Global Hydraulic Components Market Research Report By Product Type (Hydraulic Pump, Hydraulic Motor, Valve, Cylinder, and others) and Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), Industry Analysis 2024 to 2033

Global Hydraulic Components Market Size

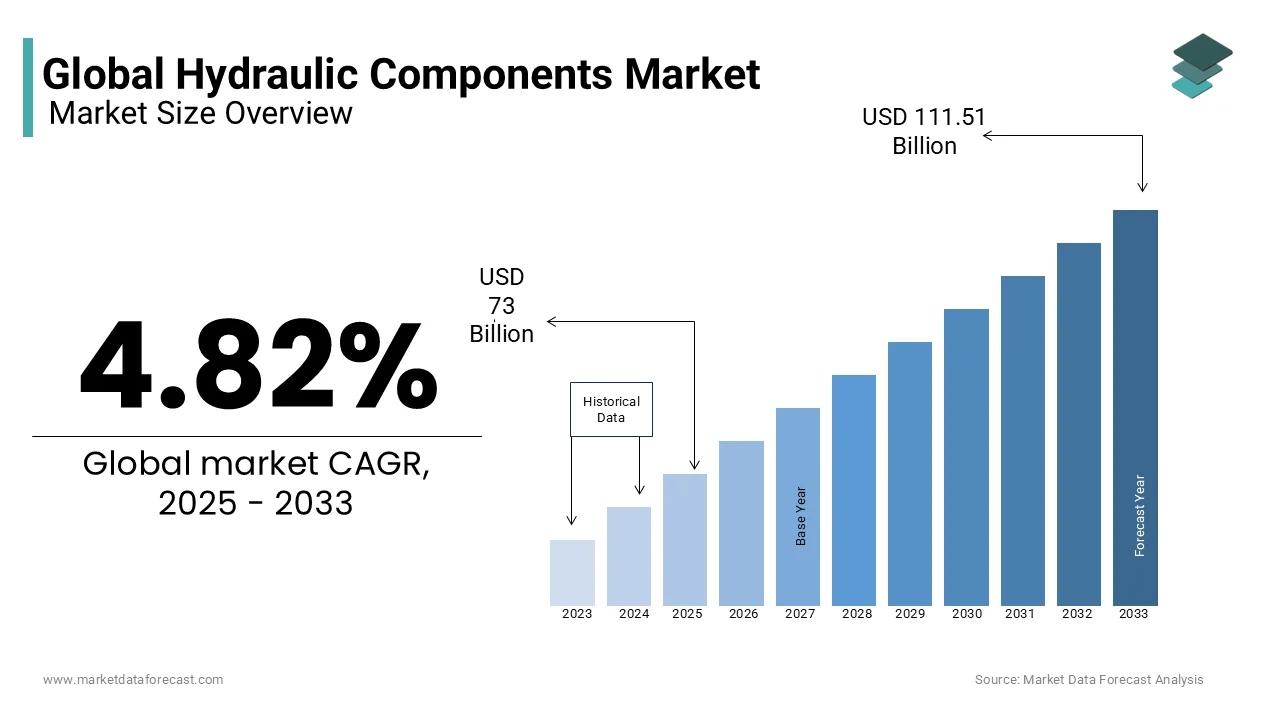

The size of the global hydraulic components market was worth USD 73 Billion in 2024. The global market is anticipated to grow at a CAGR of 4.82% from 2025 to 2033 and be worth USD 111.51 billion by 2033 from USD 76.52 billion in 2025.

Hydraulic components contain highly pressurized fluid. These are some of the limitations of the hydraulic components market. These components should be checked periodically for leaks and lubrication, and filters should be changed regularly. A hydraulic cylinder is a mechanical actuator that produces linear motion and unidirectional force using hydraulic fluid under pressure. Converts the energy reserved in hydraulic fluid into force, allowing linear movement of the cylinder. Hydraulics is a branch of applied science and the latest technology that uses chemistry, engineering, and other sciences that entail mechanical properties and the use of liquids. Hydraulics are used for transmission and power generation by fluids under pressure. Hydraulic components cover parts of science and most of the engineering building blocks.

