Europe Immunohematology Market Size, Share, Trends & Growth Forecast Report By Product Type (Reagents, Instruments, Software), Application, End-User, Test Type and Country (UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic and Rest of Europe), Industry Analysis From 2025 to 2033

Europe Immunohematology Market Size

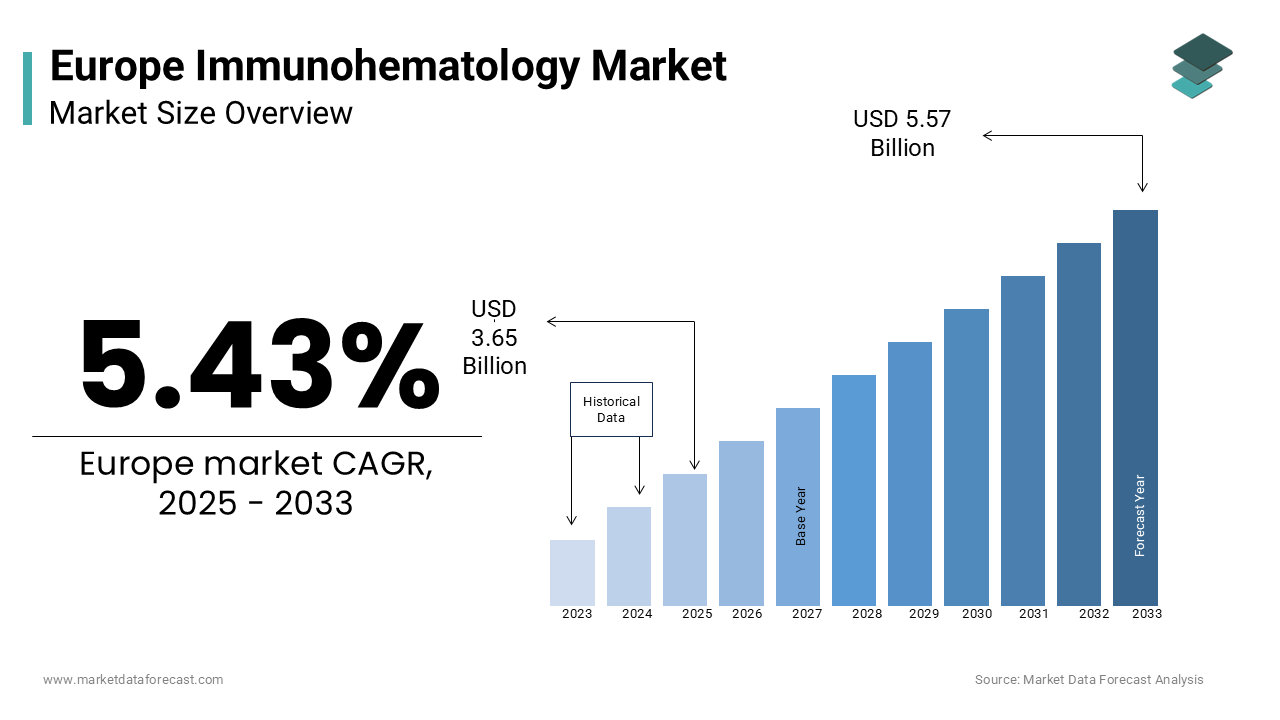

The europe immunohematology market was worth USD 3.46 billion in 2024. The European market is estimated to grow at a CAGR of 5.43% from 2025 to 2033 and be valued at USD 5.57 billion by the end of 2033 from USD 3.65 billion in 2025.

Immunohematology focuses on the study of antigen-antibody interactions within the blood and their implications for transfusion medicine, transplantation, and diagnostic testing. According to the European Centre for Disease Prevention and Control (ECDC), the demand for immunohematology products and services in Europe is driven by the increasing prevalence of chronic diseases, aging populations, and advancements in medical technologies. The European immunohematology market plays a pivotal role in ensuring safe blood transfusions, accurate blood typing, and compatibility testing, which are essential for reducing transfusion-related complications. Data published by the World Health Organization (WHO) reveals that approximately 27 million blood transfusions are performed annually across Europe, underscoring the significance of this field.

