHL and UPS are utilizing AI to predict delivery times and optimize routes, enhancing overall supply chain responsiveness. These innovations are enabling companies to meet growing consumer expectations for faster and more reliable delivery services.

Expansion of Manufacturing and Construction Sectors Globally

The global manufacturing and construction sectors are expanding, driven by increased urbanization and industrialization. In North America, infrastructure bills are paving the way for new construction projects, while in Europe, initiatives focused on green building and sustainable construction are gaining traction. In Asia, China's Belt and Road Initiative is funding large-scale infrastructure projects across multiple countries. This global expansion is creating a robust demand for industrial supplies, equipment, and raw materials, driving growth in the industrial distribution market.

MARKET RESTRAINTS

Fluctuating Raw Material Prices

Volatility in raw material prices can significantly impact the profitability of industrial distributors. Factors such as geopolitical instability, changes in global demand, and supply chain disruptions can lead to unpredictable cost increases. For example, fluctuations in steel and copper prices have affected the cost of manufacturing machinery and electronic components. Companies are adopting strategies like long-term contracts and hedging to mitigate these risks, but uncertainty remains a significant concern.

Economic Downturns Impacting Industrial Activities

Economic slowdowns, such as those caused by the COVID-19 pandemic, have a direct impact on industrial activities and demand for industrial supplies. During recessions, companies often cut back on capital expenditures, leading to reduced orders for industrial equipment and materials. The industrial distribution market is highly sensitive to such economic fluctuations, which can lead to inventory buildups and reduced cash flow. Diversifying customer bases and product offerings can help mitigate these impacts.

MARKET OPPORTUNITIES

Expansion into Emerging Markets

Emerging markets in Asia-Pacific and Africa offer significant growth opportunities for industrial distributors. As these regions continue to industrialize and urbanize, the demand for industrial goods such as machinery, construction materials, and electronic components is rising. Governments are investing heavily in infrastructure projects, creating a robust demand pipeline for industrial supplies. Establishing a strong presence in these markets through strategic partnerships and localized distribution networks can help companies capitalize on this growth.

Adoption of Digital Tools for Enhanced Operational Efficiency

The adoption of digital tools like AI, machine learning, and big data analytics is transforming the industrial distribution sector. These technologies are enabling companies to optimize inventory management, streamline supply chain operations, and improve demand forecasting. For example, predictive analytics can help distributors anticipate market trends and adjust their inventory levels accordingly, reducing costs and improving service levels.

Strategic Partnerships and Mergers & Acquisitions

Mergers and acquisitions are a key strategy for growth in the industrial distribution market. Companies are pursuing M&A to gain access to new markets, expand their product portfolios, and achieve economies of scale. For instance, large players are acquiring specialized distributors to strengthen their presence in niche segments like electrical supplies or HVAC equipment. These strategic moves are helping companies enhance their competitive positioning and achieve long-term growth.

MARKET CHALLENGES

Supply Chain Disruptions and Logistical Complexities

The global supply chain has faced significant disruptions due to factors such as geopolitical tensions, natural disasters, and the COVID-19 pandemic. These disruptions have led to increased shipping costs, delays, and product shortages. Companies are now focusing on building more resilient supply chains by diversifying their supplier base and investing in technologies that enhance visibility and control over their logistics operations.

Regulatory Compliance and Trade Tariffs

Navigating complex regulatory landscapes and fluctuating trade tariffs is a major challenge for industrial distributors operating across borders. Trade tensions between major economies like the U.S. and China have led to increased tariffs on key industrial products, affecting profit margins. Additionally, evolving environmental regulations are pushing companies to adopt sustainable practices, which can increase operational costs and complexity.

