Global Industrial 2.4 GHz Wireless Technologies Market Size, Share, Trends, & Growth Forecast Report By Sensor (Pressure Sensor, Temperature Sensor, Level Sensor, Flow Sensor, Biosensor, and others), Technology (Zigbee, Bluetooth, Wi-Fi, and Others), Industry Vertical (Oil & Gas, Automotive, Manufacturing, Healthcare, and Others), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Industrial 2.4 GHz Wireless Technologies Market Size

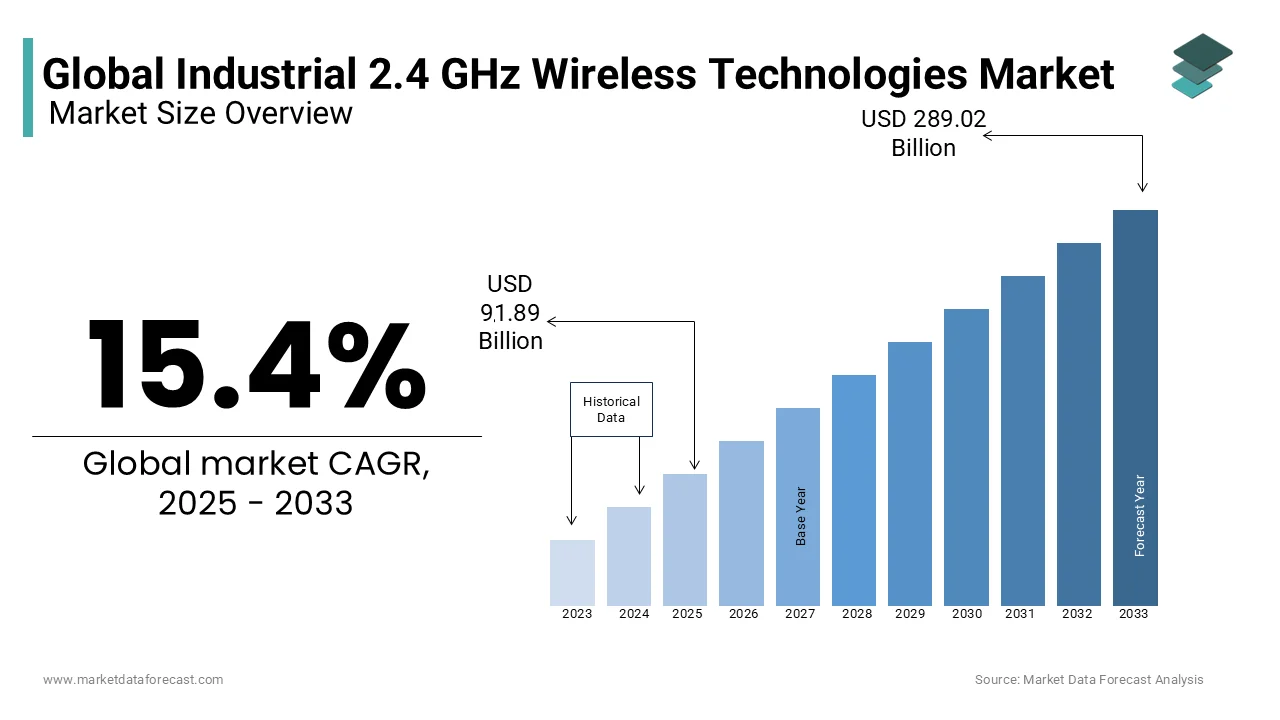

The global industrial 2.4 GHz wireless technologies market was worth USD 79.63 billion in 2024. The global market is predicted to grow from USD 91.89 billion in 2025 to USD 289.02 billion by 2033, growing at a 15.4% CAGR from 2025 to 2033.

Industries across the world are adopting wireless networks to monitor various processes and operations. Wireless networks are platforms that are distributed with wireless communication and control provisions. Also, industrial wireless networks are low cost can be deployed faster and are increasingly replacing the prevailing wired networks. Deployment of these networks results in savings in terms of labor, materials, and energy in conjunction with streamlined processes. These solutions are optimal for hazardous or hard-to-reach zones in several industries like mining or chemicals. Various communication technologies used in ISWN are Bluetooth, Wi-Fi, WLAN, Zigbee, and others. Applications for these technologies include automotive, aerospace and defense, machinery, and discrete mechanical parts manufacturing among others.

MARKET DRIVERS

Popularity of IWSN Among Various Industry Verticals

The global industrial 2.4 GHz wireless technologies market is expected to register substantial growth in the coming years due to the surge in popularity of IWSN among various industry verticals such as oil & gas, automotive, manufacturing, healthcare and others. Also, the increase in the need to improve process efficiencies and easy deployment of economic wireless sensor networks drive the market growth. Advantages delivered by IWSN like its easy-to-use & application-specific nature further fuel its adoption.

To introduce any of the new technology within the enterprise, a major driver and motivational factor is the potential financial gains, i.e. reduced costs and/or increased revenue. Potential domains where wireless technology is often helpful to the industry are often categorized into three different applications, namely mobile ICT, wireless instrumentation, and Asset & personnel tracking. The focus of manufacturers on improving wireless sensing technology has increased due to which wireless sensors are predicted to gain traction. The plunging cost of sensors, in conjunction with the growing trend of process optimization, home automation and lifestyle improvement, is increasing the adoption of wireless sensor networks (WSNs). Sensors and other peripherals are significant power consumers.

