Global Implantable Defibrillators Market Size, Share, Trends & Growth Forecast Report By Product Type (Single Chambered, Dual Chambered and Biventricular), Procedure Type (Trans-Venous and Subcutaneous), End-User (Hospitals, Specialty Clinics and Ambulatory Surgical Centers) and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) - Industry Analysis (2025 to 2033)

Global Implantable Defibrillators Market Size

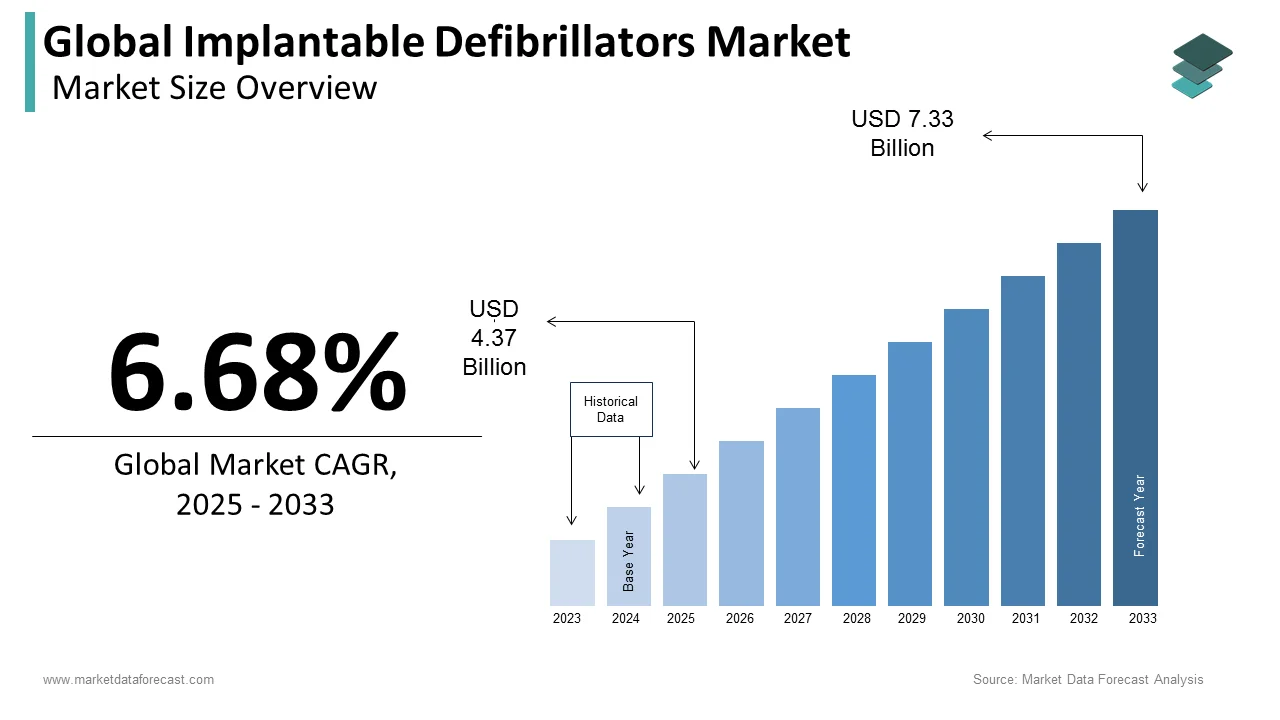

The size of the global implantable defibrillators market was worth USD 4.10 billion in 2024. The global market size is anticipated to grow at a CAGR of 6.68% from 2025 to 2033 and be valued at USD 7.33 billion by 2033 from USD 4.37 billion in 2025.