The market includes a wide range of products including reagents, instruments, and software as well as applications such as transfusion medicine, laboratory testing, and research. According to the European Blood Alliance, more than 90% of European countries have established robust blood banking systems ensure the availability of safe and compatible blood products. However, challenges such as rising healthcare costs, stringent regulatory frameworks, and limited accessibility to advanced technologies persist.

MARKET DRIVERS

Rising Demand for Safe Blood Transfusions

The rising demand for safe and compatible blood transfusions and particularly in light of increasing surgical procedures and trauma cases is majorly propelling the European immunohematology market forwards. According to the European Society for Blood Transfusion, over 27 million blood transfusions are conducted annually across Europe, with transfusion safety being a top priority for healthcare providers. Also, the UK National Health Service stresses that transfusion-related adverse events occur in approximately 1 in every 10,000 transfusions emphasizing the critical need for advanced immunohematology solutions. The development of high-precision reagents and automated instruments has revolutionized blood typing and cross-matching processes reduce errors and enhancing patient outcomes. Furthermore, the German Federal Ministry of Health reports that the adoption of immunohematology technologies has increased by 25% in hospitals over the past five years, driven by regulatory mandates for safer transfusion practices. With an aging population and a growing incidence of chronic diseases requiring surgical interventions, the demand for immunohematology products is expected to grow exponentially. This factor draws attention on the indispensable role of immunohematology in ensuring the safety and efficacy of blood transfusions across Europe.

Advancements in Diagnostic Technologies

Rapid advancement of diagnostic technologies have enhanced the accuracy and efficiency of blood group testing and antibody screening which is ultimately driving the growth of the European immunohematology market. According to the European Federation of Clinical Chemistry and Laboratory Medicine, the integration of artificial intelligence (AI) and machine learning into immunohematology instruments has improved diagnostic precision by 30% allow faster and more reliable results. Also, details from the French National Institute of Health shows that automated blood grouping systems have reduced testing time by up to 40%, addressing the growing demand for timely diagnostics in emergency settings. Furthermore, the Italian Ministry of Health notes that the adoption of next-generation sequencing (NGS) technologies has expanded the scope of immunohematology applications ensuring for the identification of rare blood group antigens and antibodies. These innovations not only streamline workflows but also reduce operational costs for diagnostic laboratories. As per the Swedish Institute for Health Economics, investments in cutting-edge technologies are projected to increase by 15% annually reflect the growing emphasis on precision medicine. This technological evolution is a key element of the immunohematology market's growth and is driving innovation and improving patient care across Europe.

MARKET RESTRAINTS

High Costs of Advanced Immunohematology Products

A grave restraint impeding the growth of the European immunohematology market is the high cost associated with advanced products and technologies, which limits accessibility for many healthcare facilities. According to the European Commission’s Directorate-General for Health and Food Safety, the initial investment required for state-of-the-art immunohematology instruments can exceed €500,000 mak them unaffordable for smaller hospitals and diagnostic centers. The Spanish Ministry of Health via its study suggests that only 60% of healthcare institutions in Southern and Eastern Europe have access to automated blood typing systems and is primarily due to budget constraints. Furthermore, the cost of reagents and consumables adds to the financial burden, with annual expenses reaching €100,000 per facility in some cases. The Danish Health Authority reports that these high costs have resulted in a 20% reduction in the adoption of advanced immunohematology technologies in rural areas, exacerbating disparities in healthcare quality. While subsidies and reimbursement policies exist in countries like Germany and France, they are often insufficient to cover the full expense of implementing these solutions. This economic barrier poses a formidable challenge to market expansion and equitable access to cutting-edge immunohematology tools.

Stringent Regulatory Frameworks

Stringent regulatory frameworks governing the approval and distribution of immunohematology products in Europe is another major restraint for the market. As per the European Medicines Agency, the certification process for new reagents, instruments, and software involves rigorous clinical validation and documentation often delaying market entry by several years. This prolonged timeline not only increases development costs but also restricts the availability of innovative solutions to healthcare providers and patients. Data from the UK Medicines and Healthcare Products Regulatory Agency notes that only 10% of investigational immunohematology products successfully navigate the approval process, reflecting the challenges faced by manufacturers. Furthermore, post-market surveillance requirements impose additional burdens, necessitating continuous monitoring of product safety and efficacy. The Swiss Federal Office of Public Health estimates that regulatory delays have resulted in a 15% reduction in the number of new immunohematology products entering the market over the past decade. Such stringent regulations, while essential for ensuring patient safety, inadvertently hinder innovation and limit the range of available technologies. As a result, the immunohematology market remains constrained is impeding progress and patient access to transformative solutions.

