Global Industrial Centrifuges Market Size, Share, Trends & Growth Forecast Report By Product, Operation, Design, End-User and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis From 2025 To 2033.

Global Industrial Centrifuges Market Size

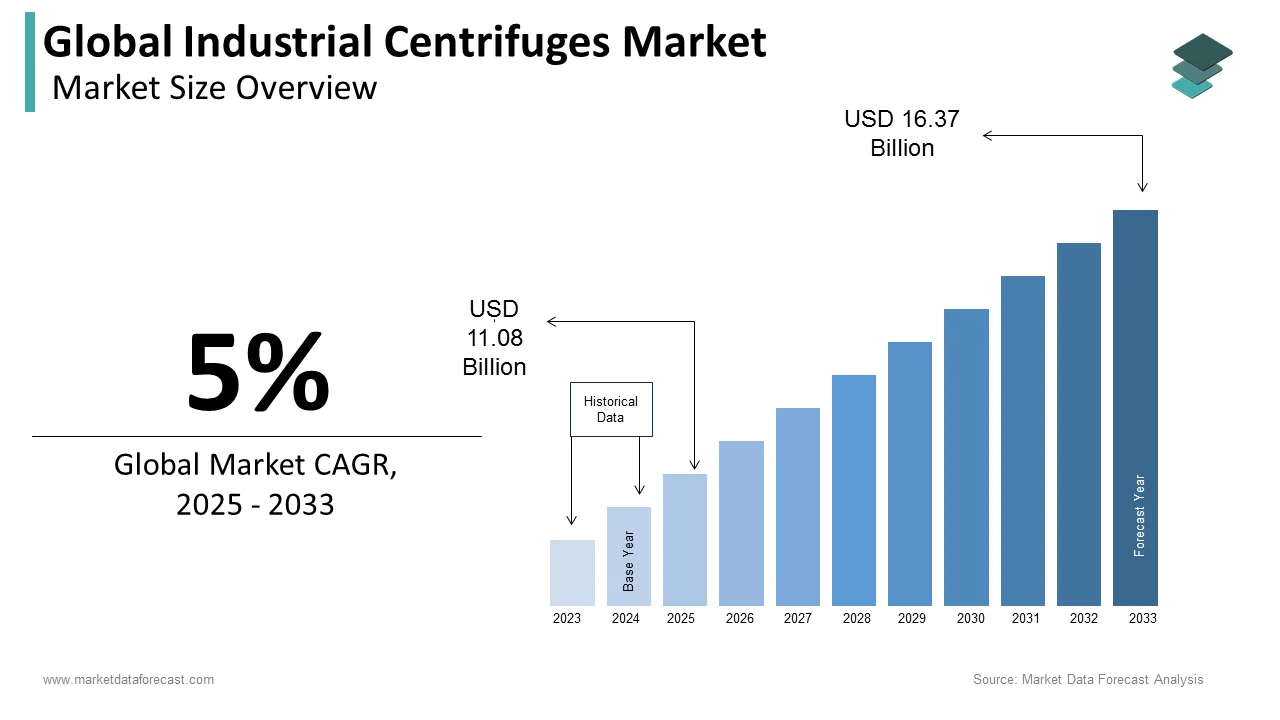

The global industrial centrifuges market was worth US$ 12.25 billion in 2024 and is anticipated to reach a valuation of US$ 16.37 billion by 2033 from US$ 11.08 billion in 2025, and it is predicted to register a CAGR of 5% during the forecast period 2025-2033.

MARKET DRIVERS

The growing demand for industrial centrifuges from various industries is one of the key factors propelling the market growth. Industrial centrifuges are used in numerous industries, including chemical, pharmaceutical, food and beverage, wastewater treatment, oil and gas, mining, and more. The growing need for efficient separation, filtration, and clarification of liquids and solids in these industries is driving demand for industrial centrifuges. The versatility and effectiveness of centrifuges in meeting the specific requirements of different industries further drive the demand for industrial centrifuges and contribute to market growth.