MARKET DRIVERS

The shortage of labor is a major concern in leveraging their productivity.

The world is evolving with all the latest developments in every sector. The shortage of labor is a major concern in leveraging their productivity. In this era, automation is gearing up with the launch of new techniques that can overcome all the challenges to increase productivity.

Ongoing research and development to probably launch innovative technology that helps to increase productivity with very little human effort using various components is quietly to spur the growth rate of the market. The prominence of investing huge amounts in R&D activities is very high among top key players that are likely to create huge growth opportunities for the market in the coming years.

The increasing demand for food products in the world is a key factor that is expected to lead to increased use of agricultural machinery during the forecast period. Safety and improving machine performance are the most important steps in the design and development phase. The most critical aspect of machine safety and integration is not the integration but the proper handling of all kinds of shutdowns and restarts, creating the need for properly designed programs, including hydraulic systems that help restart the machine back to a predetermined safety position and resume the automatic cycle with minimal operator intervention. Hydraulic components can be used safely, even in the chemical and mining industries, as they do not cause sparks. Hence, the need to improve the safety and operation of machinery is expected to drive the expansion of the global hydraulic components market during the outlook period.

In addition, the rising demand for the increasing utilization of hydraulic components in the construction industry shall boost the growth rate of the market. Increasing significant demand for construction activities in developed countries like the US with the growing economy and industrial expansion is a boom for the hydraulic components market to grow at a higher rate from the past few years.

MARKET RESTRAINTS

The new equipment in the automation needs well skilled person for positive response where the difficulty in finding the skilled operators shall impede the growth rate of the market. The people who are experienced in operating the new automation system are in very less number but with the rising training programs it is attributed in increasing the skills that can level up the market’s growth rate in the coming period.

Though the use of hydraulic components can have huge benefits, the challenge lies in the growing risk factor of hidden leakages. It is highly important to have a regular check on the leakages, as hidden leakages may alter the overall performance of the system. The high cost of investments to manufacture hydraulic components slightly impedes the growth rate of the market. Limitations over temperature range can also inhibit the market’s growth rate. These components could resist higher temperatures where there is a high need to take certain precautions while installing.

MARKET OPPORTUNITIES

The factors driving the demand for hydraulic components are the increasing call for hydraulic equipment in the construction industry and its increasing use in mining equipment. Hydraulic components are required on a massive scale in wheel loaders, telehandlers, concrete boom trucks, and excavators, among others. These requirements should encourage the installation of hydraulic equipment on construction sites. Several features and benefits associated with hydraulic components make them the preferred choice for various end applications. With the rapid adoption of the Industrial Internet of Things (IIoT), hydraulic technology is gaining importance and becoming more and more functional and commercial with its capabilities of transmitting power using the pressure of fluid in a system sealed.

REPORT COVERAGE

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 – 2033 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2033 |

|

CAGR |

4.82% |

|

Segments Covered |

By Product Type and Region. |

|

Various Analyses Covered |

Global, Regional, and Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities |

|

Regions Covered |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Market Leaders Profiled |

Eaton Corp. (US), Parker-Hannifin Corporation (US), Caterpillar, Inc. (US), Bosch Rexroth AG (Germany), Pacoma GmbH (Germany), Hydratech Industries (Denmark), Wipro Enterprises (India), and Others. |

SEGMENTAL ANALYSIS

By Product Type Insights

The hydraulic pump segment is leading with the highest share of the hydraulic component market. Hydraulic pumps have wide applications in varied industries as they are a power source for heavy-duty machines like diggers, loaders, and others. The major aspect of these pumps is converting mechanical energy into fluid power that can lift heavy weights, which has high importance in various industries like automotive, aeronautics, military, and marine. For instance, in the automotive industry, hydraulics pumps are helpful in every aspect, from braking systems to power steering.

