Global Industrial Automation Market Size, Share, Trends, and Growth Forecast Report Segmented, By Automation Type, Industry (Automotive & Transportation, Metals & Mining, Oil and Gas, Pulp & Paper, Hydropower, Energy & Power System, Chemical, Material and Food, Measurement and Instrumentation) & By Region (North America, Europe, Asia-Pacific, Latin America, Middle East And Africa), Industry Analysis From 2025 to 2033

Global Industrial Automation Market Size

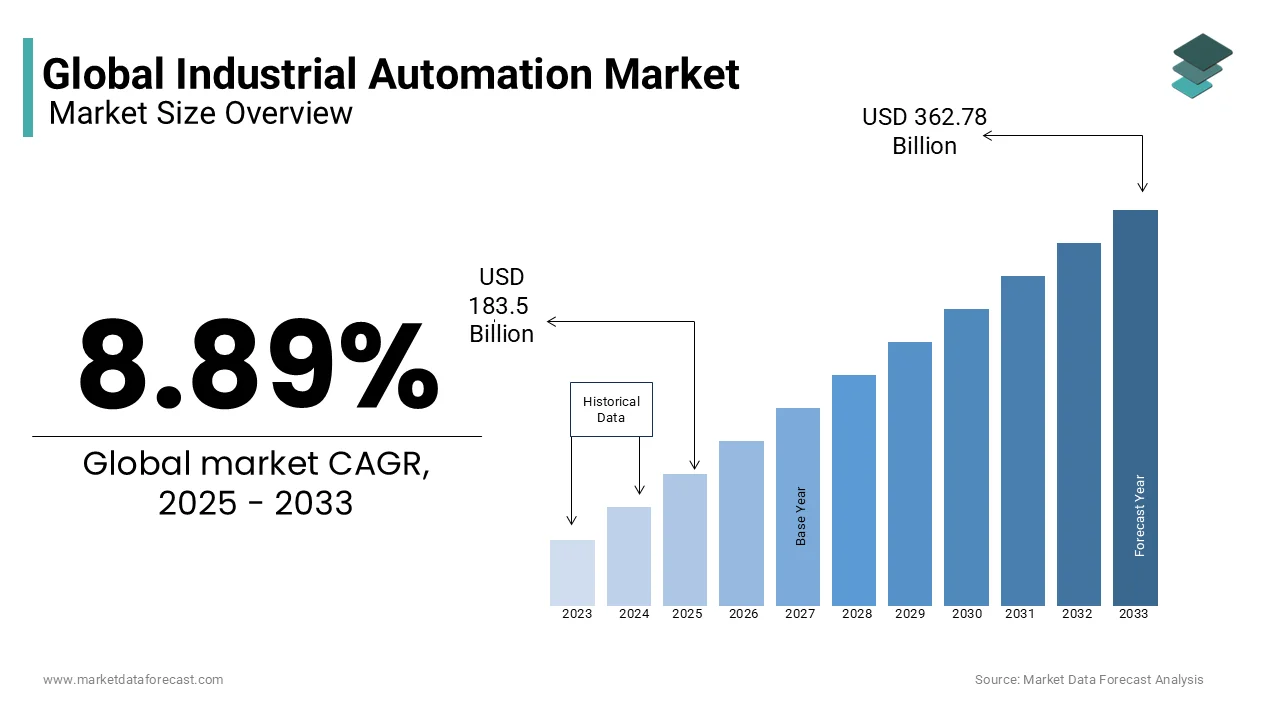

The global industrial automation market was valued at USD 168.56 billion in 2024. and is anticipated to reach USD 183.54 billion in 2025 from USD 362.78 billion by 2033, growing at a CAGR of 8.89% during the forecast period from 2025 to 2033.

Automation is the use of data technology and control systems (computers and sets of devices) to exchange human operators to regulate industrial machinery, processes, and the building environment. Computer-controlled robots that have the power to finish an equivalent process at a compatible top quality and controllable speeds are utilized in many points of commercial production. The growing need for automated systems has increasingly shifted focus to optimization within the areas of security measures, efficiency, and low power consumption.