The energy consumption rate for the sensors in a wireless sensor network differs based on the protocols followed by the sensors for communication. Although technologies like ultra-low-power processors, tiny mobile sensors, and wireless networking are available, there is a requirement for efficient power management and optical power consumption in IoT devices. Connectivity load is one more crucial factor since numerous devices are supposed to be connected simultaneously. For example, a mean smart home may contain 50 to 100 connected appliances, lights, thermostats, etc. each with their specific power requirements. Equipment such as smart meters is also used to make the road power efficient.

In addition, during the previous couple of years, the emergence of ordinary communication protocols has boosted the adoption of wireless networks across various industries. Increasing industrial automation is additionally leading to the growth of the economic wireless technologies market. The rising trend of smart factories, growing connectivity between different industrial processes and increased use of machine-to-machine solutions are a few of the crucial drivers of the market.

MARKET RESTRAINTS

Privacy Concerns and Data Security

However, growth in privacy concerns and data security are the key factors that curb the expansion of the market. A major challenge for the expansion of the economic wireless technologies market has been the availability of multiple wireless communication standards leading to little or no interoperability between the varied networks.

Impact of COVID-19

The effects of COVID-19 have an enormous impact on every end-use industry, affecting staple supply, disrupting the electronics value chain, and causing an inflationary risk on products. The pandemic has caused a boost in remote working and more focused evaluation and de-risking of the end-to-end value chain. The demand for wireless technologies has increased due to the pandemic as they're helping us to connect virtually. Different wireless communication and positioning technologies like cellular positioning systems, drones and global positioning systems (GPS) are used to supervise the spread of the infection in the outdoor environment. Radio Frequency identification (RFID), Wi-Fi, Visible light, Zigbee, and Bluetooth are indoor positioning technologies, which often offer promising solutions for monitoring isolated people and maintaining a safe working atmosphere. Proximity Trace, a recently developed solution for this cause, can be a sensing-and-communication technology for workforce remote monitoring while carrying on essential activities. A tag is incorporated with a worker’s cap or worn on a lanyard which sends real-time alerts when the workers are in close contact.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

15.4% |

|

Segments Covered |

By Sensor, Technology, Vertical, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Honeywell International Inc., Texas Instruments Inc., STMicroelectronics, Siemens AG, Endress Hauser AG, ABB Ltd., Schneider Electric, Linear Technology Corporation, NXP Semiconductors, Emersion Electric, and others. |

REGIONAL ANALYSIS

North America led the market in 2024 and the growth of the North American market is majorly driven by the growing need for industrial automation in North America. Asia-Pacific is estimated to witness absolutely the largest growth during the forecast period while North America is likely to hold the highest portion in the Industrial 2.4 GHz Wireless Technologies market.

KEY PLAYERS IN THE MARKET

Companies such as Honeywell International Inc., Texas Instruments Inc., STMicroelectronics, Siemens AG, Endress Hauser AG, ABB Ltd., Schneider Electric, Linear Technology Corporation, NXP Semiconductors and Emersion Electric are currently playing a leading role in the global industrial 2.4 GHz wireless technologies market.

RECENT HAPPENINGS IN THE MARKET

-

In May 2020, Intel acquired Rivet Networks (Austin)—a technology and products company focused on creating the only possible networking experience for users. Rivet provides a combination of hardware, software, and cloud-based technologies to provide solutions that are efficient and intuitive. Rivet Network’s team will join the Wireless Solutions Group within the Client Computing Group of Intel. Their key products, including its Killer brand, will be incorporated with Intel’s broader PC Wi-Fi portfolio. Intel can scale PC Wi-Fi portfolio to better serve the purchasers, ecosystem, and channel partners with Rivet Networks’ and Intel’s leading Wi-Fi products.

-

In April 2020, NXP Semiconductors N.V. signed a collaboration agreement with Murata—a system-in-package integrator for 5G mobile platforms—to deliver the industry’s first frequency (RF) front-end modules designed with the foremost recent Wi-Fi 6 standards.

-

Closing of the acquisition of Cypress Semiconductor Corporation was announced in April 2020 by Infineon Technologies. The addition of Cypress lets Infineon further increase its focus on structural growth drivers and on a broader range of applications. this might accelerate the company’s path to profitable growth.

MARKET SEGMENTATION

This research report on the global industrial 2.4 GHz wireless technologies market has been segmented and sub-segmented based on sensor, technology, vertical and region.

By Sensor

-

Pressure Sensor

-

Temperature Sensor

-

Level Sensor

-

Flow Sensor

-

Biosensor

By Technology

-

Zigbee

-

Bluetooth

-

Wi-Fi

By Vertical

-

Oil & Gas

-

Automotive

-

Manufacturing

-

Healthcare

By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Frequently Asked Questions

What is the current size of the global industrial 2.4 GHz wireless technologies market?

The global industrial 2.4 GHz wireless technologies market was valued at USD 79.63 bn in 2024.

Which regions contribute significantly to the market share of industrial 2.4 GHz wireless technologies globally?

Major contributors to the global market share of industrial 2.4 GHz wireless technologies include North America, Europe, Asia-Pacific, and regions with a strong industrial automation presence.

How has the COVID-19 pandemic impacted the global industrial 2.4 GHz wireless technologies market?

The COVID-19 pandemic has accelerated the adoption of industrial 2.4 GHz wireless technologies as industries prioritize remote monitoring and control solutions, contributing to market growth.

Who are the key players in the global industrial 2.4 GHz wireless technologies market?

Honeywell International Inc., Texas Instruments Inc., STMicroelectronics, Siemens AG, Endress Hauser AG, ABB Ltd., Schneider Electric, Linear Technology Corporation, NXP Semiconductors and Emersion Electric are the leading players in the global market.

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]