Global Income Protection Insurance Market Size, Share, Trends, & Growth Forecast Report By Type (Short Term Income Protection Insurance and Long Term Income Protection Insurance), End-User (Men and Women), and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa), Industry Analysis From 2024 to 2033

Global Income Protection Insurance Market Size

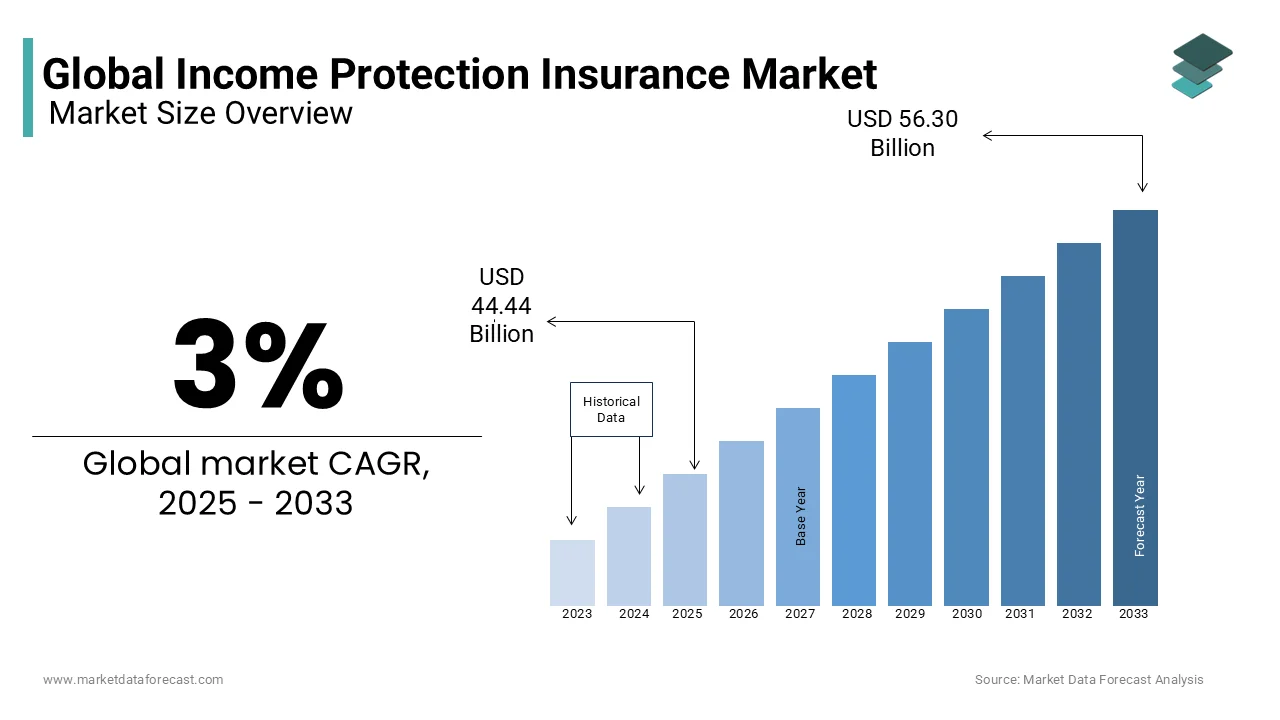

The size of the global income protection insurance market was worth USD 43.15 billion in 2024. The global market is predicted to grow at a CAGR of 3% from 2025 to 2033 and be worth USD 56.30 billion by 2033 from USD 44.44 billion in 2025.

The income protection insurance market contracted with new business premiums falling by 10.1 percent and the number of contracts falling by 1.7 percent. Income protection insurance pays up to 85% of your pre-tax income for a specified time if the insured cannot work due to partial or total disability. It is designed to replace the payment based on your annual earnings 12 months before the illness or injury.

MARKET DRIVERS

Increased Demand for IP Products

The increased demand for IP products in light of the pandemic's prolonged significance and consumers' rising awareness of their financial vulnerability is projected to fuel market expansion. One of the primary factors driving the growth of the global income protection insurance market is a failure in income protection during sickness or illness and rising disability levels due to an aging workforce internationally. In addition, rising demand, particularly in the European region, presents an opportunity for the income protection insurance market. Income protection insurance primarily covers you if you lose your job, become ill, or have an accident. It's intended to supplement your income if you're unable to work for a prolonged length of time due to illness or injury. This allows you to secure your mortgage or rent payments, as well as any other bills. You can also earn some additional money. This insurance offers short-term or long-term income protection, depending on your demands.