MARKET DRIVERS

The growing demand for operational efficiency is one of the major factors propelling the growth of the industrial automation market.

The usage of automation in industrial settings has been seen for a long time now. Companies have realized the need for automation to streamline operations, enhance precision, and boost productivity, and have been aggressively investing in automating operations at their working locations. The growing labor wages across industries and increasing demand for practical solutions that will manage failure at the component level are further propelling the global industrial automation market growth. With an increasing requirement for industrial-grade products occurring in almost every sector, a high need for automation which will help mass-produce commodities,s is being felt everywhere in the world. This has caused a spike in the number of players entering the industrial automation market, which is undoubtedly expected to extend the competitive intensity during the forecast period. Automation can also speed up the implementation of several innovative solutions, compared to manual processes.

The growing need to increase production capacities by companies in various industry verticals is resulting in the rapid adoption of industrial automation and contributing to global market growth. The demand for industrial automation is growing exponentially and the majority of the demand is coming from automotive assemblies, telecom networks, aircraft, heat-treating boilers and ovens, factory machinery, steering, and ship stabilization, and other mechanical systems. Several companies worldwide are pouring significant investments into facilitating research and development processes regarding industrial automation.

Furthermore, the rising need for cost reduction, advancements in robotics technology, rapid adoption of industrial Internet of things (IIoT), increasing adoption of smart manufacturing practices, and growing demand for real-time data analysis are promoting the growth of the industrial automation market. The rapid integration of artificial intelligence, rising focus on energy efficiency in manufacturing, increasing number of Industry 4.0 initiatives, growing complexity in manufacturing processes, and regulatory support for automation in industries are favoring the growth rate of the global market.

MARKET RESTRAINTS

High costs associated with the implementation of industrial automation solutions are showing a significant impact on its adoption by companies and hampering the global market growth. Factors such as resistance from companies to technology adoption, concerns about job displacement, lack of skilled workforce, and complexity in integrating legacy systems are impeding the global industrial automation market growth. Cybersecurity risks and vulnerabilities and regulatory compliance issues are further hindering the growth rate of the global market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

8.89% |

|

Segments Covered |

By Automation Type, Industry, and Region. |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

ABB LTD (Switzerland), Emerson Electric Co (U.S.), General Electric (U.S.), Honeywell International (U.S.), Seimens AG (Germany), Texas Instruments Inc. (U.S.), Schneider Electric (France) and Yokogawa Electric CO. (Japan) and Others. |

SEGMENTAL ANALYSIS

By Automation Type Insights

Based on automation type, the SCADA and DCS segments together accounted for the largest share of the global industrial automation market in 2023, and the same trend is expected to continue throughout the forecast period, owing to the high adoption of commercial control and factory automation to optimize the assembly process. Increasing demand for real-time visibility and sophisticated operations in power, oil and gas, food and beverages, and mining industries is anticipated to fuel the need for industrial control and factory automation and contribute to the growth of these segments. Implementation of an automated process is more complex in process industries than in the discrete sector. Thus, the deployment of control technologies, like a distributed system (DCS), is high within the process industry.

By Industry Insights

The growing adoption of automation in the automotive and transportation industries for manufacturing processes, quality control, and supply chain management is primarily driving the growth of the segment in the worldwide market.

Based on industry, the automotive and transportation segment led the market, accounting for 24.5% of the worldwide market in 2023, and is likely to expand with a noteworthy growth rate in the global industrial automation market during the forecast period. The growing emphasis on predictive maintenance and quality control by the companies that operate in the automotive and transportation sectors is further resulting in the increased usage of industrial automation and this particular factor is contributing to the global market growth considerably.

On the other hand, segments such as metals and mining, oil and gas, and chemical, material, and food accounted for a substantial share of the worldwide market in 2023 and are expected to register healthy growth in the coming years.