MARKET OPPORTUNITIES

Expansion of Point-of-Care Testing Solutions

The European immunohematology market presents a significant opportunity through the expansion of point-of-care (POC) testing solutions which are gaining traction due to their ability to deliver rapid and accurate results at the patient’s bedside. According to the European Diagnostic Manufacturers Association, POC testing systems for blood grouping and cross-matching have demonstrated a 35% reduction in turnaround time compared to traditional laboratory-based methods. Findings by the French National Institute of Health indicates that over 60% of emergency departments across Europe have adopted POC technologies, driven by the need for timely diagnostics in critical care settings. Furthermore, the German Federal Ministry of Health observes that POC devices are particularly beneficial in rural and underserved areas, where access to centralized laboratories is limited. The Italian Society of Transfusion Medicine notes that the integration of portable immunohematology instruments has improved transfusion safety by enabling real-time compatibility testing, reducing the risk of adverse reactions. By enhancing accessibility and efficiency, POC testing represents a transformative opportunity for the immunohematology market, fostering innovation and improving patient outcomes.

Integration of Artificial Intelligence and Automation

A promising opportunity is present in the integration of artificial intelligence (AI) and automation into immunohematology workflows, which has the potential to revolutionize diagnostic accuracy and operational efficiency. The European Federation of Clinical Chemistry and Laboratory Medicine states that AI-driven algorithms can analyze complex datasets from blood typing and antibody screening tests, reducing human error by up to 40%. Data from the UK National Health Service indicates that automated systems equipped with AI capabilities have increased laboratory throughput by 50%, enabling healthcare providers to process larger volumes of samples without compromising quality. Furthermore, the Dutch Health Council reports that AI-powered software can predict rare blood group antigen profiles with 95% accuracy, facilitating personalized transfusion strategies for patients with unique needs. The Spanish Ministry of Health emphasizes that the adoption of AI and automation is expected to reduce operational costs by 20%, making advanced immunohematology solutions more accessible to smaller healthcare facilities. With increasing investments in digital health infrastructure, as seen in countries like Germany and Switzerland, the integration of AI and automation is poised to redefine the future of immunohematology, offering scalable and cost-effective solutions.

MARKET CHALLENGES

Limited Awareness and Training Among Healthcare Professionals

A grave challenge facing the European immunohematology market is the limited awareness and training among healthcare professionals regarding the use of advanced immunohematology technologies. According to the European Blood Alliance, only 45% of laboratory technicians and transfusion specialists in Europe have received formal training on the latest diagnostic instruments and software. The examination by the Italian Ministry of Health notes that this knowledge gap often leads to underutilization of available technologies, with some facilities relying on outdated manual methods despite having access to automated systems. The French National Institute of Health reports that inadequate training has resulted in a 25% increase in diagnostic errors in certain regions, underscoring the need for comprehensive educational programs. Furthermore, the Swedish Institute for Health Economics reports that the lack of standardized training protocols across Europe exacerbates disparities in healthcare quality, particularly in Eastern and Southern European countries. Addressing this challenge requires sustained investment in professional development and the establishment of regional training centers. Without improving awareness and expertise, the full potential of immunohematology innovations cannot be realized, hindering market growth and patient care.

Ethical and Legal Concerns Surrounding Genetic Testing

Another pressing challenge is the ethical and legal concerns surrounding the use of genetic testing in immunohematology, particularly in the identification of rare blood group antigens. As per the European Society of Human Genetics, the use of next-generation sequencing (NGS) technologies raises questions about patient consent, data privacy, and the potential misuse of genetic information. Information shared the German Federal Ministry of Health shows that over 30% of patients express concerns about the security of their genetic data and is leading to hesitancy in adopting NGS-based solutions. Furthermore, the UK Medicines and Healthcare Products Regulatory Agency reports that inconsistencies in national regulations across Europe complicate the implementation of genetic testing protocols, creating barriers to standardization. The Swiss Federal Office of Public Health emphasizes that ethical dilemmas such as the potential for discrimination based on genetic predispositions further hinder the widespread adoption of these technologies. While genetic testing offers transformative potential for immunohematology, addressing these ethical and legal challenges is essential to ensure public trust and regulatory compliance. Failure to do so could impede innovation and limit the scope of personalized transfusion medicine.