The hydraulic motor segment has been steadily growing for the past few years and is attributed to maintaining the same growth rate throughout the forecast period. The prominence of adopting hydraulic motors of different sizes and shapes according to the application substantially elevates the growth rate of the market. The pressure to speed up work progress, especially in construction industries, is elevating the need to adopt new technological equipment to surge the market’s growth rate. High investments in construction activities across the world are also to gear up the growth rate of the hydraulic components market.

REGIONAL ANALYSIS

In terms of region, Asia-Pacific countries such as India, China, and Japan lead the market in terms of the manufacture and use of hydraulic components. The demand for these components is increasing in the region due to rapid industrialization and urbanization. The manufacturing and industrial sectors are developing at a rapid pace in India. This stimulates the country's market for hydraulic components. The expansion of the construction industry increased sales of construction equipment containing hydraulic components, and increased investment to develop intelligent machine tools are expected to boost the hydraulic components market in the near future. European countries such as Germany, the United Kingdom, the Netherlands, and France are investing in aerospace manufacturing and construction. North America continues to be an emerging market due to investments made in the manufacturing sector. The United States government is considering renewing its infrastructure plans. The call for the hydraulic components market will focus on improving energy-efficient hydraulics, increasing R&D activities in formulating innovative hydraulic fluids, and advancing electro-hydraulic automation. The market in the Middle East and Africa is expected to grow in the coming years due to the recovery from the economic downturn. Countries such as Saudi Arabia, United Arab Emirates, Kuwait, and Qatar have invested heavily in the hydraulic components market.

KEY PLAYERS IN THE MARKET

Companies playing a prominent role in the global hydraulic components market include Eaton Corp. (US), Parker-Hannifin Corporation (US), Caterpillar, Inc. (US), Bosch Rexroth AG (Germany), Pacoma GmbH (Germany), Hydratech Industries (Denmark), Wipro Enterprises (India), and Others.

RECENT HAPPENINGS IN THE MARKET

- In 2023, Bosch Rexroth AG and Hydraforce partnered together, which is ascribed to expand their product portfolio along with the expansion of the business unit’s product offering and customer support. Hydraforce helps Bosch Rexroth AG to sell the product through indirect dealers that eventually benefit the company’s long-term goals.

- In 2024, Wipro Enterprises specifically the manufacturing business of Wipro Infrastructure Engineering (WIN) in Wipro hydraulics acquired Canada Based Mailhot Industries. The acquisition is attributed in expanding the footprints of wipro hydraulics in Canada, US, and Mexico. The companies strongly believe that the acquisition will provide wider products and technologies to their customers.

MARKET SEGMENTATION

This global hydraulic components market research report has been segmented and sub-segmented based on product type and region.

By Product Type

- Hydraulic Pump

- Hydraulic Motor

- Valve

- Cylinder

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Frequently Asked Questions

What are the primary end-use industries for hydraulic components?

Key industries include construction, agriculture, manufacturing, aerospace, mining, and automotive. Construction and agriculture are the largest consumers, accounting for nearly 60% of the market demand globally.

What technological advancements are shaping the hydraulic components market?

Recent advancements include the integration of IoT and smart sensors for predictive maintenance, the development of energy-efficient and compact systems, and the adoption of eco-friendly hydraulic fluids to reduce environmental impact.

What are the major challenges faced by the hydraulic components market?

Challenges include fluctuating raw material prices, stringent environmental regulations on hydraulic fluid disposal, and competition from alternative technologies like electromechanical systems in specific applications.

What role do sustainability trends play in the hydraulic components market?

Sustainability trends drive the development of energy-efficient components and bio-based hydraulic fluids. Companies are also focusing on reducing leakage and improving recyclability to align with global environmental goals.

Related Reports

Access the study in MULTIPLE FORMATS

Purchase options starting from $ 2500

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1 888 702 9696 (U.S Toll Free)

Write to us: [email protected]