REGIONAL ANALYSIS

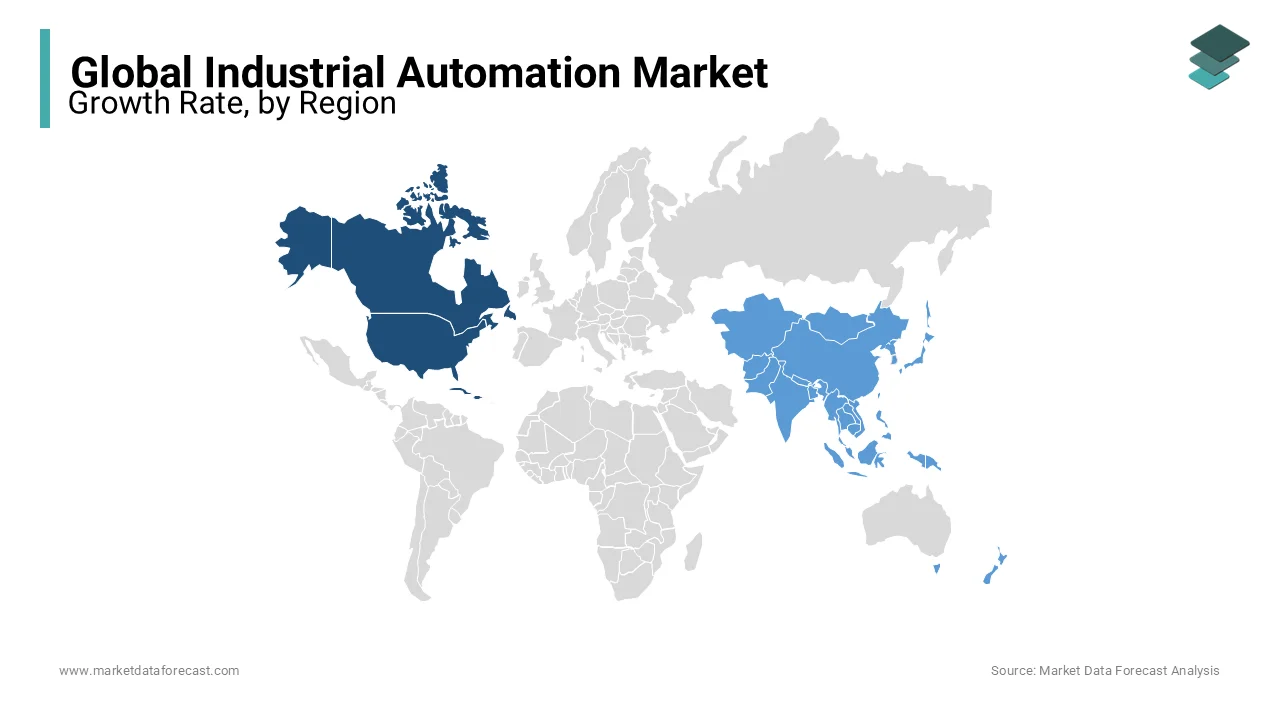

North America was the biggest regional segment in 2023 and had 36.8% of the global market share in 2024. The North American region is estimated to witness a healthy CAGR during the forecast period, owing to the rapid adoption of technological advancements, the increasing number of Industry 4.0 initiatives and the growing focus on smart manufacturing by companies in North America. The U.S. accounted for the leading share of the North American market in 2023 and is expected to grow rapidly during the forecast period,d owing to the rapid adoption of advanced robotics in U.S. automotive plants to enhance production efficiency. The rise of collaborative robots (cobots) in various industries in the U.S. is anticipated to fuel the growth rate of the North American market.

Asia-Pacific was another notable regional segment in the global market in 29023 and accounted for 31.4% of the worldwide market share. The Asia-Pacific regional market is anticipated to grow at the highest CAGR during the forecast period. The growth of industrialization throughout the Asia-Pacific region is primarily driving the regional market growth. The governments of APAC countries have been encouraging automation and bringing several supportive initiatives in favor of industrial automation and this trend is likely to continue during the forecast period and boost the regional market. The presence of emerging economies, increasing investments in smart cities and a solid focus on technological innovation are further propelling the APAC market. China dominated the industrial automation market in the Asia-Pacific region in 2023 and is projected to grow at a steady CAGR during the forecast period. “Made in China 2025” is an initiative by the Chinese government, which is promoting advanced manufacturing technologies and contributes to the increased usage of industrial automation.