The demand for implantable defibrillators has been gradually growing over the last few years. Implantable defibrillators play a significant role for patients who are at risk of sudden cardiac arrest, and these devices have become extremely important in the global healthcare system as the incidence of heart-related conditions has been growing continuously. The demand for implantable defibrillators is expected to soar during the forecast period owing to the rapid growth in the population suffering from CVDs and increasing awareness among people of advanced cardiac care options. Countries that have advanced healthcare systems and a vast amount of aging population, such as the United States, Germany, Japan, and China, are experiencing high demand for implantable defibrillators. Investments in R&D, strategic partnerships and collaborations with healthcare providers and hospitals, and educational initiatives to promote awareness and understanding of the benefits of implantable defibrillators are some of the major strategies employed by market participants to strengthen their position.

MARKET DRIVERS

YoY Growth in the Population Suffering from CVDs

Cardiovascular diseases are one of the major causes of death worldwide. The World Health Organization (WHO) says that an estimated 17.9 million per year die of cardiovascular diseases, which is also equivalent to 31% of the total deaths worldwide. An estimated 356,000 out-of-hospital cardiac arrests per year happen in the United States alone. Implantable defibrillators are essential to manage and prevent sudden cardiac arrests (SCA), and these devices deliver shocks to restore normal heart rhythms. The growing patient population of CVDs is likely to result in an increasing demand for cardiac care devices, including implantable defibrillators.

YoY Rise in the Aging Population Worldwide

People who are aged are more susceptible to heart conditions and usually stay at a higher risk of arrhythmias and other cardiac issues, which implantable defibrillators can help manage. As per the statistics of the United Nations, the population of people above 65 years of age is projected to reach 1.5 billion by 2050 worldwide, from 703 million in 2019. It is a known fact that the risk of heart disease significantly increases with age and approximately 70% of people aged 65 and above die of heart-related diseases. The aging population is expected to increase significantly over the next decade, and the same kind of growth can be seen in the demand for cardiac implants, including defibrillators.

Technological Advancements in Implantable Defibrillators

Implantable defibrillators have experienced several technological upgrades in the last decade timeline, such as smaller in size, longer battery life, and advanced features such as remote monitoring, which made these devices more effective and attractive to patients and healthcare providers. Technology is expected to continue to play an integral role in promoting the effectiveness and compatibility of implantable defibrillators. During the forecast period, the adoption of remote monitoring technologies is estimated to fuel and result in the rising demand for implantable defibrillators.

Furthermore, the growing awareness about heart disease prevention and the benefits of early intervention, increasing healthcare expenditure, the rapid expansion of healthcare infrastructure, the Y-o-Y rise in the prevalence of obesity and diabetes, and the growing availability of advanced diagnostic tools are aiding the implantable defibrillator market. Favorable government policies and funding, a Y-o-Y increase in the number of cardiac surgeries, advancements in minimally invasive surgical techniques, rapid adoption of telemedicine, and the expansion of healthcare insurance coverage are supporting the global market growth. An increase in the number of clinical trials and research activities, Y-o-Y growth in the medical tourism industry and strategic collaborations and partnerships among key players are further favoring the global implantable defibrillators market.

MARKET RESTRAINTS

High Costs

The high cost of implantable defibrillators is one of the major restraints to the global implantable defibrillators market. In addition, limited access to advanced healthcare facilities in some regions, risk of complications and infections associated with the usage of implantable defibrillators post-surgery, stringent regulatory approval processes and lack of awareness in developing countries are hampering the global market growth. The high cost of regular maintenance and monitoring, the availability of alternative treatment options, concerns over device malfunction and recalls, limited reimbursement coverage by insurance providers, and the shortage of skilled healthcare professionals for implantation procedures are impeding the growth of the global implantable defibrillators market.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 to 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 to 2033 |

|

CAGR |

6.68% |

|

Segments Covered |

By Product Type, Procedure Type, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

LivaNova PLC, Sorin Group, Biotronik SE & Co. KG, Imricor Medical Systems, Mayo Clinic, St. Jude Medical, Inc., Boston Scientific Corporation, Medtronic plc, MicroPort Scientific Corporation, Abbott, MRI Interventions, Inc., Koninklijke Philips N.V. and Fukuda Denshi Co. Ltd. |