Competition from Direct-to-Consumer (DTC) Models

The rise of DTC models, enabled by e-commerce platforms, is challenging traditional industrial distributors. Companies are increasingly bypassing distributors to reach customers directly, offering competitive pricing and faster delivery. This shift is particularly evident in sectors like automotive parts and consumer electronics, where online platforms like Amazon Business and Alibaba are capturing market share by offering a wide range of products and seamless customer experience.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

4.39% |

|

Segments Covered |

Product Type, Industry Type and Region |

|

Various Analyses Covered |

Global, Regional, & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Fastenal Company, MRC Global, Ferguson plc, MSC Industrial Direct Co., Inc., WESCO International (Industrial), Edgen Murray, Winsupply Inc., Motion Industries, W.W. Grainger, F.W. Webb, Würth Industry (USA), DXP Enterprises, Inc., Rexel USA, Inc., Wolseley Industrial Group, Applied Industrial Technologies, Wolseley plc, Kaman Distribution Group, Airgas, Air Liquide, US, Sonepar USA, HD Supply Holdings, Inc., Sonepar, Rexel Descours et Cabaud and Border States (Industrial) |

SEGMENTAL INSIGHTS

By Product Type Insights

The machinery and equipment segment occupied 32.8% of the share in the industrial distribution market in 2024. This segment includes a wide range of products such as manufacturing machinery, construction equipment, agricultural machinery, and industrial automation equipment. The growth in this segment is driven by advancements in technology, increased demand for automation, and the expansion of various industries, including manufacturing, construction, and agriculture. The rising adoption of Industry 4.0 technologies, which include the Internet of Things (IoT), Artificial Intelligence (AI), and robotics, further contribute to the expansion of the segment. These technologies are transforming traditional manufacturing processes by improving efficiency, reducing costs, and enabling predictive maintenance. For example, smart manufacturing solutions are being integrated into factory operations to monitor equipment performance and reduce downtime. The global demand for construction machinery is witnessing a surge due to significant investments in infrastructure projects, particularly in developing regions like Asia-Pacific and Africa. Countries like India and China are investing heavily in infrastructure development under initiatives like “Make in India” and the Belt and Road Initiative. Additionally, in North America and Europe, there is a strong push towards automation in agriculture and manufacturing, with companies investing in advanced machinery to enhance productivity and meet sustainability goals.

The industrial supplies segment captured 22.77% of the global market share in 2024. Industrial supplies, which include MRO (Maintenance, Repair, and Operations) products and tools, these are essential for maintaining operational efficiency and minimizing downtime across various industries. The demand is for industrial supplies are particularly high in sectors such as automotive, aerospace, and heavy manufacturing, where regular maintenance and repair are crucial for uninterrupted operations. The growth is also supported by advancements in inventory management technologies, such as automated storage and retrieval systems, which help streamline the supply chain and reduce costs. The automotive sector, for instance, is seeing increased investments in automation and robotic maintenance solutions, driving demand for industrial supplies. In addition, the aerospace industry is focusing on predictive maintenance technologies, which rely on high-quality MRO supplies to ensure the reliability and safety of aircraft.

The electrical and electronics segment is anticipated to grow at a CAGR of 5.12% during the forecast period. It comprises products such as circuit protection, transformers, wiring devices, and electronic components used in various industries, including manufacturing, energy, and construction. The growth is driven by the increasing adoption of renewable energy sources and the development of smart grid infrastructure. The integration of electrical and electronic components in industrial automation systems is also boosting demand. The need for efficient energy management systems and the expansion of electric vehicle (EV) infrastructure are additional growth drivers. In 2023, global investments in renewable energy reached new highs, with countries like China and the United States leading the charge in developing solar and wind energy projects. This has spurred demand for transformers, switchgear, and other electrical components. Furthermore, the deployment of 5G technology and the increasing use of IoT devices in industrial settings are creating new opportunities for electronic component manufacturers and distributors.

The safety products segment is projected to grow at a CAGR of 5.2%, driven by increasing workplace safety regulations and a heightened awareness of occupational health and safety. Industries such as construction, manufacturing, and healthcare are key drivers of demand, with stringent safety standards necessitating the use of high-quality protective gear and equipment. The segment gained significant attention during the COVID-19 pandemic, with a surge in demand for PPE across various industries. The ongoing pandemic and subsequent health crises have led to an increased focus on workplace safety across all sectors. Companies are investing in advanced safety products such as smart helmets and connected safety wearables that provide real-time monitoring and alerts for hazardous conditions.