Stringent regulations and environmental concerns further promote the growth of the industrial centrifuges market. Industries must follow environmental regulations such as waste management and pollution control measures imposed by governments and international bodies. Industrial centrifuges can effectively separate solids from liquids, remove impurities, clarify wastewater, and help industries achieve these objectives. The rising focus on environmental responsibility and adherence to industry regulations is contributing to the growing demand for industrial centrifuges and driving market growth.

Technological advancements boost the growth rate of the industrial centrifuges market. Industrial centrifuges have experienced several technological upgrades in recent years, and the manufacturers have used advanced technologies to develop more efficient and cost-effective centrifuge solutions. The growing emphasis from industries on process optimization and efficiency to improve productivity, reduce operating costs, and enhance product quality favors market growth. The growing usage of industrial centrifuges in the pharmaceutical and biotechnological sectors for cell separation, vaccine production, pharmaceutical ingredient separation, and blood component separation is another major factor supporting the market growth.

The growing emphasis on energy efficiency and sustainability, increasing focus on product quality, the advantages of centrifuges over other separation techniques, rising focus on water and wastewater treatment, growing demand for specialty chemicals, increasing need for oil and gas exploration and production, rapid adoption of centrifuges in the renewable energy sector, growing demand for biofuels and rising awareness of the benefits of centrifugal separation further contribute to the growth of the industrial centrifuges market.

MARKET RESTRAINTS

High initial investment costs associated with purchasing and installing industrial centrifuges, operational and maintenance costs, availability and cost of skilled personnel for operating and maintaining centrifuge systems and limited awareness and understanding of the benefits and applications of industrial centrifuges in certain industries or regions majorly hamper the growth of the industrial centrifuges market. Competition from alternative separation technologies such as filtration systems or other mechanical separation methods, challenges related to the handling and disposal of separated materials, especially hazardous or toxic substances, and limitations in the capacity and performance of existing centrifuge systems, particularly for large-scale industrial operations further hinder the industrial centrifuges market growth.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

5.24% |

|

Segments Covered |

By Product, Operation, Design, End User, and Region. |

|

Various Analyses Covered |

Global, Regional, and country-level analysis; Segment-Level Analysis, DROC; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Andritz AG, Alfa Laval AB, GEA Westfalia Separator Group GmbH, Thomas Broadbent & Sons, FLSmidth & Co. A/S MI Swaco, Flottweg Separation Technology, Hiller GmbH, Ferrum AG, Pieralisi Group and TEMA Systems, Inc., and Others. |

SEGMENTAL ANALYSIS

By Product Insights

Based on the product, the sedimentation centrifuge segment is estimated to hold the major share of the global market during the forecast period. The growing demand for solid-liquid separation in industries such as wastewater treatment, mining, and pharmaceuticals, rising emphasis on efficient dewatering and clarification processes, and stringent regulations for wastewater management and treatment drive segmental growth. The rising awareness of the benefits of sedimentation centrifuges in various industrial applications, the increasing need for effective separation of fine particles and impurities, and the rising demand for sedimentation centrifuges in the oil and gas industry further boost the growth rate of the segment.

By Operation Insights

Based on operation, the batch centrifuges segment is anticipated to grow at a healthy CAGR during the forecast period, while the continuous centrifuges segment is estimated to account for the highest share of the market during the forecast period. The demand and interest in these centrifuges are high due to their advantages, such as high separation efficiency, easy process standardization, and reduced cleaning time.

By Design Insights

Based on the design, the vertical segment had the leading share of the global market in 2024 and is expected to grow at a healthy CAGR during the forecast period due to the rising demand in the oil and gas industry, growing emphasis on wastewater treatment and an increasing number of advancements in pharmaceutical and biotechnology sectors. The rising demand for food processing and growing research and development activities further boost the growth rate of the segment.

By End User Insights

Based on the end-user, the chemical segment had the leading share of the global market in 2024 and is expected to continue to be the leading segment throughout the forecast period. The rising demand for specialty chemicals used in various applications, such as pharmaceuticals, personal care products, agrochemicals, and electronic chemicals, is one of the major factors propelling the growth of the chemical segment. The strict quality and safety regulations to ensure product purity, environmental compliance and worker safety in the chemicals industry, continuous research and development to introduce innovative products and improve existing processes and rising emphasis on sustainable practices and green manufacturing processes further contribute to the segmental growth. The growing chemical manufacturing sector, rising demand for chemicals in developing countries, growing focus on waste management, and global demand for chemicals further promote the growth of the chemical segment.