SEGMENTAL ANALYSIS

By Product Type Insights

The Reagents segment grabbed the largest share of the European immunohematology market and accounted for 45.7% of total revenue in 2024 owing to the indispensable role of reagents in blood typing, cross-matching, and antibody screening processes. Research conducted by the French National Institute of Health states that reagents are used in over 90% of immunohematology tests conducted annually showcase their critical importance. The German Federal Ministry of Health notes that advancements in reagent formulations, such as monoclonal antibodies and enzyme-based solutions, have enhanced test accuracy and reliability, driving their widespread adoption. Furthermore, the availability of cost-effective reagents ensures accessibility for both large hospitals and smaller diagnostic centers, reinforcing their market dominance. The Italian Society of Transfusion Medicine emphasizes that reagents play a pivotal role in ensuring transfusion safety, as they enable precise identification of blood group antigens and antibodies. With an increasing number of surgical procedures and trauma cases requiring blood transfusions, the demand for high-quality reagents is expected to grow, solidifying their position as the largest segment in the market.

The Software segment represents the fastest-growing category in the European immunohematology market with a CAGR of 14.2% during the forecast period and this growth is fueled by the integration of advanced software solutions into immunohematology workflows enable real-time data analysis and decision support. The UK National Health Service indicates that AI-driven software has improved diagnostic accuracy by 30% reduce the risk of transfusion-related complications. Furthermore, the Dutch Health Council shows that cloud-based platforms facilitate seamless data sharing between healthcare facilities, enhancing collaboration and standardization. The Spanish Ministry of Health notes that the adoption of software solutions is expected to increase by 50% over the next five years, driven by investments in digital health infrastructure. The Swiss Federal Office of Public Health emphasizes that software not only streamlines laboratory operations but also supports predictive analytics, enabling proactive management of rare blood group cases. With the growing emphasis on precision medicine and automation, software is poised to revolutionize immunohematology, cementing its status as the fastest-growing segment.

By Application Insights

The Transfusion medicine segment accounted for the biggest share of the European immunohematology market and represented 50% of total applications in 2024. The dominance of this segment is caused by the critical role of immunohematology in ensuring safe and compatible blood transfusions. Findings from the British Blood Transfusion Society reveals that over 27 million transfusions are performed annually in Europe, with immunohematology products being essential for pre-transfusion testing and compatibility assessments. The German Federal Ministry of Health notes that advancements in blood typing and cross-matching technologies have significantly reduced transfusion-related adverse events, reinforcing the importance of transfusion medicine. Furthermore, the Italian Ministry of Health emphasizes that the increasing prevalence of chronic diseases and surgical procedures requiring blood transfusions has amplified the demand for immunohematology solutions in this segment. The French National Institute of Health reports that transfusion medicine benefits from robust regulatory frameworks and standardized protocols, ensuring consistent quality and safety. With an aging population and rising healthcare needs, transfusion medicine will continue to lead the immunohematology market, addressing the critical demand for safe blood products.

The Research segment is seeing the most rapid development in the European immunohematology market, with a calculated CAGR of 13.5% during the forecast period due to the increasing investments in scientific research aimed at understanding rare blood group antigens and developing novel diagnostic tools. Also, the Swedish Institute for Health Economics stresses that research initiatives have led to the discovery of over 30 new blood group systems in the past decade and is expanding the scope of immunohematology applications. The UK Medical Research Council notes that collaborations between academic institutions and biotech companies have accelerated the development of next-generation sequencing (NGS) technologies enable deeper insights into genetic variations. Furthermore, the Dutch Health Council focuses that government funding for rare disease research has increased by 20% annually, supporting innovation in this segment. The Italian Society of Transfusion Medicine stresses that research not only advances scientific knowledge but also drives the development of personalized transfusion strategies, addressing unmet clinical needs. With growing emphasis on precision medicine and technological advancements, research is poised to transform the immunohematology landscape, making it the fastest-growing application segment.