SEGMENTAL ANALYSIS

By Product Type Insights

The dual-chambered segment accounted for 46.2% of the global market share in 2023 and is likely to continue to be the most dominating segment in the global market during the forecast period. The domination of the dual-chambered segment in the global market is majorly due to factors such as the growing incidence of atrial fibrillation. As per the data published by Circulation Journal, an estimated 33 million people worldwide suffer atrial fibrillation. The improved patient outcomes with using dual-chambered implantable defibrillators due to better synchronization between heart chambers are further boosting the expansion of the dual-chambered segment in the global market.

The biventricular segment is anticipated to be the fastest-growing segment in the worldwide market. Y-o-Y growth in the prevalence of heart failure is propelling the growth of the biventricular segment in the global market. As per the statistics of the Global Burden of Disease Study, more than 64 million people worldwide are suffering from heart failure and this number is consistently increasing and is resulting in the increasing need of biventricular implantable defibrillators. The rising awareness among medical professionals regarding the benefits of biventricular implantable defibrillators, such as improved clinical outcomes and enhanced quality of life for heart failure patients, is boosting the growth of the biventricular segment in the global market.

By Procedure Type Insights

The trans-venous segment had 67.8% of the global market share in 2023 and has emerged as the largest segment in the global market. The dominance of trans-venous implantable defibrillators has a longer history of use, established efficacy, and widespread acceptance among healthcare professionals. During the forecast period, the transvenous segment is expected to register a steady CAGR.

On the other hand, the subcutaneous segment is estimated to showcase rapid growth and is predicted to be the fastest-growing segment in the global market during the forecast period. The procedure associated with subcutaneous implantable defibrillators is less invasive, which is majorly boosting the adoption and contributing to the segmental expansion. The reduced infection risk, increasing clinical evidence that supports the efficacy and safety of S-ICDs and growing preference for S-ICDs from patients are further promoting the growth of the subcutaneous segment in the global market.

By End-User Insights

The hospital segment is the largest segment in the global market and held 66.9% of the worldwide market share in 2023. The lead of the hospitals segment in the global market is primarily attributed to the high patient footfall in hospitals for cardiac treatments and the presence of extensive healthcare infrastructure and the availability of advanced medical technologies in hospitals. As per the data published by the American College of Cardiology, more than 70% of implantable defibrillator procedures are conducted in hospital settings. According to the National Center for Biotechnology Information, in the U.S., more than 100,000 defibrillator implantations were performed in hospitals in 2023.

However, the ambulatory surgical centers segment is estimated to register the fastest growth by end-users in the global market during the forecast period owing to their cost-effectiveness, convenience, and reduced hospital stays.