By Industry Type Insights

The manufacturing segment accounted for 40.2% of the industrial distribution market share in 2024 and emerged as the most dominating segment. The sector is expected to grow at a CAGR of 5% as industries increasingly adopt automation and digital technologies to enhance productivity. The global manufacturing industry is projected to reach $44.5 trillion by 2030, driven by the rapid industrialization of emerging economies. Investments in smart factories and the use of advanced robotics are reshaping traditional manufacturing processes. For example, the adoption of collaborative robots (cobots) is expected to grow by 25% annually, enabling manufacturers to improve precision and efficiency.

The construction segment captured 20.8% of the global market share in 2024. The global construction market is expected to grow to $15.5 trillion by 2030, driven by urbanization and infrastructure development in regions like Asia-Pacific and Africa. Major projects, such as India’s Smart Cities Mission and Saudi Arabia’s NEOM city, are creating significant demand for construction equipment, raw materials, and safety products. The adoption of Building Information Modeling (BIM) and sustainable construction practices are transforming the industry, with companies investing in advanced machinery and eco-friendly building materials.

he oil and gas segment is expected to grow at a CAGR of 3.8% during the forecast period. Despite the shift towards renewable energy, the demand for oil and gas is projected to remain steady due to ongoing exploration and production activities. Global investments in oil and gas infrastructure are estimated to exceed $4.3 trillion by 2030, particularly in the Middle East and Africa. The adoption of digital technologies like AI and IoT for predictive maintenance and asset management is enhancing operational efficiency in the sector.

The healthcare segment is projected to grow at a CAGR of 5.5%, driven by increased spending on medical infrastructure and equipment. The global healthcare industry is expected to reach $12 trillion by 2026, with a focus on expanding access to care and improving patient outcomes. The demand for safety products, such as PPE and specialized machinery for pharmaceutical manufacturing, remains high. The adoption of advanced technologies like AI for diagnostics and robotics for surgical procedures is also influencing the industrial distribution of medical equipment and supplies.

The food and beverage segment is projected CAGR of 4.8% during the forecast period. The global market is expected to grow to $7.5 trillion by 2025, supported by increasing consumer demand for packaged and processed foods. Automation in food processing and packaging is driving demand for machinery and industrial supplies. The focus on food safety and compliance with regulations like the Food Safety Modernization Act (FSMA) in the U.S. is also boosting demand for specialized equipment and safety products.

By Region Insights

North America had 40.2% of the global market share in 2024 and was the largest regional segment in the global market. The United States, as the largest market in the region, contributes heavily to this growth, driven by strong industrial activity and ongoing investments in manufacturing and infrastructure projects. Canada also plays a critical role, with a focus on advanced manufacturing and resource-based industries. The adoption of Industry 4.0 technologies such as AI, IoT, and advanced robotics in manufacturing is a major growth driver. The U.S. government’s emphasis on revitalizing the manufacturing sector through initiatives like the “Manufacturing USA” program is boosting demand for advanced machinery and equipment. The Bipartisan Infrastructure Law in the U.S., which allocates over $1 trillion for infrastructure projects, is expected to drive demand for construction materials and equipment. This will positively impact the industrial distribution sector, particularly for raw materials and machinery. North American companies are focusing on building resilient supply chains by nearshoring and reshoring operations. This trend is expected to create demand for local industrial supplies and logistics services. In 2023, companies like Amazon and UPS have significantly invested in expanding their logistics networks to support increased e-commerce activity and faster delivery times. Additionally, the rise of electric vehicles (EVs) is creating new demand for electrical and electronics components in the region.

The Asia-Pacific region was the second biggest regional segment in the global market in 2023 and captured 32.9% of the global market share. The region's growth is primarily driven by rapid industrialization and urbanization in countries like China, India, and Southeast Asian nations. China and India are leading the region’s industrial growth, with initiatives like “Made in China 2025” and “Make in India” aimed at boosting local manufacturing capabilities. The demand for machinery, raw materials, and industrial supplies is expected to rise significantly. Large-scale infrastructure projects such as China’s Belt and Road Initiative and India’s Smart Cities Mission are driving demand for construction equipment, electrical components, and safety products. The region is witnessing a surge in the adoption of advanced manufacturing technologies. Companies are investing in automation and digitalization to increase production efficiency and reduce costs. In 2023, Foxconn, one of the largest electronics manufacturers, announced plans to set up new production facilities in India, focusing on manufacturing components for electric vehicles and consumer electronics. This move is expected to create a ripple effect across the industrial distribution sector, increasing demand for machinery and electronic components.