Short-term Income Insurance

Short-term income insurance compensates typically for any lost wages due to illness or injury that prevents you from working. It can also cover unemployment, allowing you to replace your wages with a different source of income until you return to work. This form of insurance usually lasts for a year or two. Long-term income protection is better suited for more challenging situations that keep you from working for an extended period, such as sickness or accident. Long-term protection typically starts at five years and can last until you reach retirement age.

MARKET RESTRAINTS

Health & Smoking Status

The market's growth may be hampered by variables such as health, smoking status, family history, and engagement in hazardous activities. Weaknesses have been discovered occasionally, prompting them to seek crucial protection insurance, with the income protection insurance market likely being the most sought-after. However, health, smoking status, family history, and dangerous activities may stifle market expansion. Furthermore, given that employer stability has become increasingly precarious due to the monetary consequences of the COVID-19 pandemic, this concern is likely to persist, if not worsen.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

3% |

|

Segments Covered |

By Type, End User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Legal & General, Fidelity Life, Royal London, VitalityLife, Generali, Allianz, AXA, Liverpool Victoria, AIG Life and Others. |

SEGMENTAL ANALYSIS

By Type Insights

Long-term income protection insurance is the most important market, accounting for 70.45% during the forecast period. Short Term Income Protection Insurance and Long Term Income Protection Insurance are the two types of income protection insurance available. The most important market is long-term income protection insurance, which has the most significant market share in 2024 and is predicted to dominate the industry. Covid-19 has influenced every economy worldwide, driving up demand for income protection insurance, particularly long-term income protection insurance.

By End-User Insights

However, men have a larger market share in end-users, accounting for 54.75 percent of the market in 2024. Therefore, the most important market is for men. It had the most significant share during the forecast period, and it appears that it will maintain its dominance, as most people have lost their jobs due to the covid-19 epidemic, and the unemployment rate in the leading countries is at an all-time high. These elements will contribute to the market's growth.