REGIONAL ANALYSIS

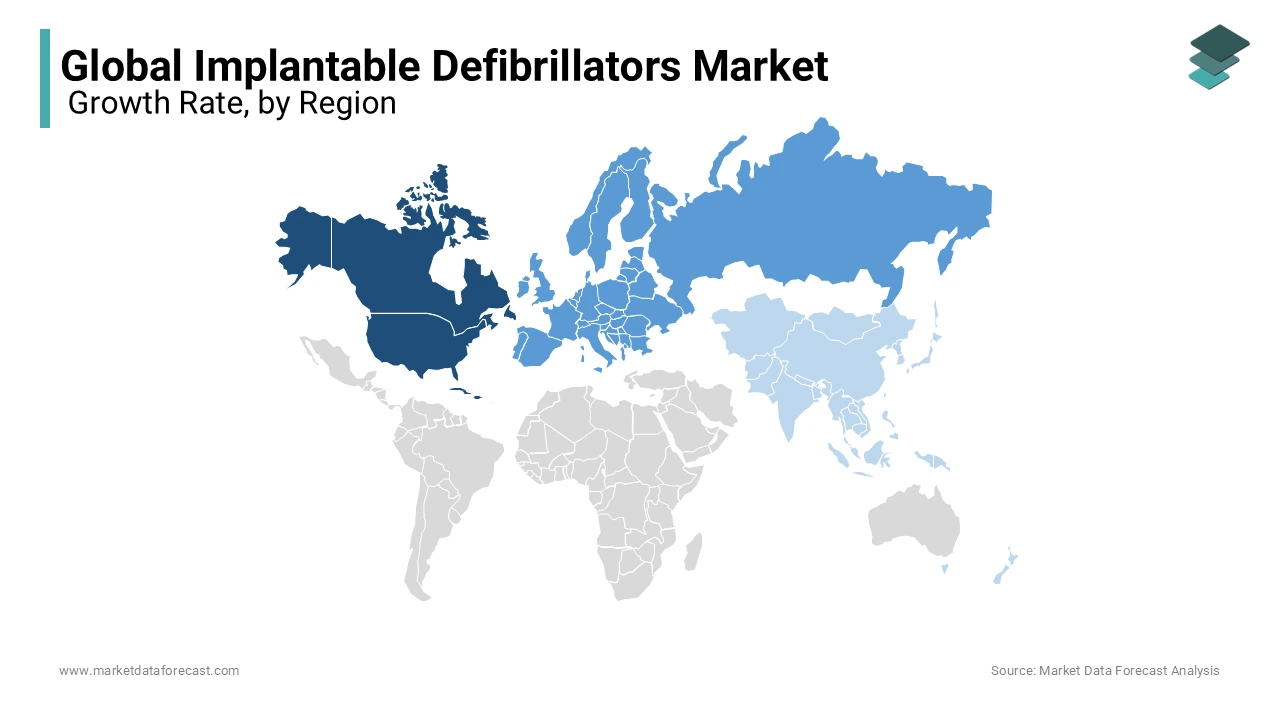

North America captured 39.4% of the global market share in 2023 and stood as the biggest regional segment for implantable defibrillators worldwide. North America is projected to grow at a steady CAGR during the forecast period. The domination of the North American market is majorly attributed to the presence of advanced healthcare infrastructure, robust adoption of advanced medical technologies and Y-o-Y increase in the patient population of cardiovascular diseases. As per the data of the American Heart Association, more than 18.2 million adults in North America have coronary artery disease (CAD). The high healthcare expenditure in North America is also contributing to the expansion of the North American market.

Europe is another major market for implantable defibrillators worldwide and had a substantial share of the global market in 2023. Cardiovascular diseases are the leading cause of death in Europe. As per the statistics published by the European Heart Network, approximately 3.9 million people die of CVDs in Europe every year. Germany dominates the implantable defibrillator market within Europe owing to the increasing number of implantable defibrillator procedures. According to the German Society of Cardiology, more than 30,000 implantable defibrillator procedures are being performed each year in Germany.

The Asia-Pacific region is predicted to be the fastest-growing regional segment for implantable defibrillators worldwide. The prevalence of cardiovascular diseases in Asia is growing exponentially, which is one of the key factors fueling the regional market expansion. An estimated 9.5 million people died of CVDs in the Asia-Pacific in 2019 and this number is experiencing a gradual increase with each year. China and India together are projected to account for most of the regional market share during the forecast period.

KEY MARKET PLAYERS

Sorin Group, Biotronik SE & Co. KG, Imricor Medical Systems, Mayo Clinic, St. Jude Medical, Inc., Boston Scientific Corporation, Medtronic plc, MicroPort Scientific Corporation, Abbott, MRI Interventions, Inc., Koninklijke Philips N.V., Fukuda Denshi Co. Ltd., and Livanova Plc are some of the notable players in the global implantable defibrillators market.

MARKET SEGMENTATION

This research report on the global implantable defibrillator market has been segmented and sub-segmented based on product type, procedure type, end-user, and region.

By Product Type

- Single Chambered

- Dual Chambered

- Biventricular

By Procedure Type

- Trans-Venous

- Subcutaneous

By End-User

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]