REGIONAL ANALYSIS

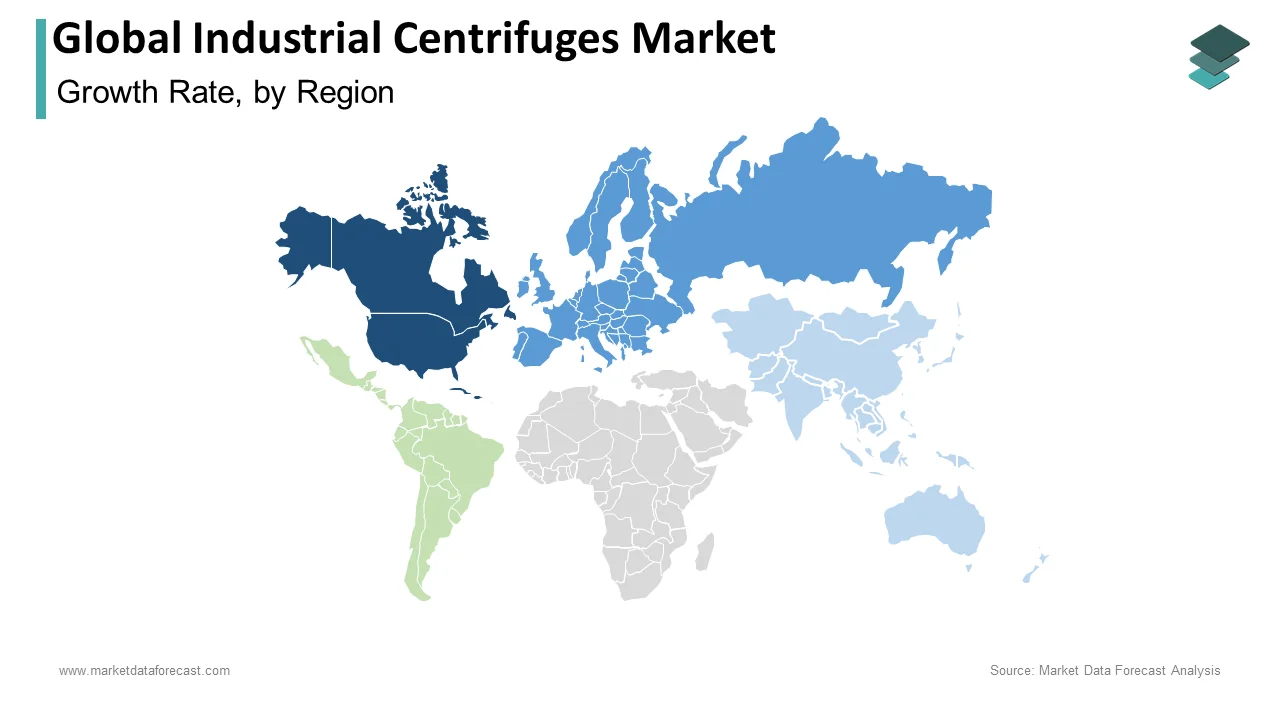

North America led the market in 2024 and is expected to hold the leading share of the global market throughout the forecast period. Technological advancements and automation in various industries, growing demand for pharmaceuticals and biotechnology products and the strong presence of major industrial centrifuge manufacturers in North America majorly propel the North American market growth. The rising emphasis on research and development activities, stringent regulatory standards and guidelines for industrial processes and increasing adoption of industrial centrifuges in the oil and gas sector further fuel the growth rate of the North American industrial centrifuges market. The U.S. held the major share of the North American market followed by Canada in 2024.