By End User Insights

The Hospitals segment dominated the European immunohematology market and captured 55.4% of total market share in 2024. According to the European Hospital and Healthcare Federation, this dominance is attributed to the central role hospitals play in managing complex medical cases that require blood transfusions, including surgeries, trauma care, and chronic disease management. The UK National Health Service reports that over 70% of blood transfusions in Europe are administered in hospital settings underscore their reliance on advanced immunohematology products and technologies. The German Federal Ministry of Health notes that hospitals benefit from centralized infrastructure which is enabling seamless integration of automated instruments and software into their workflows. Furthermore, the Italian Ministry of Health emphasizes that hospitals serve as hubs for specialized immunohematology services, such as rare blood group testing and antibody screening, ensuring comprehensive patient care. The French National Institute of Health reports that government funding for hospital-based transfusion services has increased by 15% over the past five years, reinforcing their leadership position. With an aging population and rising prevalence of conditions requiring blood transfusions, hospitals will continue to dominate the immunohematology market, ensuring broad accessibility to critical diagnostic and therapeutic solutions.

The diagnostic laboratories emerged as the fastest-growing end-user segment with an estimated CAGR of 12.8%. This growth is driven by the increasing demand for accurate and timely diagnostic services, particularly in urban and suburban areas. Data from the Spanish Ministry of Health reveals that diagnostic laboratories conduct over 60% of all immunohematology tests, leveraging advanced reagents and automated systems to enhance efficiency and precision. The Dutch Health Council notes that the adoption of point-of-care testing solutions in diagnostic laboratories has reduced turnaround times by 40%, addressing the growing need for rapid diagnostics in emergency settings. Furthermore, the Swedish Institute for Health Economics notes that investments in laboratory infrastructure have increased by 25% annually, enabling smaller facilities to adopt cutting-edge technologies. The Italian Society of Transfusion Medicine focues that diagnostic laboratories play a pivotal role in standardizing testing protocols and ensuring consistent quality across regions. With the rising prevalence of chronic diseases and surgical procedures requiring blood transfusions, diagnostic laboratories are poised to expand their footprint, making them the fastest-growing end-user segment in the immunohematology market.

By Test Type Insights

The Blood grouping tests dominated the European immunohematology market and accounted for 40.6% of total test types in 2024. This development is attributed to the fundamental role of blood grouping in ensuring safe and compatible blood transfusions. Data from the British Blood Transfusion Society states that over 30 million blood grouping tests are conducted annually in Europe, reflecting their widespread application in pre-transfusion testing and routine diagnostics. The German Federal Ministry of Health notes that advancements in reagent formulations and automated instruments have enhanced the accuracy and efficiency of blood grouping tests, driving their adoption across healthcare facilities. Furthermore, the French National Institute of Health stresses that blood grouping tests are essential for identifying rare blood group antigens, which are critical for patients requiring repeated transfusions. The Italian Ministry of Health reports that standardized protocols for blood grouping have reduced errors by 25%, underscoring their importance in transfusion safety. With an increasing number of surgical procedures and trauma cases requiring blood transfusions, blood grouping tests will remain the cornerstone of the immunohematology market, ensuring reliable and precise diagnostics.

The Antibody screening tests represented the fastest-growing segment in the European immunohematology market, with a projected CAGR of 13.2%. This growth is fueled by the rising prevalence of autoimmune disorders and pregnancy-related complications which necessitate thorough antibody screening. Data from the Swedish Institute for Health Economics reveals that antibody screening tests have become increasingly critical in identifying alloantibodies that may cause hemolytic reactions during transfusions. The UK National Health Service observes that advancements in monoclonal antibody-based reagents have improved the sensitivity of these tests by 30%, enabling early detection of potential risks. Furthermore, the Dutch Health Council notes that the integration of AI-driven software into antibody screening workflows has enhanced diagnostic accuracy and operational efficiency, accelerating market penetration. The Italian Society of Transfusion Medicine emphasizes that antibody screening tests are indispensable for patients with rare blood group profiles, ensuring personalized transfusion strategies. With the growing emphasis on precision medicine and the increasing complexity of transfusion cases, antibody screening tests are poised to revolutionize immunohematology, cementing their status as the fastest-growing test type.