REGIONAL ANALYSIS

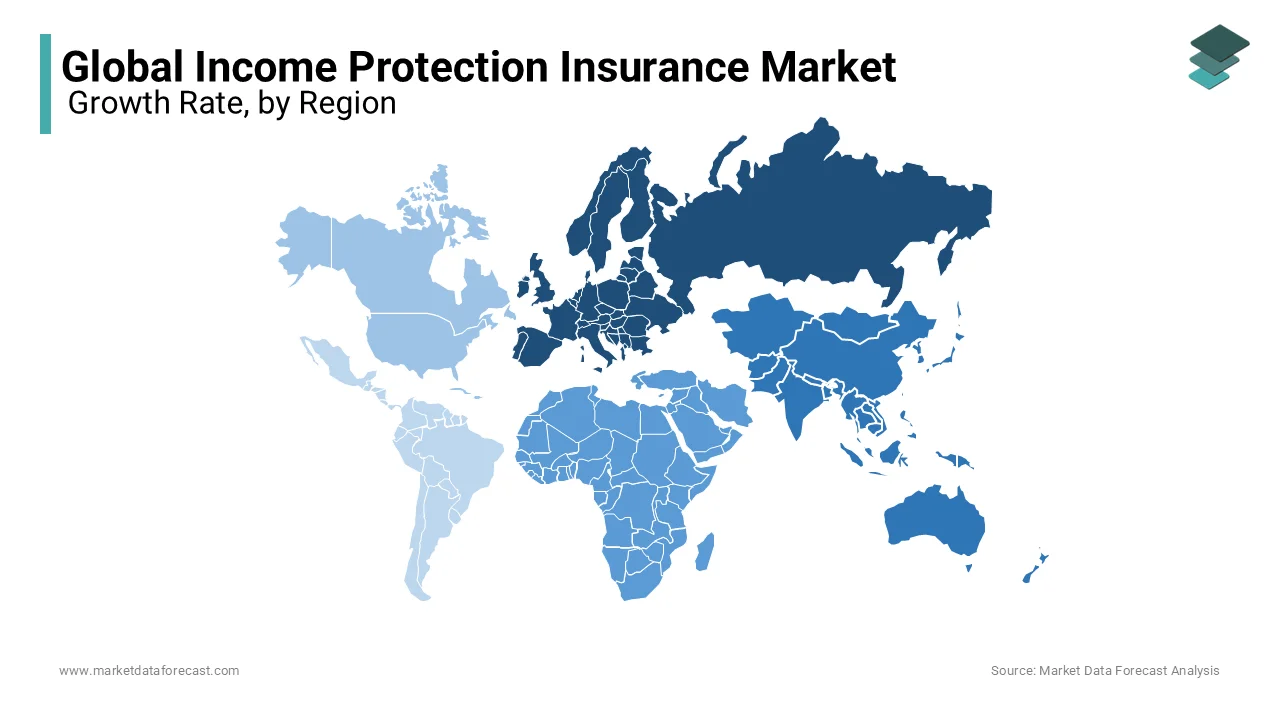

Europe is anticipated to dominate the income protection insurance market during the forecast period. In addition, New business premiums and contracts are expected to increase by 10.0 percent and 10.8 percent in the UK during the forecast period. FMI, a Durban-based insurance company, claims a 62 percent increase in income insurance protection for customers following the pandemic. Moreover, insurance is a contract, represented by a policy, that provides financial protection or reimbursement against potential future losses to an individual or a corporate entity. There are many types of insurance policies available on the European market, and each individual or business can find an insurance firm that can cater to their specific needs.

Customer demands are rising, populations and workforces are aging, competition is intensifying (particularly from nontraditional players), and regulatory scrutiny is tightening, all of which drive the sector forecast for the next few years. In the coming years, Asia Pacific will be the driving force behind global income protection insurance market expansion. To ensure that numerous people in the region receive the insurance protection they require, technological innovation, stable financing, and appropriate policies will be required. Moreover, the increasing demand for income protection insurance in APAC is driven primarily due to the enlarging middle-class policies and increasing government insurance programs.

Despite the potential advantages, the Middle East and Africa insurance businesses are underdeveloped, and their growth-enhancing potential has not been fully realized. This can be described in part by cultural and religious influences on insurance purchasing behavior. Aside from that, there is a lack of faith in insurance, and people are only vaguely aware of the benefits it provides. Furthermore, insurance is frequently out of reach for broad portions of the population. Furthermore, numerous regulatory and policy-related roadblocks have hampered the establishment of a competitive and robust insurance sector.

KEY PLAYERS IN THE MARKET

Companies such as Legal & General, Fidelity Life, Royal London, VitalityLife, Generali, Allianz, AXA, Liverpool Victoria and AIG Life are currently dominating the income protection insurance market and profiled in this report. Aviva, the leading provider of IP, saw its market share shrink by 6.2 percentage points in 2019, accounting for 26.1 percent of the market.

RECENT HAPPENINGS IN THE MARKET

-

Aviva completed the sale of its Italian general insurance business, Aviva Italia, to Allianz for £284 million.

-

After obtaining the necessary regulatory approvals, Aéma Groupe acquired Aviva France on September 30, 2021. Aéma Groupe is now ranked fifth in the French insurance industry as a result of this large-scale operation.

-

Societe Beaujon, the leader in the investment holding company of AXA Group, has decided to come up for sale 1.75 crore shares of ICICI Lombard—representing a 3.85% stake in the general insurer in a block deal at a price range of Rs 1,497.9 to Rs 1,576.7 apiece.

MARKET SEGMENTATION

This research report on the global income protection insurance market has been segmented and sub-segmented based on type, end-user and region.

By Type

- Short Term

- Long Term

By End-User

- Men

- Women

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Frequently Asked Questions

What factors are driving the growth of the Income Protection Insurance market globally?

The growth of the global Income Protection Insurance market is driven by increasing awareness of the importance of financial security, rising incidences of chronic illnesses and injuries, and greater employment instability. Additionally, regulatory changes and the expansion of insurance providers in emerging markets contribute to this growth.

What are the main challenges faced by the global Income Protection Insurance market?

Key challenges include varying regulatory environments across countries, high competition among insurers, low penetration rates in developing countries, and the complexity of insurance products which can deter potential policyholders.

What are the typical coverage limits for Income Protection Insurance globally?

Coverage limits for Income Protection Insurance vary widely but generally range from 50% to 75% of the policyholder's gross income. The exact limits depend on factors such as the insurer's policies, the country’s regulations, and the individual’s occupation and health status.

What future trends are expected in the global Income Protection Insurance market?

Future trends include the increased use of artificial intelligence and big data to customize policies and assess risk more accurately, greater integration of wellness programs to prevent claims, and expansion into underinsured markets. Additionally, there is likely to be a growing emphasis on mental health coverage as awareness of its importance increases.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]