Europe is expected to grow at a CAGR of 3.8%, driven by investments in sustainable technologies and energy-efficient solutions. Key markets include Germany, the UK, and France, where industrial activities are supported by strong regulatory frameworks and technological advancements. Europe is at the forefront of the transition to renewable energy, which is driving demand for electrical equipment and components such as transformers and switchgear. The European Green Deal aims to make the EU climate-neutral by 2050, further boosting investments in green infrastructure. European companies are investing heavily in digital technologies to enhance productivity and reduce operational costs. The adoption of smart manufacturing solutions, particularly in Germany's automotive sector, is driving demand for advanced machinery and industrial supplies. Stringent regulations on emissions and workplace safety are pushing companies to upgrade their facilities and adopt more sustainable practices, thereby increasing demand for safety products and energy-efficient equipment. In 2023, Siemens and Bosch announced significant investments in developing smart manufacturing hubs across Europe, focusing on integrating AI and IoT technologies into their production processes. The construction of large-scale offshore wind farms in the North Sea is also generating demand for specialized machinery and electrical components.

Latin America accounts is projected to grow at a CAGR of 3.5%, supported by investments in infrastructure and energy projects, particularly in Brazil and Mexico. Brazil and Mexico are investing heavily in oil and gas exploration, renewable energy projects, and mining activities. This is driving demand for industrial machinery, raw materials, and safety products. Governments across the region are focusing on improving infrastructure, which is creating demand for construction materials and equipment. The expansion of ports, roads, and airports is particularly boosting the market for heavy machinery and industrial supplies. Latin American countries are diversifying their industrial base, moving beyond traditional sectors like agriculture and mining to manufacturing and technology. This is increasing the demand for advanced industrial supplies and equipment. In 2023, the Brazilian government announced a $100 billion investment plan to modernize the country’s infrastructure, including the construction of new highways and airports. This initiative is expected to significantly boost the demand for industrial machinery and raw materials in the coming years.

The market in the Middle East and Africa (MEA) is anticipated to grow at a CAGR of 4% due to ongoing infrastructure projects and industrial diversification efforts. Countries like Saudi Arabia, the UAE, and South Africa are key markets driving this growth. Gulf countries, particularly Saudi Arabia and the UAE, are investing in non-oil sectors such as tourism, construction, and renewable energy as part of their economic diversification plans. This is driving demand for industrial machinery, construction materials, and safety equipment. Massive infrastructure projects like Saudi Arabia’s NEOM city and various Expo 2020 projects in Dubai are creating demand for machinery, raw materials, and construction equipment. The expansion of mining and manufacturing activities in countries like South Africa and Nigeria is boosting the demand for industrial supplies and safety products. In 2023, Saudi Arabia announced the launch of several mega-projects under its Vision 2030 plan, including the construction of the world’s largest industrial city in NEOM. This project is expected to generate substantial demand for construction machinery, electrical equipment, and safety products in the region.

COMPETITIVE LANDSCAPE & KEY PLAYERS IN THE MARKET

The industrial distribution market is dominated by several key players, each with a significant share and influence over the industry. W.W. Grainger, a leader in the sector, reported annual sales of over $15 billion, highlighting its extensive product range and robust distribution network. MSC Industrial Direct is another major player, specializing in metalworking and maintenance, repair, and operations (MRO) supplies, with a market share of around 8%. Ferguson PLC, primarily focused on plumbing and heating products, commands a strong presence in North America with annual sales exceeding $21 billion.

These companies leverage vast distribution networks and digital platforms to maintain their market positions. The competition is intense, with players like Fastenal, Motion Industries, and WESCO International also holding significant shares. Market consolidation through mergers and acquisitions is a common strategy, enabling companies to expand their product portfolios and geographic reach. Overall, the market is characterized by a mix of broad-line distributors and specialized players, each vying for leadership in various product segments.

List of companies playing a leading role in the global industrial distribution market include

- Fastenal Company

- MRC Global

- Ferguson plc

- MSC Industrial Direct Co., Inc.