KEY MARKET PLAYERS

Some of the major players in the global industrial automation market include ABB LTD (Switzerland), Emerson Electric Co (U.S.), General Electric (U.S.), Honeywell International (U.S.), Seimens AG (Germany), Texas Instruments Inc. (U.S.), Schneider Electric (France) and Yokogawa Electric CO. (Japan).

RECENT HAPPENINGS IN THE MARKET

- ABB acquires SVIA automation solutions. The acquisition combines SVIA's leading robotized machine tending solutions with ABB's globally leading position in industrial automation.

- B&R, a unit of ABB's Robotics and Discrete Automation business, announced the integration of ABB robots into its automation portfolio. With the power to supply unprecedented levels of machine flexibility and precision, merging robotics with machine control into one unified architecture will enable manufacturers to embrace the trend of mass customization and optimize their lot size in one process.

- Emerson launched the most advanced Industrial Wireless Network Solution that joins the company's existing expertise in industrial automation and applications with Cisco's networking, cybersecurity, and IT infrastructure innovations. The new Emerson Wireless 1410S Gateway with the Cisco Catalyst® IW6300 Heavy Duty Series Access Point includes the latest wireless technology with advanced WirelessHART® sensor technology, delivering reliable and highly secure data, even within the harshest industrial environments.

MARKET SEGMENTATION

This research report on the global industrial automation market has been segmented and sub-segmented based on the automation type, industry, and region.

By Automation Type

- Distributed Control System (DCS)

- Programmable Logic Control System (PLC)

- Machine Vision System

- Manufacturing Execution System (MES)

- Human Machine Interface (HMI)

- Supervisory Control and Data Acquisition (SCADA)

- Product Lifecycle Management (PLM)

- Plant Asset Management

- Computer Numerical Control (CNC) routers

- Electronic Control Units (ECU)

- Others

By Industry

- Automotive and Transportation

- Metals and Mining

- Oil and Gas

- Pulp and Paper

- Hydro Power

- Energy and Power System

- Chemical, Material, and Food

- Measurement and Instrumentation

By Region

- North America

- The United States

- Canada

- Rest of North America

- Europe

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

- The Asia Pacific

- India

- Japan

- China

- Australia

- Singapore

- Malaysia

- South Korea

- New Zealand

- Southeast Asia

- Latin America

- Brazil

- Argentina

- Mexico

- Rest of LATAM

- The Middle East and Africa

- Saudi Arabia

- UAE

- Lebanon

- Jordan

- Cyprus

Frequently Asked Questions

Which industries are the primary drivers of the industrial automation market?

Key industries driving the growth of the industrial automation market include automotive, aerospace, pharmaceuticals, food and beverage, and electronics. These industries are adopting automation technologies to enhance productivity, reduce costs, and improve safety.

What are the major technologies used in industrial automation?

The major technologies in industrial automation include robotics, programmable logic controllers (PLCs), supervisory control and data acquisition (SCADA) systems, distributed control systems (DCS), and industrial internet of things (IIoT) platforms. These technologies enable the automation of complex industrial processes.

What role does AI play in the industrial automation market?

AI plays a crucial role in enhancing industrial automation by enabling predictive maintenance, optimizing production processes, and improving decision-making through advanced data analytics. AI-driven automation systems can adapt in real-time, leading to increased efficiency and reduced downtime.

How is the industrial automation market expected to evolve in the next 5 years?

The industrial automation market is expected to continue its growth trajectory, driven by advancements in AI, machine learning, and IIoT. The market is likely to see increased adoption of autonomous robots, smart factories, and digital twins, with a focus on enhancing flexibility and customization in manufacturing.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]