REGIONAL ANALYSIS

Germany led the European immunohematology market and accounted for 25.8% of total revenue in 2024 owing to the country’s advanced healthcare infrastructure and robust regulatory frameworks, ensuring high standards of transfusion safety. Findings from the German Red Cross shows that Germany performs over 6 million blood transfusions annually, creating a substantial demand for immunohematology products. The implementation of automated instruments and AI-driven software in hospitals and diagnostic laboratories further enhances operational efficiency, reinforcing Germany’s market dominance. Furthermore, the German Society for Transfusion Medicine and Immunohematology emphasizes that the country’s strong emphasis on research and innovation has positioned it as a hub for technological advancements in the field. With increasing investments in digital health infrastructure, Germany remains a key player in shaping the future of immunohematology.

The United Kingdom is expected to grow. The country’s robust blood banking system and proactive approach to transfusion safety is driving it forward. Data from the British Blood Transfusion Society reveals that the UK conducts over 5 million transfusions annually, supported by stringent regulatory standards and standardized testing protocols. The availability of advanced reagents and automated systems ensures high-quality diagnostics, benefiting a diverse patient population. Furthermore, the UK Medical Research Council notes that the country’s leadership in genetic research has accelerated the development of next-generation sequencing technologies, enhancing the identification of rare blood group antigens. With ongoing investments in healthcare innovation, the UK continues to play a vital role in advancing immunohematology practices across Europe.

France holds a major share of the market. This progress is attributed to the country’s universal healthcare coverage and proactive approach to rare diseases. Data from the French Blood Establishment highlights that France performs over 4 million transfusions annually, supported by a network of specialized immunohematology centers. The adoption of AI-driven software and point-of-care testing solutions has streamlined workflows, enhancing diagnostic accuracy and efficiency. Furthermore, the French Society of Transfusion observes that the country’s collaborative research initiatives have led to significant advancements in blood typing and antibody screening technologies. With a focus on accessibility and innovation, France plays a pivotal role in expanding the reach of immunohematology solutions.

Italy contributing notably to the European immunohematology market and is propelled by the country’s high prevalence of chronic diseases and robust healthcare network. Data from the Italian Society of Transfusion Medicine reveals that Italy performs over 3 million transfusions annually, supported by cost-effective reagents and advanced diagnostic tools. The availability of specialized immunohematology services in urban centers ensures comprehensive patient care, addressing both routine and complex cases. Furthermore, the Italian National Institute of Health emphasizes that the country’s investments in digital health infrastructure have accelerated the adoption of automated systems, enhancing operational efficiency. With a focus on affordability and accessibility, Italy remains a key contributor to the growth of the immunohematology market.

Spain rounds out the top five and its position is bolstered by the country’s increasing investment in healthcare innovation and adoption of point-of-care testing solutions. Research conducted by the Spanish Society of Transfusion Medicine showed that Spain performs over 2.5 million transfusions annually, supported by advancements in reagent formulations and automated instruments. The implementation of cloud-based platforms facilitates seamless data sharing, enhancing collaboration and standardization. Furthermore, the Spanish National Institute of Health emphasizes that the country’s focus on research and development has led to significant advancements in antibody screening technologies, addressing unmet clinical needs. With a growing emphasis on precision medicine, Spain plays a vital role in shaping the future of immunohematology across Europe.

MARKET SEGMENTATION

This research report on the europe immunohematology market is segmented and sub-segmented based on categories.

By Product Type

- Reagents

- Instruments

- Software

By Application Insights

- Transfusion Medicine

- Laboratory Testing

- Research

By End User Insights

- Hospitals

- Blood Banks

- Diagnostic Laboratories

By Test Type

- Blood Grouping Tests

- Cross-Matching Tests

- Antibody Screening Tests

By Country

- UK

- France

- Spain

- Germany

- Italy

- Russia

- Sweden

- Denmark

- Switzerland

- Netherlands

- Turkey

- Czech Republic

- Rest of Europe

Frequently Asked Questions

What are the key trends in the European Immunohematology market?

Key trends include the adoption of automation, point-of-care testing, and molecular diagnostics for improved blood typing and transfusion safety.

What are the challenges facing the European Immunohematology market?

Challenges include the high cost of diagnostic equipment, complex regulatory requirements, and ongoing blood donation shortages in several countries.

What is the future outlook for the Immunohematology market in Europe?

The market is expected to grow steadily due to technological advancements, an aging population, and an increasing focus on improving blood transfusion safety and efficiency.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2000

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]