Europe captured a substantial share of the global market in 2024 and is estimated to grow at a notable CAGR during the forecast period. Expanding pharmaceutical and chemical industries in Europe, rising emphasis on environmental sustainability, growing investments in renewable energy projects and strong presence of automotive and aerospace industries primarily propel the European market growth. Favorable government policies and initiatives and growing demand for food and beverage processing further contribute to the growth of the European industrial centrifuges market. Germany followed by UK, France and Spain held the leading share of the European market in 2024.

APAC is the most lucrative regional market for industrial centrifuges and is predicted to witness the fastest CAGR during the forecast period. Rapid industrialization and urbanization, growing manufacturing activities in countries like China and India and rising demand for healthcare and pharmaceutical products boost the industrial centrifuges market in the Asia-Pacific region. The expansion of the oil and gas sector, rise in infrastructure development projects and rapid adoption of advanced technologies in various industries further accelerate the growth rate of the APAC industrial centrifuges market. China followed by Japan and India are predicted to hold the leading share of the APAC market during the forecast period.

Latin America had a considerable share of the global market in 2024 and is projected to grow at a healthy CAGR during the forecast period. The growing mining and mineral processing industries, expansion of the agricultural sector and rising focus on water and wastewater treatment drive the Latin American industrial centrifuges market growth. The growing demand for energy and power generation, the increasing number of initiatives from the Latin American governments to attract foreign investments and the development of the food processing industry further boost the growth rate of the Latin American market.

The MEA industrial centrifuges market accounted for a moderate share of the global market in 2024 and is expected to grow at a steady CAGR during the forecast period.

KEY MARKET PLAYERS

Some of the prominent companies dominating the global industrial centrifuges market profiled in this report are Andritz AG, Alfa Laval AB, GEA Westfalia Separator Group GmbH, Thomas Broadbent & Sons, FLSmidth & Co. A/S MI Swaco, Flottweg Separation Technology, Hiller GmbH, Ferrum AG, Pieralisi Group, TEMA Systems, Inc., and Others.

RECENT HAPPENINGS IN THE MARKET

-

FLSmidth and the University of Denmark expanded their collaboration for another four years in 2017 to find new ways to collaborate in the global cement and mining industries.

-

Alfa Laval launched the ALDEC G3 VecFlow decanter in 2019.

- In July 2020, GEA Group Aktiengesellschaft launched the giant steam-sterilizable centrifuge and delivered it to Jiangsu Wecare Biotechnology in Luohe, China. After the fermentation method, the centrifuge collects bacteria to produce probiotic powder for the agriculture, dairy, and pharmaceutical industries.

MARKET SEGMENTATION

This research report on the global industrial centrifuges market has been segmented and sub-segmented based on the product, operation, design, end-user, and region.

By Product

-

Sedimentation Centrifuges

-

Clarifier Centrifuges

- Decanter Centrifuges

- Disc-Stack Centrifuges

- Hydrocyclones

- Other Sedimentation Centrifuges

-

- Filtering Centrifuges

- Basket Centrifuges

- Scroll Screen Centrifuges

- Peeler Centrifuges

- Pusher Centrifuges

By Operation

- Batch Centrifuges

- Continuous Centrifuges

By Design

- Horizontal

- Vertical

By End User

- Chemical Industry

- Mining Industry

- Pharmaceutical and Biotechnology Industries

- Power Plants

- Food and Beverage Industry

- Pulp and Paper Industry

- Wastewater Treatment Plants

- Water Purification Plants

- Metal Processing Industry

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

Which region has the highest market share in the industrial centrifuges market?

In 2024, the North American region held the major share of the global market.

How much was the global industrial centrifuges market worth in 2024?

The global industrial centrifuges market size was valued at USD 12.25 billion in 2024

Which are the major players operating in the industrial centrifuges market?

Andritz AG, Alfa Laval AB, GEA Westfalia Separator Group GmbH, Thomas Broadbent & Sons, FLSmidth & Co. A/S MI Swaco, Flottweg Separation Technology, Hiller GmbH, Ferrum AG, Pieralisi Group and TEMA Systems, Inc. are some of the prominent players in the industrial centrifuges market.

Which segment by product led the industrial centrifuges market?

Based on type, the sedimentation segment accounted for the leading share of the market in 2024.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]