- WESCO International (Industrial)

- Edgen Murray

- Winsupply Inc.

- Motion Industries

- W.W. Grainger

- F.W. Webb

- DXP Enterprises, Inc.

- Rexel USA, Inc.

- Wolseley Industrial Group

- Applied Industrial Technologies

- Wolseley plc

- Kaman Distribution Group

- Airgas, Air Liquide, US

- Sonepar USA

- HD Supply Holdings, Inc.

- Sonepar

- Wurth Group

- Rexel

- Descours et Cabaud

- Border States (Industrial)

RECENT HAPPENINGS IN THE MARKET

Mergers, Acquisitions, and Joint Ventures:

- In January 2023, W.W. Grainger acquired Cromwell Group to enhance its presence in the European market.

- In March 2023, Ferguson acquired Columbia Pipe & Supply to expand its industrial distribution capabilities in the Midwest U.S.

- In May 2023, MSC Industrial Direct acquired Deco Tool Supply to strengthen its metalworking and MRO product offerings.

- In July 2023, Fastenal acquired Av-Tech Industries to expand its fastener and component distribution capabilities.

- In October 2023, WESCO International merged with Anixter International to create a leading distributor of electrical and electronic solutions.

- In December 2023, Motion Industries acquired Kaman Distribution Group to expand its automation and power transmission products portfolio.

Strategic Alliances and Partnerships:

- In February 2023, W.W. Grainger partnered with Amazon Business to expand its reach in the online B2B marketplace.

- In April 2023, Ferguson partnered with Home Depot Pro to strengthen its service capabilities in the professional plumbing segment.

- In June 2023, MSC Industrial Direct partnered with Markforged to integrate 3D printing solutions into its product offerings.

- In August 2023, Fastenal partnered with Stanley Black & Decker to provide co-branded safety and industrial tools.

- In November 2023, WESCO partnered with ABB to enhance its automation and electrical solutions.

- In January 2024, Motion Industries partnered with Mitsubishi Electric to expand its industrial automation product line.

Product Offerings and Innovations:

- In March 2023, W.W. Grainger launched KeepStock solutions to streamline inventory management for customers.

- In June 2023, MSC Industrial Direct introduced the new Accupro line to focus on high-performance metalworking tools.

- In July 2023, Ferguson launched the Wolseley One platform to integrate its digital and physical sales channels.

- In September 2023, Fastenal introduced its Onsite Solutions program to provide in-facility inventory management.

- In October 2023, Motion Industries launched Mi Virtual Warehouse to offer a digital twin of its inventory for customers.

- In November 2023, WESCO launched the EnduraLite safety range to focus on lightweight, high-durability safety products.

DETAILED SEGMENTATION OF THE GLOBAL INDUSTRIAL DISTRIBUTION MARKET INCLUDED IN THIS REPORT

This research report on the global industrial distribution market is segmented and sub-segmented based on product type, industry type and region.

By Product Type

- Machinery & Equipment

- Electrical & Electronics

- Industrial Supplies

- Raw Materials

- Safety Products

- Others

By Industry Type

- Manufacturing

- Construction

- Oil & Gas

- Chemicals

- Healthcare

- Food & Beverage

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

How big is the industrial distribution market?

The global industrial distribution market was worth USD 8.41 trillion in 2024.

What are the factors driving the market?

The rising demand for industrial supplies and rapid adoption of technological advancements such as industry 4.0 are driving the global market growth.

Which segment by industry is leading the market?

The manufacturing segment accounted for the largest share of the global market in 2024.

Who are the key players in the market?

Fastenal Company, MRC Global, Ferguson plc, MSC Industrial Direct Co., Inc., WESCO International (Industrial), Edgen Murray, Winsupply Inc., Motion Industries, W.W. Grainger, F.W. Webb, Würth Industry (USA), DXP Enterprises, Inc., Rexel USA, Inc., Wolseley Industrial Group, Applied Industrial Technologies, Wolseley plc, Kaman Distribution Group, Airgas, Air Liquide, US, Sonepar USA, HD Supply Holdings, Inc., Sonepar and Rexel are the key players in the market.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]